The new energy vehicle market in the United States has recently reached a milestone: through the executive order of the President, the sales of new energy vehicles (including sedans, SUVs, and pickups, consisting of pure electric, plug-in hybrid, and fuel cell vehicles) are required to reach a share of 50% by 2030. Although the sales target is voluntarily set by several major automakers (General Motors, Ford Motor Company, and Stellantis), and the target ratio is not mandatory, a series of measures by the US government will promote the development of this issue.

Target is a target. To achieve this goal, there are already organizations responding to it. For example, the US Environmental Protection Agency (EPA) and the US Department of Transportation (USDOT) announced that they will resolve the problem of the previous government’s backwardness in fuel efficiency and emission standards. The two agencies are responsible for correcting historical errors and promoting the achievement of the next phase of fuel efficiency and emission standards targets.

Through investment (Build Back Better Investment Agenda), the United States aims to reintegrate into a favorable position in electric vehicle manufacturing, infrastructure, and innovation. The specific goals include:

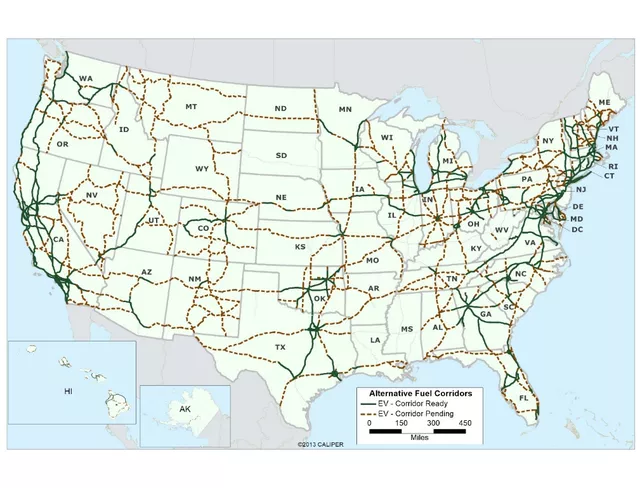

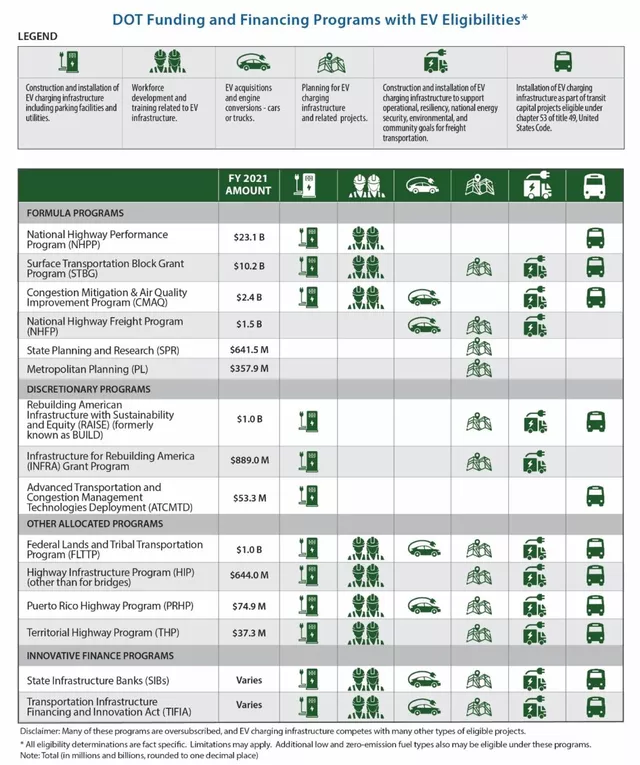

(1) Establish a nationwide network of electric vehicle charging stations (which has been determined by a bipartisan basic agreement in the Senate, with a budget of $7.5 billion for electric vehicle charging infrastructure, corresponding to 500 thousand charging piles)

Earlier, the US DOE released a report on how to spend money in the charging infrastructure field, as shown below. $7.5 billion seems to be of limited effect.

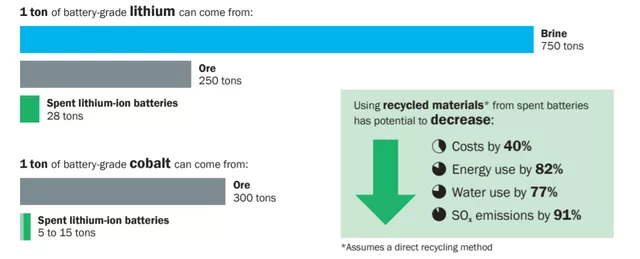

(2) Offer incentives for electric vehicle consumers (tax refunds) to increase US manufacturing employment opportunities. The amount for this part has been increased from $7,500 to $12,000, which is still controversial, but the specific amount can be seen in the subsequent gradual implementation.(3) Provide funding for the restructuring and expansion of the entire domestic electric vehicle supply chain – this measure is actually the most critical. As I have previously analyzed, Europe and the United States will not rely on the East Asian supply chain. This has already been planned in the United States. We have seen before the release of the comprehensive transformation of electric vehicles in the United States that they reviewed their own supply chain in this way:

This is intended to establish a complete and independent U.S. electric vehicle industry chain:

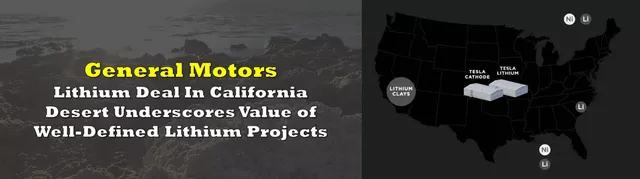

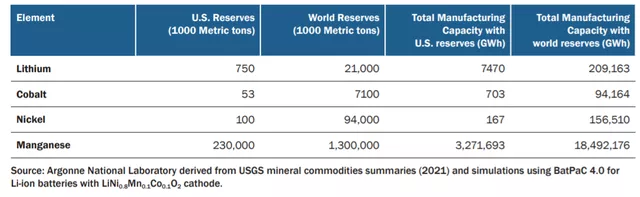

First, all super battery factories need to be achieved. General Motors is the first (in cooperation with LG), Ford is the second (in cooperation with SK), and Stellantis (from the current selection, it is likely to be SDI); coupled with Tesla’s self-built factory in the United States, LG plans to plan to build its own independent factory in the United States. It can be seen that the production of battery cells is all on the U.S. homeland. General Motors cooperates with Controlled Thermal Resources for strategic investment to ensure local and low-cost lithium resource supply. Last year, Tesla signed a supply agreement with Piedmont Lithium (North Carolina) which is a company developing lithium resources, but these companies all need government funds to support.

Logically speaking, the United States will call on its allied resources to strategically reserve lithium, cobalt, and nickel resources. The only thing that can be determined is that the United States does not lack manganese.

From the current perspective, cobalt may not be a big bottleneck because the overall recycling efficiency is relatively high.

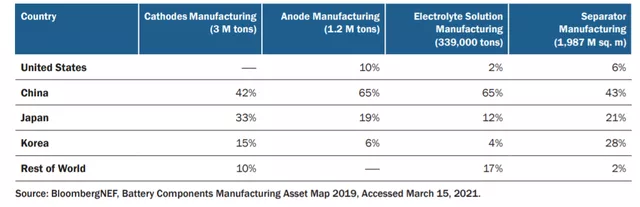

From the perspective of main materials, the positive electrode is obtained from Japan and South Korea, while the negative electrode can only rely on Japan. The estimated supply of electrolyte needs to be increased, and production of diaphragms needs to be introduced from Japan and South Korea. It can be seen that in the future, huge demands will not all be met through the Chinese export of lithium-ion materials to the world.

(4) Innovating and developing the next generation of new energy vehicle technology: This can be seen as the 2030 Battery Plan previously developed by the United States Department of Energy.

In summary, I think that the United States’ grand initiative to promote electric vehicles may have short-term benefits for China’s industrial chain. However, in the long run, this may not be entirely good news for China’s industries. From the perspective of mineral resources and other factors, it is clear that the Americans are seriously planning and preparing for these matters in the next 30-50 years. With the emergence of Tesla and the upcoming Apple Car, you can see the advantages of the United States in terms of resource integration and software innovation. At the level of electric pickup trucks, Americans are playing a special game. If we believe that lithium iron phosphate is enough to secure our position in the next 10 years, innovation is still necessary to maintain our leading position.

From this perspective, it must be said that technologies and ideas such as sodium batteries are good news for the long-term development of China’s industry chain.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.