On the first day of September, the top three new forces in the automobile industry, as usual, updated the delivery performance of the previous month. In August, XPeng ranked second with 7,214 vehicles, while NIO was relatively unexpected with 5,880 vehicles. Ideal took the top spot again with 9,433 vehicles, a growth rate of 9.8% compared to the previous month, and the first time the monthly delivery volume exceeded 9,000 units.

Undoubtedly, this month’s sales volume has been the most highly anticipated event of the year so far, and discussions about the positioning of the three models, supply chains, product line layout, and a series of other issues have once again been raised. In this article, we will discuss these issues together.

Matters related to this month’s sales

Firstly, let’s look at the August data

Before diving deeper into the discussion, let’s take a brief look at the sales data of the top three new forces in August.

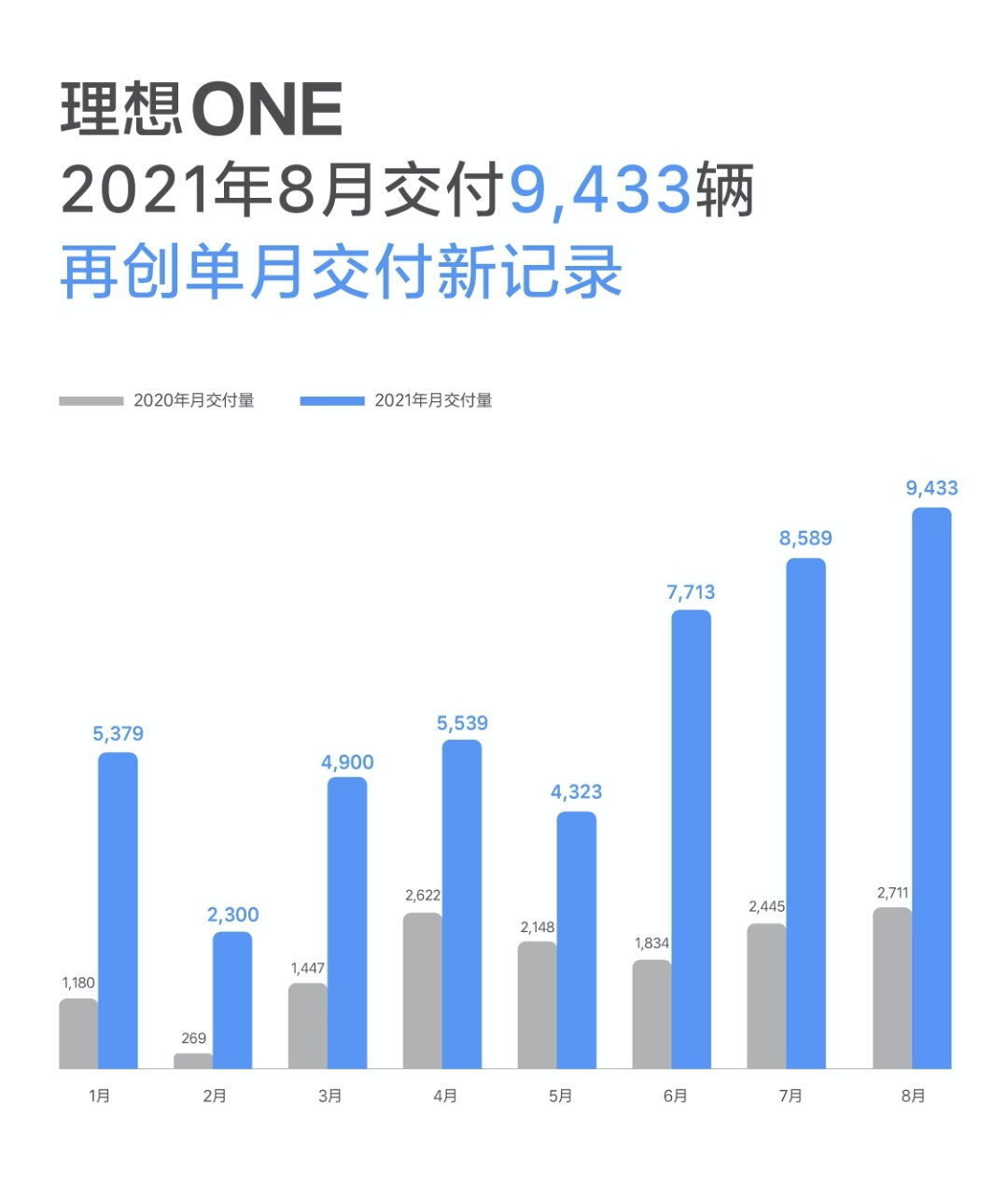

- Ideal delivered 9,433 cars in August, a month-on-month increase of 9.8%, and the first time the monthly delivery volume exceeded 9,000 units.

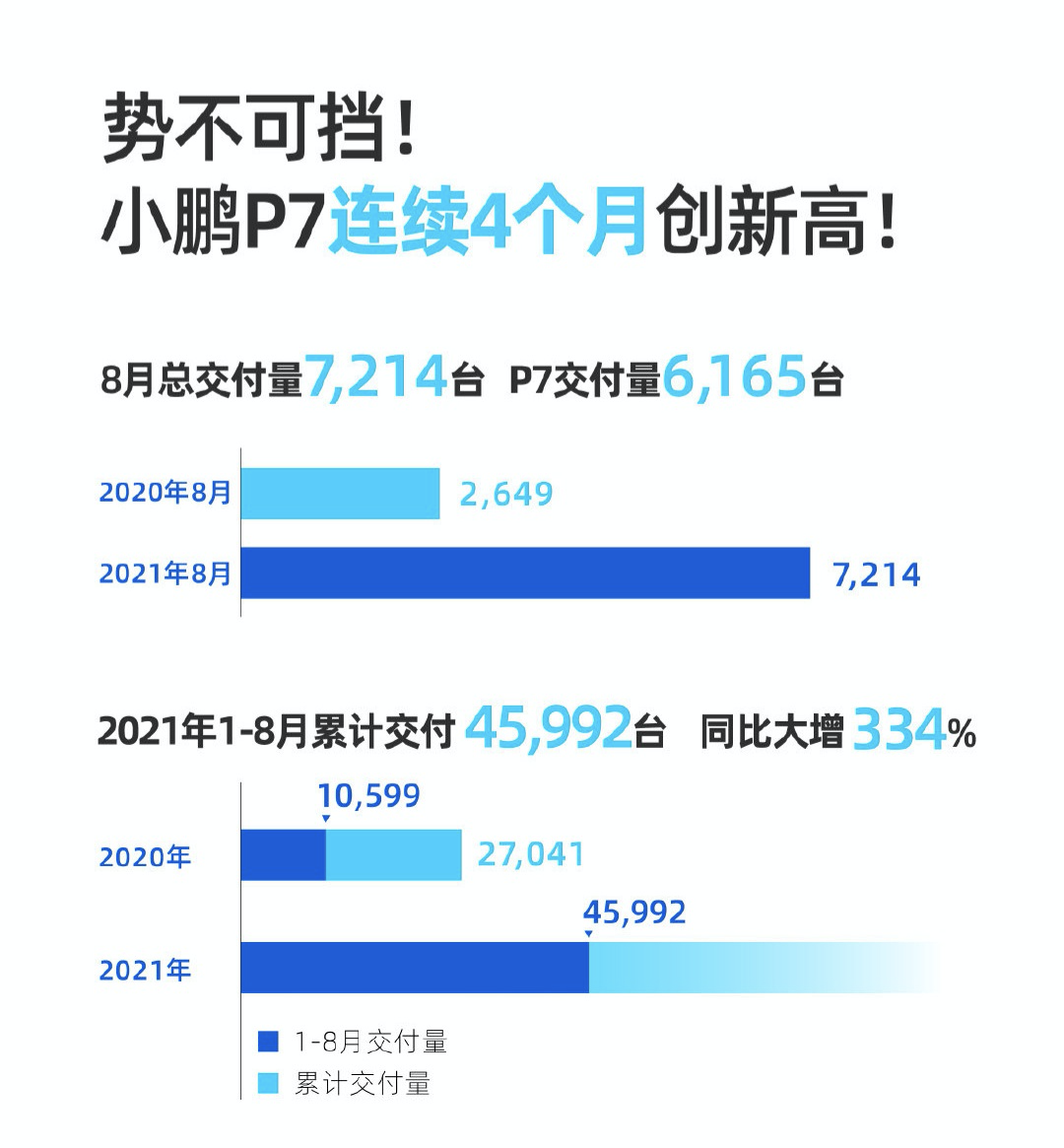

- XPeng delivered 7,214 cars in August, including 6,165 P7 and 1,049 G3, a month-on-month decrease of 10.3%, but still the second highest monthly delivery volume since its debut.

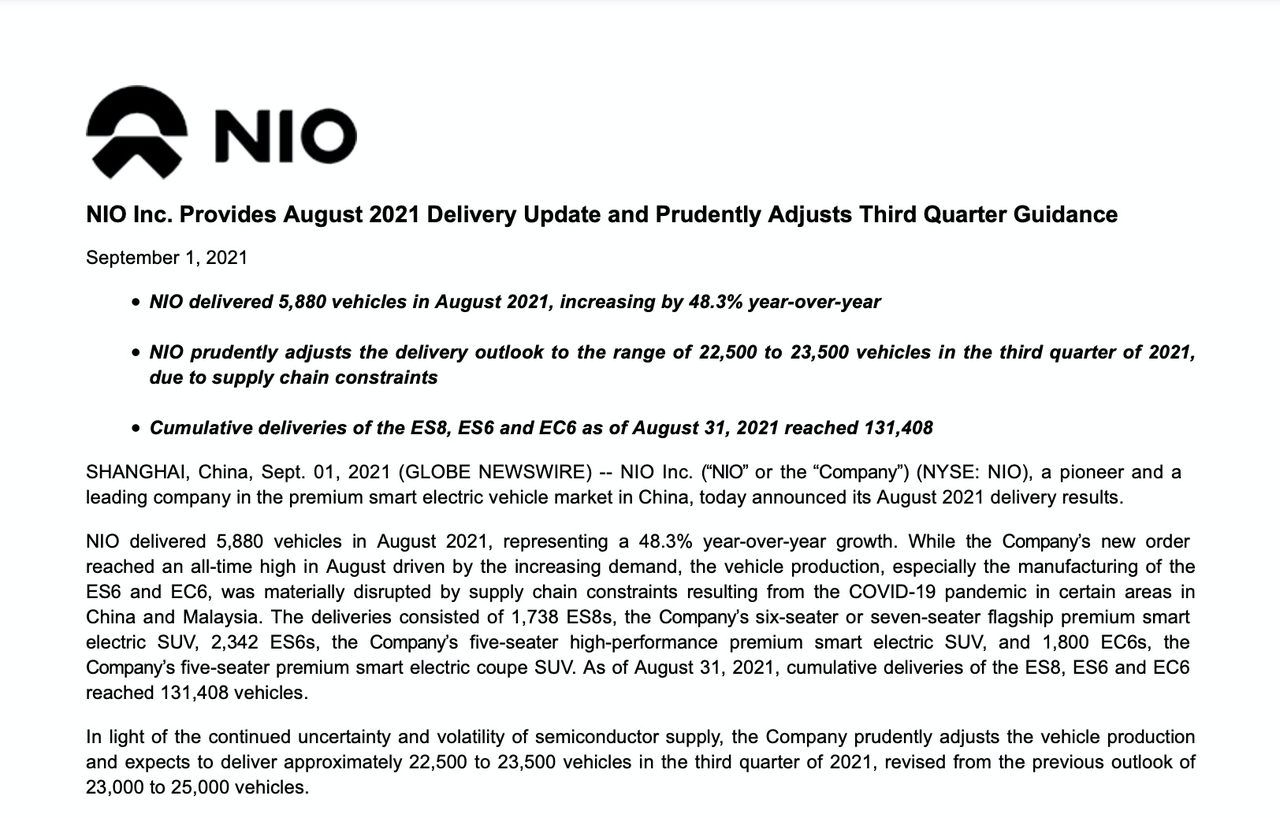

- NIO delivered 5,880 cars in August, including 1,738 ES8, 2,342 ES6, and 1,800 EC6, a month-on-month decrease of 25.9%.

After reviewing the data of the three companies, we will now analyze the reasons for the changes in their sales volumes one by one.

The increase in Ideal’s sales volume in August still came from the 2021 Ideal ONE model. Since its release, the sales orders have been climbing rapidly, with over 10,000 orders in June. The sales growth after the new car was officially delivered was also very obvious. The company had set a goal of exceeding 10,000 deliveries in September.# Monthly Deliveries in August

The delivery data for August from XPeng Motors showed P7 maintaining similar numbers as in June. However, the drop in sales was mainly due to a decrease in G3 deliveries. This was caused by the release of the new G3i model in July, which led to a decline in deliveries of the older model before the launch of the new one. XPeng has announced that they expect to achieve a monthly sales volume of 15,000 vehicles in Q4 with the large-scale delivery of G3i.

NIO’s sales drop in August was mainly reflected in ES6/EC6. NIO attributed the decline to the impact of the pandemic in Nanjing and Malaysia, which has led to a shortage of parts from suppliers.

One of the reasons for the production restriction was the suspension of operations at the Nanjibar Co., Ltd., which supplies A/B pillar interior trim panels for ES6/EC6 due to the high-risk pandemic situation in Nanjing. This suspension had a significant impact on the production of ES6/EC6 in August.

On the other hand, STMicroelectronics’ supply of chips was affected by the pandemic in Malaysia, causing supply disruptions for Bosch ESP. Bosch is NIO’s single supplier for ESP and this has also affected the normal production rhythm of the factory.

Both of these cases have common keywords: “pandemic” and “single supplier”. When they occur simultaneously, the risks to production are enormous. Insufficient expectations regarding supply chain risks and a lack of backup supply chain plans are the underlying reasons for NIO’s August supply chain issues. Redundancy considerations in the automotive supply chain are becoming increasingly important during this special time.

NIO has already made adjustments and responded to the current supply crises. The Nanjing interior supplier has resumed production, but chip supply remains uncertain. The NIO supply chain team is working with Bosch and STMicroelectronics to resolve chip supply issues.What everyone is more concerned about regarding the sales decline in August is whether there are any problems on the demand side, rather than the supply side. According to the official statement of NIO, the order performance remains strong. The new orders received in August reached a single-month historical high, and if the supply chain does not deteriorate further, NIO has the opportunity to set another monthly delivery record in September.

Talking about the supply issue, during the interview with Li Mingyuan, the chief engineer of Zeekr New Energy Platform, he mentioned that Tesla is actually very cautious in this regard, and one example is that the Model 3 has a SiC Mosfet power module, which is globally first integrated on its rear high-power motor, but Tesla actually made a replacement plan with IGBT for this module, which can be switched in time once there is a supply crisis of SiC Mosfet.

As for Ideanomics, in the media interview during the Hong Kong stock market listing of Ideanomics, the vice president of Ideanomics, Shen Yanan, stated that the new round of national epidemic, including situations in Jiangsu, Wuhan, has actually caused some impact on Ideanomics. Over the past period of time, Ideanomics has also been troubled by chip supply, the reason why the delivery has not exceeded 10,000 since breaking the 10,000 orders in June is somewhat related to chip supply, but Ideanomics is trying to find alternative solutions more flexibly and actively acquire more industry resources.

When asked about more specific situations, an internal source at Ideanomics said: “It’s actually the wolf spirit and diligence. (When there is a chip shortage), you can only go supplier by supplier to purchase. If the purchasing manager can’t handle it, go to the purchasing director, if the director can’t handle it, go to Kevin (Shen Yanan).”

Regarding the possible shortage of supply, Ideanomics has started planning since the epidemic period last year, stocking up on inventory while also paying attention to the interactive communication with the supply chain and arranging prepayment processes for purchases.

These predictions and plans are now reflected in the recent new car delivery data.

When dots connect

After talking about August sales and the supply issue, let’s take a look at the following sales statistics chart of the three new forces from June 2020 to present.

The big brother with slowing growth in increments

The reason why NIO can become recognized as the big brother among the three new forces, apart from being the earliest established, listed, highest positioned and with the highest market value enterprise among them, the most important point on its market performance is the overall sales volume.

During the one-year period from June 2020 to June 2021, despite occasional competition with each other by XPeng and Li Auto for the second place on monthly sales, NIO has always secured the first place.In the three companies, NIO’s relatively abundant and more complete product line has played a role during this period. The EC6, initially considered by people as “optional,” has further expanded the audience after its launch and contributed impressive sales to NIO during this time.

However, as can also be seen from the graph, except for February during the Chinese New Year, NIO’s overall growth trend from December of last year has become flat and has been overtaken by Xpeng and Li Auto in July and August.

Looking at this year’s market for pure electric vehicles, such trends are influenced both by external and internal factors.

External factors are mainly due to an increase in competitors, this year new models such as Tesla Model Y, BMW iX3, Ford Mustang Mach-E, and Xpeng P5 overlap with NIO’s current main sales force, the ES6/EC6, in terms of product and price range. User diversion is inevitable.

The more important internal factors are mainly due to the discontinuation of new cars in 2021 and NIO’s existing products being less competitive. Objectively speaking, without new cars this year, the ES6/EC6 vehicles are already considered to have relatively poor mileage within the same price range, unfortunately, Tesla Model Y falls exactly in this price range. NIO has made enough differentiation on product positioning and services compared to Tesla, but when facing this stronger rival with more cost-effective and comprehensive product strength, NIO has still lost some of the mainstream market’s increments.

Regarding NIO’s sales expectations for the remainder of the year, the company has downgraded its Q3 delivery guidance by 1,500 vehicles, the adjusted expectations are between 22,500 and 23,500 vehicles. This means that after accounting for the previously reported deliveries in July and August, the sales data for September should be between 8,689 and 9,689 vehicles.

However, as mentioned earlier, the problem with NIO’s August deliveries was due to production issues rather than lack of demand. Based on an order volume of about 8,000 per month, NIO’s 2,000+ outstanding orders in August can be fully met if the production in the following months is stable. Therefore, it is reasonable to expect that NIO can achieve a breakthrough of monthly sales of 10,000 in September by fulfilling 8,000 + 2,000 orders. The main challenge for NIO is whether its supply chain can keep up.

Xpeng has gradually stabilized its sales level between December of last year and May of this year, with sales of around 2,000 units of the G3 and 3,000 units of the P7.“`

Competitive pressure is also an issue for XPeng this year, mainly from the BYD Han and Model 3, with the latter’s large price cuts affecting P7 sales.

To increase market coverage and sales without reducing prices, XPeng has made significant horizontal expansion in its product offerings, including financial services for battery rental, an entry-level P7 with lithium iron phosphate batteries, and the Peng Wing version of the P7, among others. In addition, XPeng has begun to explore the dealer model as a way to achieve greater sales growth.

The effect has been clear, with XPeng P7 sales seeing a significant increase since June this year, with sales even exceeding 6,000 in July and August.

The addition of the G3i and P5 two new cars is expected to add to the delivery volume for the remaining time this year. The G3i is a relatively normal model upgrade, with some improvements and an achievable increase in sales compared to the pre-upgrade version.

On the other hand, the new product P5, while focusing on smart strategies in the A-class market, falls short in comparison to the P7 in terms of appeal.

Overall, the G3i and P5 may not achieve explosive sales, but given the new forces and intelligence tags, as well as their relatively low prices, they still cannot be ignored for boosting XPeng’s current sales.

I believe that XPeng’s goal of achieving monthly sales of 15,000 in Q4 is feasible, but difficult. After the G3i has been on sale for two months in September, if the accumulated orders are fully released, they should reach around 4,000. Coupled with continuing P7 sales of 6,000 units, XPeng may achieve monthly sales of more than 10,000 for the first time.

Gradually Growing Daddy Cars

The only ideal car achieved its ideal in May this year, when the modification of the Ideal ONE was completed. After the month of overlap between the old and new models, the 2021 Ideal ONE started to break delivery records from then on.

With only one product and one configuration, Ideal’s sales growth has surprised some people over the past few months. In fact, understanding the situation is not difficult if you look at the market that Ideal ONE operates in.

As a plug-in hybrid model, Ideal ONE can “divide” the gasoline car market. The positioning of a 6-seater large SUV family car is also a highly demanded and universally applicable form, which allows Ideal ONE’s growth to break through the limitations of the pure electric market.

“`Before the facelift, the monthly sales volume of 5,000 to 6,000 units for the Ideal ONE was already convincing. After improving key product pain points such as seats, third-row space, assisted driving, and fuel tank size, the overall product strength of the vehicle has become more balanced.

Moreover, relying on extremely accurate product positioning, the Ideal ONE still meets the evaluation of “a model without benchmark competitors” in today’s market.

Regarding the sales expectations for September, the Ideal official has already expressed strong hope to break 10,000 units. As a new brand and new model starting from scratch, this journey is truly rare.

For the sustainability of future sales, with the successive launch of new family car models such as the new Camry, Land Rover, and Senna, the Ideal ONE in the market of just over 300,000 RMB will face more competitors, and consumers in non-limited license plate cities will have more choices. However, the Ideal ONE is still in an advantageous position in terms of overall product strength in space, intelligence, configuration, power, and energy replenishment. This is also the characteristic of explosive single-product usually having a long life cycle and not fearing competitors.

In conclusion

Apart from the car itself, the speed of software iteration of the three new forces this year is still active. Ideal and XPeng can have more user attention due to the release of new cars this year compared to others. When the new car of NIO is out of stock, it actually needs to maintain users’ freshness and expectations through software upgrade iteration.

The 3.0 version of NIO’s vehicle update released recently has indeed shared a lot of work in this aspect. From the content and direction of improvements, NIO is indeed making efforts to enhance users’ experience through this way.

In addition, NIO and XPeng are also continuing to actively develop charging infrastructure, and the construction speed of NIO’s battery swapping stations has also significantly accelerated this year. As of August 31, NIO’s battery-swapping stations across the country have reached 427.

For Ideal, this may be something that needs to be intensified and started to lay out. If they want to fulfill the promise of allowing users to immediately enjoy the 400 kW super fast charging at the time of delivery of the first pure electric model, they not only need charging piles, but also a sufficient number of them.In August, it may be the last month before the top three new forces enter into the ten thousand monthly sales club. The top three new forces may achieve this goal faster than we thought. However, it should be noted that although these three new forces are still in the same tier in terms of overall market performance, the difference in efficiency due to different strategies will become more and more prominent with the passage of time and the increase of volume. Under similar sales volume, the pressure each company bears will also increase with the growth of numbers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.