Author: First-Line Report Team

Finally, the transfer of Jiangling Motors Corporation (JMC) equity has settled.

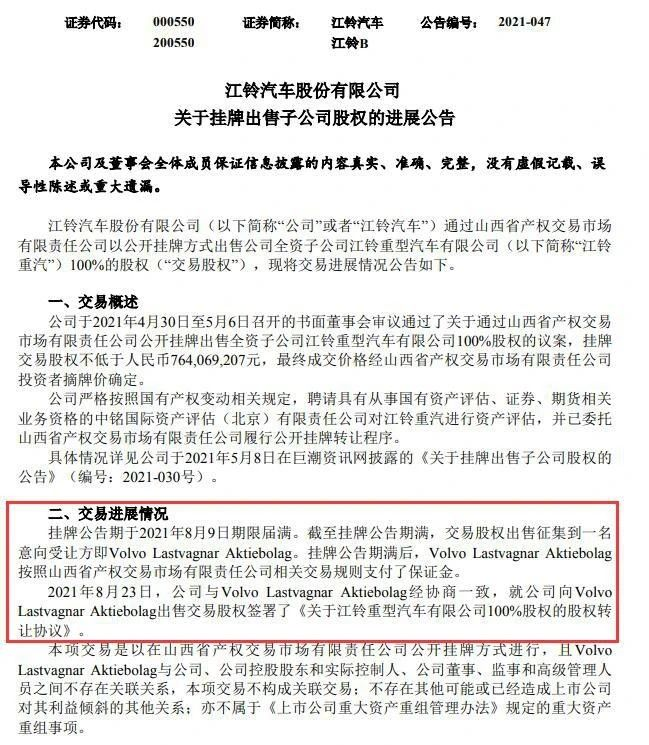

On August 23, 2021, JMC and Volvo Lastvagnar Aktiebolag signed the “Stock Transfer Agreement on the 100% Equity of Jiangling Motors Corporation Limited” after negotiation and agreement.

JMC has been adjusting its strategic pace to further focus on its strategic vision of “becoming a leader in the light commercial vehicle industry and a provider of high cost-effective Ford products.”

On May 7th this year, JMC released an announcement stating that the board of directors approved selling 100% of the equity of its wholly-owned subsidiary, Jiangling Motors Corporation Limited (Jiangling Motors), whose minimum price is not less than 764 million yuan, via the public listing on the Shanxi Province Property Rights Trading Market. The listing expired on August 9th.

According to the agreement, the deal includes all equity and asset-liability of Jiangling Motors, including all land property rights, production equipment, facilities, and production qualifications.

This deal is beneficial to JMC, Volvo Trucks, and Jiangling Motors.

Entering the Heavy-Duty Truck Industry for 8 Years and Choosing to Quit

As we all know, over the past few years, JMC has been a leading company in the light commercial vehicle sector in terms of sales volume, brand strength, and sales profit rate, but only a blank space in the heavy-duty commercial vehicle sector.

In 2012, JMC acquired Taiyuan Changan Heavy Truck Co., Ltd. at a price of 270 million yuan. In January of the following year, Taiyuan Changan Heavy Truck was renamed Jiangling Motors Corporation Limited (Jiangling Motors), and JMC officially entered the heavy-duty truck market. At that time, JMC stated that entering the heavy-duty truck market was an intent to achieve comprehensive coverage of the commercial vehicle industry.

To develop the heavy-duty truck business, JMC spared no expense in investment.

In terms of product, JMC cooperated with Ford Otosan in Turkey, importing Ford heavy-duty truck engines, cabs, and entire vehicle projects. According to the investment plan formulated by Ford and JMC, the entire project is expected to invest 3.415 billion and Jiangling Motors’ heavy-duty trucks are the international leading technology level in terms of chassis, cab, and engine.

In terms of brand marketing, at the 2017 Shanghai Auto Show, Jiangling Motors released its first heavy-duty truck product and announced that Jiangling heavy-duty trucks would cooperate with Disney Marvel’s superhero Iron Man for marketing to combine Iron Man’s well-known heroic image with Jiangling’s first traction vehicle.However, despite the implementation of a series of layout measures, JMC Heavy Duty Vehicles did not achieve the expected market results. From January to September 2020, JMC Heavy Duty Vehicles sold 1347 vehicles, which, although significantly higher than in 2019, could still be considered a drop in the bucket. Financial reports show that JMC Heavy Duty Vehicles accumulated losses of over 600 million yuan between 2019 and 2020, with total liabilities reaching 1.269 billion yuan.

The reasons behind this lie in the product aspect. JMC Heavy trucks have been firmly tied to JMC power since birth, and for a long time, only narrow-body models were sold, which resulted in a single product type. Coupled with a deviation in market demand judgment, this actually made JMC Heavy Duty Vehicles’ opening not smooth.

In addition, due to high expectations for JMC Heavy Duty Vehicles’ brand and products, there have been deviations in channel strategy, pricing strategy, marketing strategy, and so on. Therefore, JMC Heavy Duty Vehicles’ channel promotion is more difficult, the market does not approve of the product prices of JMC Heavy trucks, and user expectations for JMC Heavy trucks are not high.

Unloading the Burden to Focus More on Strategy

For Jiangling Motors, divesting its heavy-duty truck business was a decision made under a new strategy.

In July 2019, Jiangling Motors officially established a new strategic vision of “becoming the leader in the lightweight commercial vehicle industry and the provider of high-quality and cost-effective Ford products”. Selling JMC Heavy Duty Vehicles is one of the measures to achieve this new strategic vision.

The announcement also mentioned that this transaction is in line with Jiangling Motors’ strategic vision of “becoming the leader in the lightweight commercial vehicle industry and the provider of high-quality and cost-effective Ford products”, and the sale of 100% equity of JMC Heavy Duty Vehicles is one of the measures to achieve this strategic vision.

Jin Wenhui, the first executive vice president of Jiangling Motors, candidly stated in a media communication meeting: “JMC Heavy Duty Vehicles do indeed lose several hundred million yuan every year. Selling it to Volvo Trucks can indeed reduce losses for Jiangling Motors. But for Jiangling Motors, we are not just looking to reduce losses or gain one-time cash. Because in the heavy-duty vehicle field, we think we don’t know enough about heavy-duty vehicle customers and our operations are not good. So we are looking for opportunities to find reliable companies to operate, which is also a return to the support and help given by JMC Heavy Duty Vehicles employees and the Taiyuan government. We cannot do it ourselves, but we hope to find a reputable company to do it, and we also look forward to Volvo Trucks doing better in Shanxi Province and China.”江铃汽车以负责任的态度,为江铃重汽找到沃尔沃卡车这样的好“买家”,也让江铃重汽迎来全面新生。工厂不仅将采用沃尔沃卡车全球生产体系,依照沃尔沃卡车的高标准运营,同时沃尔沃卡车中央采购和技术开发部门将为太原本地的团队配备强大的供应链管理和研发能力支持。

“完成股权转让后,公司在重卡业务上的持续亏损将不复存在,7.8 亿资产变现也会让江铃的现金流更宽裕,能够对轻型商用车和乘用车业务的发展形成更有力的支撑。” 江铃汽车表示,当然重汽转让后我们的现金会更宽裕,对轻型商用车和乘用车发展将有更多的资源聚焦。

江铃汽车虽然全面退出重卡市场,但在轻卡、皮卡、轻客等方面,都在寻求新的发展机会。剥离重卡业务后,卸下重担的江铃汽车,通过不断推出新品,也会给市场和消费者带来新期待!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.