Author: Xiao Dong

On August 26th, XPeng Motors released its Q2 2021 financial report, with a total revenue of 3.761 billion yuan, up 27.5% from the previous quarter. They delivered 17,398 vehicles, up 30% from the previous quarter. What information has XPeng revealed in this financial report?

They plan to deliver 15,000 vehicles in a single month in Q4.

By the end of the year, their R&D team will reach 4,500 people, including a self-driving team of 1,500 people.

Their current cash reserve has already reached 46 billion yuan.

The construction of the second phase of the Zhaoqing factory has started, and the annual production capacity will increase from 100,000 vehicles to over 200,000 vehicles.

Through standardized services and differentiated products, the flying car will be promoted, achieving growth in sales, an increase in gross profit, and rapid development of intelligentization, all while having sufficient funds, doubling production capacity, and laying out high-end positioning. XPeng is now making a comprehensive attack.

Delivering 15,000 vehicles per month

Starting from August, XPeng’s Zhaoqing factory will be operating on two shifts. With increased production capacity, the company estimates that the monthly delivery volume in Q4 could reach 15,000 vehicles.

This statement comes from He XPeng in XPeng’s Q2 financial report conference call. What gave He XPeng such confidence?

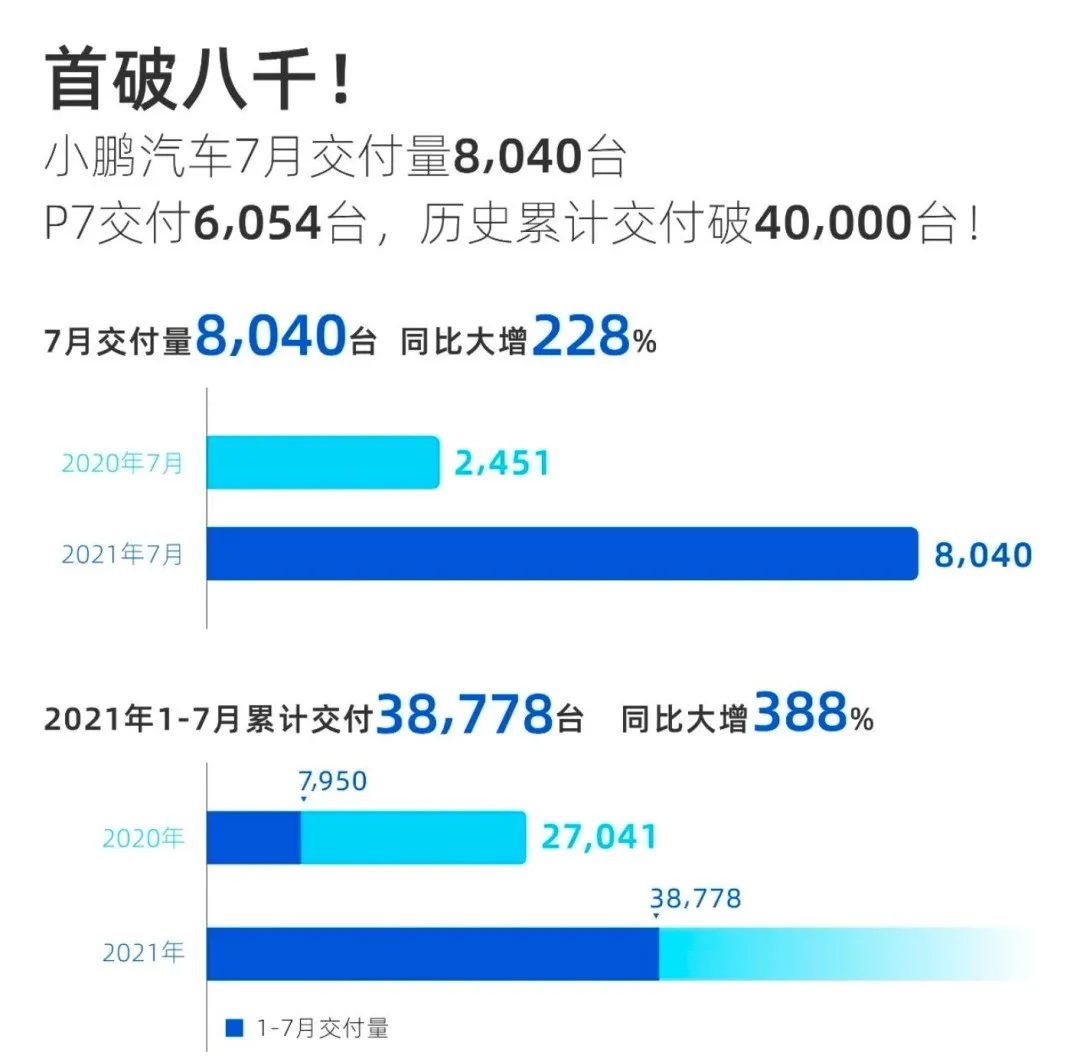

In July, XPeng delivered 8,040 vehicles. In the global environment of chip shortage, they increased their delivery volume nearly twice as much in less than half a year. This confidence stems from not only He XPeng’s confidence in their products, but also their self-assurance in supply chain management.

Indeed, as the G3 model is about to be redesigned, they broke through 6,000 vehicle deliveries in July with only the P7 model. According to the conference call, G3i pre-orders have exceeded expectations. The first batch of G3i will be delivered in small quantities at the end of August, and production is currently the only bottleneck for G3i deliveries.

The G3i production line has just been moved from the Haima factory to the Zhaoqing factory, where they are currently producing three models (G3i, P7, and P5) simultaneously. Once the production line is adjusted, G3i will expand its delivery scale next quarter.

Q4 is also the first delivery quarter for XPeng’s P5. He XPeng defines the P5 as “providing advanced driving assistance systems and intelligent cabin technology to the family car market at an attractive price range of CNY 160,000 to 230,000, further accelerating the subversion of electric cars on traditional fuel cars and non-intelligent cars.” During the Q&A session, he also revealed that the demand for P5 is not lacking among consumers.The expectation for P5 by He XPeng is high, and it seems not very difficult to achieve 15,000 sales when the three versions are released simultaneously in the fourth quarter.

However, production capacity and chips are closely related in the global chip shortage. Regarding this issue, He XPeng explained it in the Q&A session.

The chip problem can be classified into two categories, one is the shortage that XPeng can anticipate and cope with, and the other is unpredictable, such as the recent outbreak in Nanjing. If Tire 1 or Tire 2 is in the epidemic area, it will definitely have an impact.

For the first category, XPeng has already coped with the shortage of chips through early ordering and cooperation with top suppliers to alleviate the shortage of chips. In addition, XPeng may also cooperate with local governments to purchase or reserve the required chips in bulk. XPeng is also in a priority position compared to other new forces. Meanwhile, XPeng does not have a large backlog of deliveries at present, and can flexibly choose different suppliers to meet the demand for chips. XPeng will also consider purchasing overseas.

If there is no large-scale outbreak in China in the future, XPeng’s production capacity is expected to be less affected. By the completion of the expansion of the Zhaoqing Phase II factory in the first half of next year and the completion of the Guangzhou factory in the third quarter, XPeng’s planned annual production capacity will exceed 300,000 vehicles.

XPeng is optimistic and actively competing in the future market trend.

In July, XPeng delivered 8,040 vehicles, reaching a record high, and the second-quarter profit increased further, with a gross profit margin of 11.9%. At the same time, the XPILOT 3.0 optional rate has increased from 20% in Q1 to 25% in Q2. The NGP has been used for more than 1.45 million kilometers, with an average monthly usage rate of more than 65%, indicating that XPeng’s car owners are using the intelligent assistance driving system more and more.

XPeng’s intelligence is generating revenue for the company.

In January of this year, XPeng launched NGP, which realizes intelligent navigation assistance driving on highways and city expressways. In June, it launched VPA, which enables parking memory parking and can store up to 100 parking memory maps. In early next year, XPeng P5 will be equipped with XPILOT 3.5 to achieve city NGP, covering all basic scenarios within a year, with the progress being remarkable.

However, due to cost factors, the price of XPILOT 3.5 will be slightly higher than that of XPILOT 3.0.

According to official spoilers, XPILOT 4.0 built on the next generation hardware platform will be able to cover end-to-end driving scenarios, including scenarios without HD maps. Therefore, users’ demand and dependence on intelligent assisted driving systems will continue to increase. It is foreseeable that XPeng will have a considerable income in the future in terms of intelligence.

Compared with today’s intelligent assisted driving, safety is also a concern for consumers. What preparations has XPeng made in terms of safety?

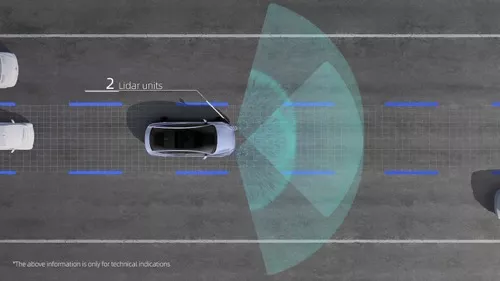

In the phone conference, He XPeng stated that “safety is always XPeng’s top priority”. XPeng is the first company that needs to pass the intelligent assisted driving test to use related functions, and also increases the redundancy of the perception system through lidar in P5. Improving the adaptability of vehicles in extreme situations further ensures safety.

While XPeng’s technology is constantly evolving, its R&D costs are also rising. According to financial reports, XPeng’s R&D costs in the second quarter reached 865 million yuan, a quarter-on-quarter increase of 61.4%. The main reasons are the increase in R&D personnel, resulting in salary increases, and the development of software technology. At the same time, it was revealed in the phone conference that XPeng’s R&D costs this year will reach 4 billion yuan. In this way, compared with the first half of the year, the R&D costs of the second half of the year will increase by more than 100%.

In terms of R&D personnel configuration, XPeng is at the forefront. As of the end of the second quarter of this year, XPeng’s R&D personnel has exceeded 3,000, an increase of nearly 50% compared to the beginning of the year. And it is planned that by the end of 2021, XPeng’s R&D team will exceed 4,500, with the autonomous driving team exceeding 1,500. Compared to NIO and LI’s autonomous driving teams, this number is almost doubled.

XPeng is constantly expanding its R&D and logistics support.

The financial report for the second quarter shows sales and general administrative expenses of 1.031 billion yuan, a quarter-on-quarter increase of 43%. The main reasons are the increase in marketing and advertising expenses, and the costs related to expanding the sales network. The phone conference also made plans for XPeng’s future charging and sales network layout.

On August 9th of this year, XPeng’s first batch of 11 high-speed super charging stations went online, realizing the connection of the Shandong section of the Beijing-Shanghai Expressway and the Henan section of the Beijing-Hong Kong-Macau Expressway. This is also the first domestic automaker to layout high-speed super charging stations, and XPeng’s high-speed charging stations will only be open to XPeng owners, providing better convenience for XPeng car owners on long-distance trips.

In future plans, XPeng will continue to deploy super charging stations on the Beijing-Shanghai, Beijing-Guangzhou and Beijing-Hong Kong-Macau expressways. By the end of this year, it will deploy more than 500 super charging stations to accelerate the charging network layout in third- and fourth-tier cities.By the end of June, XPeng has opened over 200 physical stores, covering 74 cities. During the conference call, He XPeng said that “after laying out charging stations and stores in cities, their sales performance improved greatly within a few months.” Therefore, XPeng plans to expand its sales stores faster and aims to reach 350 by the end of this year. The proportion of direct-operated stores will be increased, and the displayed car models will be planned according to the needs of different cities.

Armed with a spear at the front and a shield at the back, XPeng has begun to plan for the long term.

Planning for the high-end market

Starting from 2023, XPeng plans to launch at least 2-3 car models every year, with the main price range increasing from CNY 150,000-300,000 to CNY 150,000-400,000.

XPeng is now planning for the high-end market.

At present, we know about the car models G3i, P7, P5 and the flagship SUV to be unveiled next year. What about the fifth and sixth car models?

The platform for the new car models has also been revealed. During the conference call, Gu Hongdi stated that the fifth and sixth car models will use a new platform that is tailored for the mid- to high-end market.

In 2023, XPeng will launch a high-end product with a price tag exceeding CNY 400,000. Based on the current pace of new automakers, the R&D cycle for a new car model is at least 2 years. Therefore, the R&D for the fifth, sixth, and even seventh car models may have already started.

So, how will XPeng provide better service for high-end car models? Will it provide differentiated products?

He XPeng said that high-end car models will not be achieved through better services. XPeng will standardize its services, and high-end car models will mainly reflect product differentiation. Currently, the differentiation of XPeng’s products is under development, and typical differentiation will be seen between 2023-2025, forming the next barrier through differentiation.

At the same time, He XPeng also revealed the flying car, which will target higher-end markets (CNY 500,000-1,000,000).

A flying car? Full of suspense.

ConclusionThe financial report of XPeng Q2 illustrates significant ambition. XPeng started from the middle and low-end market and entered the high-end market through differentiation. The journey has been exceptionally arduous. However, XPeng seems to have been prepared, with continuously breaking historical records in delivery, sufficient cash reserves, expanded production capacity, and progressively improved infrastructure. Going forward with positive research and development, XPeng is making great strides. Are you looking forward to such a XPeng?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.