Looking back at the electric vehicle market in the United States, the term “lithium iron phosphate” might have only been a brief trend ten years ago. The years 2011-2012 were the era of A123’s independent operation, and CODA, Spark EV, and Fisker’s extended range all used lithium iron phosphate at the time, but as A123 was acquired, the United States’ batteries entered the era of ternary lithium. As Tesla prepares to bring the standard version battery to the U.S. market next month, lithium iron phosphate will reappear. We can see that in Europe and the United States, it was Tesla who first applied lithium iron phosphate in entry-level models, which in a sense, greatly changed the rules.

Tesla North American Factory

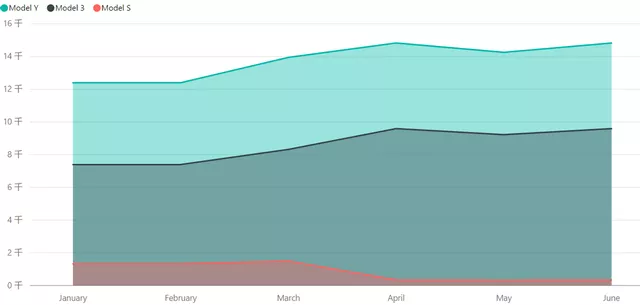

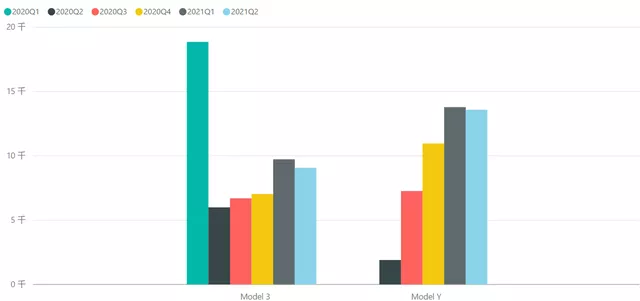

Tesla has been plagued by battery shortages in the United States. Analysis shows that in reality, Model Y exceeds Model 3, which is a strategy for Tesla, but it is the battery constraint that made Tesla make that choice. From the perspective of the entire market, Tesla is inclined towards Model Y.

In other words, the quarterly delivery of Model 3 in the U.S. market is being suppressed. Tesla’s battery supply chain has always been in a tight balance.

With the scale of Chinese battery supply coming up, Tesla found a solution, which is to send batteries to the U.S. factory. This model, on the one hand, reduces costs (the sales price in the United States is still $39,990), and on the other hand, it also solves the problem of balance between Model 3 and Model Y demand.

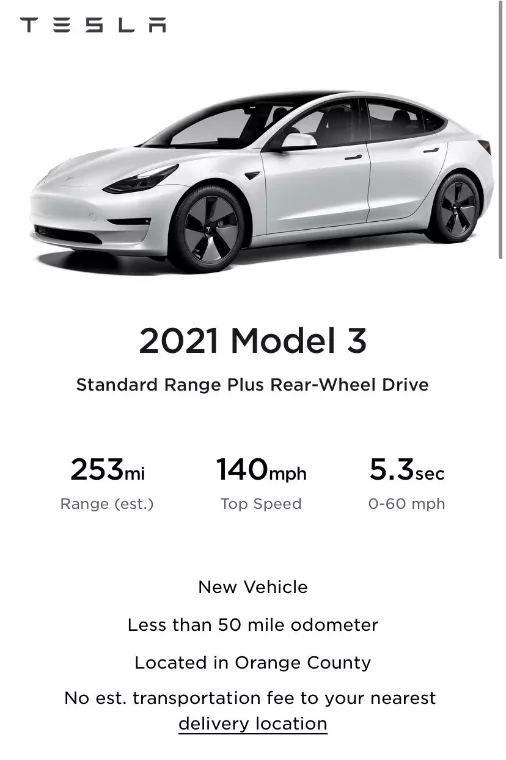

The entry-level Tesla Model 3 Standard Range Plus (SR+) in the U.S. market has introduced a new LFP (Lithium Iron Phosphate) battery option, with cylindrical batteries provided by China’s CATL. Due to the high demand for the Model Y, the estimated delivery time for new orders of the Model SR+ with Panasonic NCA 21700 batteries is not until January 2022. Tesla is now contacting some Order customers via email and conducting a small-scale survey to ask if they would accept the LFP version that could be delivered as early as September. As iron-phosphate batteries are being delivered in North America, Lithium Iron Phosphate is starting to penetrate the global market in a low-cost manner.

The entry-level Tesla Model 3 Standard Range Plus (SR+) in the U.S. market has introduced a new LFP (Lithium Iron Phosphate) battery option, with cylindrical batteries provided by China’s CATL. Due to the high demand for the Model Y, the estimated delivery time for new orders of the Model SR+ with Panasonic NCA 21700 batteries is not until January 2022. Tesla is now contacting some Order customers via email and conducting a small-scale survey to ask if they would accept the LFP version that could be delivered as early as September. As iron-phosphate batteries are being delivered in North America, Lithium Iron Phosphate is starting to penetrate the global market in a low-cost manner.

Based on current data, the EPA range for the iron-phosphate version is 253 miles (407 kilometers), while the NCA version is 263 miles (423 kilometers), a difference of 10 miles (16 kilometers) in range. Elon Musk has given his personal recommendation for the LFP battery, suggesting that the iron-phosphate version of Tesla can be charged to 100% within the available SOC window without worrying about battery life, which is highly recommended for consumers to buy.

In my opinion, the main problem solved by Lithium Iron Phosphate is the fast charging speed issue, which was previously addressed through software adjustments. The SOC algorithm has also been adjusted, and after being relatively perfected, it has been launched globally.

According to Tesla’s timeline, the iron-phosphate version of Model 3 may be introduced to the U.S. market in September 2021. As the iron-phosphate version of Model Y is being put into production in China, it is estimated that it will take 6-9 months to gradually launch the iron-phosphate version in Europe and the U.S. Based on this assessment, by around Q3 2022, regardless of the progress of 4680, the supply of entry-level versions should be sufficient.In the European automotive industry, Volkswagen’s MEB iron lithium version of around 40 kWh may also be further accelerated, and Europe may launch iron lithium around 2023-2024, which is probably 1-2 years later than Tesla.

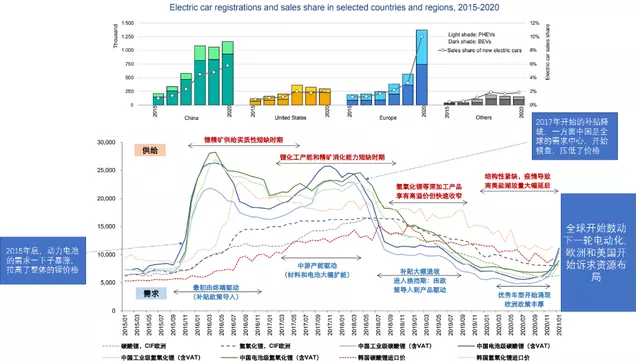

The biggest problem now is whether the price of lithium carbonate can be controlled with the large-scale use of iron lithium. As mentioned earlier, the expected cost of this iron lithium was very low, and material prices must be brought down to achieve this price.

Summary: With the comprehensive resurgence of iron lithium, the market for power batteries in China is being reshaped, and it may develop in a direction from the original dominant high market share to a more balanced direction. This depends entirely on the speed of import of phosphate iron lithium by all car companies and the subsequent import of B-point suppliers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.