Volkswagen’s ID.4 Electric Vehicles Disappoint in the Chinese Market

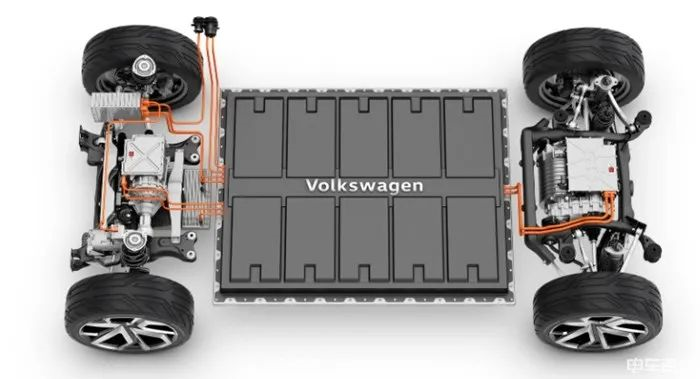

In March of this year, Volkswagen released two pure electric vehicles, the ID.4 X and the ID.4 CROZZ, which were both based on the MEB platform. The company hoped that these vehicles would sell well and help establish Volkswagen’s position in the Chinese electric vehicle market. However, the sales figures have not met expectations.

According to data, from their release until June of this year, the ID.4 X sold 3,401 units, and the ID.4 CROZZ sold 3,664 units, for a total of 6,976 units. In June alone, the two models sold a combined total of 2,902 units, a year-on-year increase of 90%.

However, despite these positive figures, the sales numbers are still disappointing. The ID.4 has been on sale in China for six months, with promotions featuring a popular celebrity spokesperson. In comparison, flagship electric vehicles from other automakers have performed better than the ID.4 in the Chinese market.

The goal for Volkswagen was to sell between 50,000 to 60,000 units this year, but the company’s performance in China has been described as a “worrisome start.” Additionally, sources state that the utilization rate of Volkswagen’s two joint venture electric vehicle factories in China is less than 10%.

According to a dealer’s inventory list, there are over 550 units of ID.4 CROZZ available for delivery in the next seven days, but despite the increasing production capacity, the supply still outweighs demand. In fact, some reports suggest that Volkswagen’s sales employees in China purchased the vehicles themselves to take advantage of the maximum subsidy of 80,000 yuan due to inventory pressure.From the exposed content, the welfare involves supplier employees. The content shows that the supplier company purchases ID.4 X bicycles in its name, and Yappi subsidizes 50,000 yuan. The discount for the three models is around 30% off. What is even more crazy is that if the bicycle is purchased in the name of the supplier’s employee, Yappi will directly subsidize 80,000 yuan, which is equivalent to a 40% discount. The lowest range version with a driving range has already reached 120,000 yuan for the bare car price, which can be said to be the lowest price in the country to take away SAIC Volkswagen ID.4 X.

However, this news has been refuted by Yappi Automotive Components, which stated that the company has never issued relevant policies. At the same time, SAIC Volkswagen also responded to the media that the SAIC Volkswagen ID series models adopt an agency marketing model, the terminal price is unified and transparent nationwide, and the online information is not credible.

Why is there an agency marketing even though there are 4S stores?

In fact, Volkswagen is not unwilling to do so. North and South Volkswagen have nearly 2,000 dealers in the Chinese market. Throughout 2020, these 4S stores sold more than 3.5 million Volkswagen vehicles nationwide. In the two years before the epidemic in 2018 and 2019, this number exceeded 4 million vehicles, accounting for nearly 40% of Volkswagen’s global sales. So, why not sell it in the thousands of Volkswagen 4S stores and let consumers place orders online?

From the manufacturer’s point of view, the business logic also stands. Set up a experience store in a densely populated business district, not only can sell, but also display, although the sales experience is not as thoughtful as a 4S store, but this direct sales model allows customers to go in and out at any time, without going to remote 4S stores, and can directly place an order.

Public information shows that in 2021, NIO plans to add 20 NIO Centers and 120 NIO Spaces, and increase the total number of stores to 366; Ideal plans to expand its sales outlets to 200 stores and increase them to 100 cities; XPeng plans to increase the total number of sales outlets to more than 300, covering more than 110 cities.Therefore, whether it’s XPeng and other new car companies, or the new energy brands established by old car companies like Geely Geometry and BAIC Jiuhu, they have all brought their exhibition halls to the closest place to the people. Even Volkswagen, a traditional car manufacturer with more power, how could they miss this opportunity? Therefore, in the electric vehicle market, the way of viewing cars built in the core consumer circle has become a mainstream.

“Learn as long as you live.” Volkswagen is also learning new sales models from the new wave. ID.4 adopts a direct sales model and agency sales model, rather than traditional wholesale to dealers. As of the end of May, Volkswagen has 12 ID. stores in China and plans to expand to more than 100 by the end of this year.

In short, the agency sales model means that in the past, most fuel vehicles went from the whole vehicle factory to the hands of consumers through dealers, that is, dealers need to wholesale the car at a contract price agreed upon by both parties, and then sell it to consumers. In this process, the host factory has little intervention in terminal sales. However, in the ID.4 agency sales model, the price is set by the whole vehicle factory and is uniformly priced nationwide. Except for inspection, insurance, and after-sales service, all other links are completed through the official website, which is similar to Tesla’s process.

Reasons for Failure

With timing and location advantages, we have to look for problems with the vehicles themselves.

To be honest, the comprehensive strength of ID.4 X and ID.4 CROZZ is barely passable. The exterior, interior, endurance, and power can all reach a certain level. However, for Volkswagen’s new energy products, there is still a lack of a product breakthrough to attract consumers’ attention.

New car companies like Li Xiang, NIO, and XPeng all have obvious product labels. For example, Li Xiang claims to be a “smart electric car without range anxiety” with its extended range power, NIO has its battery swapping and user service ecology, and XPeng has its intelligent technology…

Therefore, consumers’ impressions of Volkswagen are still tied to fuel vehicles. So, products like ID.4 are generally regarded by some consumers as “gasoline-to-electric” models.

It is reported that the selling points of the Volkswagen ID.4 model in the actual sales process still focus on hardware advantages such as spaciousness, body strength, chassis tuning, and turning radius, regardless of the intelligent networked concept that new energy vehicles are currently focusing on. Experienced salespeople from both FAW-Volkswagen and SAIC Volkswagen directly stated that “there is nothing worth mentioning” and “we did not learn any language skills during training” compared to the similarly priced competitive models such as BYD, Tesla, and Xpeng. “We will emphasize more that it is an SUV and has the profound accumulation of Volkswagen brand and technology.”

It is reported that the selling points of the Volkswagen ID.4 model in the actual sales process still focus on hardware advantages such as spaciousness, body strength, chassis tuning, and turning radius, regardless of the intelligent networked concept that new energy vehicles are currently focusing on. Experienced salespeople from both FAW-Volkswagen and SAIC Volkswagen directly stated that “there is nothing worth mentioning” and “we did not learn any language skills during training” compared to the similarly priced competitive models such as BYD, Tesla, and Xpeng. “We will emphasize more that it is an SUV and has the profound accumulation of Volkswagen brand and technology.”

In fact, the automaker was quite confident in the product strength of the ID.4. Both North and South Volkswagen have trained sales staff of the first batch of dealerships selected to sell the “ID” series, among which the language skills to deal with the main competitor Tesla Model 3 were highlighted. Sales staff would specifically emphasize the fine workmanship of the ID.4’s interior, the standard glass roof sunshade, and the cruising range.

In short, compared with the competing models, Volkswagen ID.4’s product can only be regarded as a lonely punching, lacking confidence to directly face the competition.

In addition, the primary issue to consider when buying an electric car is charging, not to mention that many automakers such as Tesla, Xpeng, and Ideals have equipped their pure electric car models with home-style charging piles and even laid out their own brand “superfast charging piles” and “battery swapping stations” all over public charging piles.

In contrast, Volkswagen has only released a home charging pile priced at 399 Euros (approximately 3,000 RMB) in the European region and the “Kaimaisi supercharging station” currently under preliminary cooperation with CAMS.

Therefore, the selling point of vehicle replenishment is still the “latter” for the Volkswagen ID.4.

As for the ID.4, consumers have the following opinions:

- Compared with domestic electric vehicles, the appearance is too mediocre and lacks a sense of atmosphere, not even as good as Volkswagen’s fuel vehicles;

- The interior is similar to the new Golf and feels a generation behind compared with domestic electric vehicles;

- The car’s system is said to be prone to card issues, with a huge gap compared to domestic electric vehicles;

- Low configuration and no advantage compared to domestic electric vehicles, and the rear drum brakes are the biggest drawback.

Of course, the current poor performance of the North and South Volkswagen ID.4 model sales is largely related to the lack of fully released channel capacity. Professionals pointed out that the current bottleneck for the ID series is the incentive mechanism that has not been sorted out, and the enthusiasm of dealers has not been fully released. This has a lot to do with the previously mentioned “direct sales model”.### How anxious is Volkswagen?

With the background of the “dual carbon” target and the “dual credit” policy in China, the entire automotive industry is striving for this goal. Among them, the desire for traditional car companies to transform into electrification is the most obvious. Recently, automakers such as FAW, GAC, and Great Wall have clear targets for new energy vehicle sales in 2025, showing their determination to accelerate transformation. Among them, BYD may even be the first traditional car company in China to “ban fuel” by completely stopping the production of pure internal combustion engine vehicles next year.

Under this situation, Volkswagen’s pressure is reflected in its actions.

On March 15th, the Volkswagen Group held its first Power Day in history, covering topics including power batteries, production capacity, battery cycling, and charging network construction, demonstrating the company’s roadmap for battery and charging technology in the next decade.

On July 13th, Volkswagen held a press conference called “2030 NEW AUTO”, which can be regarded as a comprehensive electrification declaration by Volkswagen Group and CEO Herbert Diess, lasting 90 minutes.

Only four months later, Volkswagen has held a series of events of this level, which is rare. In addition, actions such as SAIC Volkswagen’s Yu Jingmin and five models including SAIC Volkswagen ID.4 X “coming to Beijing to take the exam”; A Volkswagen ID.4 remote-controlled vehicle carrying a game ball at the opening ceremony of this year’s European Cup showed that Volkswagen’s electrification transition road was “a headache”.

Coupled with the MEB platform, which is specialized in the production of pure electric vehicle models, Volkswagen Group alone invested about RMB 50 billion in its research and development. Can Volkswagen not be anxious?

Closing Remarks

It is noteworthy that the sales of the two models of ID.4 are gradually increasing, but for Volkswagen’s plan to achieve a sales ratio of at least 50% of pure electric vehicle models in the Chinese market by 2030, ID.4’s results are still considered to be “poor” performances.The performance of Volkswagen in China’s fossil fuel era is undeniable. For example, last year its sales in China were 3.85 million vehicles, and China has always been known as Volkswagen’s second home. As it enters the era of electrification, Volkswagen is seen as one of the traditional automakers with the greatest determination and fastest action. However, from the current perspective, there are still many challenges that need to be overcome in its transition and adaptation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.