Author: James Yang Jianwen

Just yesterday, Geely Holding Group and Renault contributed the first big news of the week: they are cooperating.

Specifically, the two parties signed a memorandum of understanding (MoU) to establish an innovative partnership, share resources and technology, and cooperate in key markets such as China and South Korea.

In China, the two parties will jointly develop Renault-branded hybrid models based on Geely’s platform technology; in South Korea, they will work together to develop models for the Korean market based on the Lynk & Co energy-saving platform (CMA).

To sum up their cooperation in a few keywords: Renault chose to use Geely’s platform to develop hybrid models, which is actually quite interesting.

Because Renault actually has its own hybrid technology: E-TECH. Since the summer of 2020, Renault has launched E-TECH hybrid and plug-in hybrid versions of the Clio, Captur and Megane estate, with sales of over 30,000 units in Europe, accounting for 25% of orders for such products. The release of these hybrid models increased Renault’s orders in Europe by 14% year-on-year in 2020.

And now Renault is still pushing for technological progress. In just the first half of this year, Renault has launched the Arkana E-TECH hybrid, Captur E-TECH hybrid, and Megane E-TECH plug-in hybrid models, continuously enriching the E-TECH product line.

But now, Renault is using Geely’s platform to make cars instead of its own.

What is Renault thinking?

Euro 7 emission regulations: killing the internal combustion engine

European emission regulations are the driving force behind this decision.

Since the “dieselgate” scandal, Europe has gradually tightened its emission standards. In September 2018, it introduced the WLTP emission testing standard; in 2019, the EU passed a resolution requiring that 95% of new passenger cars purchased in EU countries in 2020 have an average carbon dioxide emissions below 95g/km. By 2021, the average must be below 95g/km for all new passenger cars purchased in EU countries.Recently, the Euro 7 emission standards have made European automakers uneasy. Strict regulations have not allowed internal combustion engines to breathe, nor have they left much room for hybrids. Hildegard Muller, President of the German Association of the Automotive Industry, stated that “if the tailpipe emission restrictions are too strict, internal combustion engines will no longer be competitive. Although strict emission regulations are conducive to carbon neutrality, they are not long-term measures.”

The European Automobile Manufacturers’ Association (ACEA) bluntly stated that the proposal to implement the Euro 7 emission regulations in 2025 is tantamount to directly phasing out internal combustion engine vehicles by 2026. European automakers have even joined together to criticize the European Commission, stating that “this is the political end of the European industry.”

This storm, which began from the top, has already swept over.

Although all car manufacturers are unhappy, they have all formulated new coping strategies. BMW, which was previously ambivalent and inclined towards hybrids, is now clearly tilting towards pure electrification. It is expected that pure electric vehicles will cover about 90% of the sub-segment market in 2023, and at least 50% of global sales will be pure electric vehicles by 2030. Mercedes-Benz stated that from 2025, all new vehicle architectures will be pure electric platforms, and each model will provide customers with a pure electric version to transition from “electric first” to “fully electric”. Volvo is even more aggressive, planning to achieve a global sales target of 1.2 million vehicles by 2025, of which at least 50% will be pure electric vehicles, and to become a fully electric luxury car company by 2030.

As for Renault, by 2025, more than 65% of the models launched in Europe will be pure electric, and this number will increase to 90% by 2030. The attitude is already very clear.

Obviously, at this point in time, if Renault invests a lot of time and money in hybrid platforms again, it is not necessary, but possible.

In the “Renaulution” strategy at the beginning of the year, Renault reorganized its business and shifted its strategic focus from pursuing sales to valuing value creation. At the same time, it stated that it would simplify its business from the engineering design phase and adjust its scale when necessary, reallocating resources to high-potential products and technologies.

In this strategy, cost, efficiency, and profit have become Renault’s most important points of concern in the past three years.So, whether from the perspective of the overall historical process or from Renault’s own strategic planning, investing heavily in hybrid technology is not a wise choice. Collaborating with existing major platforms is a good option, as it saves development costs and speeds up the production process, while not missing the timing window.

Why Geely?

In Renault’s “Renaulution” strategy, a section is specifically dedicated to describing the importance of the Chinese market, stating that “China plays an important role in Renault Group’s global strategy.”

Although Renault’s market share in China is currently small, to say the least:)

Renault currently has little presence in China, especially after Renault sold its shares in the Dongfeng Renault joint venture to Dongfeng in April 2020. Some people even thought Renault had exited the Chinese market.

How can Renault, a weak player, “return” to the public eye? This is the question.

Renault’s focus in China will be on two areas: electric cars and light commercial vehicles. Renault says it will “develop locally-branded models. Looking to the future, the company will reshape its business model in China, using its assets in China and leveraging China’s competitive industrial ecosystem to develop new mobility solutions for China and global markets.”

In other words, Renault will seek the help of local “industrial ecosystems” in China.

In March this year, Renault adjusted its organizational structure in China, appointing Weiming Soh as Renault China CEO. Prior to joining Renault, Soh served as Executive Vice President of Volkswagen Group (China), Director and CEO of Mobility Asia, and Chairman of CAMS (China Automotive Mobile Solutions Co., Ltd.). With over 20 years of extensive experience, this move is to help Renault China better grasp the local market.

This cooperation with Geely is one of its strategies.

So why Geely?

Firstly, from a strategic perspective, Renault and Geely have the same goals.

After the first Blue Geely Action failed, Geely released the “New Blue Geely Action Plan.”

The Blue Geely Action Plan focuses on energy-saving and new energy vehicles, including hybrid electric vehicles, plug-in hybrid electric vehicles, extended range electric vehicles, and small-displacement energy-saving vehicles. Approximately 90% of them are hybrid, and around 10% are traditional small displacement energy-saving vehicles.# Geely’s Blue Plan 2: Focusing on Pure Electric Intelligent Vehicles

Geely is planning to make efforts in both hybrid and pure electric vehicles. The company is forming a new pure electric vehicle company to participate in the competition of the intelligent pure electric vehicle market.

In summary, Geely will focus on hybrid and pure electric vehicles.

This direction is in line with Renault.

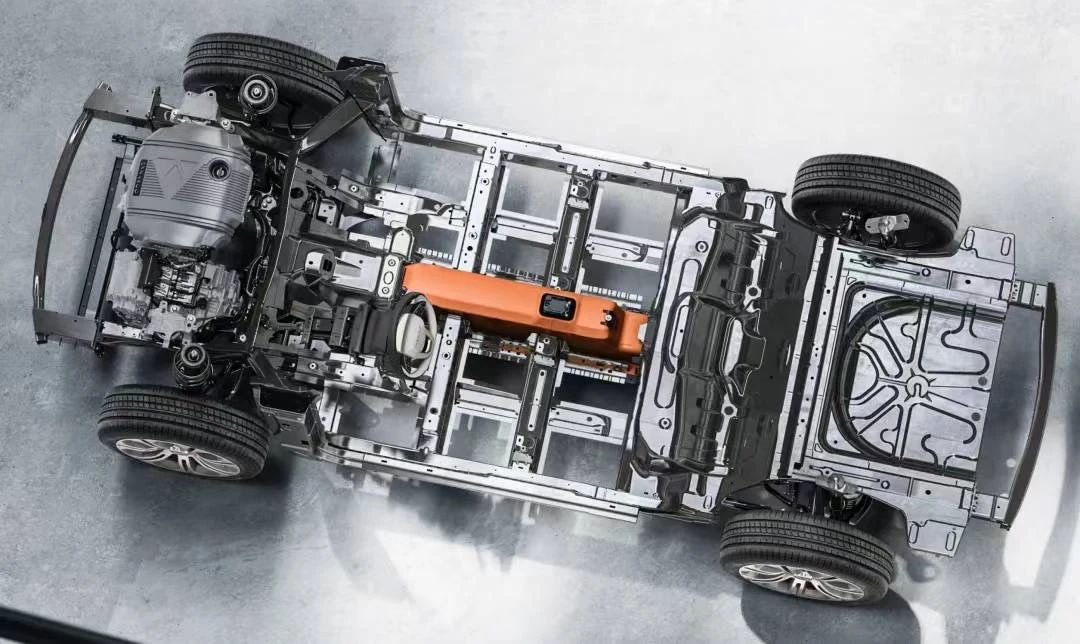

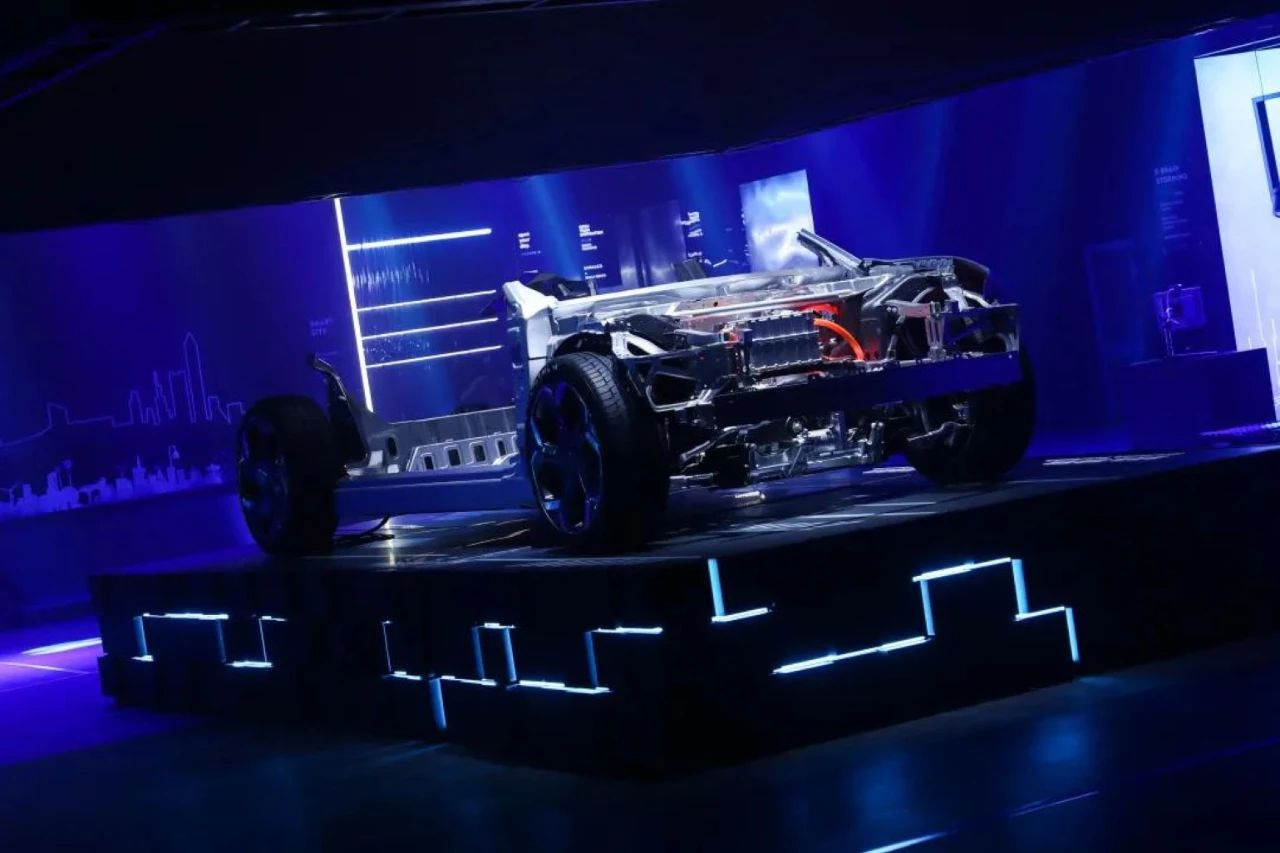

In terms of technology, Geely has excellent technology platforms. Looking at the CMA platform which the two parties plan to cooperate with, it is jointly developed by Geely and Volvo. It can support various models and match different types of powertrains. This platform has been market-validated, and Geely, Volvo, Lynk & Co, and Polestar all use it. Let’s look at some data: CMA architecture system product sales have exceeded 600,000 units.

At the same time, Geely’s GHS2.0 hybrid system will also achieve mass production and be installed in vehicles. The system has a thermal efficiency of 43.32% and a fuel saving rate of 40%. It also supports OTA over the full power domain. In comparison, the first-generation product GHS1.0 has a fuel-saving rate of 25%, which shows a significant improvement.

In addition, Geely Holding Group and Daimler have cooperated in the hybrid field and plan to jointly develop hybrid powertrain solutions to create scale effects and enhance competitiveness in global markets. This is further evidence of Geely’s technological recognition.

Another point is that Renault and Geely have a basis for cooperation. Renault subsidiary Alpine and Geely subsidiary Lotus have also signed a memorandum of understanding to study multiple areas of cooperation, including the joint development of an electric sports car.

It can be seen that Renault and Geely’s cooperation has some similarities.

How to Cooperate?

Now the question is: what is the cooperation method between the two parties?

Currently, there is not much information disclosed except for their cooperation intention. However, this is only the first step, and there might be many new actions from both parties later on.

The issue now is what the cooperation method is and what the cooperation content and scope of independent operations are.

Referring to the previous cooperation between Toyota and BYD, the two parties established a 50:50 joint venture and then carried out related businesses such as the design and development of pure electric vehicles and the platform and components used by such vehicles.Now, Renault is using Geely’s platform to develop its own hybrid car. The two parties will probably adopt a joint venture form to manufacture cars, sharing platforms, driving systems, and jointly purchasing, while sharing research and development and engineering costs. It is just unclear who will dominate who.

Another question that makes me curious is: Will the Renault hybrid car based on the Geely platform be exported to Europe in reverse?

China is the world’s largest car market and plays an important role in Renault’s global strategy. Therefore, obtaining more market share is what Renault wants to do.

However, the competition of electric vehicles in the Chinese market has reached a white-hot stage. At the same time, after so many years of market education, users have reshaped their understanding of electric vehicles. In a word, they have become more demanding.

If only a very ordinary electric car is produced, it cannot attract the attention of domestic consumers and will have sales problems. Therefore, this is also the challenge that Renault will face next: how to create electrified vehicle models that local users will like.

I am really looking forward to Renault’s localized car production.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.