At 5:30 am EST, XPeng (XPeng) released their Q2 2021 financial report before the market opened. This quarter marked XPeng’s best sales and gross profit performance since their IPO in August 2020. CEO He XPeng stated, “Our delivery volume in first half of 2021 exceeded the total delivery volume of 2020, reaching 30,738 vehicles!”

Double happiness for sales and gross profit

In Q2, XPeng’s delivery volume reached 17,398 vehicles, a year-over-year growth of 439%, and a 30.4% increase from Q1’s 13,340 vehicles, exceeding the Q1 expectation of 15,500 to 16,000 vehicles. Meanwhile, Q2’s total revenue was RMB 3.7613 billion, a year-over-year growth of 536.7%, which exceeded the Q1 expectation of between RMB 3.4 billion and RMB 3.5 billion.

Looking back at XPeng’s delivery volume in April, May, and June, the delivery volume of the old G3 and P7 models was maintained at about 6,000 vehicles. That’s why the “exceeding the expectation” in Q2 seems reasonable. Among them, P7’s delivery volume reached 11,522 vehicles, a 44.5% increase from Q1’s 7,974 vehicles, setting a new quarterly record, and the 50,000th XPeng P7 was rolled off the assembly line on August 23. Since the delivery started in June last year, the P7 model has always taken on the larger part of XPeng’s delivery volume, accounting for nearly 60% in Q2.

XPeng’s higher-than-expected delivery volume in Q2 also drove the growth of its total revenue for this quarter. In Q2, XPeng’s automotive sales revenue was RMB 3.5844 billion, a year-over-year increase of 562.4% from RMB 0.5411 billion last year and a 27.5% increase from Q1’s RMB 2.8103 billion.

Not only did sales and revenue take off, but XPeng’s gross profit margin also hit a new high, increasing from 11.2% in Q1 to 11.9%. The gross profit margin of a single vehicle also reached 11.0%, up from 10.1% in Q1, and a significant improvement from last year’s -5.6%.

The reason for the increase in the gross profit margin per vehicle is multifaceted. On the one hand, XPeng’s improvement in sales and production capacity allowed scale benefits to improve accordingly. XPeng can also lower the cost of goods by using larger order volumes in transactions with suppliers. In addition, the higher sales volume of the P7, relative to the G3, within XPeng’s product mix also played a key role in driving the improvement in the overall gross profit margin.

Of course, the increase in software revenue cannot be ignored, as it has started to steadily increase and objectively pushed up the gross margin per vehicle.

The Ace of Intelligence”Intelligence” is absolutely what XPeng relies on for survival and further development, which includes XPILOT and the intelligent cockpit centered on voice interaction.

In XPeng’s first-quarter financial report, the revenue of XPILOT’s assisted/automatic driving software was officially confirmed. XPeng became the first domestic new energy automaker and the second in the world following Tesla.

In the first quarter conference call, He XPeng stated that the total revenue for the software part in the first quarter was 80 million yuan, of which 50 million yuan was the revenue of software sold last year, and 30 million yuan was the revenue of the first quarter of this year. The penetration rate of XPILOT will continue to increase in the second quarter.

In the second-quarter financial report and conference call, XPeng did not specifically disclose how much revenue XPILOT brought in, but only mentioned that about 97% of the vehicles in the P7 delivered support XPILOT 2.5/XPILOT 3.0. He XPeng also mentioned in the conference call that the software penetration rate has increased from 20% in the first quarter to 25% in the second quarter, and the NGP monthly utilization rate has exceeded 65%.

As for XPILOT 4.0, which has no news yet, He XPeng also responded that “it will cover more end-to-end scenarios through software and hardware iterations, including scenarios without high-precision maps.” We will see XPILOT 4.0 on XPeng’s new car in 2023, and it will even be output synchronously to the international market.

In late June, after XPeng was approved for listing on the Hong Kong Stock Exchange, the exchange disclosed the materials of XPeng’s hearing, showing that the fourth flagship SUV to be launched this year will not only be equipped with an intelligent chassis and an air suspension system but also an advanced autonomous driving system and lidar, and it “can support” XPILOT 4.0.

However, just last week, several departments in China jointly issued the “Regulations on the Management of Automotive Data Security (Trial)” (hereinafter referred to as the “Regulations”), which emphasized data security issues.

He XPeng believes that independent research and development is the best way for security management, and the improvement of policies and laws is a good thing for the development of high-level autonomous driving and for all-in-house vehicle companies.

XPeng believes that their data is not only safe and compliant with domestic requirements but also complies with overseas standards. Strict regulation is good news for XPeng, which will help XPeng and its competitors further differentiate.

Losses are not scary.In the second quarter of this year, XPeng’s net loss was CNY 1.1946 billion, which continues to expand compared to CNY 0.146 billion in the same period last year. In the first quarter of this year, the net loss was CNY 0.7866 billion. Despite the increase in sales, revenue, and gross profit, XPeng’s profit-making ability has also been strengthened. However, it is important to examine where the money is being spent.

Firstly, XPeng increased its investment in research and development. The investment reached CNY 0.8635 billion, up 170.0% from CNY 0.3198 billion in the same period last year, and up 61.4% from CNY 0.5351 billion in the previous quarter. This was mainly due to XPeng’s investment in research and development, including personnel, salary, vehicles, and software. XPeng’s research and development team will increase from 3,000 people at the end of last year to 4,500 people by the end of this year. The expenses of this part will continue to rise in the third and fourth quarters.

In addition, XPeng’s sales and general and administrative expenses were CNY 1.0308 billion in the second quarter, an increase of 116% from CNY 0.4771 billion in the same period last year, and an increase of 43.0% from the first quarter of this year, which was CNY 0.72 billion. This part includes XPeng’s investment in automobile sales and marketing, advertising, and the expansion of sales outlets, which require corresponding construction, operation, and personnel costs.

XPeng originally planned to increase the total number of sales outlets to 300 this year, covering more than 100 cities. However, XPeng has now raised this target to 350. As of June 30, XPeng’s physical sales and service network includes 200 stores and 64 service centers, covering 74 cities. The completion of the task is more than sufficient, but more investment is needed during rapid expansion.

XPeng advocates simultaneous promotion of self-operation and authorization. In April of this year, XPeng reached a cooperation agreement with Zhongsheng Group, which will invest and operate XPeng’s authorized sales and service stores. However, what XPeng emphasized is to increase the proportion of self-operated stores, and to attract consumers’ attention to other models of XPeng through flagship stores and flagship models.

XPeng is still steadily promoting the layout of its charging network. As of the end of the first quarter, XPeng’s supercharging stations for the XPeng brand had operated 172, covering 60 cities, and its free supercharging system had more than 1,000 supercharging stations covering more than 160 cities. By the end of the second quarter, XPeng’s brand supercharging station had expanded to 231, covering 65 cities. This investment in user experience will also increase with the increase in sales.

About the futureIn this financial report, XPeng provided a better expectation for the third quarter. They expect to deliver between 21,500 and 22,500 vehicles, an increase of about 150.6% to 162.3% YoY; total revenue is expected to be between RMB 4.8 billion and RMB 5 billion, an increase of about 141.2% to 151.3% YoY. They even proudly declared that “in the fourth quarter, we will break through 15,000 deliveries”.

What supports XPeng’s sales?

From the delivery plan, G3i will start delivery in small quantities at the end of August and quickly expand the delivery scale, which is “beyond expectations” in popularity. P5 will officially announce the price and go public in mid-September, expected to be delivered in October. He XPeng said that compared with P7, P5’s sales are not bad, and G3i’s market popularity also exceeds expectations.

Among them, the LFP version of the model was previously expected to balance supply and demand in the third quarter due to battery core production capacity issues. But as the supply of battery cores increases, the proportion of LFP version G3i and P7 deliveries will continue to increase.

Good market feedback, an increase in the number of sales outlets, and an increase in the coverage of cities have indeed supported the continued increase in deliveries. But all of these ultimately depend on XPeng’s production capacity.

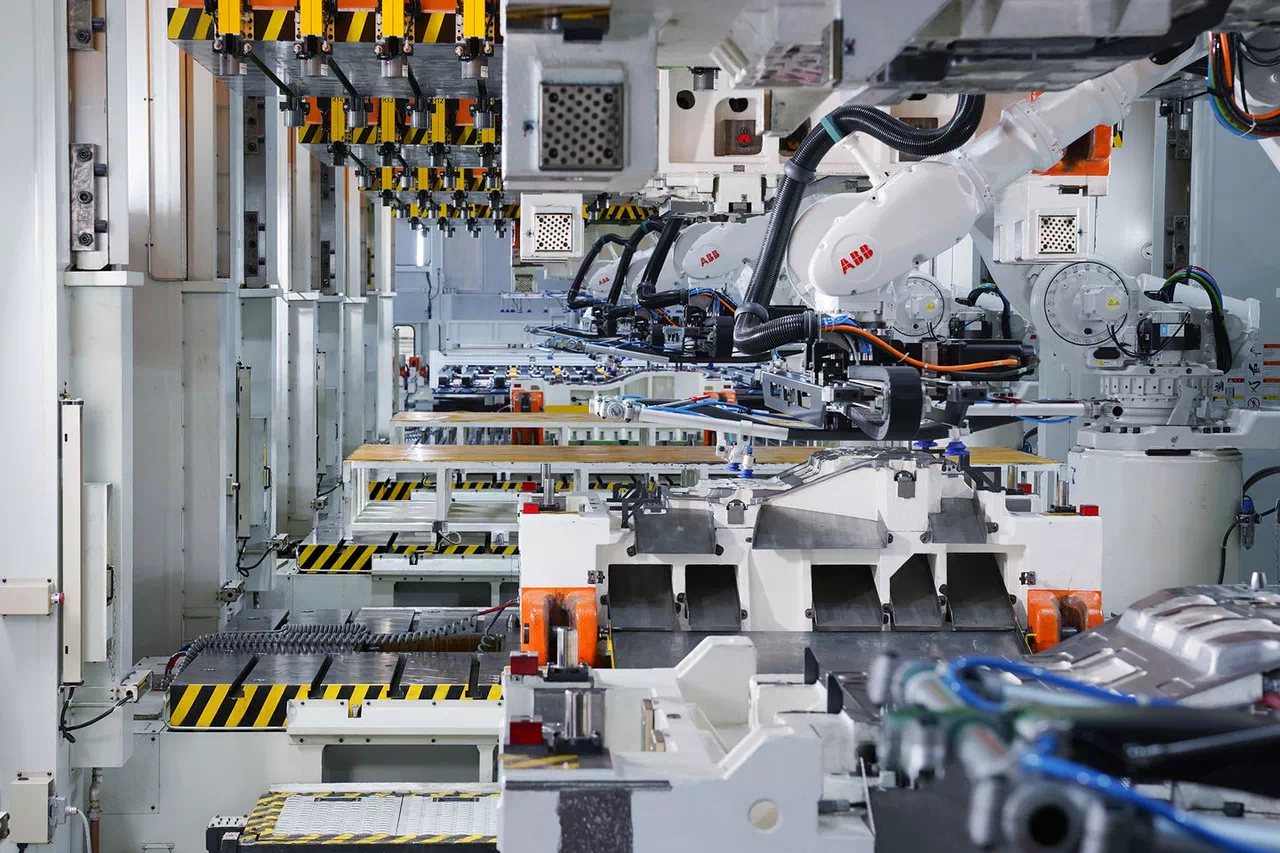

The only Zhaoqing Phase I factory that XPeng is currently producing in has almost reached full-capacity operation. During last year’s Spring Festival, XPeng upgraded and renovated the Zhaoqing Phase I factory, with a target output of 10,000 vehicles per month. Now, XPeng plans to make the production volume of Phase I meet their monthly delivery target of 15,000 vehicles. Therefore, the only factory has started the concurrent production of three models: P5, P7, and G3i, and has also moved to a two-shift schedule to complete production targets before the delivery peak arrives.

Regarding the Zhaoqing Phase II factory, it started construction in mid-August and it is expected to be completed in the first half of next year, with production capacity increasing from 100,000 vehicles to 200,000 vehicles. I predict that the total output of the Zhaoqing factory working at full capacity could exceed 250,000 vehicles.

The Guangzhou factory, which started construction in September last year, is expected to be put into operation in the third quarter of 2022. He XPeng said that the main body of the plant will be completed in the first quarter of next year, and it will be officially put into operation on schedule in the third quarter. XPeng’s Wuhan factory also started construction at the end of July this year, with an expected annual output of 100,000 vehicles.About production, there are many variables, such as the pandemic and chip shortages, which have forced consumers to face the dilemma of a car shortage.

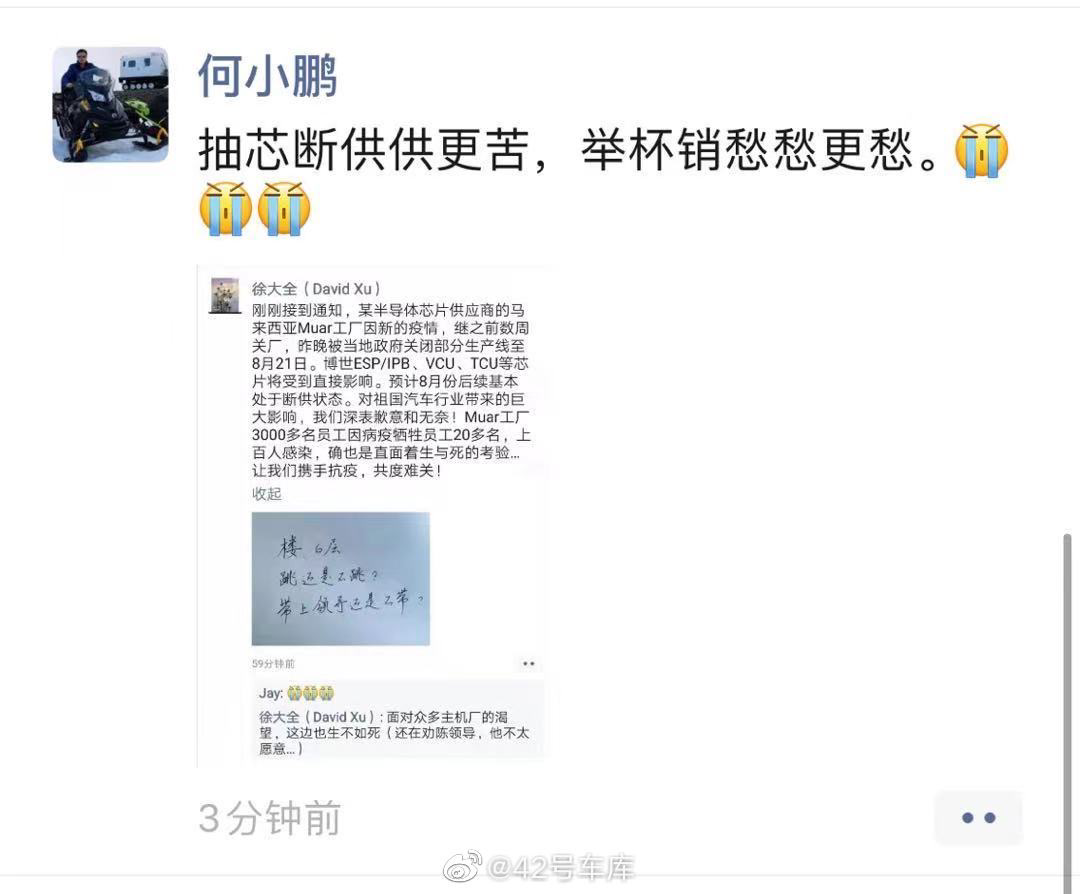

XPeng Motor has stated that it has secured sufficient supplies of chips by placing advance orders. However, recently, Bosch’s chip factory in Indonesia was affected by the pandemic, causing the production line to be shut down for an extended period of time. Furthermore, Bosch stated that starting from August, chips such as ESP/IPB, VCU, TCU, and others will be in short supply. He XPeng was forced to express his troubles on social media: “Lack of chips is already painful enough, and supply cut-off will make it more sorrowful.”

He XPeng believes that chip shortages can be expected, while the pandemic is unpredictable. To address the chip shortage, in addition to placing advance orders, XPeng Motor also plans to ensure chip supply through strategic cooperation, investment, and joint procurement with the government.

Although XPeng has a strong self-developed system and is relatively calm in selecting suppliers for chip shortages, XPeng may still be affected by the chip shortage problem, as Tier 1 suppliers like Bosch face the problem of production stoppage due to the pandemic.

Intelligence is King

Regarding this data, He XPeng himself explained that “the price range of 150,000-400,000 yuan will be the fastest growing sub-segment in the smart EV market and will disrupt tradition.”

Starting from 2023, XPeng will launch new models using a brand-new platform, which will expand XPeng’s product price range from 150,000-300,000 yuan to 150,000-400,000 yuan.

Why does XPeng want to make products in the 300,000-400,000 yuan price range? Is this to challenge the high-end market?

To explain all of this, we need to look back at the success story of XPeng P7. Last year, the top configuration of the P7, priced at over 300,000 yuan, happened to compete head-to-head with the domestically-produced Model 3. At that time, many people thought that the P7 was too expensive, and under the condition of unchanged price, the monthly sales volume would be at most 2000 vehicles. However, the fact is that the steady demand for the P7 remained above 6000 vehicles, and even a more expensive P7 Wing was launched.

This is a chess move we did not understand, and the root cause was intelligence. At that time, the P7 carried the strongest sensing hardware in production cars, with 8 sensing cameras+5 millimeter-wave radars+NVIDIA DRIVE AGX Xavier autonomous driving chips (30 TOPS computing power, 30 W power consumption). The cost was not low, and the P7 continuously released OTA updates based on its strong hardware foundation, truly making “intelligence” a core value label for XPeng.

Following the “intelligence is king” philosophy, let us look back at the G3i. Among models in the same price range and class, it is the most intelligent.Even many people don’t understand P5, which has a lower position than P7, but still equipped with a LiDAR and even realizes XPILOT 3.5, which P7 cannot carry. Putting the latest research technology and achievements, without distinguishing between high and low levels, to be implemented in the latest products, this is the best interpretation of “intelligence is king” by XPENG.

Let’s take a look back at the 30-40 price range. NIO and LI Auto have clear self-research paths, and spare no cost in stacking materials on flagship models, such as 4 Orin chips on NIO ET7 and at least 2 or more chips on LI Auto X01, plus LiDAR. This hardware cost is increasing layer by layer.

Therefore, it is simple. To continue to lead in intelligence, XPENG must work harder than NIO and LI Auto on this path, which can be seen in the size and investment of their R&D team. It can be said that the cost is stacked to the 30-40 price range.

Of course, XPENG is not only focusing on products in the 150-400k price range but also leaving flying cars to target the 500k-1m market.

Finally

He XPeng mentioned that the products to be launched in 2023 will also be synchronized with the international market in terms of software and hardware.

Currently, XPENG is also starting to experimentally expand its sales volume and categories internationally. By the second quarter, the export volume of G3 has reached 500 vehicles, and P7 also started to export to Norway in August and will officially deliver in October.

XPENG’s overseas plan includes cooperation with local dealers and hopes to open direct stores in the capitals of various European countries.

Even today, I saw CNBC reporters participating in XPENG’s report.

XPENG is now holding the torch of intelligence and starting to accelerate its pace.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.