After August, the battery-related data will be available soon. Before that, it is necessary to review the data for months 1 to 7 from the Battery Innovation Alliance and SNE, and answer the following questions:

- Where did the power batteries go?

- Who is supplying these batteries?

Where have the power batteries gone?

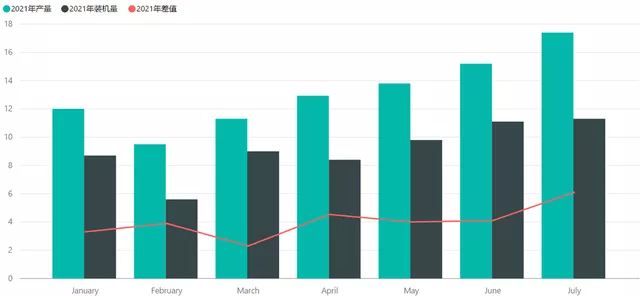

In the first seven months of this year, the production of power batteries reached 92.13GWh, exceeding the annual production of 83.42GWh. The installation volume also reached 63.9GWh, surpassing last year’s 63.65GWh. Therefore, 28.23GWh of batteries were not installed in domestic cars from January to July, and it is unknown where they are. The corresponding data last year was 19.77GWh.

There may be several reasons for this:

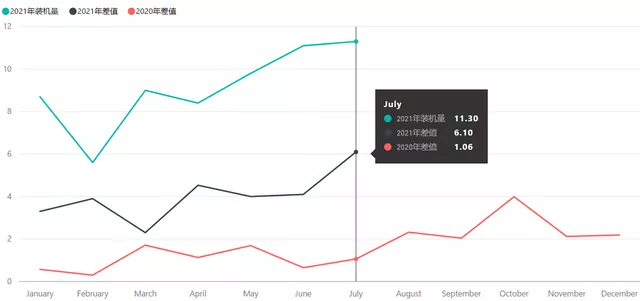

- Power battery exports: According to SNE data, CATL’s global deliveries currently reach 41.2GWh, while the domestic installation volume is 31.42GWh. There may be 10GWh of exports, with an estimated error of 20%-30%, approximately 12-14GWh.

-

Inventory: Due to the special chip problem this year, this gap currently accounts for more than 50% of the installation volume. From this perspective, as the production bottleneck for car companies is a lack of chips, batteries are still being produced according to the original plan. Therefore, it is estimated that there is an inventory of about 10GWh, which has been reserved for about a month.

-

Temporary storage: This mainly refers to the temporary storage process during delivery, and it is estimated that 50% of monthly demand is around 5GWh, similar to last year, with a maximum of 3GWh per month.

The following graph clearly shows the current deviation degree, which is worth paying attention to.

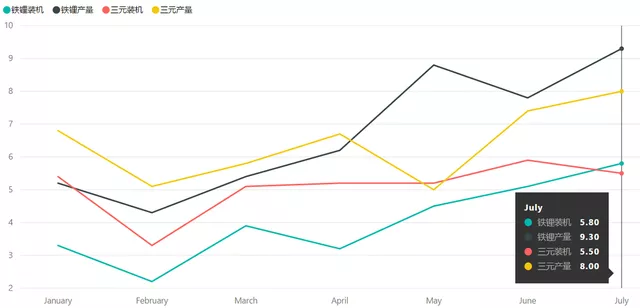

It is worth noting that the domestic market is accelerating the penetration of lithium iron phosphate batteries. As most entry-level models use lithium iron phosphate, the demand and installation volume are rapidly rising. The installation volume of ternary materials, on the other hand, has started to decline month on month, which is also a significant turning point.

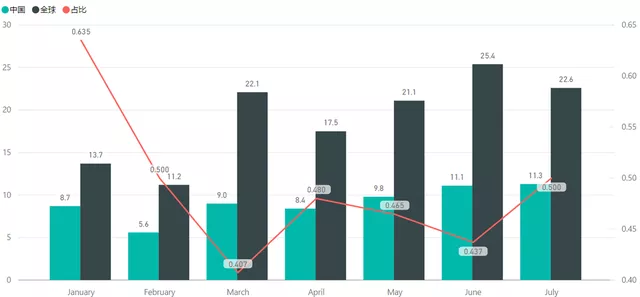

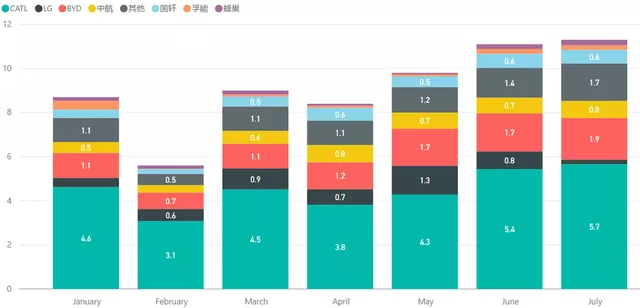

Here is a figure needed below, showing the proportion of China’s power battery in the world. As half of Europe’s are PHEV, from the amount of installations, the installed capacity in China accounts for about 50% of the world’s. The total installed capacity in the first 7 months of 2021 is about 137.1GWh.

Here is a figure needed below, showing the proportion of China’s power battery in the world. As half of Europe’s are PHEV, from the amount of installations, the installed capacity in China accounts for about 50% of the world’s. The total installed capacity in the first 7 months of 2021 is about 137.1GWh.

Study by Supplier

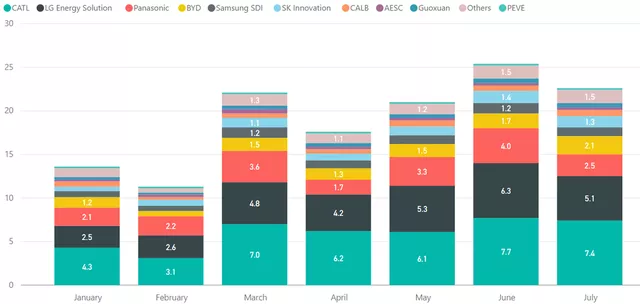

The following figure is a study by SNE. This year, CATL and LG’s installed capacity, as well as other battery companies, have rapidly expanded, especially the status of Panasonic is still very typical.

The next wave of secondary-line companies in China will focus on the volume of LFP batteries. If it is determined to follow the LFP route, potential of other secondary-line battery companies can be seen from BYD’s digital figures.

Finally, let’s break down the data of CATL. According to the semi-annual report, CATL’s production capacity in the first half of 2021 was 60.34GWh. Based on the ratio of energy storage (4.69 billion) and power battery (30.4 billion) revenue, it can be broken down into 8GWh for energy storage and 52.5GWh for power. The production capacity of power battery from January to June was 74.73GWh. That is to say, CATL accounted for 70%. During the same period, CATL’s domestic installed capacity was 25.76GWh, and the total installed capacity was 52.6GWh, accounting for 48.9%. It can be seen that the market concentration ratio of installed capacity lags behind the concentration ratio of production capacity. Due to the order of capacity layout, concentration in the market will continue to increase from September to December 2021.

In conclusion, with the current intensification of concentration, the data for August’s power battery will be released next week, which will have a certain reflection. It is worth paying attention to whether the gap between production capacity and installed capacity will continue to widen and whether the market share difference will continue to widen.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.