Author: Michelin

On September 1st, Xiao Mi Car officially landed in Beijing Economic and Technological Development Zone.

In 155 days, from Lei Jun’s personal honor announcement to the official registration of Xiao Mi Car, which he bet everything on, it took just 5 months.

During these 5 months, Xiao Mi has done a lot of things: Lei Jun almost visited half of the domestic vehicle manufacturers, there were rumors with many car companies, and nearly 10 technology companies related to car manufacturing were invested in. But think carefully, it seems that Xiao Mi Car has not done much, and the company has just been established.

Compared with Jidu Auto, which completed the first vehicle design after just 182 days of establishment, the progress of Xiao Mi Car is slow.

“Decisive moves and cautious steps.”

For Xiao Mi, this cautiousness is intentional and a choice that has to be made.

In the early expansion of the Xiao Mi ecological chain, it went through many difficulties. For the cross-border “transfer student” Xiao Mi Car, there are even more pitfalls in car manufacturing.

Avoiding the Pitfalls 1.0: Manufacturing Cars is Easy

It is not easy to create your own car.

A few years ago, the first batch of new car makers who entered the electric car market were inevitably criticized as “PPT carmakers”. Nowadays, with the gradual maturity of the domestic electric vehicle industry chain, it is not as difficult as it was five years ago to turn a designed car into a reality. But it is not easy to manufacture a safe, consistent, stable, and competitive car with its own brand soul.

Tesla, which has already established itself in the car-making wave, has overcome the technical barriers and capacity crises, but it still suffers from negative quality issues such as abnormal noise, paint rush, and even brake loss. Quality control happens to be a problem with the Mi series products.

For the modern industrial crown on the vehicle, how important is quality control?

One light bulb on the car can affect the entire electronic system, and an error in one solder joint or screw may lead to accidents. A poor quality experience with a mobile phone can lead to a lower user experience and can be returned, but a small mistake on a car may directly affect safety, or even the safety of other vehicles and pedestrians on the same road.Building the automotive supply chain is more complex, besides ensuring security and quality stability. The model of choosing an OEM factory and supplier can indeed create a car, however, the difference between cars is much greater than that between entry-level smartphones and flagship smartphones. The tuning of mechanical traditional devices, electrified components, kinetic energy recovery systems, and the selection of the power, electronics, and electrical systems all affect the performance and comfort of the car.

Even the choice of the OEM factory directly affects everyone’s second impression of Xiaomi’s cars.

The stability of the supply chain is directly related to whether the car can be produced sustainably. Just look at the chip shortage crisis that has stuck the necks of car companies around the world for the past year.

SAIC, Chang’an, Great Wall, BYD, XPeng, Bosch, CATL… for the past few months, Lei Jun has visited almost half of the domestic vehicle manufacturers and traditional suppliers.

In addition to the speculated purpose of finding an OEM factory, he is also investigating the industry rules and standards of the automotive industry and building his own supply chain.

Before the supply chain is built and the automotive industry rules are understood, Xiaomi’s cars are unlikely to be released easily.

Avoiding Pitfalls 2.0: How to Give a Car “Soul”?

Before Xiaomi officially announced its entry into the automotive industry, a group of car companies “died” on the eve of the explosion of electric vehicle sales. Some of them failed to produce cars, but some produced cars that couldn’t sell.

As the threshold for making cars gradually decreases and the public’s acceptance of electric vehicles increases, people’s demands for intelligent electric vehicles are also increasing. The core technology of intelligence, the construction of detailed experience, the ability to participate deeply in electrification and digitization, have all become bonus items, and even necessary options for a brand.

“A company provides us with an overall solution, thus becoming the soul, while SAIC becomes the body.”

The chairman of SAIC’s “soul theory” probably reflects the current situation of car manufacturing:

- NIO restarted its self-developed L4 level autonomous driving plan at the end of 2020;

- Li Auto chose a more open and participatory Horizon chip for deeper full-stack self-development;

- XPeng has always adopted the self-developed automatic driving full-stack mode, and even extended its tentacles to chips;

- …

It can be said that the deep involvement in intelligence and digitization and the mainstream trend of self-development are creating a moat for each company to compete in the future, and Lei Jun is certainly well aware of this.

For the past few months, most of Xiaomi’s investment actions have targeted intelligence: investing in BYD Semiconductor, a chip-focused company, Hesai Technology, a lidar company, Hive Energy, which has mass production technology for cobalt-free batteries, and iPark, which provides smart parking solutions; acquiring self-driving technology company Deepmotion…

However, investment alone cannot solve the problem. The previous car company spent nearly 50 billion yuan, made grandiose acquisitions, and still hasn’t produced a mass-produced car after more than a year. Recently, things have been tough.

Therefore, Xiaomi CEO Wang Xiang said in the Q2 financial report that Xiaomi wants to deeply participate in self-research and master core technology in its own hands. In mid-June, Xiaomi’s car division released the first batch of recruitment information, including perception, decision-making, control, simulation… all related to autonomous driving positions, and is still looking for more than 500 talents focused on L4 autonomous driving technology.

Expanding the self-research team of autonomous driving is to give the car its own “soul,” but creating a “soul” is easier said than done.

Recent accidents and controversies about “assisted driving” have poured cold water on the hotly discussed autonomous driving in the industry, making L4 autonomous driving technology landing on private cars not just a problem for Xiaomi Auto, but a challenge that almost the entire industry is facing.

To face this challenge, it requires time, professional personnel, and money. Similarly crossing into the automotive industry, Huawei is expected to invest CNY 6.5 billion in autonomous driving technology this year. From this perspective, the first batch of 10 billion yuan investment by Xiaomi Auto and the 100 billion USD investment over 10 years may not be as shocking as it seems.

Stepping up to the new 3.0: Xiaomi’s eco-chain model

Can car-making be replicated?

What is your expectation of Xiaomi’s auto?

Although Xiaomi has transitioned to high-end phones, “ultimate cost-effectiveness” and “price butcher” are still the impressions Xiaomi leaves on most people.

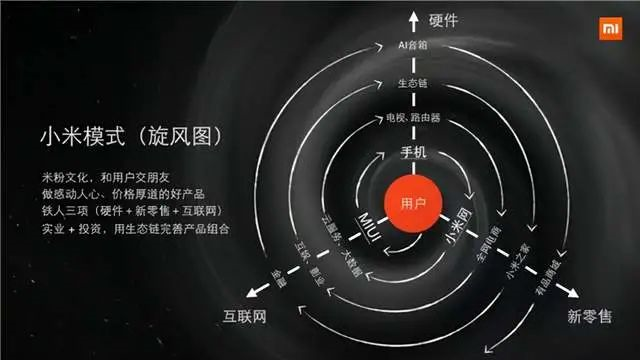

Cost-effectiveness + explosive products + diversification are the secrets of Xiaomi’s success. Creating explosive products with decent appearance design and intelligent functions, and using the large amount of orders of explosive products to suppress the prices of the supply chain, is Xiaomi’s most powerful weapon of cost-effectiveness.

### How to Build Hit Cars and Reduce Supply Chain Costs in the Automotive Industry?

### How to Build Hit Cars and Reduce Supply Chain Costs in the Automotive Industry?

Nowadays, automotive suppliers are usually divided into two categories: stock suppliers that provide traditional automotive parts and incremental suppliers that provide electrification and intelligent parts.

For traditional parts, the nearly century-old history of the automotive industry has already squeezed out most of the profits. As for the remaining profits, they are still uncontested by Toyota and Volkswagen, with their annual sales of several million vehicles. How can Xiaomi achieve success with its quantity-over-quality approach?

As for incremental parts, such as battery technology, which is becoming more technically mature and scalable, costs are indeed showing a downward trend. However, for these players, continuous investment in R&D is required to push out new concepts and technologies, such as blade batteries, magazine batteries, and sodium-ion batteries. Under heavy investment and R&D, are they willing to partner with Xiaomi to gain benefits from quantity discounts?

In fact, this applies not only to suppliers but also to Xiaomi itself. The high cost-effectiveness of Xiaomi’s products comes from the sacrifice of profits. Yunmi and Stone Technology, both of which are part of the Xiaomi ecosystem, have experienced a decrease in profits and weakened R&D investment due to price wars with robot vacuums.

For smart homes and small appliances, the light R&D model may work, but it is obviously not feasible for smart cars. As mentioned earlier, the “soul” of intelligent cars, i.e., intelligent technology, can only be nurtured through time, talent, and investment.

When Xiaomi’s ecological chain model is replicated in car-making, it comes with the inherent advantage of high cost-effectiveness. However, when it comes to developing intelligent car “souls” that require heavy R&D and high investment, how will Xiaomi make its choice?

Conclusion

Of course, while helping Xiaomi find so many potholes on the road to car-making and pouring so much cold water, the advantages that Xiaomi inherently possesses cannot be ignored.

Xiaomi’s years of experience in the AIoT and software fields, as well as the interconnectivity of Xiaomi’s smart products, provide more possibilities for car software functions.

In addition, just like Huawei selling Huawei Select cars in flagship stores, Xiaomi, as a smartphone manufacturer, has the advantage of a dense and sinking sales network, and the annual investment in direct stores by Weimai can save Xiaomi a lot of money.

Moreover, in today’s world, where every car company wants to become a “user-oriented enterprise,” it is not bad to explain what a truly user-oriented enterprise is from a user’s perspective.

Perhaps it is these advantages that make people look forward to Xiaomi’s cars, and Lei Jun will choose to embark on car-making without hesitation. It is also because there are so many pitfalls on the road to car-making that Xiaomi’s car project has just been established and is not eager to make moves.Just as Li Shufu once said, “the best part of the century-long drama of car revolution is yet to come.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.