Sodium-ion battery

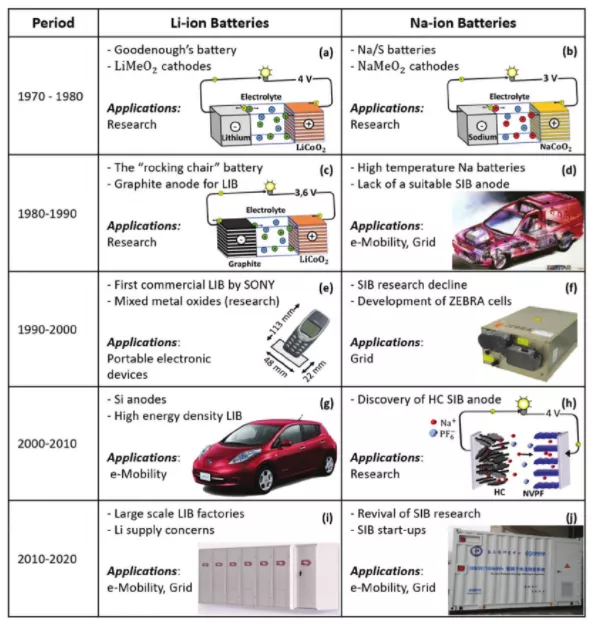

First, let’s answer a question: what is a sodium-ion battery? It works by relying on the movement of sodium ions between the positive electrode and the negative electrode, similar to the working principle of lithium-ion batteries. Since the end of the 1970s, sodium-ion batteries have been studied almost simultaneously with lithium-ion batteries. From the perspective of ultimate maturity and application range, lithium-ion batteries occupy a good position. Currently, the main potential application field of sodium-ion batteries is energy storage.

For sodium-ion batteries, whose industrial chain has not yet fully matured, their advantages and disadvantages are quite obvious. First, their volume energy density and specific energy density are relatively limited; but compared with lead-acid batteries, they have obvious cost advantages, good energy density, cycle life, high and low temperature performance, and rate performance. Therefore, their early positioning is relatively clear.

What did CATL release this time?

The key points of the release that I have summarized are as follows:

(1) In terms of sodium-ion positive electrode materials, there are currently two types of materials with potential commercial value: Prussian white and layered oxides. The capacity has reached 160mAh/g, which is equivalent to the positive electrode material of existing lithium-ion batteries. CATL mainly rearranges the charge of the material’s bulk structure, redesigns the surface of the material, and solves the global problem of rapid capacity attenuation during the cyclic process, making the innovative materials capable of industrialization. In terms of the negative electrode material, it has developed a unique porous structure hard carbon material that can store and pass a large amount of sodium ions. In terms of electrolyte, a new, unique electrolyte system that is compatible with such positive and negative electrode materials has been developed. In terms of manufacturing process, it can be compatible with the current lithium-ion battery manufacturing process and equipment.

Note: That is to say, it can achieve the maximum possible reuse on the existing packaging and production line of lithium-ion batteries.

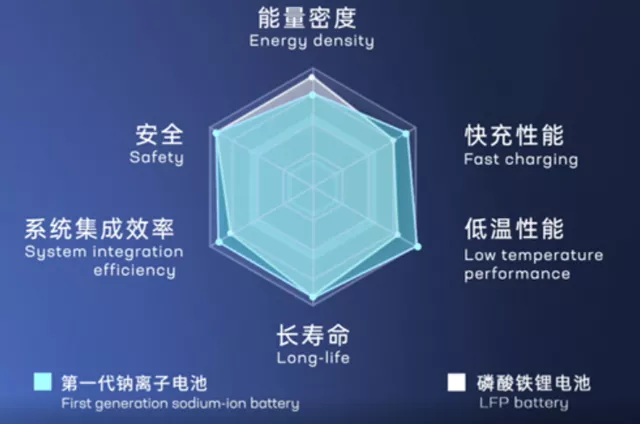

(2) From the product perspective, the performance indicators of the first generation sodium-ion battery developed by CATL are as follows:

The single cell energy density of the battery has reached 160Wh/kg;

At room temperature, the battery can reach 80% of its capacity in just 15 minutes, possessing fast charging capability;

The battery has a discharge retention rate of over 90% at -20°C;

In terms of system integration efficiency, it can also reach over 80%;

The battery has excellent thermal stability, which has surpassed the national safety requirements for power batteries.

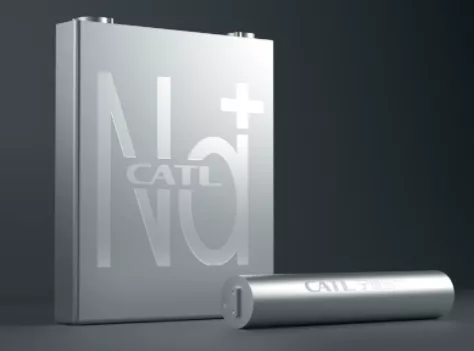

The information provided in the live broadcast suggests that CATL may be planning to pursue two application routes for their products. The first is a large cylindrical sodium-ion battery, which is based on the previous route of large cylindrical lithium iron phosphate batteries.

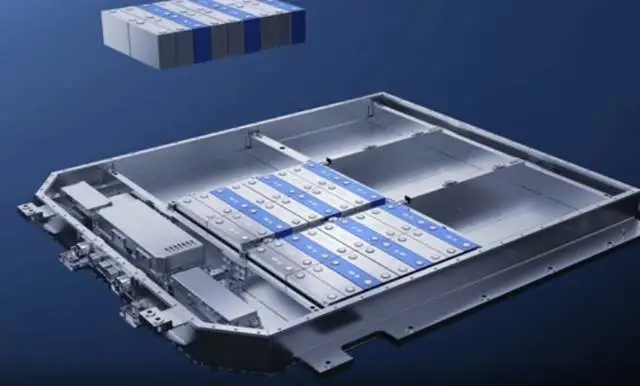

The second route involves attempting to produce products using existing prismatic batteries, specifically mentioning innovation in battery system integration. Previously, CATL proposed a solution to integrate lithium iron phosphate (LFP) and ternary (NCM) batteries. At this press conference, we saw a solution that combined sodium-ion and lithium-ion batteries. This principle is similar to using LFP and NCM together, integrating both types of batteries into the same system in a specified proportion, arrangement, and connection through precise BMS algorithms for balanced control.

I believe that sodium-ion batteries are still a kind of futures product, especially when CATL stated that in 2021, commercialization of sodium-ion batteries will begin, with the goal of forming a basic industry chain by 2023. This press conference also aims to encourage participation from relevant research institutions, upstream materials suppliers, and downstream battery applications to jointly accelerate the improvement and development of the sodium-ion battery industry chain. Speaking of this, we need to explore the next topic:

The Constraints of Electrochemical Energy Storage Resources in China and the World

(1) Lithium Resource Reserve

Lithium is the lightest metal on the periodic table, a natural charge-discharge medium, and the most appropriate element for batteries. However, for battery companies, the reserves and prices of lithium resources are uncontrollable and a major concern. In other words, the development of the global new energy vehicle industry has entered a positive self-circulation phase, and lithium, as the metal element with the most negative electrode potential in nature, is the natural battery metal. We believe that it will have long-term demand rigidity in high-specific-power power batteries and most energy storage applications. Therefore, the lithium industry is regarded as the future “white oil,” and its strategic value has become a global consensus. Without innovation, lithium will become a strategic resource that every country needs to prepare for.

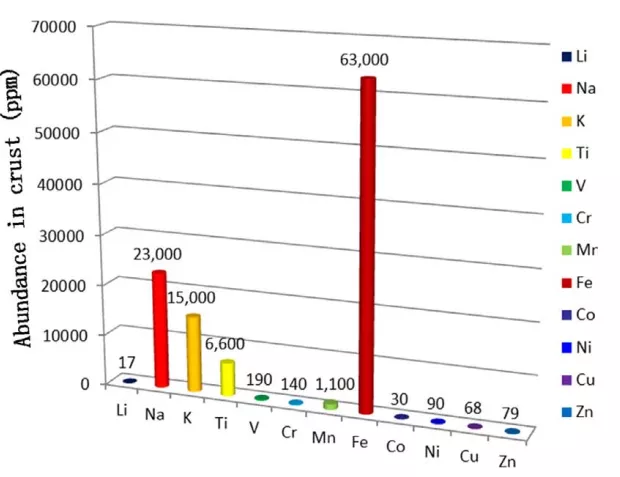

(2) Abundance of Sodium Resources

From the perspective of the periodic table, the most likely element to replace lithium is sodium, which is located directly below lithium. The surface concentration of lithium is only 0.0065%, while that of sodium is 2.75%, which is more than 400 times that of lithium.

Prospects for Sodium Batteries

Finally, let’s discuss the prospects for the use of sodium batteries. Personally, I think this press conference was a bit hasty, and a lot of information was not fully elaborated. From the perspective of usage scenarios, sodium batteries are positioned as low-cost and aiming to replace lead-acid batteries comprehensively.

China is the world’s largest producer, consumer, and exporter of lead-acid batteries. In 2020, the production of lead-acid batteries was 227.4 billion ampere-hours, or about 227 GWh, while the installed capacity of lithium-ion batteries was 64GWh in China. Compared with this, the space for sodium-ion batteries in the lead-acid battery market is very large. Currently, lead-acid batteries still have considerable usage space in the short term, especially in the following fields:

(1) In the field where lead-acid batteries are being iterated towards lithium batteries, but sodium batteries can be used. The most typical application is in electric bicycles. In 2020, there were 38 million new electric bicycles sold in China. If calculated based on 1 kWh, it corresponds to nearly 38 GWh. It can be clearly seen that as lithium batteries are being replaced, many safety issues arise in this area. Sodium batteries have the characteristics of relatively low energy density and high safety, which can play a very important role in this field.

(2) In the energy storage field, lead-acid batteries are still the main type of battery used in UPS. Recently, the National Development and Reform Commission and the National Energy Administration issued guidelines to accelerate the development of new energy storage methods. The guidelines clearly propose quantitative development targets for energy storage, that is, by 2025, the new energy storage will shift from the initial stage of commercialization to large-scale development, and the installed capacity of new energy storage will reach more than 30 million kW. By 2030, the comprehensive commercialization of new energy storage will be achieved, and the installed capacity of new energy storage will basically meet the corresponding needs of the new power system. In this guidance document, the development of energy storage technology is diversified, and lithium-ion batteries and other relatively mature new energy storage technologies will continue to have reduced costs and support commercialization at a larger scale. Compressed air and flow batteries and other long-term energy storage technologies will enter the commercialization phase. Accelerating the pilot demonstration of technologies such as flywheels and sodium-ion batteries on a large scale. Therefore, with the application of sodium-ion batteries, they are likely to become very useful by 2030.(3) Coordinated Use with Lithium Ion Batteries in the Automotive Industry: Ningde Times proposed a mixed-use scheme, which requires engineering and practical verification between two different lithium ion batteries, three-element and iron-lithium, to determine if refined management can achieve better results in the future. However, whether this road can be as expected, we cannot judge. Personally, I believe that making sodium batteries into 10kwh and putting them in A00 BEV pure electric vehicles has great application space.

To truly achieve automotive use, it may require the emergence of this 200wh/kg sodium battery before it can be widely used in A-level vehicles. Of course, in this case, there is still a long way to go.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.