This article is a special column by “Data Intelligence Bureau”, Written by Zhuge Jun, a marketing professional, known as the same name author in Zhihu.

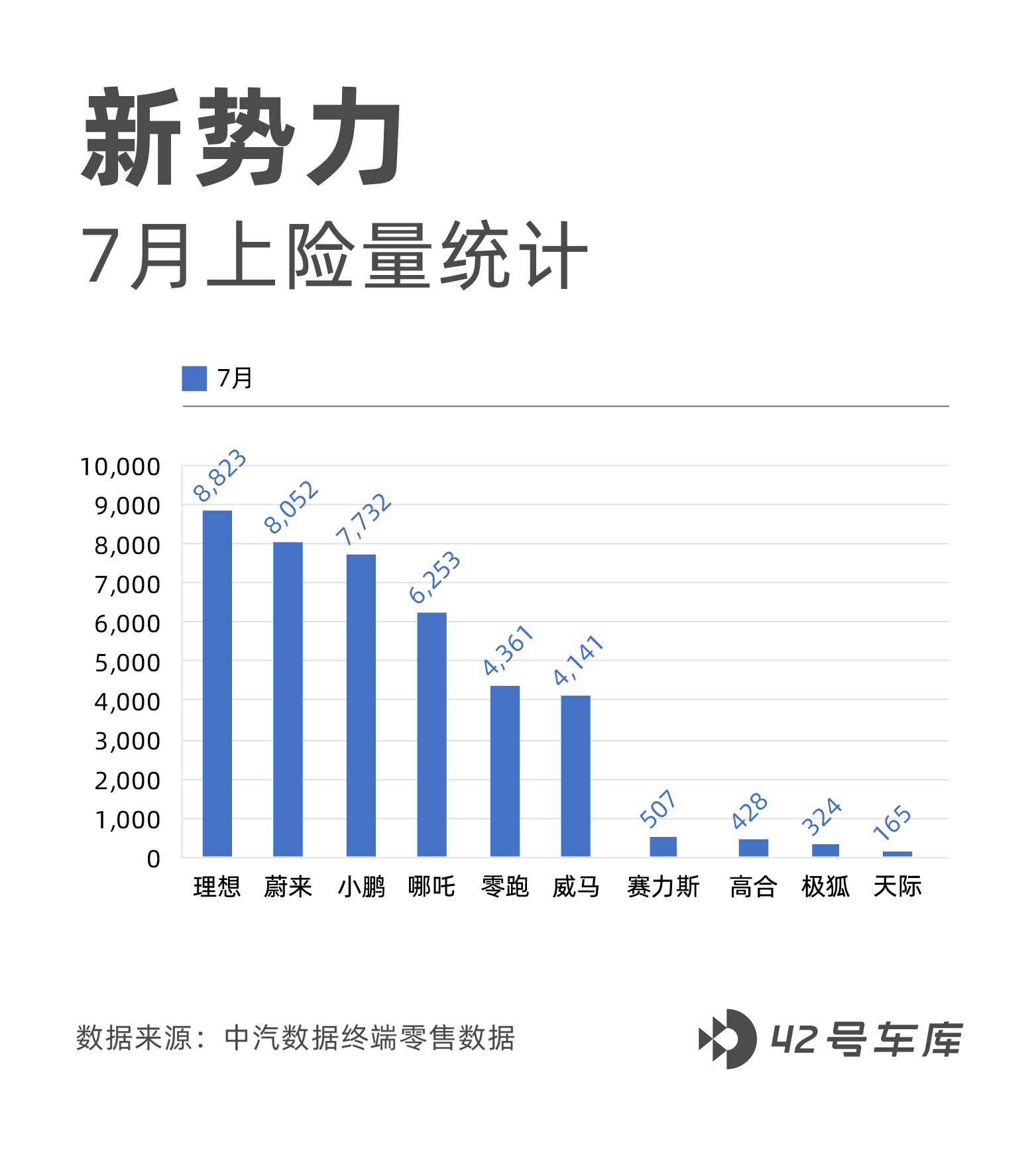

Since the beginning of the third quarter of 2021, the differentiation of new forces has become increasingly evident. Judging from the insurance registration data for July, the top three new forces have already stabilized at 8,000 units/month, and are striving to reach the goal of selling over ten thousand units per month.

The top three of the second-tier new forces have basically reached 4,000-6,000 units per month. Based on product updates and strengthened sales channels, they are also trying to squeeze into the top three. The following brands are all below 1,000 units per month, and are still struggling to survive. Here we summarize and comment on the top ten new forces in terms of insurance registration data in July.

Li Auto – 8,823 units

Focus on differentiation competition: available with both electric and oil-based range extender + 6 seats with spacious interior + high configuration + 350,000 RMB. It has power and intelligence advantages over mainstream brands of large SUVs, price, configuration, and power system advantages over luxury brands of large SUVs, and size, configuration, and power system advantages over luxury brands of mid-size SUVs.

With unique power systems, it has relatively many advantages in various sub-markets. Currently, the only limitations are that it cannot obtain green license within certain cities (it requires direct conversion from oil-upgrading users), and the speed of channel layout development. Li Auto is currently the most focused and strong in terms of product category advantages in the top three, with channel layout/cost advantages, but it needs to evolve in terms of brand awareness, vehicle intelligence, and service.

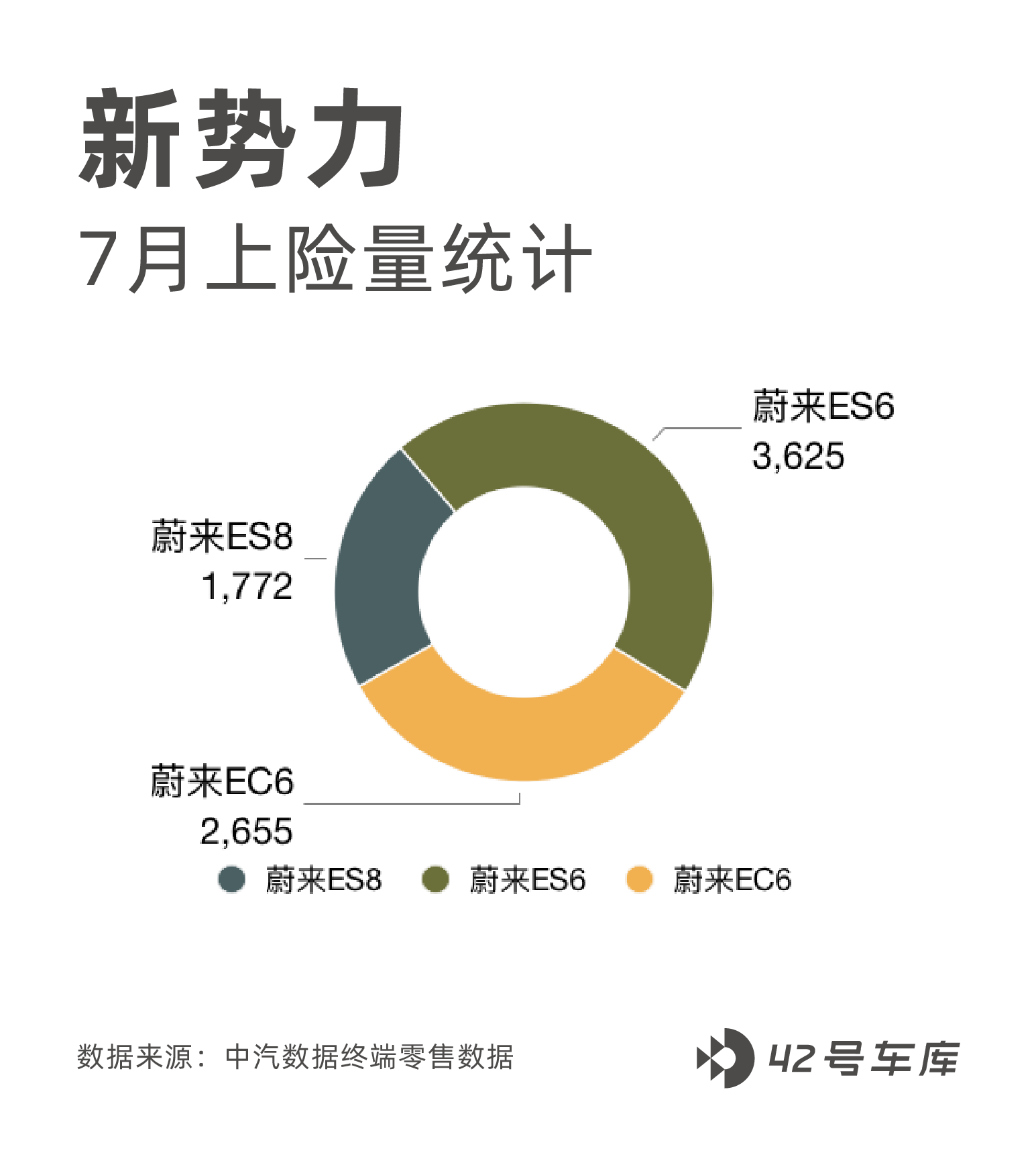

NIO – 8,052 units

NIO has successfully stabilized at 8,000 units, achieving the highest average unit price and the largest overall sales volume among new force brands.

ES6 has not been affected by the 276,000-unit Tesla Model Y recall this month. It is expected that both EC6 and ES6 will be affected when they go on sale in August, but NIO has also launched terminal competitive strategies such as offering bonus points, preferential loans and thoughtful services. ES8 is expected to be less affected and can still maintain its position. NIO’s next move should be the launch of ET7 and the introduction of the rumored mid-to-low-end sub-brand Gemini.

ES6 has not been affected by the 276,000-unit Tesla Model Y recall this month. It is expected that both EC6 and ES6 will be affected when they go on sale in August, but NIO has also launched terminal competitive strategies such as offering bonus points, preferential loans and thoughtful services. ES8 is expected to be less affected and can still maintain its position. NIO’s next move should be the launch of ET7 and the introduction of the rumored mid-to-low-end sub-brand Gemini.

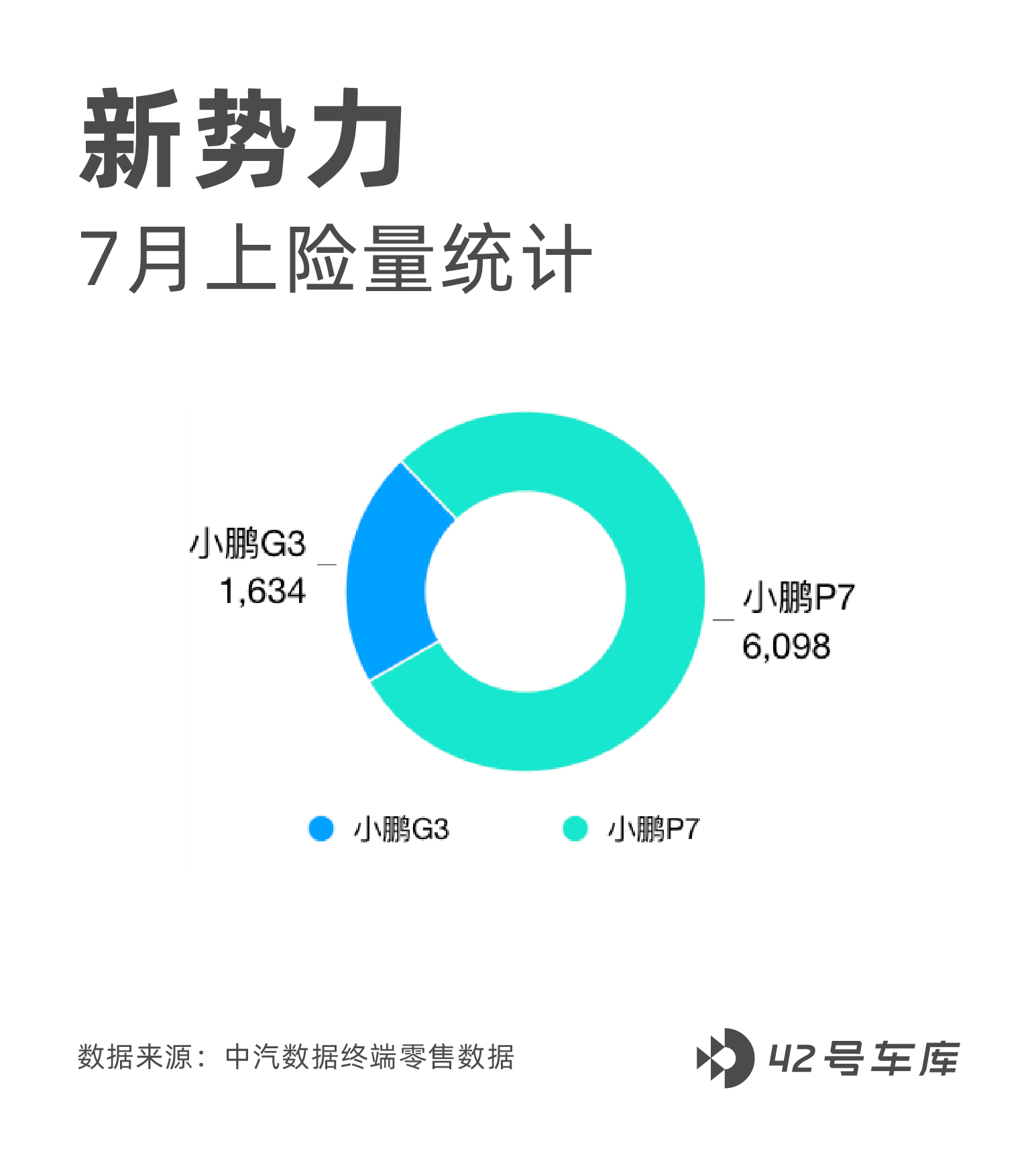

XPeng 7,732 units

XPeng is also continuing to make great progress. Perhaps learning from the lesson of customer dissatisfaction with the G3’s battery upgrade last time, a lot of work was done to deal with the current inventory orders before the G3i was upgraded this time. The P7 has been increasingly recognized by customers this month.

However, in late July and early August, the launch of new lower-priced entry-level versions of Model Y and Model 3 will have an impact on the P7, which is mainly sold at a price of 250,000 yuan. In response, BYD Han immediately launched a 200,000 yuan version with a range of 500 km to compete directly. At present, P7 has not yet launched a new version to compete.

XPeng is competing on the terminal with bonus points, discounts, charging and financial solutions, while speculating that it has not previously prepared low-range versions. XPeng’s current focus is on the launch of the G3i to consolidate the 150,000-yuan price range and the P5 to occupy the 200,000-yuan price range, and has never fully covered the three price ranges of 150,000-200,000-250,000 yuan.

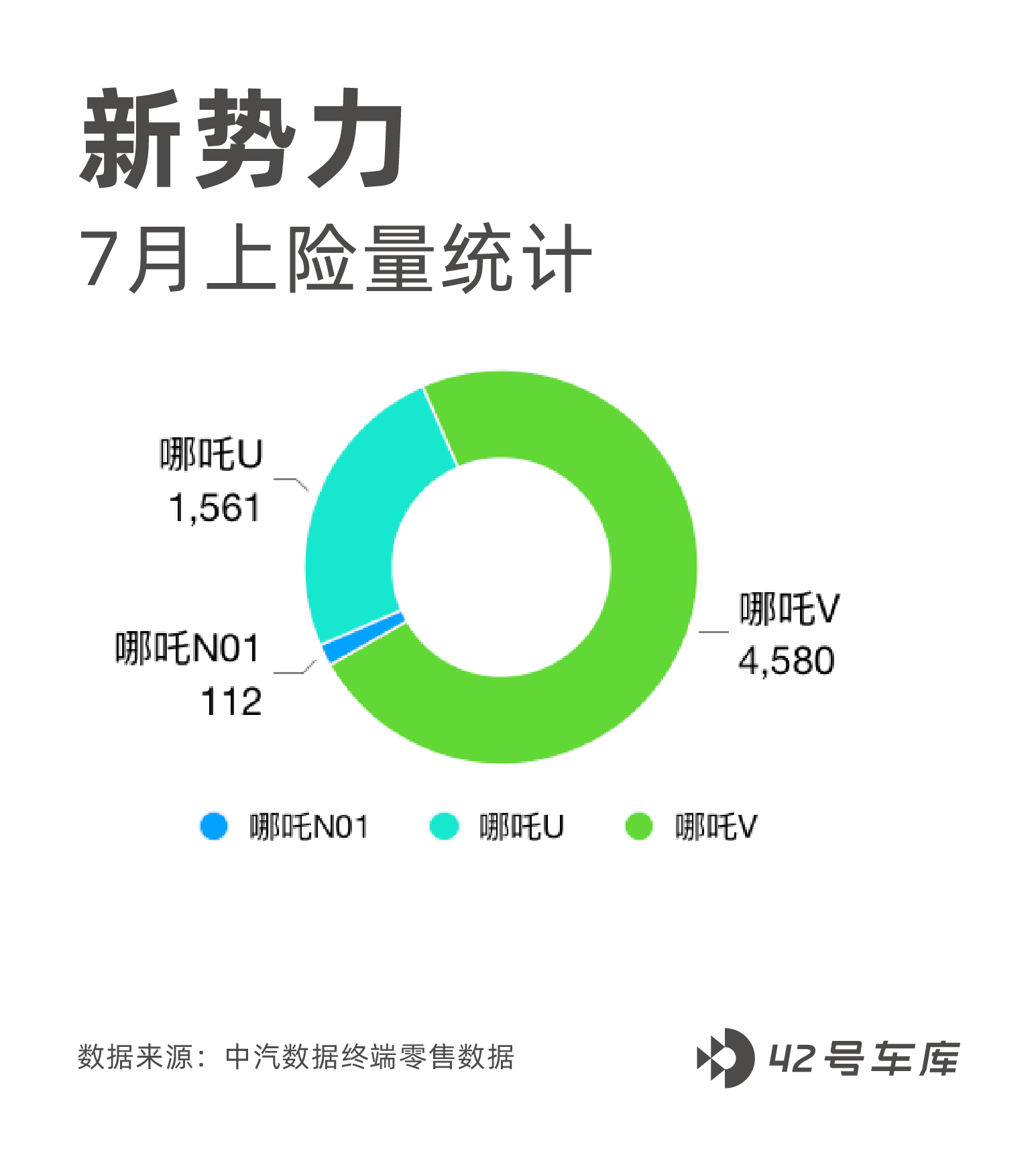

NIO 6,253 units

At present, NIO’s rapid increase in sales mainly relies on the V series’ impact on the market below 100,000 yuan, while the U series is climbing to 1,500 units. NIO currently leads in sales volume over Zero Run and WM Motor, but its main products, like Zero Run’s T03, are in the range of 50,000-100,000 yuan, which includes models such as the Great Wall M4, Chery EQ and Changan E-star.

Translate the Chinese Markdown text below into English Markdown text in a professional manner, retaining HTML tags inside the Markdown, and only output the corrected and/or improved parts without explanation:

Translate the Chinese Markdown text below into English Markdown text in a professional manner, retaining HTML tags inside the Markdown, and only output the corrected and/or improved parts without explanation:

NETA is currently facing the situation of maintaining sales volume while sacrificing single-bike profits, but no matter what, maintaining the volume is the best choice. If U, which are highly expected, can stand firm in the price range above 100,000 yuan, it can help NETA gain some footing (financing).

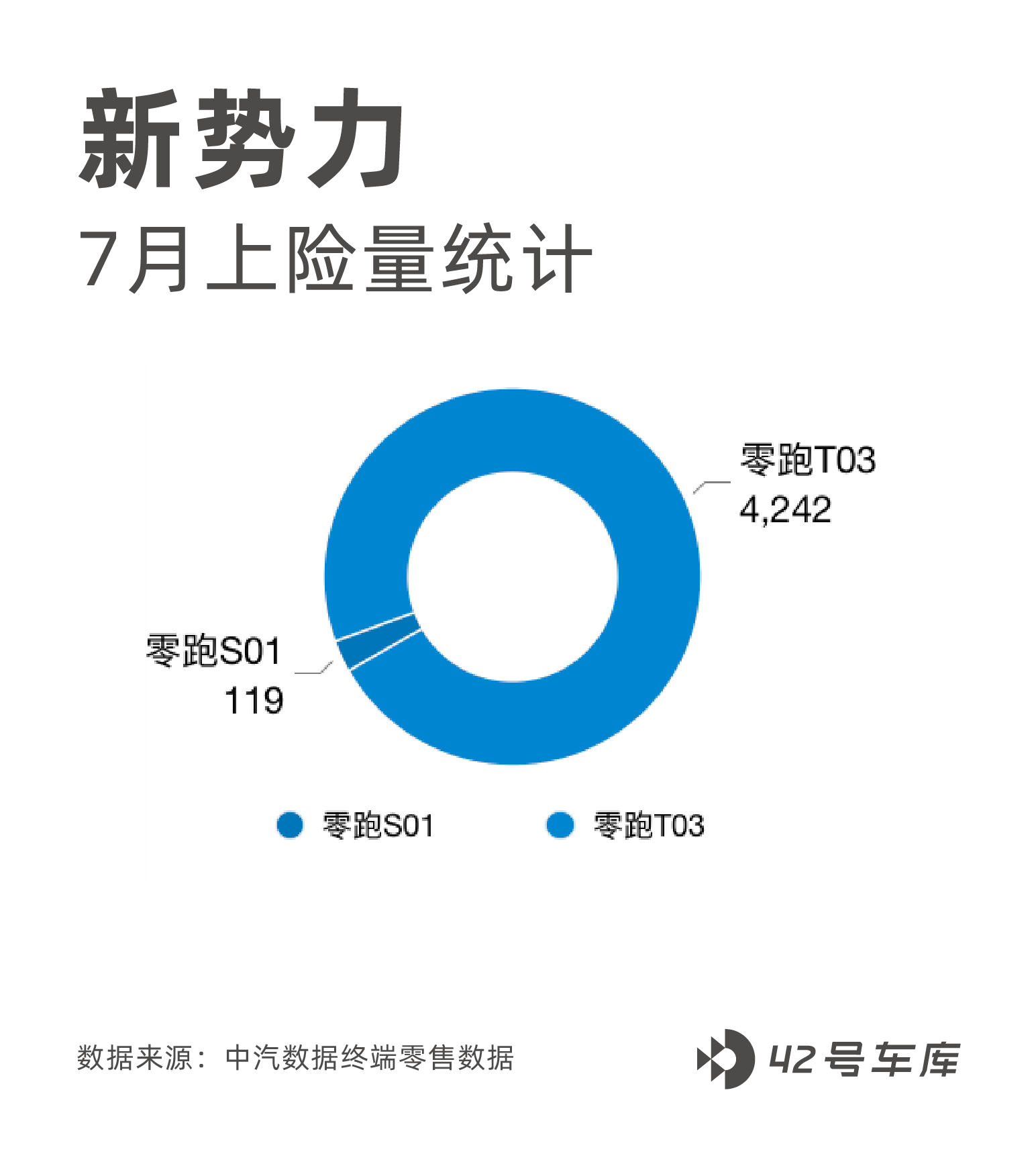

Leapmotor, 4,361 Units

Leapmotor is a brand whose first product did not take off, but its second product quickly corrected its course and iterated to the best of its ability. The T03 product looks simple, but it can compete with traditional forces such as Great Wall, Chery, and Changan in the 50,000-100,000 yuan market. However, if only having T03 can only solve short-term survival, it is relatively more optimistic because of C11. C11 is a product that can bravely enter a higher price segment. It is an already successful strategy for P7 and Han to compete against Model 3.

What people expect from C11 is not just the styling and price, but that the founder who is currently operating Leapmotor, Zhu Jiangming, can introduce customer media to participate in product experience research and development beforehand, and make many improvements in the product before it goes on the market, which means real user experience. It is predicted that if C11 is successfully launched this year, it can firmly secure Leapmotor’s position in the TOP 4 of new forces.

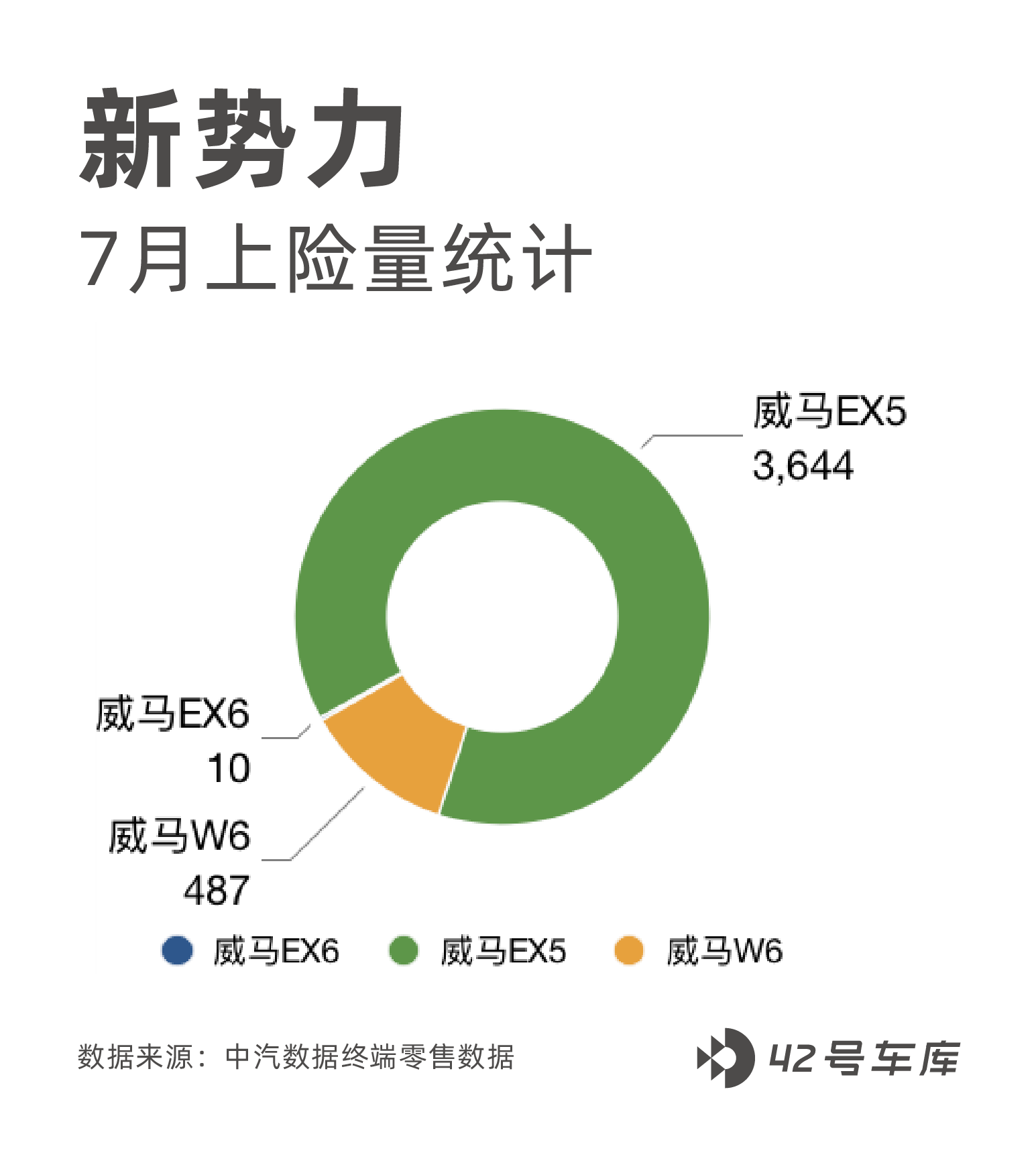

WM Motor, 4,141 Units

What’s been noticed? WM Motor, which launched its product very early, is still relying on the first product, EX5.

WM Motor’s EX6 has failed, and W6 has not been successful. Initially, when EX5 came out, it could be said to be slightly ahead of XPeng G3, but after P7 came out, the two companies’ level was vastly different. P7 is a qualitative leap compared to G3, while EX6 can only be said to be the lingering breaths of EX5. Its slightly elongated body presents no breakthrough in product competitiveness, but its price has been pushed up to over 200,000 yuan, and customers are not buying.

Translate the Chinese text in the following Markdown into English Markdown text, in a professional manner, preserving the HTML tags inside the Markdown, and outputting only the result.

Translate the Chinese text in the following Markdown into English Markdown text, in a professional manner, preserving the HTML tags inside the Markdown, and outputting only the result.

Same for W6, the styling language has not been optimized, only unified. Sales represent everything, especially since WmAuto is generally a brand that relies more on the B-end for getting on the market among new forces. Without serious changes, WmAuto’s position may still slide down in the future. In the past, it relied on Baidu, but now with the emergence of Jidu by Baidu, can WmAuto continue to easily “RAP”?

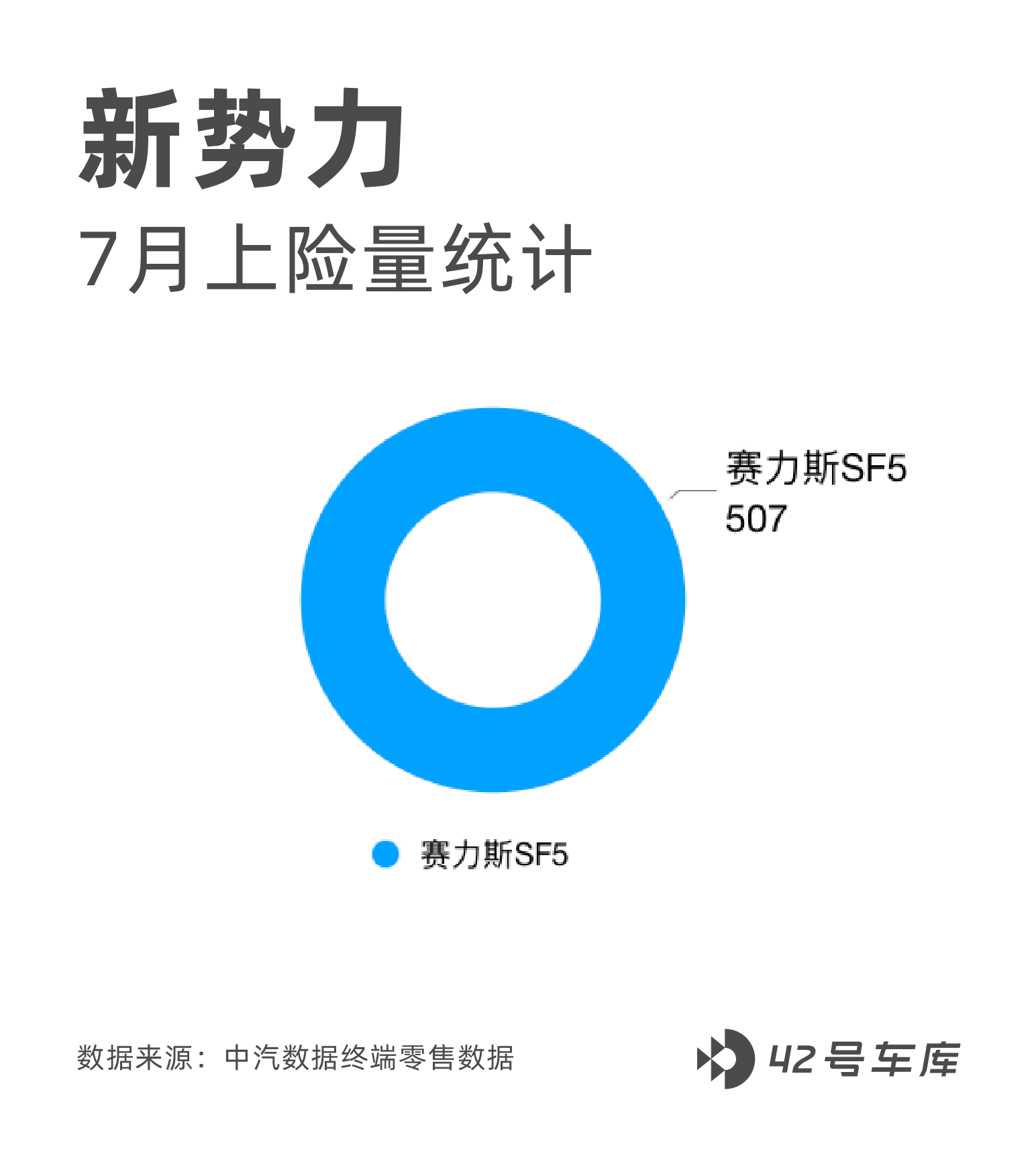

Jinkang Seiles 507 units

Jinkang enjoys Huawei’s most enviable endorsement in the entire industry, not only personally promoted by Yu Minhong, but also entered Huawei’s exhibition hall for sales, and finally marked as Huawei’s smart choice.

The problem is that the SF5’s competitiveness is weak, despite the same range extension as Ideal One; yet, when it comes to normal five-seater compact SUVs, BEVs can already achieve 600+ kilometers of range, and higher range is not the core customer pain point. Regarding the rest of SF5’s styling, configuration, and intelligence, they cannot be considered outstanding. Currently, even though the absolute number of 507 units is not high, it has already far exceeded Jinkang’s own expectations. Perhaps entrusting the future product and marketing entirely to Huawei for guidance is Jinkang’s best choice.

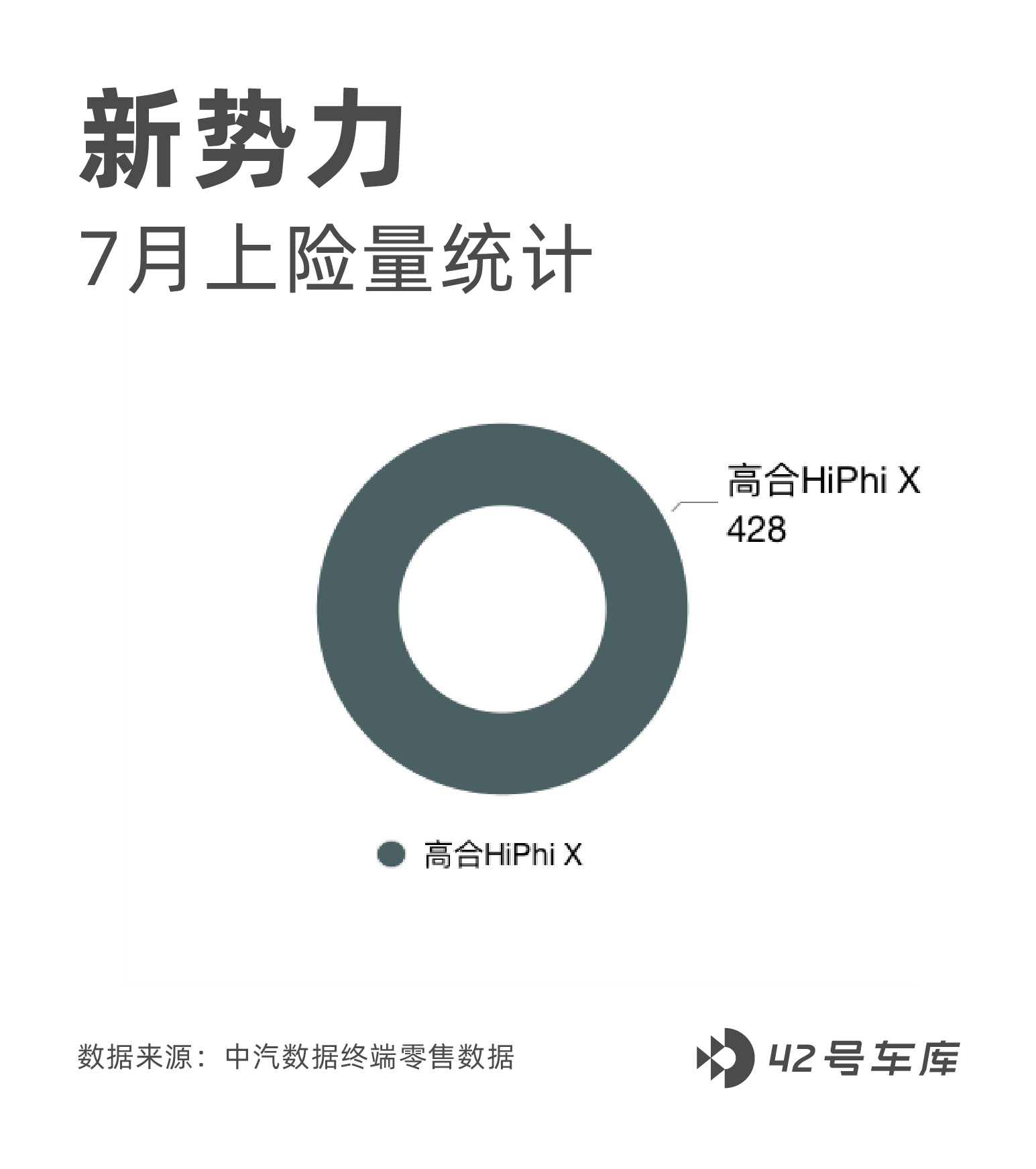

Gaobo 428 units

In this sales chart of luxury EVs costing over 500,000 yuan, Gaobo ranks just below Porsche’s Taycan, surpassing the Mercedes EQC’s 323 units, and Hongqi’s E-HS9’s 296 units, expertly squeezing NIO’s Tesla Model X13 and Model S1 to the end.

Indeed, the play of using “500,000” and “luxury” as adjectives is impressive. The former successfully eliminates NIO’s ES8 and BMW iX3 (with a sales volume of 1,841 units in July), while the latter successfully classifies Gaobo with the already accepted group of luxury brands. Admired. One of the core competitive advantages for new EV brands to get on the charts is to learn how to select adjective phrases according to the rankings.

Translate the following Markdown Chinese text into English Markdown text. Retain the HTML tags inside Markdown and only output the results.

With the current sales and prices of GAOHE, if the sales are not significantly increased, the overall operation may suffer severe losses. With R&D + fixed investment + marketing expenses amortized to sales of over 300 units, financial data is likely to reach the level of losing one unit for every unit sold. To increase sales + launch new models + introduce new investments, which one do you think GAOHE would prefer to come first?

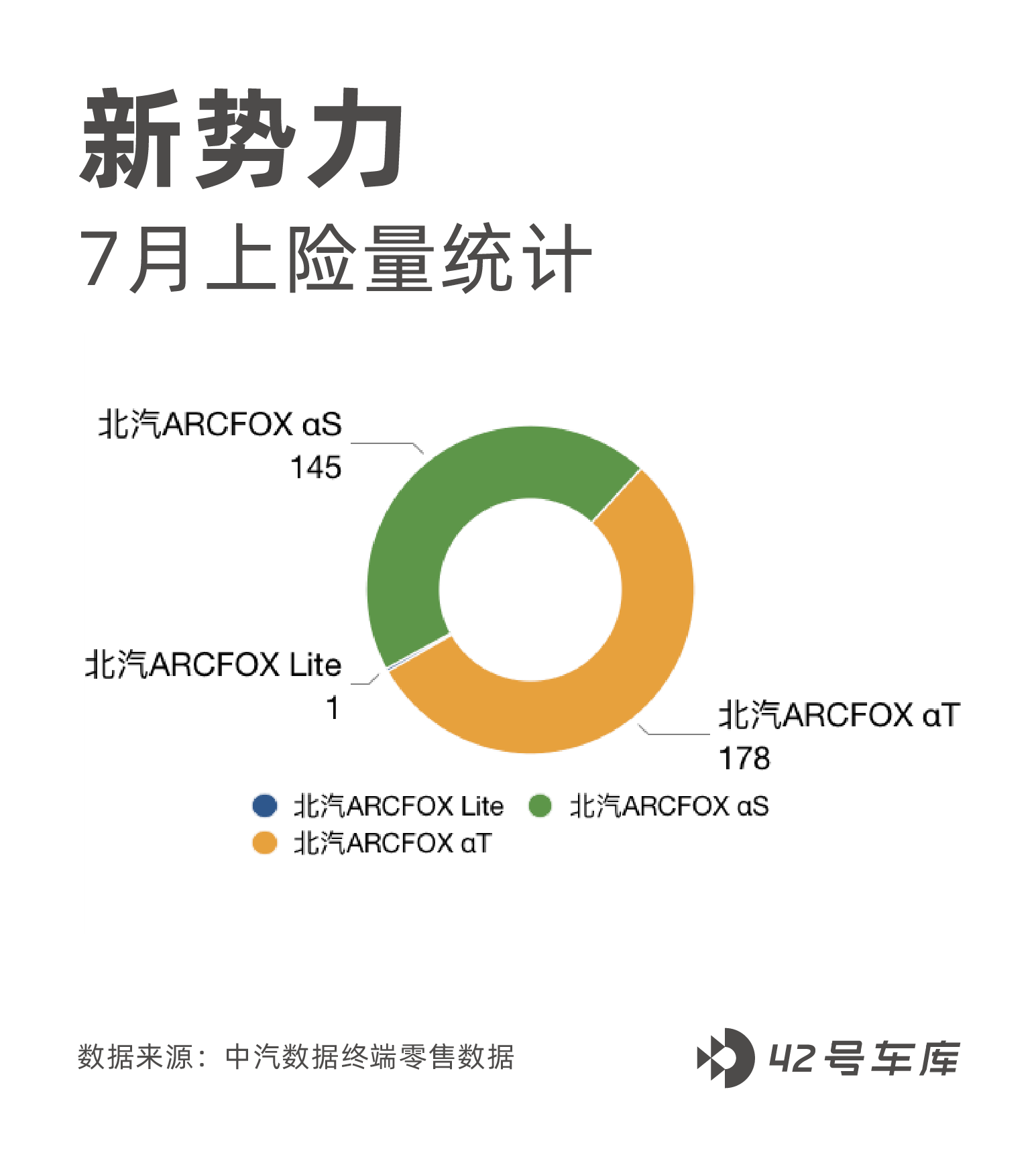

JIHU 324 units

There are already 50 JIHU stores open, with each store delivering 6 units. It is relatively difficult for directly operated or franchised dealerships. Generally speaking, if the average monthly delivery can be increased to over 30 units, the channel side can develop more healthily.

ALPHA T has launched 480 2 models, 653 2 models, and 600 1 model. It seems that almost all customers choose the 653 high-end version, which proves that only the high-end version of 653 km endurance has certain competitiveness in the price range above 250,000 for the non-Huawei version of T.

From the fourth quarter of last year to the second quarter of this year, within the six-month time window, ALPHA T took the aggressive pricing strategy of offering a high-end 653 km version for less than 250,000. It might perform better after being launched than it is now. We can face the Model Y of 270,000 and the Model 3 of 230,000 more rationally.

Regarding ALPHA S’s problems, if it focuses on its 708 km product, it may perform better. Now, the tactical level only has promotion at terminal or waiting for Huawei’s version of 400,000 at the end of the year to improve sales opportunities. However, the problem is that the market three months later may be even more intense than it is now.

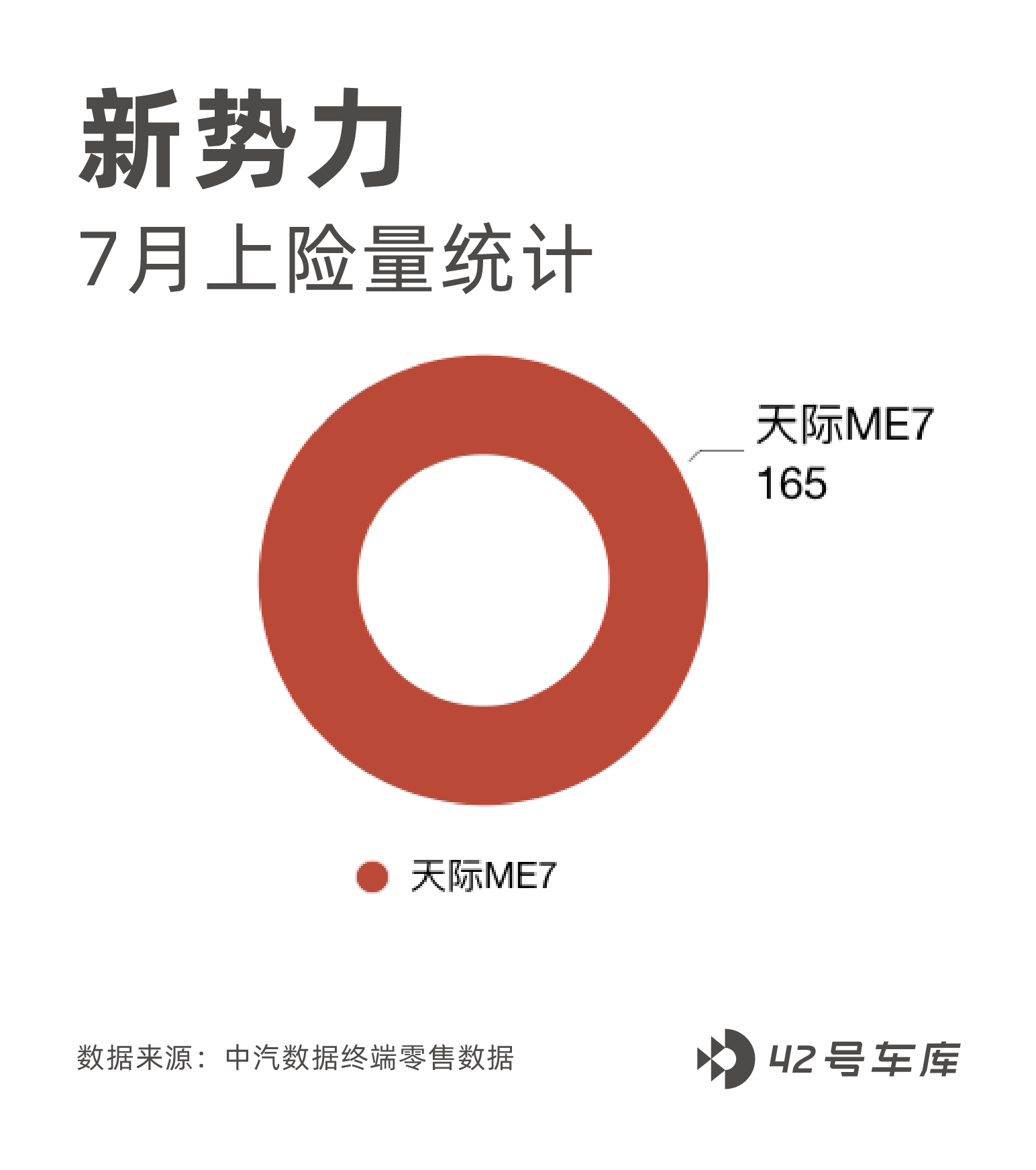

Horizon 165 units

So far, it is rare to see ME7 on the road. The endurance, styling, price, configuration, and intelligence may not remind anyone of the vehicle.

# ME5 compact SUV with JD, although similar to SF5, may finally be inferior to SF5 with the support of Huawei.

# ME5 compact SUV with JD, although similar to SF5, may finally be inferior to SF5 with the support of Huawei.

Conclusion

In summary, July marks the beginning of differentiation. The development paths of the top five are relatively certain, compared to who makes fewer mistakes, while the race for the sixth to tenth positions is about who has more bright and distinctive advantages to move forward.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.