By Qiu Kaijun

Baidu, which has invested heavily in the field of AI, is about to enter the harvesting season in the most important area of AI – the automatic driving track.

On August 18, 2021, the Baidu World Conference was held online. Baidu founder, chairman and CEO Robin Li and the leaders of Baidu’s various business sections showcased the strength of Baidu AI in various fields.

First up is AI travel, which mainly includes five major content:

- Release of the autonomous driving car robot: Baidu has launched the world’s first L5-level autonomous driving car. Li Yanhong used this product to once again express his understanding of autonomous driving cars, which is called car robot. The so-called car robot must have four characteristics: autonomous driving, intelligent assistant, loyal companion, and self-learning.

-

Launch of the “Radish Run” brand: Baidu has already landed in four cities across the country. Its consumer-side APP, ApolloGo, has been upgraded to Radish Run, indicating Baidu’s determination to accelerate the commercialization of unmanned vehicle operations.

-

Baidu’s car-making project degree will mass-produce the first new car in two to three years, incorporating all of Baidu’s most advanced unmanned driving technology and intelligent cockpit technology.

-

Baidu can provide car companies with AI assistants and AI drivers, namely Xiaodu Assistant Car Edition and intelligent driving assistance functions: ANP and AVA. ANP is the leading navigation assisted driving system, which integrates Baidu’s high-precision map and V2X, and can provide full-range assisted driving ability from start to finish without intervention. AVP is a level 4 autonomous parking system.

-

Baidu Intelligent Transportation Travel Service, through big data, artificial intelligence, intelligent road network, V2X and other technologies, guides traffic and improves traffic efficiency.

When introducing Baidu’s Robotaxi new brand, Li Yanhong stated that in the next three years, Radish Run will enter 30 cities. Against the background of such a large expansion, Li Yanhong judges that by 2025, the total cost of Robotaxi will be lower than that of online car-hailing services. By then, the scale of Baidu Robotaxi will be much larger and will create a new profitable business line for Baidu.

In addition to operating unmanned vehicles, Baidu is also a provider of automatic driving solutions for car companies and is building intelligent cars of its own. Baidu, which has “three-pronged approach”, is a unique and indispensable player in the field of autonomous driving. With the opportunity of a trillion-level market in the future, Baidu is already very close.

Moreover, AI and autonomous driving have become the global competition highland, and AI is even considered to be the core of the fourth industrial revolution. In this round of technological innovation, Baidu’s AI exploration is expected to give China an advantage.

From ApolloGo to Radish RunWithin 3 years, 30 cities, 3000 autonomous vehicles, and 3 million users – this is the promotional plan for Baidu’s Robotaxi, which will be deployed under the Luobokuaipao brand, representing Baidu’s effort to accelerate the commercial operation of autonomous vehicles.

There are several prerequisites for commercial operation of autonomous vehicles.

First and foremost, it is safety. Although UBER’s autonomous driving development was progressing smoothly, in March 2018, UBER’s autonomous test vehicle killed a pedestrian riding a bike. Since then, UBER’s autonomous driving testing has been stagnated and recently sold its autonomous driving business for 4 billion US dollars.

Baidu is confident to constantly deploy its autonomous taxi business due to its confidence from historical data.

At the Baidu Q2 investor conference call, an investment institution asked Li Yanhong about the safety issue of Baidu’s autonomous taxi.

“Our test mileage has exceeded 10 million kilometers, but there have been no serious accidents.” Li Yanhong said, “Once we decide to start Robotaxi service on a certain route, we are confident that Robotaxi service will have a higher safety level than human drivers. This will be the minimum threshold for launching fully autonomous driving services. My expectation is that Robotaxi should be ten times safer than human drivers.”

Indeed, Baidu Apollo has the richest autonomous driving testing experience in China, with 336 autonomous driving test licenses, and has conducted autonomous driving tests in 27 cities nationwide, with a total test mileage of more than 14 million kilometers. Autonomous driving taxis have served more than 400,000 passengers.

Secondly, it is the commercial feasibility. In terms of revenue, due to reference prices from taxi and ride-hailing business, the key is cost.

Autonomous taxis save on labor costs more but vehicle cost is high. In June, Baidu released the fifth-generation autonomous taxi Apollo Moon in collaboration with Jidi, with a unit cost of 480,000 yuan, a 60% reduction in mileage cost from the previous generation. Moreover, in the first four generations of models, the mileage cost could be reduced by about 62% for each generation. With the advancement of technology and the expansion of scale operation, the cost of Baidu’s autonomous taxis will continue to decline rapidly. In traditional ride-hailing business, driver costs are difficult to reduce or even increase.

# Baidu believes that Robotaxi will become a mainstream mode of transportation in the future.

# Baidu believes that Robotaxi will become a mainstream mode of transportation in the future.

According to Li Yanhong, the total cost of Robotaxi is expected to be lower than that of ride-hailing taxis by 2025. For Baidu, Robotaxi will also become a new source of revenue. Currently, Baidu is the only company in the world that has launched Robotaxi services in multiple cities. With the expansion of the service, the leading position of Baidu Robotaxi may also increase.

Baidu is very confident that Robotaxi will become the mainstream mode of transportation in the future.

But is the future of Robotaxi really that promising?

On November 11th, 2020, the “Intelligent Networked Automobile Technology Roadmap 2.0” compiled by the China Society of Automotive Engineers was released. This document, representing the opinions of the regulatory authorities, predicts that by 2030, Level HA (L4) vehicles will account for 20% of the total. Based on the annual sales volume of 30 million passenger cars in 2030, there will be as many as 6 million HA-level vehicles.

However, the well-known research institution IHS believes that due to price factors, the private car market cannot quickly achieve the overall development of L4, and the future main market potential will rely on the promotion of commercial models such as Robotaxi in mobile travel scenarios.

IHS further predicts that in the future, Robotaxi will account for more than 60% of the shared transportation market, with a market size expected to exceed 1.3 trillion. Moreover, the main participants in Robotaxi will be concentrated in 2-3 service providers, and the head service provider may have more than 40% of the market share.

This means that in 2030, shared transportation will have an oligopoly competition pattern, but the giants in the industry will not be platforms with driver services such as Didi, but platforms like Baidu’s Apollo. For Baidu, the 1.3 trillion market undoubtedly worths sticking to Robotaxi business, regardless of the setbacks of the industry.

Provide ADAS solutions suitable for car companies

If the prediction in the “Intelligent Networked Automobile Technology Roadmap 2.0” comes true, Level L4 and below vehicles will still account for the majority in 2030. Moreover, there are still nearly ten years from now until 2030. Can most cars enjoy AI driving in these ten years?

This was also the question repeatedly asked by Sa Beining, the host of the Baidu World Conference 2021, to Li Yanhong and Li Zhenyu, Senior Vice President of Baidu Group and General Manager of the Intelligent Driving Business Group.

Li Zhenyu answered that compared to the ultimate form of car robots, current cars can have some modules of car robots. He mainly divides them into two parts: AI assistants and AI drivers.The AI assistant part that Li Zhenyu focused on introducing is Xiaodu Assistant for cars, which can control functions such as calling and music through voice interaction. In addition, it also provides event reminders and information push through artificial intelligence, and can be personalized in its image, title, and voice, making it more human-like.

As for the AI driver part, Li Zhenyu specifically mentioned the ANP and AVP functions of Apollo’s autonomous driving system.

ANP (Apollo Navigation Pilot) belongs to the category of navigation and driving assistance. Currently, only three companies, Tesla, NIO, and XPeng Motors, have realized production vehicles equipped with this technology. However, ANP defined by Baidu has higher capabilities, as it aims to achieve full-assist driving without intervention from start to finish. General navigation and driving assistance can only be achieved on some road sections, particularly the start and end points, including entering highways and passing through toll stations, which often require drivers to take over.

The reason why Baidu defines ANP as “full-assist driving without intervention” is because it leverages Baidu L4 technology, combined with high-precision maps and V2X technology. The Baidu L4-level assisted driving system, Apollo Lite, is designed specifically for autonomous driving and can operate on complex urban roads.

In addition, ANP can also work in combination with AVP (Automated Valet Parking). So consumers can wait on the roadside for AVP to bring the vehicle to them, then they can get in and ANP will drive the vehicle to the destination. The consumer can then leave the vehicle, and AVP will automatically park the car in a parking spot.

AVP + ANP + AVP means consumers don’t have to intervene throughout the process. If this feature is realized, it will surpass all competitors.

At present, AVP has been installed on the WM W6 model, while ANP is on standby. Baidu has said that there will be one vehicle every month launched with Baidu Intelligent Driving Technology in the second half of this year. Baidu aims to achieve mass production at the level of millions of vehicles equipped with AVP + ANP in the next 3-5 years.

The ANP/AVP solution is one of the core functions of Baidu Apollo’s autonomous driving platform. Apollo is an open autonomous driving platform that Baidu provides to car manufacturers. One of its characteristic features is its openness. By using Apollo’s open-source code and platform, car manufacturers can define their own solutions for autonomous driving. This can let many car manufacturers relax and adopt solutions without worrying about being strangled by suppliers.

Do car manufacturers need the Baidu ANP/AVP solution?In today’s automotive market, ADAS is already standard on mid- to high-end models, but it is mostly at the L1 or L2 level. For higher-end models and those that market themselves based on intelligence, driven by Tesla and WeRide, they have to deploy more advanced driver assistance systems.

However, while ADAS can be obtained through the traditional supplier model, traditional suppliers do not provide higher-level driver assistance systems, and the vast majority of car companies are unable to independently develop such systems.

With its basic AI capabilities, top-tier intelligent driving assistants, Baidu’s intelligent driving solution, its content ecosystem, and open-source collaboration, the solution is more in line with the needs of most car companies.

IHS’s research report also predicts that Baidu’s Apollo will account for about 38% of the overall adoption and market size in China. With the current trend, Baidu’s Apollo autonomous driving business is indeed gaining recognition from car manufacturers, with business revenue growing five times last year.

Jidu: Combining the Soul and Body

In 2019, Huawei participated in the Shanghai Auto Show, touting a full range of autonomous driving solutions to the automotive industry.

Two years later, only three companies were willing to take out a separate version of a car model and cooperate with Huawei to build a sub-brand model.

The entire country looks up to and sympathizes with Huawei, so why do most car companies not want to work with Huawei?

SAIC Group Chairman Chen Hong’s remarks reveal the mindset of car companies: “This is like a company providing us with a complete solution, which makes it the soul, and SAIC is the body. SAIC cannot accept such a result and must own the soul itself.”

Chen Hong and those who agree with his views clearly see one thing: the future of intelligent vehicles will become more and more like smartphones, and brand operators must be able to control both hardware (body) and software (soul).

Looking at the ultimate form, intelligent vehicle players of different origins are all trying to address their own shortcomings. Ambitious car companies establish large software teams and some claim full-stack independent research to achieve a complete and thorough soul. Meanwhile, cross-border automakers are attempting to make up for their lack of experience in automotive research and development and production.

Baidu is undoubtedly qualified as a “soul” provider in the intelligent cockpit and intelligent driving domains, but through open-source approaches, it also allows different car companies to have their own personalities. Besides, Baidu is also building up the capability to develop “body”.

On January 11 this year, Baidu announced the establishment of an automobile company, highlighting its identity as a “vehicle manufacturer” to enter the automotive industry. Baidu has also brought in Geely Group, one of China’s strongest private automakers, as a strategic partner, with Geely teaching Baidu how to build cars.

The latest development is that Li Yanhong announced at the Baidu World Conference that “in the next two to three years, privately-owned cars that concentrate on all of Baidu’s most advanced unmanned driving technology and intelligent cockpit technology will be launched.”# Baidu Entering the Auto Industry — What Will Other Carmakers Make of It?

Will Baidu’s autonomous driving and smart cockpit solutions be able to compete with Jidu Auto after entering the auto industry and making their own cars? Will there be any chance of success?

According to Li Yanhong, “The purpose of Jidu Auto is to promote Baidu’s years of autonomous driving technology and intelligent cockpit technology to the market as soon as possible.” This implies that while on one hand he is dissatisfied with the slow pace of their partners’ application, on the other hand, it is also a demonstration with the hope of attracting more cooperative enterprises.

Three-pronged Approach, Unique Worldwide

At the Baidu World Conference, Baidu accelerated the commercial operation of Robotaxi, providing smart car solutions to car manufacturers, and promoting Jidu Auto’s independent car-making efforts. Baidu is practicing a three-pronged approach to the commercialization of autonomous driving and its business.

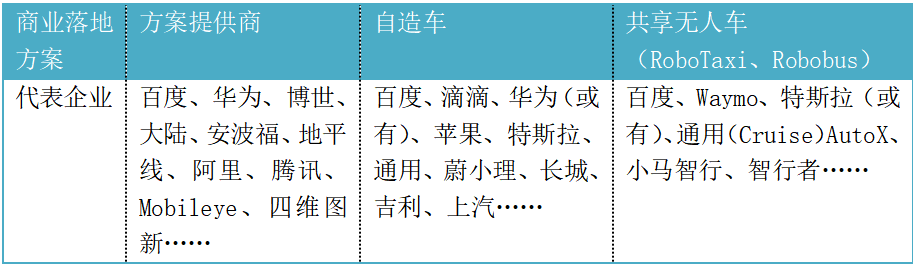

In March of this year, Li Yanhong wrote in the Baidu’s internal memo that autonomous driving is approaching a turning point. Apollo has developed three business models: provide Apollo’s autonomous driving technology solutions to host manufacturers; manufacture cars for Baidu; and share autonomous vehicles.

Among these three business models, providing solutions usually involves charging supplier fees. Smart cars have also started a software charging model. Baidu may also be able to divide software charging fees with car manufacturers under car manufacturing mode. Under the shared autonomous vehicle model, they will charge for travel services and any possible derivative charges.

This three-pronged business model of Baidu’s may be unique among global autonomous driving development companies.

Classification of Commercial Landing Plans of Global Autonomous Driving Companies:

Compared with other competitors, such a layout allows Baidu to avoid the risk of missing any one item. Regardless of where the commercialization of autonomous driving is applied first, Baidu can reap the benefits.

Secondly, the three-pronged approach has a mutually promoting effect. Although Baidu believes that autonomous driving has reached the stage of commercial operation, it is unquestionable that continuous improvement of autonomous driving technology is necessary for all companies. On the one hand, companies aim to exhaust safety risk scenarios, improve algorithms, and on the other hand, strengthen the ability to handle existing scenarios, ultimately leading to an overall improvement in efficiency.“`

Three modes are advancing together, forming a large-scale intelligent vehicle fleet. Whether it is a private vehicle with a pure visual solution or an unmanned vehicle with a lidar, they will collect vast amounts of geographical information, scene information, driver and passenger behaviors, etc. for Baidu day and night, enabling Baidu to form a global autonomous driving dataset and help enhance the autonomous driving ability.

Profit both commercially and through data acquisition can be achieved.

Of course, the primary benefit is still commercial. Since 2013, Baidu has been researching autonomous driving technology and launched the Apollo program in 2017. After nearly ten years of heavy investment, autonomous driving has come to a turning point with the prospect of a trillion-dollar market return just around the corner.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.