On Trip, a media platform under Bai Ren Hui, focuses on the evolution of the automotive travel industry chain

Author: Zheng Wen

The old world is collapsing, but the new world has not yet taken shape.

Behind us, the strange and fantastic world of the past has gradually closed, while in front of us, the gate to the new world hastily opened. People live in a somewhat ignorant and stumbling manner, constantly returning to the old world to find maps and directions.

However, there is no instruction manual or enlightenment hidden in the old world. What follows are occasionally bloody disasters, sometimes rewards, and sometimes wandering aimlessly in the fog…

Who is paying for the “Autonomous Driving” hazards?

On the afternoon of August 12th, the 31-year-old NIO owner Lin Wenqin was driving the NIO ES8 and had enabled the NOP function. He was involved in a traffic accident on the Shenhai Expressway Hanjiang section and unfortunately died.

In the past eight months, NIO vehicles have been involved in three major traffic accidents on the Shenhai Expressway, and at least two of them were confirmed to have enabled the NOP function.

After enabling the NOP function, NIO vehicles can automatically adjust their speed when entering or exiting a ramp, recognize vehicles, and flash their headlights to change lanes and merge onto the main road. In cruising mode, it can combine road environment and high-precision map information to automatically flash its headlights to change lanes and overtake slow vehicles. When switching to highways or elevated roads, the NOP system can automatically change lanes to the right, and automatically adjust the speed and select the lane to complete a set of automatic driving assistance functions.

According to the NIO official website, the fully equipped package of the NIO Pilot automated driving assistance system costs 39,000 yuan, including functions such as NOP, TJP, and ALC. NOP stands for “Navigate on Pilot,” also known as “Guidance Assistance” in Chinese.

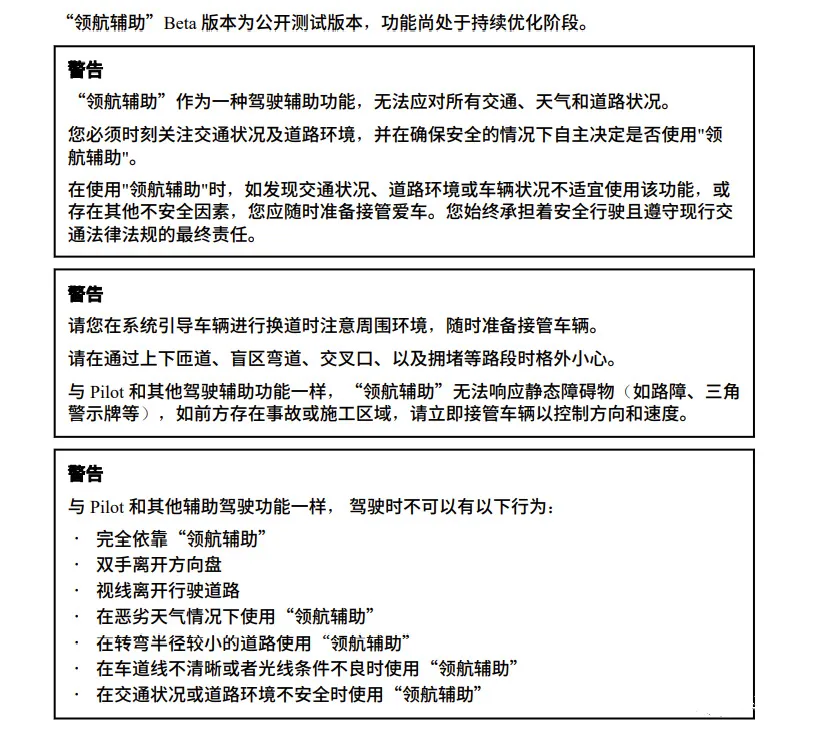

In the NIO ES8 user manual, NOP is defined as a function that deeply integrates the navigation system and Pilot automated driving assistance. However, NIO explicitly states in the user manual that “Guidance Assistance” Beta version is a public test version and the function is still in the continuous optimization stage.

Among the many warnings listed in the user manual, one of them is: “Like Pilot and other driving assistance functions, ‘Guidance Assistance’ cannot respond to static obstacles (such as roadblocks, triangular warning signs, etc.). If there is an accident or construction area ahead, immediately take control of the vehicle to control the direction and speed.”

Unfortunately, the accident involving Lin Wenqin driving a NIO ES8 occurred in the “construction area” warned in the user manual, which is also the scenario that NIO’s NOP system cannot handle.

Unfortunately, the accident involving Lin Wenqin driving a NIO ES8 occurred in the “construction area” warned in the user manual, which is also the scenario that NIO’s NOP system cannot handle.

According to the recognized technical definition, NIO’s NOP is a Level 2 autonomous driving system. According to national regulations, drivers are not allowed to leave the steering wheel for a long time under this level.

In fact, since Tesla, many people around us have referred to driving assistance as “autonomous driving” function. The main contradiction of intelligent vehicles currently is that people think it is “autonomous driving” while in reality it is only driving assistance.

Of course, the “credit” for this lies with the car companies. Tesla, as a typical example, has indeed been suspected of over-promoting “driving assistance” and misleading consumers.

The final responsibility for the accident is still pending the results given by the traffic police department, but it also sounds an alarm for industry players who promote autonomous driving functions.

Car companies tend to see autonomous driving as a very slow progressive process: the first stage is to continuously optimize driver assistance technology; the second stage is to install limited autonomous driving modules on a few high-end car models that are only used in specific scenarios, most of which are applied to highway driving; the third stage is to penetrate these limited autonomous modules to cheaper car models. However, this cautious process is not wise. Research has shown that when humans and machines share the control of the steering wheel, if humans are required to suddenly take control of the steering wheel in an emergency, they may not be competent.

A typical misconception is that some people believe that the automation transition of automobiles will be staged during the driving process, and these stages are just expanding the application scope of driver assistance technologies step by step, such as adaptive cruise control and lane keeping assist systems. In fact, this staged control is not only unsafe but also technically challenging.

As former CEO John Krafcik of Waymo once sarcastically commented on this view: “Many people mistakenly believe that developing an ADAS system will dramatically upgrade to autonomous driving in the future.”

Evergrande is selling car assets in a last-ditch attempt

The debt crisis of China Evergrande Group has reached a new node.

On August 10, China Evergrande (3333.HK), Evergrande Auto, and Evergrande Property Group Limited all issued announcements, stating that the company’s controlling shareholder, China Evergrande Group, is contacting potential independent third-party investors to explore the sale of some equity interests, including but not limited to Evergrande Auto and Evergrande Property.Based on positive news, the stocks of the Evergrande Group have rebounded continuously for three days, with China Evergrande increasing by 22%, Evergrande Auto increasing by 18.5%, and Evergrande Property increasing by 45.4% from the opening on August 9th to the closing on August 11th.

According to financial reports, as of June 30th this year, China Evergrande’s interest-bearing debt totaled more than 570 billion yuan. However, the market tends to believe that the debt of the entire Evergrande Group is far more than this, with a considerable amount of debt not disclosed in the financial reports.

The automotive business is obviously a huge burden for Evergrande.

On August 9th, Evergrande Auto issued a profit warning announcement, expecting a net loss of approximately 4.8 billion yuan in the first half of this year. According to the financial report for 2020, Evergrande Auto had a net loss of 7.665 billion yuan, an increase of 54.93% compared to the same period last year.

In 2019, Xu Jiayin, the chairman of Evergrande, stated that “over the next three years, 45 billion yuan will be invested to research and develop 15 new energy vehicle models in sync, and the Hengchi series of products will achieve full-scale mass production in 2021.” However, reality has proven otherwise, at least in the automobile industry, as Evergrande has failed to find the right path for success.

At the summer testing launch ceremony of Evergrande Auto in June of this year, Evergrande Auto announced that Hengchi Auto will enter the trial production stage in the fourth quarter of this year, with large-scale deliveries scheduled for next year. However, before delivery of the first car model, the market learned of the news that Evergrande Auto would be forced to sell some of its equity.

Evidently, Evergrande wanted to replicate some of the successful experiences of the real estate market in other arenas, but it has proven to be mistaken. Now, with hundreds of billions already invested, Evergrande Auto is hanging by a thread and whether it can achieve volume production on schedule is yet to be seen. It will not be easy for anyone who could help Evergrande Auto out of its financial predicament, whether it be by the sale of some equity or restructuring.

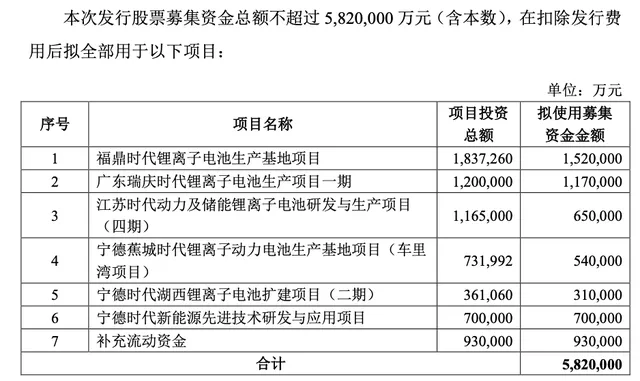

In other news, on August 13th, the lithium battery leader CATL announced a 58.2 billion yuan “sky-high” private placement plan, which shook the A-share market. The concept of 58.2 billion yuan is significant, considering that the company only had a total revenue of 50.3 billion yuan last year.Ningde Times announced in the announcement of the non-public offering of shares that the raised funds will be used for the following projects after deducting the issuance expenses: Fuding Times Lithium-ion Battery Production Base Project, Guangdong Ruiqing Times Lithium-ion Battery Production Project Phase I, Jiangsu Times Power and Energy Storage Lithium-ion Battery R&D and Production Project (Phase IV), Ningde Jiaocheng Times Lithium-ion Power Battery Production Base Project (Cheliwan Project), Ningde Times Huxi Lithium-ion Battery Expansion Project (Phase II), Ningde Times New Energy Advanced Technology Research and Application Project, and Supplementary Working Capital.

The non-public offering is mainly for expanding production capacity.

From 2017 to 2020, Ningde Times’ power battery usage has ranked first globally for four consecutive years. According to GGII data, the global shipment of energy storage lithium-ion batteries in 2020 was 27GWh, a year-on-year increase of 58.8%; of which, China’s shipment volume of energy storage lithium-ion batteries was 16.2GWh, a year-on-year increase of 70.5%. Ningde Times accounts for more than half of China’s shipment volume.

From Ningde Times’ balance sheet, it doesn’t lack money. As of the end of 2020, Ningde Times’ cash reserves reached 68.42 billion yuan, and in the first quarter of this year, its cash reserves rose to 71.68 billion yuan.

This fundraising for expanding production capacity includes the 137GWh lithium battery projects and 30GWh energy storage projects of the above five major bases, which shows the aggressiveness of Ningde Times’ capacity expansion.

Ningde Times is making a bold bet that market expansion will fully consume its own power batteries.

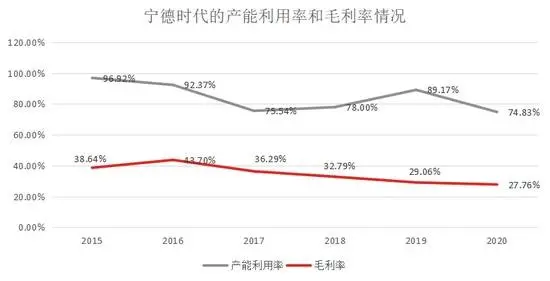

However, it is worth noting that data shows that Ningde Times’ capacity utilization rate was 74.83% in 2020, a year-on-year decrease of 14.34 percentage points, which is the lowest capacity utilization rate in years. In addition, Ningde Times’ gross profit margin has also decreased from 43.7% in 2016 to 27.76% in 2020, and it fell to 27.28% in the first quarter of this year, showing a significant decline.

Geely Teams Up with Renault to Become a “Technology Exporter”

On August 9th, Renault and China’s Geely (Geely) Holding Group announced that they have signed a memorandum of understanding for the joint production of hybrid cars. The joint venture will operate separately from existing businesses. The two companies also said that they will seek to produce models based on the Link & Co platform in South Korea.

In China, Geely’s technology and manufacturing plants will produce Renault-branded cars. Renault will focus on brand strategy, sales channels, and services. The new company will initially consider the Chinese and Korean markets but will seek to expand into the Asian market in the long run. Renault plans to introduce Geely’s Lynk & Co platform into Korea, using Renault Samsung Motors, which has about 20 years of experience in car production.

This cooperation can basically be seen as a win-win result. For Renault, it has come back to the Chinese market after a short farewell, which people thought that it would never come back again.

Luca de Meo, CEO of Renault Group, once said: “A car manufacturer without Chinese business is like a chair without legs. This is the world’s most important market and Renault needs to consider how to achieve this goal.” Despite setbacks, Renault has shown great determination to return to China.

For Geely, this cooperation is an opportunity for it to reach a new round of layout as a “technology output party.”

In the past, Geely has had rich experience in international cooperation. After acquiring Volvo, Proton and Lotus, which were on the verge of bankruptcy, Volvo was completely revitalized, and Proton and Lotus also operated well. This cooperation shows that Geely’s ability to cooperate with overseas car companies has been recognized by the international market.

Outputting technology and platforms to Renault is also a path for Geely to participate in global competition. From a longer-term perspective, the Lynk & Co platform and products built to European standards may benefit from Renault’s advantages in the European market in the future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.