After analyzing the regional sales data of new energy vehicles for the period from January to July 2021, I have come up with some interesting conclusions for your reference.

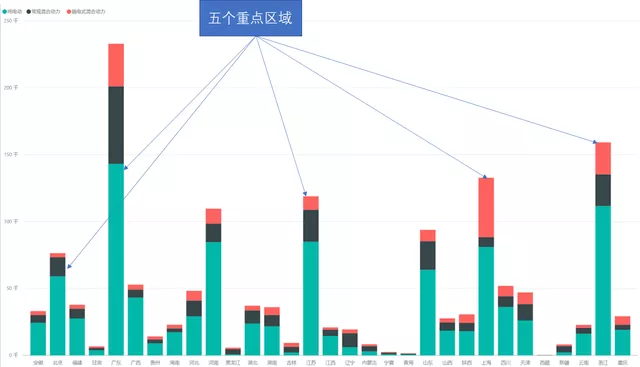

Key Regions

(1) Plug-in hybrids (212,000 units) and hybrid vehicles (293,100 units) have a wider distribution than pure electric vehicles. Although they are also concentrated in regions where pure electric vehicle development is relatively good, such as Guangdong, Shanghai, Jiangsu, Beijing, and Zhejiang, this concentration should be mainly related to the price system – these regions have sufficient purchasing power to buy more expensive cars.

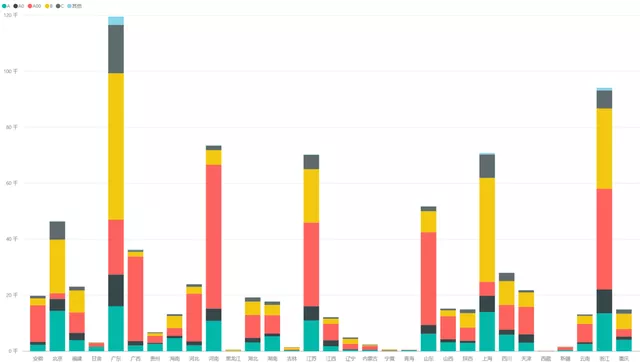

Of the 992,300 units insured for pure electric vehicles, a considerable portion are A00 level cars (37,000 units from only a few large enterprises).

(2) If we break down the distribution of pure electric vehicles by vehicle grades, we can see that A00-level pure electric vehicles are more widely distributed, with the majority of provinces being Guangxi, Henan, Shandong, and Anhui, which are not among the five key regions (Shanghai, Beijing, Guangdong, Jiangsu, and Zhejiang) discussed yesterday regarding new energy vehicle sales.

Therefore, when looking at sales data for new car manufacturers, the granularity of provinces is still relatively large. I believe that analyzing sales data by city would be more accurate. When we analyze further, I will choose to analyze by city.

If we analyze sales data based on Grade A and above, the key regions are still Guangdong, Shanghai, Beijing, Zhejiang, and Jiangsu.

In other words, if you want to understand the effective penetration rate of China’s new energy development, you need to first understand these five regions.

Analysis of Guangdong Province

Let’s take a look at the performance of Guangdong Province, which has performed best this year.

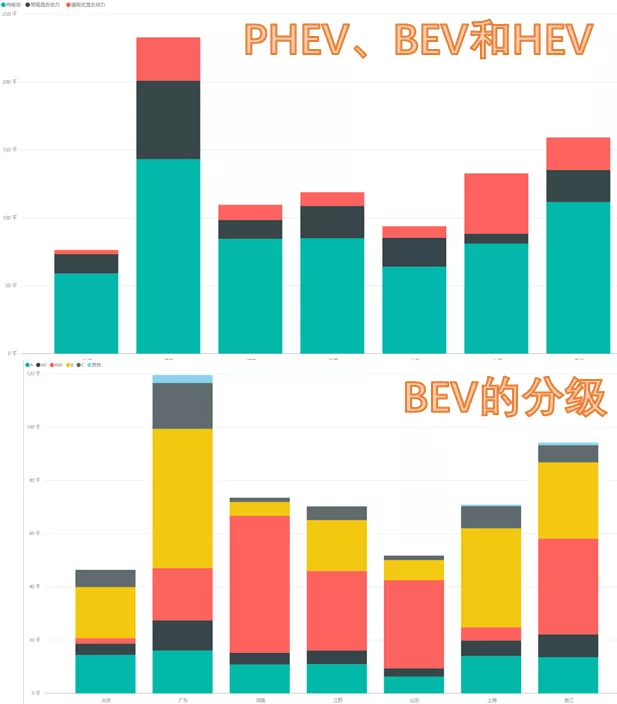

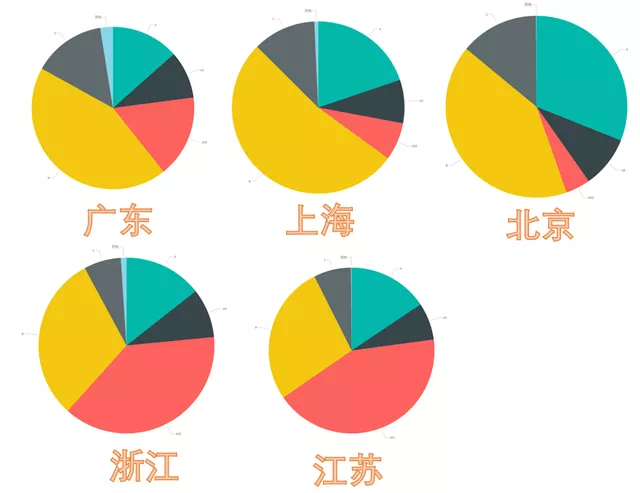

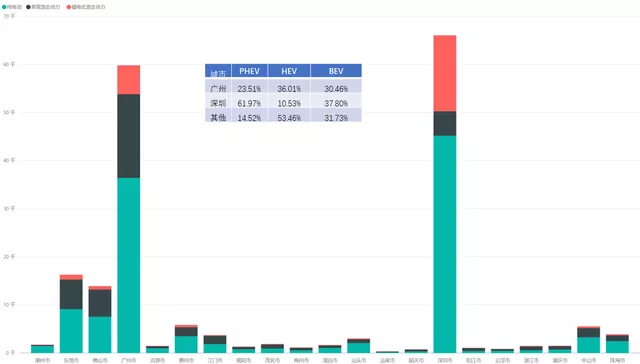

First, let’s take a look at the penetration of BEV, PHEV, and HEV in Guangdong. Guangzhou and Shenzhen are the main drivers of Guangdong’s data, including:BEV accounts for 30% in Guangzhou, 37.8% in Shenzhen, and 31.73% in all other cities in Guangdong.

HEV accounts for 36% in Guangzhou, only 10.5% in Shenzhen, and the rest 53.46% in other cities, indicating a good promotion of HEV. I estimate that the sales of DM-i in the future can refer to this proportion.

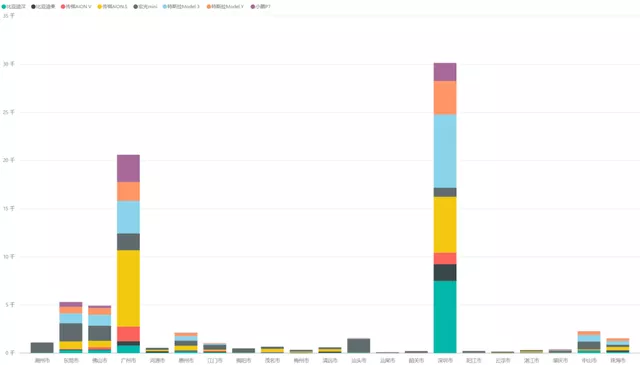

PHEV: From January to June, PHEV sales mainly concentrated in Shenzhen, accounting for nearly 62%, Guangzhou accounting for 23.51%, and other places accounting for 14.5%.

After the launch of DM-i in July, there is a noteworthy change in proportion: in the first half of the year, PHEV sales in the two main cities of Guangzhou and Shenzhen accounted for 85% of the total sales in Guangdong Province. However, this proportion decreased to 75% in July, and sales in other regions increased. This change also proves from another point of view that DM-i does follow the trend of HEV, but whether it can break through the penetration rate limit of HEV is still unknown.

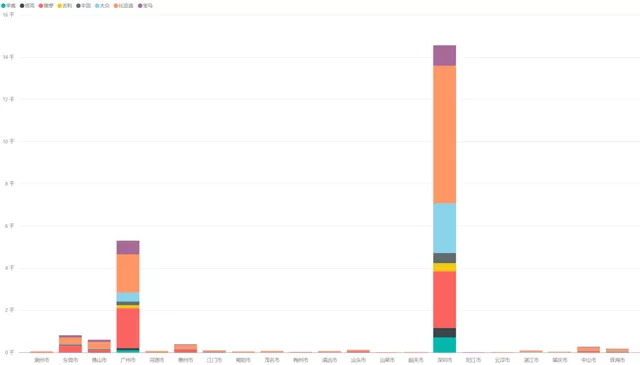

Regarding PHEV, I separately summarized a brand overview. BYD ranks first in PHEV sales in both Shenzhen and Guangzhou, followed by Ideal, and Volkswagen’s PHEV also performs well in Shenzhen. BMW’s PHEV has limited sales in Guangdong this year.

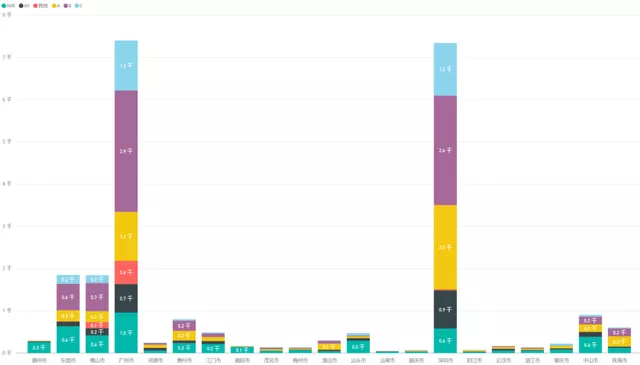

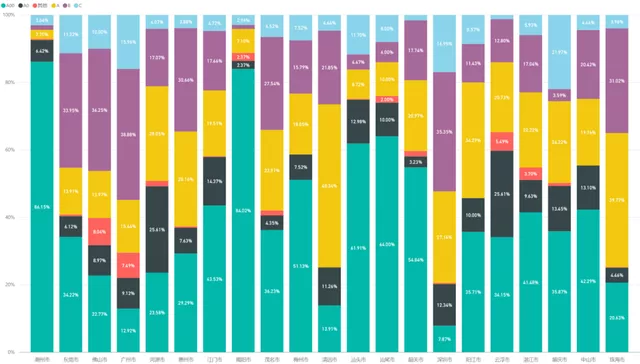

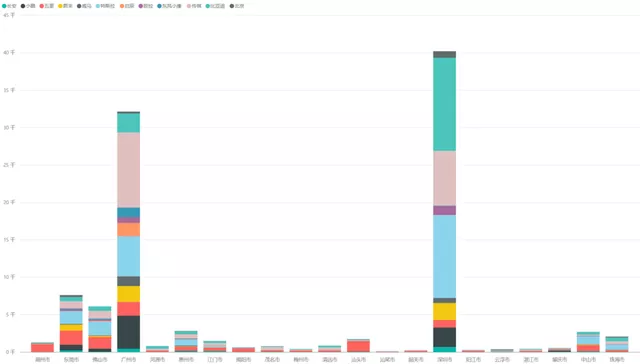

Next, let’s focus on BEV. First of all, according to the classification, we already know that Guangzhou and Shenzhen have the largest total sales of pure electric vehicles, but when we really look at the data distribution, it is still difficult to penetrate into other areas.

Comparing Figure 9 with the above figure, many places have a higher proportion of A00, and the cities that can really support the sales of pure electric vehicles above A level are only Guangzhou, Shenzhen, Dongguan, Foshan, followed by Huizhou, Zhongshan, and Zhuhai.

From the sales of major brands, Tesla has performed well in two key cities in Guangdong, while BYD seems to have a very weak position in the pure electric market in Guangzhou but relatively stronger in Shenzhen. This breakdown chart shows the actual city sales. Currently, Tesla and new energy startups occupy a good position in the mid-to-high end. Traditional car companies need to transform quickly to keep up. For traditional car companies, home field advantage represents some 2B orders.

Note: Wuling is also quite popular in Guangdong.

The distribution of car models in Guangdong varies by city. What surprised me the most was that only Shenzhen seems to recognize Han EV well, while its performance in other cities is mediocre. Aion S has performed exceptionally well in Guangdong’s travel market. We can see that it is still difficult to smoothly promote BEVs priced above ¥200K to non-restricted purchase cities, with limited purchasing power.

Summary: This is the first time I have analyzed Guangdong, but the situation in Zhejiang and Jiangsu is somewhat similar. After carefully analyzing A00 and A-level cars, we can have a clear understanding of China’s acceptance of new energy vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.