GoOut100 media, focused on the evolution of the automotive industry chain

Author: Zheng Wen

Su Jing probably didn’t expect that he became famous for “speaking out” and was also “punished” for “speaking out.”

As the head of Huawei’s intelligent driving product department, the leader of Huawei’s autonomous driving team, former chief architect of Huawei’s terminal company, and head of Huawei DaVinci AI architecture research and development, he was dismissed and had to be trained and reassigned to Huawei’s strategic reserve team according to the latest adjustment.

The official response was that he made inappropriate comments about Tesla.

Su Jing is very popular with the media. Having a person in Huawei who dares to speak out and can catch the media’s attention is equivalent to directly mastering the “traffic password.”

“Tesla’s accident rate is still quite high over the past few years, and its accident type is very similar, from the first killed person to the most recent killed person.”

“Huawei’s autonomous driving is definitely the best.”

“At this stage, companies that do Robotaxi are all dead.”

Objectively speaking, Su Jing has said many unconventional things, some of which tell the truth, some show his absolute confidence, and some are more extreme. But no matter what, they are all attractive enough.

The question is whether the current Huawei needs to stand in the center of the stage?

No matter which automaker sees Huawei at the Shanghai Auto Show, holding ARCFOX in the left hand and Chery in the right hand like a mascot, and grabbing all the attention, they will be anxious.

Ren Zhengfei should have realized that Huawei’s role as a supplier of intelligent driving solutions is not easy to establish, and the public’s perception is far from Huawei’s role positioning. Because of the sharp “soul theory” related to Huawei, there is still a high degree of discussion to this day.

Behind Su Jing’s dismissal is a war without smoke on the autonomous driving track.

The Conservative and Open-Minded Camps on the Track

Huawei doesn’t want to be high-profile anymore. It just wants to make money “incrementally” in the automotive industry, but objective conditions do not allow it.

There is a question that needs to be thrown out for thinking. Why does Huawei repeatedly emphasize that it does not make cars, but still cannot cover up the outside’s repeated guesses? Even internal employees’ restlessness needs to be suppressed by banning.

The reason lies in the image that Huawei presents to automakers, whether it makes automakers feel “crisis.” One real dilemma that Huawei faces is that its supplier role continues to be unrecognized. You tell others that you don’t make cars and won’t compete with car companies head-on, but car companies think you have taken away the soul of the car, which is more deterrent than direct competition.On June 30th, at the SAIC shareholders meeting, SAIC Chairman Chen Hong’s speech triggered the sensitive nerves of many people. “Huawei provides a complete solution, it has become the soul and SAIC has become the body. SAIC cannot accept such a result, it needs to grasp the soul in its own hands.”

Chen Hong’s “Huawei provides a complete solution” refers to Huawei’s “Huawei Inside” mode, which provides full-stack autonomous driving solutions. Choosing a packaged solution means that the OEM basically loses its voice. To coordinate with the overall solution, not only autonomous driving-related chips and sensors but even core hardware components cannot be independently selected. Automakers lose control over the automotive market.

An engineer from a first-tier component manufacturer revealed that in a vehicle model project with a certain automaker, the selection of the steering system was coordinated with Huawei engineers, and the project execution completely served the packaged solution.

In fact, Huawei also finds it difficult to fully leverage its strengths in such a collaboration. A former BU employee who participated in the Lynx project revealed that “during the collaboration, Huawei’s ecosystem was not well applied, and traditional automakers were still wary of Huawei, which resulted in Huawei’s many advantages not being fully utilized.”

Like Tesla, Huawei also collects a large amount of driving behavior data using a “shadow mode” to strengthen the iteration and execution of its autonomous driving algorithm. However, this requires a precondition, which is a large number of real-running vehicles. However, currently, Huawei’s partners are apparently not large enough.

An employee from BYD’s technology department pointed out that “Huawei’s model is highly dependent on the OEM for data acquisition.” In his view, Huawei’s current mode is difficult to sustain.

A person in charge of an OEM’s autonomous driving business believes that the traditional “black box” delivery model has made OEMs passive. Since they are responsible for both software and hardware, they are left with very little room for maneuver, and all they can do is supplier management.

If Huawei’s mode is difficult for OEMs to accept, what other options do they have?

Two leading new car manufacturing companies chose to do it themselves to become self-sufficient.

William Li, the chairman of NIO, said, “If it’s software, NIO must develop it itself. We cannot obtain systematic capabilities through cooperation. We will also cooperate with others, but the core things must be done by ourselves, just like all the phone companies in the world earn less money than Apple alone because Apple provides the best experience. Therefore, integrated research and development are very important.”# Firmly Committed to Self-Developing Full-Stack Technology: Xiao-Peng He, the Chairman of Xiao-Peng Motors

Xiao-Peng He, the chairman of Xiao-Peng Motors, who firmly believes that the core of autonomous driving lies in hardware, software, and data, not just software. As for the strategy of fully outsourcing autonomous driving technology to Huawei, he bluntly said, “I tried this model before in UC and it ended up in a disaster.”

Compared with the above two paths, employees in BYD’s technology department expressed that they prefer another self-driving solution company, Baidu, which does not rely on the ecological construction of host plants but has its own ecosystem.

As for the “fuel” data of autonomous driving, Huawei needs to rely on a partner to complete road tests and improve algorithms, while Baidu has its own Robotaxi business, which continually supplies fuel. For Baidu, ASD (Apollo Self-Driving) is just one part of its autonomous driving business.

Therefore, when cooperating with host plants, Baidu’s style is completely different from Huawei’s. “Baidu has its own complete ecosystem, so its cooperative attitude is more open.”

As IT technology and the Internet integrate, Baidu and Huawei are crossing the same river in two different ways.

OEMs Do Not Need to Be Afraid of Losing Their Souls?

Let’s first take a look at the ecosystem of smartphones. Apple has obviously created an integrated ecosystem of hardware and software, where everything is of its own. However, Google emerged with the Android system and created a better ecosystem.

For host plants who want to self-develop full-stack technology, they have a dream of “Apple” in the car industry. But this way is not recommended.

Industry insiders told “AutocarMax”: “Unlike the mobile phone industry, there is no free Android to use; hence, OEMs will have to (heavily) invest everything that is needed to support their ASD-like functions; in the long run, only the top one, at most the top two players have the ability to self-develop, while other companies need to purchase from Baidu or Huawei.”

This is brutal and realistic. Why is it not recommended for host plants to self-develop full-stack technology?

From the perspective of R&D investment costs, if considering the development of a multi-model platform that supports intelligent driving and includes the E/E architecture, the investment cost level is around 10-20 billion. Moreover, the research and development investment cost of autonomous driving software is also in the range of several hundred billion, and it requires the cumulative sale of 1-2 million units to achieve cost amortization.The development of autonomous driving software requires enormous investment not only in terms of financial cost, but also in time and capability building, from forming effective R&D teams to productizing output. Companies who independently develop autonomous driving software typically require at least six years or more. However, costly R&D investment does not guarantee available technological achievements.

In the eyes of Nvidia’s autonomous driving experts, talent reserves and organizational structures are important factors limiting the development of traditional automotive companies. An HR representative from an intelligent driving solution supplier expressed that it is difficult to find excellent software algorithm engineers, and automotive companies are less attractive to them.

It should be noted that for automotive start-ups focusing on “smart cars,” perhaps their technical accumulation in autonomous driving is not as deep as imagined. In mid-2020, the Ideal Auto autonomous driving team comprised of 30 people; the autonomous driving team at XPeng Motors boasted 300 members in 2019. In comparison, Huawei has over 2,000 R&D personnel in autonomous driving, spending approximately $1 billion annually, with future investment set to maintain a growth rate of around 30%. Baidu’s investment in unmanned driving exceeds RMB 50 billion.

Relatively speaking, choosing a more open supplier may be the better option. According to Xu Yanhua, Deputy Secretary-General of the China Association of Automobile Manufacturers, “While the OEM’s absolute leadership in transformation sounds promising, it disrupts the supply chain and ecosystem, posing high risks. On the other hand, a model led by suppliers is certainly not what most OEMs want to see. There is also a model where the OEM focuses on bringing new value experiences to their customers based on their own architecture in an open system, open standard software, and various supply chain premises, while improving their software competitiveness.”

It seems that Baidu is most in line with Xu Yanhua’s description of an open collaboration supplier. The Apollo Lego-style intelligent solution demonstrates that their partnership with automakers adheres to high quality, openness, and configurability. “Baidu Apollo can use more deterministic technology and solutions to accelerate onboarding of intelligent technology for OEM customers within a limited time window, avoiding duplicate efforts.”More importantly, Baidu has strong data support for Robotaxi. The road test mileage has reached 13 million kilometers, which is equivalent to an unexplored area in the field of global autonomous driving. Currently, only Baidu and Waymo in the United States have road test mileage exceeding 10 million kilometers. In addition, the transportation modes in China and the United States are different. The travel in the United States is mainly on highways and expressways, with fast mileage accumulation and relatively simple driving scenes. Baidu’s tests in China are mostly complex city scenes, accounting for 90%.

It is worth mentioning that Baidu’s road test data is all high-quality data. The data itself is generated by algorithms. The low-level system itself has a high complexity, which results in relatively low data quality. Baidu’s road test data is based on L4 level data.

Based on the new generation of autonomous driving system, Baidu’s Apollo Robotaxi will be connected with the front-loading mass-produced models to achieve data co-ordination between mass-produced cars and Robotaxi.

In a rational view, the open Baidu platform technology route empowers car companies, surpassing the full-stack independent research and development.

Of course, for Baidu’s own car manufacturing, the host factory does not need to have too much concern. The car manufacturing company and Apollo are key components of Baidu’s layout for intelligent travel. The new car manufacturing company will operate independently of Baidu’s parent company and produce private cars for the consumer market. Apollo, on the other hand, adheres to the open platform route, providing automotive intelligent products and technologies for OEM customers, and helping their partners to make good cars.

Whether it is the degree of the new car brand or Baidu Apollo, they are essentially accelerating the transformation of China’s intelligent travel. However, the host factory may not have too much concern about this, after all, they are wary of “usurpation” rather than “competition”.

In 2017, the first time the revenue of Android app store exceeded that of the Apple app store, whether you are willing to admit it or not, it is indeed a “open” surpassing “closed” in the Internet industry. Will this become another metaphor for the automotive industry in many years to come?

The Lighter of the Pre-Moore’s Law Era

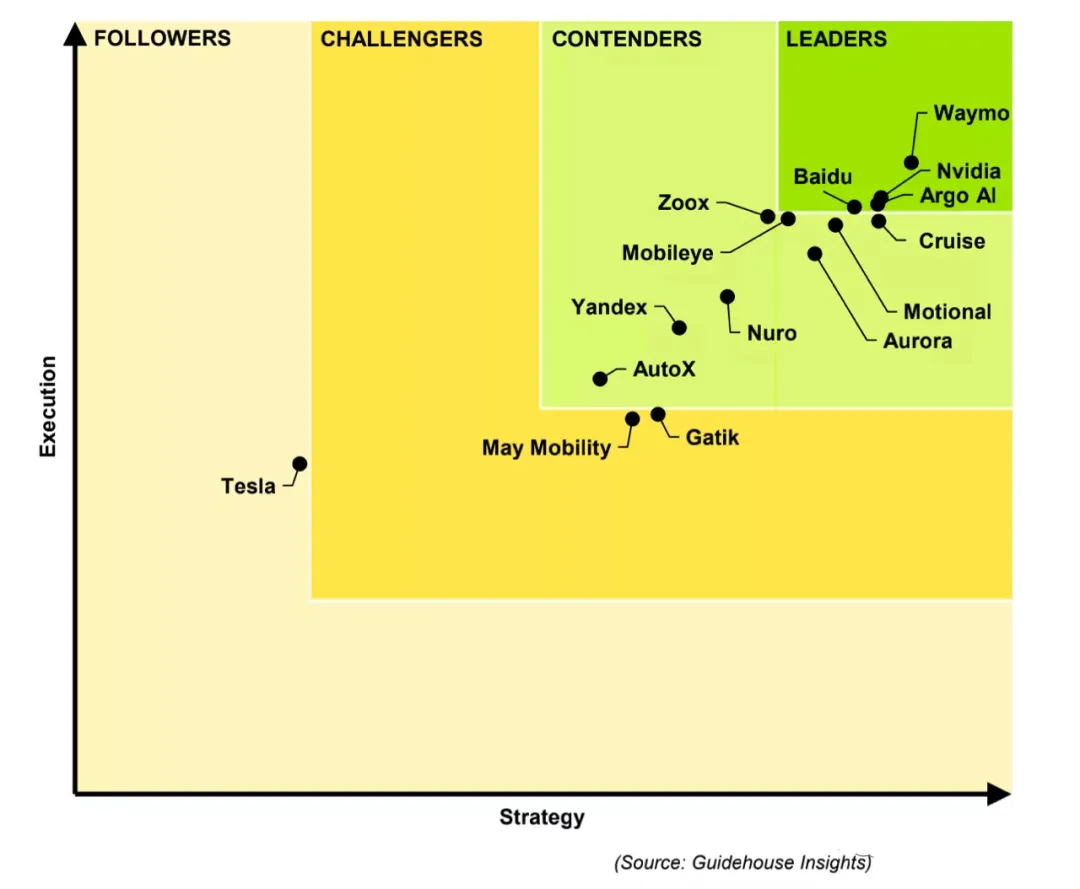

On April 27th, Guidehouse, the world’s leading public and commercial consulting company, released the latest autonomous driving competitiveness list, with 15 companies on the list. In the evaluation system, these companies are divided into leaders (75 points and above), competitors (50-75 points), challengers (25-50 points), and followers (below 25 points) based on their strategy and implementation scores.The top four companies with the highest score are classified as “leaders” in the field, namely Waymo, Nvidia, Argo AI, and Baidu. Baidu is the only leader from China, while Tesla, which has attracted much attention, ranked last.

Looking back eight years ago, Baidu, the pioneer of autonomous driving in China, had no idea how to proceed in the field.

In 2012, after a half-hour conversation with Li Yanhong, Yu Kai decided to return to China and join Baidu. His mission was to establish the Baidu Deep Learning Institute, one of Baidu’s most strategically significant technological layouts and the birthplace of autonomous driving. Of course, it was also the starting point of the development of autonomous driving in China.

In March 2017, an internal email from Baidu instructed the Autonomous Driving Division, the Intelligent Automotive Division, and the Connected Vehicle Business to come together and form the Intelligent Driving Group (IDG). Shortly after, on April 19th, Baidu officially launched the “Apollo Plan” with the goal of developing autonomous driving into the next milestone of human civilization.

On another track, a large number of “dreamers” entered the car industry under the name of electrification and intelligence, including Li Bin, Li Xiang, He XPeng, Shen Hui, Shen Haiyin, Huang Ximing, Dai Lei, Zhang Hailiang, and Jia Yueting.

Years have passed, and few of the dreamers who survived the first stage remain, while Baidu has successively hatched three eggs-Robotaxi, ASD (Apollo Self-Driving), and Jidu-while continuously climbing.

On April 20th, 2020, the third anniversary of the opening of the Baidu Apollo platform, Li Zhenyu, Senior Vice President of the Baidu Group and General Manager of the Intelligent Driving Group, issued an internal message summarizing Baidu’s commercial path for Apollo’s future in eight words: “Climb Mount Everest, lay eggs along the way.” In other words, the ultimate goal is autonomous driving, with landing scenarios along the way.

Baidu’s accumulated efforts and strategic planning enable the two tracks to finally intersect after nearly a decade of struggle through the “cold winter” of the pre-Moore era in the era of intelligent application promotion. Moreover, it has gradually found its own rhythm.

On the Robotaxi ride-hailing service, Baidu is also the clear leader.

In April last year, Baidu opened its Robotaxi ride-hailing service to all citizens in Changsha.After the end of this year’s Shanghai Auto Show, Baidu launched the first commercial Robotaxi service for the public in the Beijing Steel Park, starting the first commercial pay-per-use service of fully autonomous Robotaxi in China.

On June 17th, Baidu Apollo and ARCFOX jointly released the new generation of production-ready shared autonomous vehicle, the Apollo Moon. As a vehicle that can be put into large-scale operation, the cost of Apollo Moon has been reduced to 480,000 yuan, which is only one-third of the average cost of L4 level autonomous vehicle models in the industry.

Interestingly, shortly afterwards, a domestic autonomous driving startup AutoX took another extreme approach. In July, its autonomous driving system AutoX Gen5, which was launched in Shanghai, was equipped with as many as 50 sensors, including 28 8-megapixel cameras, 6 high-beam lidars, and a computing platform with 2200Tops computing power, integrated into Chrysler Pacifica, with a vehicle price of up to 2 million yuan.

This just shows that cost reduction is not an easy task to achieve scale mass production of autonomous driving capabilities.

As Baidu Vice President and General Manager of Autonomous Driving Technology Department Wang Yunpeng said, the release of the fifth generation of shared autonomous vehicle models is a new milestone in the true large-scale commercialization of shared autonomous vehicles.

Nowadays, Baidu has indeed become the child of others.

Looking ahead, the third wave of joint ventures is coming, in which automotive companies and technology giants like Baidu are like giant cruise ships crossing each other’s paths, heading towards a common destination of reaping the greatest benefits from the new generation of automated vehicles.

In people’s annual travel, there is a gold mine waiting to be discovered. Larry Burns, Vice President of General Motors Research and Strategic Planning, said, “In the United States, if the company that leads the way into the field of autonomous driving cars can capture 10% of the 3 trillion miles of travel each year, and charge 10 cents per mile, its annual revenue can reach $30 billion, roughly equivalent to the bumper year of earnings for the world’s most profitable companies such as Apple and ExxonMobil.”As an important role in this field, automotive companies are not just dragging their feet. In an industry with high barriers and fierce competition, they must have significant advantages to secure a place.

According to a senior manager in the industry, “outsiders simply don’t understand the complexity of developing a new car today, the difficulty of incorporating new technology into the vehicle architecture, and the little-known requirements and slow response of regulatory authorities”.

Even making a simple car is very difficult. It requires advanced logistics systems, high-end technology, and precise manufacturing processes, which is the culmination of valuable experience in car manufacturing over the past century. To procure the necessary raw materials and components, each car company has commercial dealings with thousands of suppliers around the world.

A car has as many as 30,000 parts, and assembling them into a car takes up to 17-18 hours. Even though electric cars have reduced the number of parts by about 40% compared to traditional fuel cars, they still have as many as 18,000 parts.

Many new car makers have realized that as product delivery increases, it is increasingly difficult to hide their shortcomings in hardware. Radical Tesla is a very typical example. Though it plays the role of a pioneer and leader in intelligence, its problems are also very prominent.

An engineer in the information security field at Continental Group revealed to “AutocarMax”: “It was well-known within the industry before 2019 that Tesla did not do ‘functional safety’.”

What is automotive functional safety? This international standard called ISO 26262, named “Road vehicles – Functional safety,” is a key element of automotive system design and the functional safety requirements that the host factory needs to follow. Another explanation by Baidu’s relevant technical experts is that Tesla did not do functional safety in accordance with the ISO 26262 standard, but according to its own.

What makes car manufacturers helpless is that due to the significant advantage of the traditional automotive industry in manufacturing the main hardware of cars, they may only be able to maintain their livelihoods through such businesses. However, they still need to bear full responsibility for consumer safety, while technology companies can sit back and relax while earning pots of money.

The main factories will certainly not sit back and wait for death. Although they seem to be in a passive situation in this competition, do not forget that their accumulated capital is not to be underestimated.It is easy to foresee a future industry form where a batch of new car companies, jointly established by software companies and automobile enterprises, will emerge and complement each other.

In foreign countries, some experimental collaborations have already appeared, such as Google and Ford, Volvo and Microsoft, etc. In China, these collaborations have also started to emerge.

In fact, Jidu Auto is a good example. Baidu and Geely jointly invested and cooperated closely in the field of intelligent automobile manufacturing based on Geely’s latest global leading pure electric architecture – the “Haoyue SEA Intelligent Evolution Experience Architecture”, to jointly develop next-generation intelligent automobiles. At the same time, Baidu will fully empower the automobile company with core technologies such as artificial intelligence, Apollo automated driving, Xiaodu Car, Baidu Maps, etc., and support its rapid growth.

In addition, it was also reported that the joint venture between Changan, Huawei, and Ningde Times has developed and reserved multiple models, and the brand-new high-end brand jointly created by the three parties will soon be announced.

“In the future, it may become a very common pattern for automakers to acquire startups in the field of autonomous driving or to collaborate with leading companies in autonomous driving.” said a high-level executive of an automaker.

Fortunately, autonomous driving technology companies and automakers are trying to understand each other. Both sides are looking for a way to win-win, and they have realized that they are driving towards the same destination…

Reference: “Autonomous Driving” by Hod Lipson and Melba Kurman.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.