Once in the article “Tearing off the veil of NIO Gemini” (https://mp.weixin.qq.com/s/brExut3JcJL66E_sFX9ZDA), I mentioned that Gemini might be NIO’s next sedan ET5. After the publication of the article, I felt too young and too simple and overlooked some key information, resulting in a somewhat incorrect conclusion. However, it’s fortunate that Gemini is not the model for NIO to enter the mass market.

Today, NIO released its Q2 financial report. In addition to mentioning that it will deliver three models on the NT2.0 platform including the ET7 next year, combined with Li Bin’s mention at EP Club that it will iterate on existing models next year, the answer to Gemini is actually imminent.

You may think that this news is not compelling enough. Li Bin mentioned in the earnings call that “NIO has accelerated the pace of building a new brand to enter the mass market, and the relevant team has been put in place.” This echoes the rumors that Ai Tiecheng, the former General Manager of Wework Greater China, joined NIO to lead the new brand.

However, it seems that this is not enough. Li Bin also mentioned that a new NT2.0 model that is priced lower than all current NIO models will be delivered next year. After being bombed with information for so many rounds, I vaguely feel that my order for the ET7 is no longer desirable.

In addition to new cars and new brands, NIO’s widening losses in this quarter’s financial report also caught my attention. Since the first quarter of 2020, with the increase in the number of vehicle deliveries and the improvement of revenue and gross profit margin, NIO’s operating loss has continued to decrease. The operating loss had narrowed to RMB 296 million in the previous quarter’s financial report. I thought that NIO could turn a profit in the second quarter by lying down and logging on.

So in the Q2 earnings report, NIO’s operating loss was RMB 763.3 million, although it decreased by 34.2% YoY, it increased by 158% QoQ. Where did NIO spend the money?

Due to the large amount of information in this financial report, let’s review NIO’s Q2 financial report information one by one.

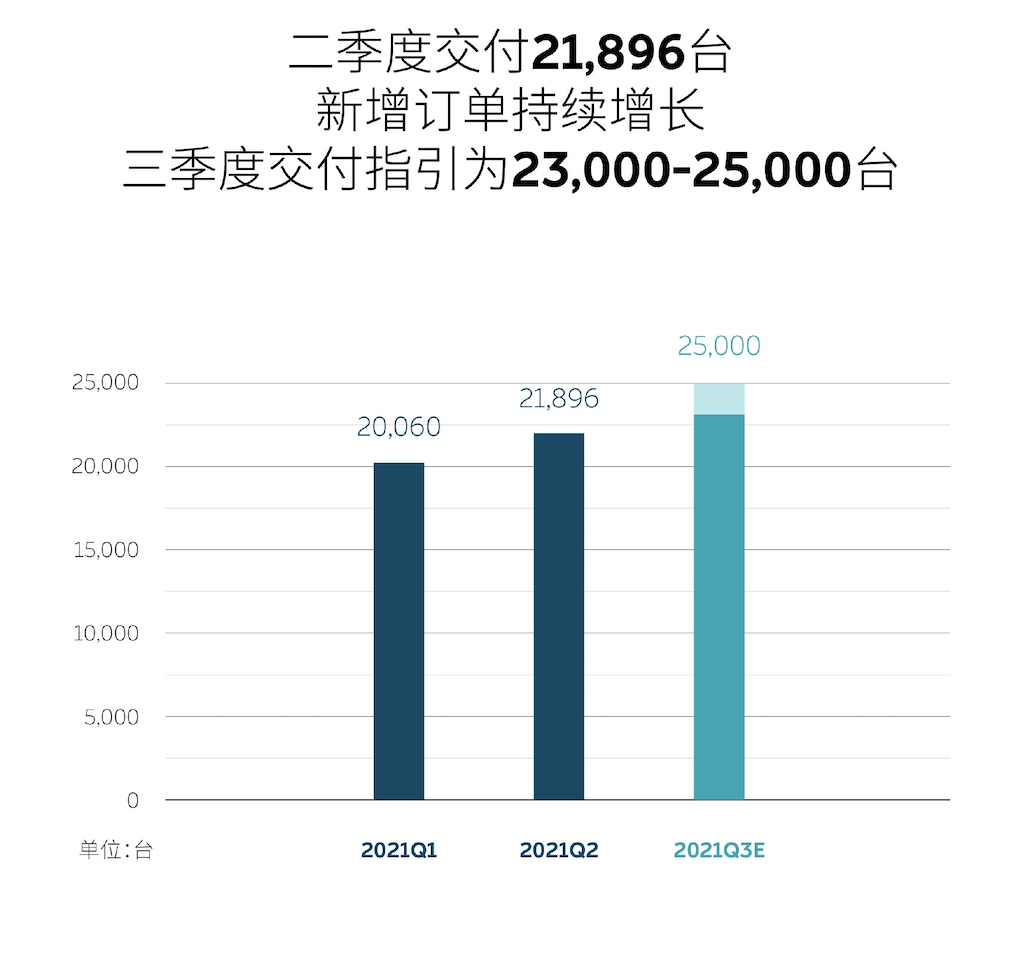

No new cars this yearIn the second quarter, NIO delivered 21,896 vehicles, a year-on-year increase of 111.9% and a quarter-on-quarter increase of 9.2%. It has achieved a quarter-on-quarter growth for five consecutive quarters. Among them, ES8 had 4,433 vehicles, ES6 had 9,935 vehicles, and EC6 had 7,528 vehicles. From the volume perspective, it is clear that ES6/EC6 accounted for the majority of NIO’s deliveries.

Of course, this achievement also means that NIO’s cumulative delivery in the first half of 2021 was 41,956 units, which is equivalent to 95.9% of the total delivery volume in 2020.

Turning to revenue, NIO’s total revenue in the first quarter was RMB 8.448 billion, a year-on-year increase of 127.2% and a quarter-on-quarter increase of 5.8%. Among them, the revenue of the automotive business was RMB 7.9118 billion, a year-on-year increase of 127% and a quarter-on-quarter increase of 6.8%. Compared with the number of vehicle deliveries, NIO’s revenue growth rate is relatively low.

This reason is not difficult to understand. In the context of no significant increase in production capacity, the supply chain costs remain stable. However, in the second quarter, NIO made a certain degree of concessions to consumers on terminal purchases, including the interest-free policy introduced in June, etc.

The same data is also reflected in the vehicle gross margin. In the second quarter, NIO’s vehicle gross margin was 20.3%, a significant increase from last year’s second-quarter vehicle gross margin of 9.7%. But as the saying goes, you can’t just look at the year-on-year growth. The vehicle gross margin in the first quarter was 21.2%, which still slightly decreased this quarter.

On the earnings call, Li Bin mentioned that from a long-term perspective, he hopes that after excluding income from bonus points and NAD subscriptions, the vehicle gross margin can be maintained at around 25%.

However, since the vehicle delivery volume in the second quarter has increased both year-on-year and quarter-on-quarter, and the user base is also expanding. NIO’s gross profit for the second quarter was RMB 15.739 billion, a year-on-year increase of 402.7% and a quarter-on-quarter increase of 1.2%.

Total gross margin can be compared to the reason for the vehicle gross margin. The gross margin for the second quarter of this year was 18.6%, a year-on-year increase from 8.4% in the second quarter of last year and a quarter-on-quarter decrease from 19.5% in the first quarter of this year.

The operating loss was RMB 763.3 million, a year-on-year decrease of 34.2% and an increase of 158% quarter-on-quarter. The net loss for the second quarter was RMB 587.2 million, a year-on-year decrease of 50.1% and a quarter-on-quarter increase of 30.2%.

From the above data, it is not difficult to see that since NIO does not have any new cars this year, it is indeed a bit difficult for the sales department from the revenue perspective. As Li Bin said in the earnings call, we won’t have too much volume growth this year, but we value long-term benefits more.The focus of NIO’s work this year has shifted to infrastructure construction, such as battery swapping stations and supercharging piles.

Since the second-generation battery swap station was put into operation on April 15, it has taken less than 4 months. As of today, the number of NIO’s swap station has increased from 201 to 361, with a total increase of 160. I also checked that there are approximately 104 swap stations deployed in Q2.

It is clear that NIO’s strategy is to use more perfect infrastructure construction to stimulate sales and lay the foundation for the future. Therefore, the second-quarter loss expansion can be understood. The good news is that there may be a big turnaround next year, as Li Bin has said, focusing on long-term benefits. The bad news is that there are still two “Q”s this year.

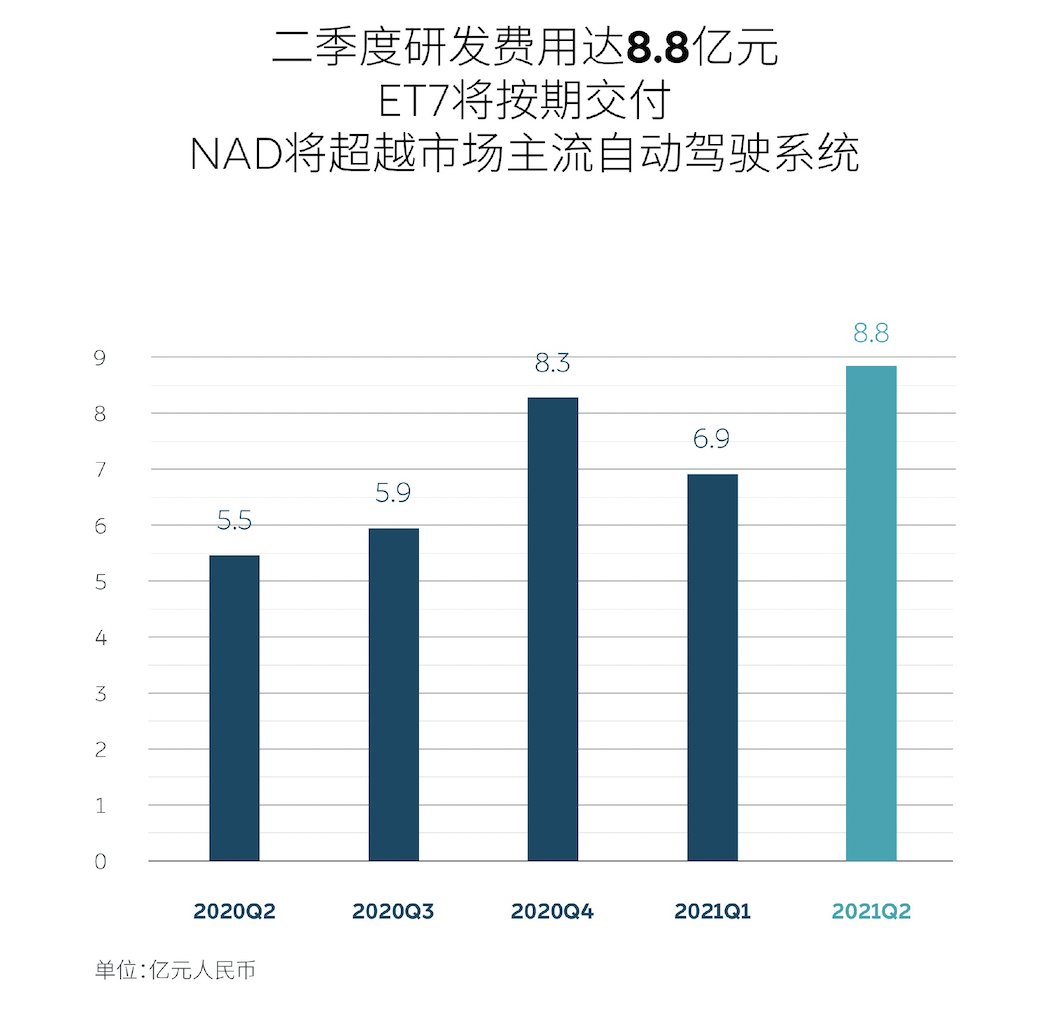

In addition, one key piece of information is that NIO’s R&D expenses in Q2 were RMB 883.7 million, an increase of 62.1% YoY and 28.7% QoQ. NIO explained that the increase was “mainly due to the increase in design and development costs of new products and technologies, as well as the increase in the number of R&D functional department employees.”

According to some friends working in the human resources industry, NIO’s recruitment actions have further increased recently. Apart from the R&D department for car owners’ car machine and assisted driving, I believe there is a possibility of storing manpower for the upcoming new brand.

Looking at NIO’s expectations for Q3, the vehicle delivery volume is expected to be between 23,000 and 25,000 units, an increase of approximately 88.4% to 104.8% YoY and an increase of approximately 5.0% to 14.2% QoQ. The expected total revenue will be between RMB 8.913 billion and RMB 9.631 billion, an increase of approximately 96.9% to 112.8% YoY and an increase of approximately 5.5% to 14.0% QoQ.I think the sales forecast is reasonable and possible. Last month, I mingled into an official seat solution launch event organized by NIO and conversed with workers from the Hefei factory. I learned that the factory’s monthly production capacity is stable between 7,500-8,000 vehicles, depending on the supply chain situation. Li Bin also mentioned the impact of the COVID-19 outbreak in Nanjing and the floods in Germany on the supply chain during a conference call, but the situation is still under control.

Lastly, let’s talk about NIO’s current cash position. As of June 30, 2021, NIO’s cash, cash equivalents, restricted cash, and short-term investments totaled RMB 48.3 billion.

In the financial report, it was mentioned that three models, including ET7, will be delivered next year, which is both reasonable and unreasonable. The reason why it makes sense is that the new model to be delivered next year is Gemini, which implies two models. However, the reason why it doesn’t make sense is that NIO already has three models on sale, so besides ET7, which other two models will come with NT2.0?

Considering Li Bin’s statement on the EP Club that the current models will be iterated to the NT2.0 platform, it is reasonable to speculate that Gemini represents the iteration of the current models. Based on the current sales models of NIO, it is likely that the combination will be ES6/EC6, which has a higher delivery volume and is more conducive to reducing costs for LIDAR and Orin chips. It also corresponds to the meaning of Gemini with two models, and the current sales of the two models are more in line with the planned 60,000 annual capacity.

However, in this way, NIO will give up the more high-end ES8, which will affect the brand’s high-end positioning. On the other hand, if they choose the ES8/ES6 combination, it will be more suitable from an inheritance perspective. However, it will give up the more youthful and popular EC6, which is hard to justify from a business perspective. Of course, if NIO chooses the third option ES8/EC6 or other possibilities, then I will be “proved wrong.”What is the intention behind NIO’s announcement of two NT2.0 products for next year, in addition to the ET7? From my perspective, there are two aspects to consider: firstly, due to the absence of new cars this year, NIO may have wanted to release some information in advance to give internal employees confidence. Secondly, it may be a way to vaccinate existing owners, building their immunity against the arrival of new cars. I spoke with a source familiar with NIO, who said “no, we won’t let owners explode” when asked if owners would react strongly to news of new models. While details on how NIO plans to prevent vehicular explosions remain elusive, NIO does have a wealth of experience handling these types of situations with tact and professionalism.

As for me, I had discussed in a previous article that ET7, which no longer offers free battery replacement, but rather battery replacement discounts, in turn suggests that the other two NT2.0 platform models will probably not offer free battery replacement either. It’s important to note that this benefit is tied to the individual and not the car itself.

To be completely frank, considering NIO’s current market penetration rate of about 50%, almost half of its users do not have great demand for assisted driving. However, NIO’s CEO, William Li, mentioned at the EP Club conference that the company will be updating the car’s SOC for the current model next year, and the biggest change for NT2.0 for this model will be the upgrade in assisted driving capabilities.

Li also pointed out that NT1.0 will continue to be sold next year, which makes sense from the supply chain perspective. After all, the capacity ramp-up is still a work-in-progress for Orin chips and Velodyne’s lidar. Before the supply chain capacity is fully released, NT1.0 is needed for a smoother transition.

Additionally, here are some excerpts from Li’s responses to investor questions during a conference call:

Factory:

In May 2021, NIO extended its vehicle production agreement with JAC Motors until May 2024. JAC will continue to produce the ES8, ES6, EC6, ET7, and other NIO models under production. Also, if calculated on a yearly basis, JAC will expand its annual production capacity to 240,000 vehicles.

Autonomous driving team:# Translation in English with Markdown

Li Bin stated that the current organizational structure of NIO’s autonomous driving is different from other companies, with four VPs reporting to him at the same time, from hardware to operating system to algorithms and system integration operations. Currently, the size of the autonomous driving-related team is around 500 people and will add 300 more people by the end of the year, reaching 800 people.

About R&D:

NIO will speed up R&D from Q2, deliver three new models next year, and more models will be available in the following year. Several projects have been launched internally this year. R&D expenses will significantly increase from Q3, with a planned R&D expenditure of RMB 5 billion for the whole year. The R&D team is expected to double by the end of the year as compared to the beginning of the year.

About the New Brand:

Li Bin believes that the relationship between NIO’s brand and the new brand is similar to that of Audi and Volkswagen, or Lexus and Toyota. The new brand will not enter the segment market of Wuling Hongguang but will target the current market where Model 3 is located, aiming to provide a better product than Tesla with a lower price and better service.

About NIO Pilot:

Li Bin also mentioned that the optional rate of NIO Pilot has exceeded 80% in Q2, and as of July, the NIO Pilot’s total mileage for automatic assisted driving has exceeded 200 million kilometers.

About Overseas Markets:

NIO appointed a European CEO in Q2 and is forming a European team. With the exception of ES8 sold in Norway, overseas market products will be based on the NT2.0 platform. The export product prices are uniform, but the specific prices depend on the local subsidy and tax policies.

The first principle of user experience and benefit also applies to overseas markets, but adjustments will be made according to different regional cultures. When recruiting 200 user consultants in Norway, there were 7 to 800 applicants, which basically verified the enthusiasm and participation of this user community all over the world. According to the feedback from the Norwegian UAB, the BaaS service model and battery swapping are widely recognized and expected.

In Conclusion

After listening to the NIO earnings call conference, we can clearly sense that NIO is accelerating in the industry wave. Traditional automakers are transforming, and technology companies are entering the market, which means that new forces are facing enemies on both fronts.

Obviously, NIO knows that the market capacity, reputation, and level of scale accumulated through first-mover advantages are still not enough to ensure that it can survive until the finals.

And the only way to get that ticket is to restart the selfless running when the rehabilitation training is over.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.