This article is reproduced from Autocarweekly WeChat Official Account

Author: Finance Street Old Li

The chip shortage in the automotive industry has been brewing for a year and is about to come to an end.

On August 17th, Xu Daquan, the Executive Vice President of Bosch China, wrote on his WeChat moments: Due to the increasingly serious epidemic situation in Malaysia, the factories of Bosch’s related chip suppliers will be shut down until August 21st. The chip supply of many key components of Bosch will be directly affected and is expected to be in a state of suspended supply after August. The news was widely circulated in the industry for a while, and the Old Li team interviewed relevant experts for the first time.

Since the second half of last year, the issue of chip shortage has been hyped up by the media from time to time, from the extreme weather in Texas to the fire in Japanese factories and the epidemic situation in Malaysia. The Old Li team has almost organized monthly interviews with automotive chip experts to judge the chip supply situation. Although the semiconductor industry is relatively closed, researchers have built a supply chain for automotive chips. Based on the current supply and demand situation, many researchers have predicted that “starting from Q4, the chip shortage problem for automakers will be gradually solved, and coupled with the market peak season and the effects of the prosperity, the entire vehicle stocks will reach a new high.”

The time for the secondary market to resolve the chip shortage may exceed the expectations of many friends. Today, Old Li and everyone will discuss what impact the shutdown of the Malaysian chip factory will bring to China, what problems have been exposed in the domestic chip shortage that lasted for a year, and how will China’s automotive chip industry develop?

The Domino Effect of the Industry Chain

In addition to the giant TSMC, Malaysia is also an important supporting area for the Asian automotive semiconductor industry. Its semiconductor industry began in the 1970s and has become an important component of the global backend semiconductor production after nearly half a century of accumulation. Malaysia contributes 13% of the global backend semiconductor output.

In the automotive semiconductor packaging and testing link, Malaysia is even more dominant. Its automotive chip packaging and testing market share accounts for over 40% of the global market share. ST, Infineon, ON Semiconductor, and NXP all have factories in Malaysia, and the final destination of their factory chips is China. According to the researchers, the ESP of Bosch is needed for more than 60% of the passenger car models of Chinese-European joint venture brands, and the core chip L9369 of Bosch’s ESP system comes mainly from ST in Malaysia, which is the company most affected by the epidemic situation in Malaysia in this case.

The situation is not as bad as imagined. Although Malaysia entered a complete lockdown in June, most semiconductor companies have resumed production capacity close to 100%. Earlier, many researchers predicted that the problem of automotive chip shortage in China would be basically solved starting from August of this year, but unexpected events always happen unexpectedly. The Malaysian factory of ST had a collective infection of COVID-19, which led to its shutdown, and it is not surprising that Bosch management posted on WeChat moments.

It’s interesting that many people are spreading the word about the chip shortage problem, but few are studying its solutions. The researcher team from Mr. Li’s team in Malaysia interviewed local experts and found that 80% of the labor force in Malaysian chip factories were vaccinated. As a result, the government allowed chip factories to operate at 100% capacity. According to the progress of vaccination and the recovery time, the chip shortage problem is expected to be relieved from September this year, and the supply chain is expected to fully recover to its pre-pandemic level in November.

The automotive semiconductor industry has a long supply chain, and any problem in any of its links could lead to different and unique patterns of chip shortages.

In February this year, the chip shortage was caused by TSMC’s lack of wafers. In the context of a shortage of production capacity, TSMC primarily allocated wafer production capacity to consumer electronics customers, resulting in less wafer allocation to the automotive sector, and the capacity was not released. TSMC is also trying to solve the wafer allocation problem, starting in April this year. As wafer production capacity switchover is progressive, wafer production capacity can only be restored to normal levels until Q4 this year.

Compared with the wafer production capacity shortage, the chip shortage problem in Texas, the United States, was caused by natural disasters. Semiconductor companies in Texas suddenly shut down during the production process. Normally, if semiconductor factories shut down normally, capacity can be restored in a few weeks. If a sudden shutdown occurs during production, its recovery period may be much longer. The technical assessment alone could take 2-3 weeks, and in the case of problems with lithography machines, the repair time could take at least 2-3 months.

While everyone was focusing on the chip shortage problem, the industry was quietly undergoing changes. From the demand side, the demand for new energy vehicles in China was rapidly increasing, with monthly market penetration rate exceeding 10% in the past three months, while the market demand for gasoline vehicles decreased and sales continued to decline.

On the supply side, polarization has also emerged. Some companies have controlled the chip shortage problem due to their fast response and continuous optimization of the chip supply chain, while others have experienced a sharp drop in the short-term safety of their chip supply chain due to their supply chain problems combined with the Malaysian pandemic.

From the perspective of the secondary market, the demand side of China’s passenger car industry is generally better than the supply side after entering the fourth quarter, and terminal customers often experience queues or even price increases in the second-hand car market. If the automobile sector experiences a recent correction, it is a good opportunity to buy in. After the end of the chip shortage in the fourth quarter, car companies with better demand will enter the phase of inventory replenishment, with greater profit elasticity. In this process, domestic brands have more advantages than joint venture brands.

From the perspective of the secondary market, the demand side of China’s passenger car industry is generally better than the supply side after entering the fourth quarter, and terminal customers often experience queues or even price increases in the second-hand car market. If the automobile sector experiences a recent correction, it is a good opportunity to buy in. After the end of the chip shortage in the fourth quarter, car companies with better demand will enter the phase of inventory replenishment, with greater profit elasticity. In this process, domestic brands have more advantages than joint venture brands.

What problems does the chip shortage expose?

The reasons for the chip shortage are diverse, but the essence is the issue of supply chain security.

Before the COVID-19 pandemic, the globalization of the automobile industry progressed rapidly, and each country and enterprise had relatively clear division of labor, forming a perfect supply chain. When there were changes upstream in the production chain, another country or enterprise thousands of miles away would be quickly affected. Let’s take a look at the transmission path using the example of the chip shortage in Malaysia:

Malaysia is the sealing and testing base for ST semiconductor chips, and ST chips are paired with Bosch ESP products. Bosch ESP products mainly flow to China, and more than half of the models in China require Bosch ESP products.

In this supply chain, China’s automobile manufacturing is entirely “bound” by ST’s chips. To solve the problem of supply chain security, we need to start from several directions:

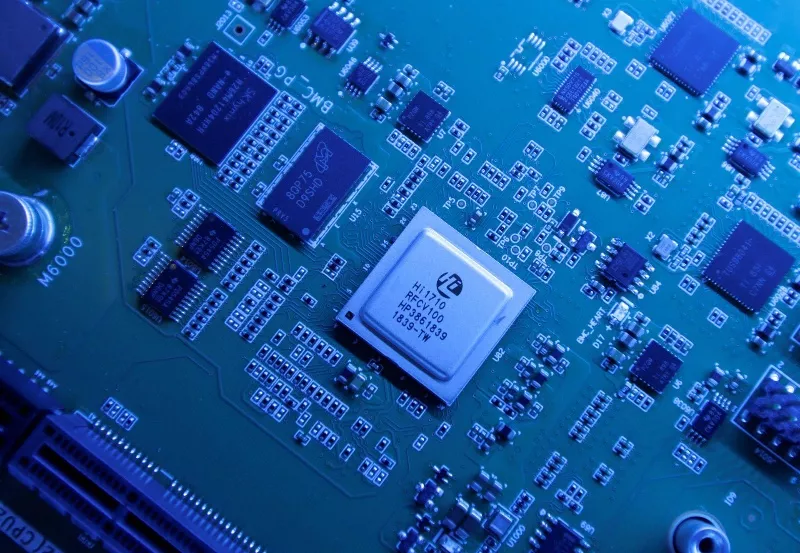

The first is self-controlled core technology. Whether it is the bottleneck problem of Huawei chips or the ban on high-end semiconductor equipment, the essence is the lack of control over core technology. The chip shortage problem in automobiles has also been determined to be related to the lack of control over core technology. Although the MCU produced by ST is not a high-end chip, no enterprise in China except BYD can achieve vehicle-grade applications.

In the future, Chinese enterprises will continue to emphasize the self-control of chips. Some chip enterprises that have not received much attention in the past may usher in a relatively large opportunity in China. At present, domestic OEMs have seized this direction, but the replacement process is relatively long. There is not much chance of chip switching this year, but there may be opportunities next year.

Japanese enterprises’ supply chain management capabilities are worthy of learning for many companies. The impact of this round of chip crisis on Japanese enterprises is not significant because on the one hand, the sales and trends of Japanese brands in China are relatively stable and well controlled; on the other hand, Japanese OEMs will position their top-tier suppliers as domestic enterprises, and Japanese Tier 1 suppliers will choose local suppliers such as Renesas for the main chip, forming synergy.The second is to have a sound supply chain management mechanism, including supply time, supply mechanism and supply price. For relatively complex devices such as MCUs, it takes 12-16 weeks from ordering to delivery, while inertial sensors for vehicle stability system take 26 weeks. Therefore, it is crucial to handle the dependence relationship through careful management of ordering arrangements and maintaining inventory balance for timely supply, and inventory balance can easily be disrupted by unusual market factors such as the COVID-19 pandemic, as in the case of Malaysia.

From the perspective of supply time, automotive companies and Tier 1 chip companies have fixed management models, generally using the LeadTime indicator of the product for control. During the chip shortage period, the hoarding behavior of distributors and Tier 1 companies caused the LeadTime of automotive chips to increase from the normal level of 16 weeks to 10 weeks, and the safety stock from 7-10 days to one month. The chip shortage problem is a problem of market mechanism failure.

There are also problems in the supply mechanism. After capacity is restored in Malaysia, some countries and companies may be given priority in supply, with multinational corporations being more likely to procure first, while Chinese companies may not be given priority. It is currently impossible to judge which countries will be harmed or benefited.

In the process of ensuring chip supply for global OEMs, multinational companies such as Volkswagen, General Motors, and Mercedes-Benz will prioritize the better profitability of European and American demands. Domestic joint venture brands will suffer from more severe chip shortage problems as they have weaker purchasing power compared to their headquarters. Independent brands have higher bargaining power in chip management than joint venture companies, so their chip supply problems and autonomy are stronger.

Generally speaking, there are two price systems for automotive semiconductors. The first is the big customer system where large automakers negotiate based on annual purchases, usually determining the demand and price for the next year with chip companies from September to November and executing the agreement according to the agreement the following year. Therefore, large Tier-1 and Tier-2 companies will not hike prices midway. The second is the non-big customer system, targeted at small customers, where semiconductor and channel companies often increase prices, and most of the online price hikes come from this system.

The automotive semiconductor industry is like a big river, with half of the water clear and visible, and the other half turbid and elusive. From this perspective, it is reasonable to strictly investigate the price hikes of semiconductors.

Is there a future for Chinese automotive chips?

The chip shortage problem has led Chinese automotive companies to think about where the future of Chinese automotive semiconductors lies. They have thought about it for a long time, and realized that they need to act, but haven’t figured out how to do it yet.The annual sales volume of cars in China is 25 million, accounting for over 30% of the global sales volume. However, the domestic production of auto chips is less than 15 billion, only occupying 4.5% of the global production capacity. Key components, such as the MCU, have an import rate of over 80% to 90%. Therefore, the amount of imported car chips in China exceeds 100 billion yuan annually.

In terms of products, automotive semiconductors are a broad concept. They are divided into automotive chips, power devices, sensors, and so on based on their functions. Automotive chips refer to the computing chips in a car and can be divided into MCU chips and SoC chips according to their integration scale. Power devices mainly include IGBT and SiC.

There are supply security issues with all domestic automotive semiconductor products. Currently, the domestic shortage is mainly in MCU chips. NXP, TI, and Renesas are among the MCU suppliers in the market, while there are not many domestic enterprises producing MCU products for cars. BYD is an exception. Previously, there was also a shortage of IGBT in China. The global IGBT products are mainly supplied by Infineon from Germany, while China has only fostered two domestic enterprises, StarPower Semiconductor and CRRC Times Electric, to promote IGBT. The road is still long.

Automotive chips will face the common problem of chip manufacturing. An expert told Lao Li that currently about 70% of car MCU production globally relies on TSMC, causing production bottlenecks in the entire industry. Worse still, the auto chip business accounts for only 3% of TSMC’s total revenue, which is high in market share but low in value. Therefore, TSMC does not attach much importance to this business.

Although TSMC has said it will increase investment to support its automotive customers, this is a long-term action to cater to the long-term trend of the industry towards high-performance computing, rather than to help solve the current supply bottleneck.

During the year-long chip shortage, as the most downstream application enterprises, car companies did not think about solving the bottleneck problem but instead opted to hoard inventory by various means. Overall, BYD has relatively better performance, while other automakers are under different pressure. However, it is expected that all companies will overcome the chip shortage by Q4.In terms of self-owned brands, BYD’s overall inventory is relatively abundant, and many experts have feedback that it has a minimal impact. Geely, which has invested in Proton in Malaysia, can obtain more resources in terms of local government and production capacity, and is also actively responding. Conversely, Changan and GAC are under some pressure.

Vehicle enterprises are also formulating strategies that best serve their corporate interests based on the chip supply situation. Enterprises such as Great Wall, which mainly focus on traditional fuel vehicles, prioritize the production of highly profitable tanks and Haval vehicles, while reducing production of less profitable Ora cars in the event of chip shortage. New energy vehicle enterprises such as NIO, IDEAL, Xpeng, and BYD mainly focus on guaranteeing the production of electric vehicles (EVs). These companies’ proportion of new energy cars is relatively high, even reaching 100%. At this stage, their market share and sales are relatively more important, and shareholders are not concerned with profitability. In the first half of this year, IDEAL, Xpeng and NIO basically didn’t consider the chip price when procuring chips. However, for traditional vehicle enterprises or those with certain profit pressures, they will not accept chip prices once the price rise to a certain extent.

In a year, China’s automotive chip industry has experienced too much. For many enterprises, automotive MCUs, which have certain thresholds but low value, are redundant. However, without their “redundancy”, the risk of chip supply disruptions will always exist in China’s automotive chip industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.