Car Companies’ Attempt at the Sci-Tech Innovation Board

Many car companies have mentioned their intention to go public on the Sci-Tech Innovation Board, but none have actually done so.

Since its launch in 2019, the Sci-Tech Innovation Board has been highly favored by sci-tech innovation companies due to its registration system and a series of more inclusive and open public listing policies. However, the number of companies that have been terminated during the audit process has also steadily increased.

As of July 14th, there are a total of 131 companies in the queue for Sci-Tech Innovation Board application (including those that have been accepted and those that have been inquired about), while 117 have been terminated during the audit process, according to data from the Shanghai Stock Exchange’s official website. Unlike the low entry requirements initially, it is becoming increasingly difficult to get listed on the board.

This is exemplified by new energy vehicle companies. From WM Motor, which was identified as eligible for listing on the Sci-Tech Innovation Board earlier this year by the Shanghai Securities Regulatory Bureau, to Geely, which broke the record by getting listed in just 28 days from acceptance, the board has not yet welcomed the so-called “first new energy vehicle company.” Moreover, there are no car companies visible in the long queue of applicants on the Shanghai Stock Exchange’s official website.

However, despite the setbacks suffered by car manufacturers, new energy component companies upstream have performed well. For example, Funeng Technology and Yihuatong, both of which went public last year, and several related companies have recently completed the audit and registration process:

-

Jingjin Electric passed the audit on June 16th.

-

Giant Scientific and Technological passed the audit on June 25th.

Among them, Changyuan Lithium Technology passed the audit on September 14th, 2020, and submitted registration in April of this year. Xiamen Tungsten’s new energy and Fangyuan Environmental Protection, two companies that passed the audit on December 29th last year, submitted registration on the same day in June.

Furthermore, unlike new energy car companies, whose presence is largely absent in the queue list, there are also new energy upstream companies such as Jiangsu Huasheng Lithium Battery Materials Co., Ltd. among the companies currently in the queue.

Why is there such a big difference in treatment between new energy car companies and upstream component companies on the Sci-Tech Innovation Board?

The Tightening of the Registration System

The registration system, as well as the lack of consideration of profitability, more flexible stock incentives and reduction rules, and market-oriented issuance, have contributed to the low “listig threshold” on the Sci-Tech Innovation Board. This is one of the reasons for the severe queue situation on the board. However, in light of the situation of long queues and previous negative examples such as Ant Group, the policy on the board is likely to be tightened.

As the only car company that appeared in the dynamic project list on the Shanghai Stock Exchange’s official website until recently, Geely Auto, a red-chip company registered overseas and operating domestically, only met the conditions to return to the A-share market after the China Securities Regulatory Commission released the “Announcement on Relevant Arrangements for Innovative Pilot Red-Chip Enterprises to Be Listed in the Domestic Market” in April 2020. Since then, Geely has been preparing to list on the Sci-Tech Innovation Board.

Timeline of Funeng Technology (above) and Yihuatong (below) on the sci-tech innovation board listing application review (Source: Shanghai Stock Exchange website)

From the time of acceptance to passing the review process, Geely is very fast.

Other companies usually take over a month from acceptance to inquiry, while Geely only took six days. The inquiry was also routine, involving whether they have the qualifications for issuing and listing, whether they meet the attributes of a sci-tech innovation board-listed company, whether their R&D capabilities are reflected, financial and accounting information, and management analysis.

In the process from inquiry to review meeting, if there are situations where the language used in the response is vague or too general, difficult to understand, or if the review center has new inquiry questions, there will be multiple rounds of inquiry to ensure consistency in information disclosure and sufficiently warn of risks. The eight listed auto parts companies in this article went through two rounds of inquiries, but as a stable operation that had previously been listed on the Hong Kong stock exchange for many years, Geely passed this stage quickly. After the inquiry, it provided more than 200 pages of reply letter in 11 days, and the inquiry was ended in one round. This shows that Geely is well-prepared for this listing.

Later, in March 2021, the Shanghai Stock Exchange suspended the review due to outdated financial information in the application documents. According to relevant requirements, as long as Geely updates the corresponding materials, the review can be resumed. However, three months later, the result was Geely’s withdrawal of its listing application and the Shanghai Stock Exchange’s decision to terminate the review of its listing application.

Geely’s official explanation was a strategic adjustment. In 2020, Geely and Volvo first announced the reorganization, and then abandoned the plan. Volvo also considered IPO in Sweden. In March of this year, Geely also established a new energy sub-brand, Geometry, and an independent listing of Geometry is also under consideration by Geely.

As for WM Motor’s withdrawal from the sci-tech innovation board, it stems from two explosive rumors in April of this year.A news report pointed out that WM Motor had to delay its IPO on the STAR Market due to “a number of problems found during the review of materials submitted.” WM Motor refuted the news and stated that it is still queuing for IPO on the STAR Market under tightened policies, and preparations for listing are progressing in an orderly manner. “Please refer to the public announcement of the Shanghai Stock Exchange for specific information.” However, so far, there has been no news about WM Motor from the Shanghai Stock Exchange, and the company cannot be found in the STAR Market queue.

Another report mentioned that WM Motor, Skyworth Auto, Baoneng Motor, and other companies are placing more focus on going public in Hong Kong, but the company has not responded to this news.

From a timeline perspective, Geely withdrawing its application and WM Motor’s application not going smoothly both occurred after the tightening of policies on the STAR Market. Since the end of last year, the STAR Market has been increasing the scrutiny of the technology content of the companies applying for listing. In April of this year, the new “Rules for the Issuance and Listing of Securities on the STAR Market of the Shanghai Stock Exchange” were released.

Unlike the 2020 version, the new regulations add a clause that “the STAR Market gives priority to supporting science and technology innovation enterprises that meet the national science and technology innovation strategy, have advanced technologies, outstanding science and technology innovation capabilities, outstanding capabilities to transform scientific and technological achievements, outstanding industry status, or high market recognition to issue and list.” The R&D personnel ratio among the total number of employees of a company for a given year must also be no less than 10%. R&D capabilities, R&D ratio, and technological attributes will play a more important role in the IPO application review.

According to authoritative sources, for companies that have already applied before the new regulations were released, the relevant indicia for science and technology attributes will still be evaluated according to the rules at the time of their application, but the company’s technological advancement will be comprehensively assessed based on the revised regulations.

Since WM Motor’s disclosure in April, companies such as Unisplendour New Energy, Leapmotor, and others have also slowed down their IPO progress on the STAR Market. After the rush to become the first automobile company on the STAR Market, it became more important to take advantage of the favorable trend and prepare more fully for the IPO.

So, does the fact that there has yet to be a “first automobile company on the STAR Market” imply that the STAR Market is unfriendly to new energy automobile companies? It is not necessarily so. In the new rules for issuing and listing securities on the STAR Market, new energy vehicles, key parts for new energy vehicles, and power batteries still belong to the energy conservation and environmental protection field and have not been removed. Therefore, it is not a matter of unfriendliness, but rather stricter scrutiny.

The Road of Science and Technology Innovation Board IPO for Auto Parts Enterprises

Zhuhai Guanyu’s main business is consumer batteries, and its power lithium-ion battery is still in the layout stage. Therefore, in the inquiry content, only the question of why to enter the power battery market and the R&D expenses and capital expenditure plan for the next five years were brought up in the on-site inquiry of the listing committee. Therefore, this article does not analyze this matter. Let us take a closer look at how Jingjin Electric and Juyi Technology were able to pass the IPO review.# Jingjin Electric’s Two Rounds of Inquiry

Jingjin Electric was founded in 2008 and is focused on new energy electric drive systems and comprehensive technical solutions for electric vehicles. Prior to an initial public offering, Jingjin Electric underwent two rounds of inquiry.

The first round of inquiry focused on four areas, including the company’s shareholder structure and basic information on directors and executives, the company’s business, governance and independence, and financial accounting information and management analysis. In the fourth area, Jingjin Electric was specifically asked about its ongoing profitability concerns, including the risk of unrealized losses and continued losses.

In the second round of inquiry, Jingjin Electric was asked to clarify questions that were not answered in the first round, including business qualifications, production capacity utilization rates, and use of proceeds. Additionally, the company was asked about the stability and sustainability of its operations, and to provide a simulation analysis on the prerequisite conditions necessary to achieve profitability regarding production capacity, output, sales, and revenue. Jingjin Electric was also asked to explain the sharp decline in gross profit margins in the first six months of 2020 and whether its business decline aligns with industry trends.

In the final phase of the review process, the audit center requested further explanation and risk disclosure for its ongoing loss and negative gross profit margin in 2020, as well as an analysis of its operating conditions in 2021.

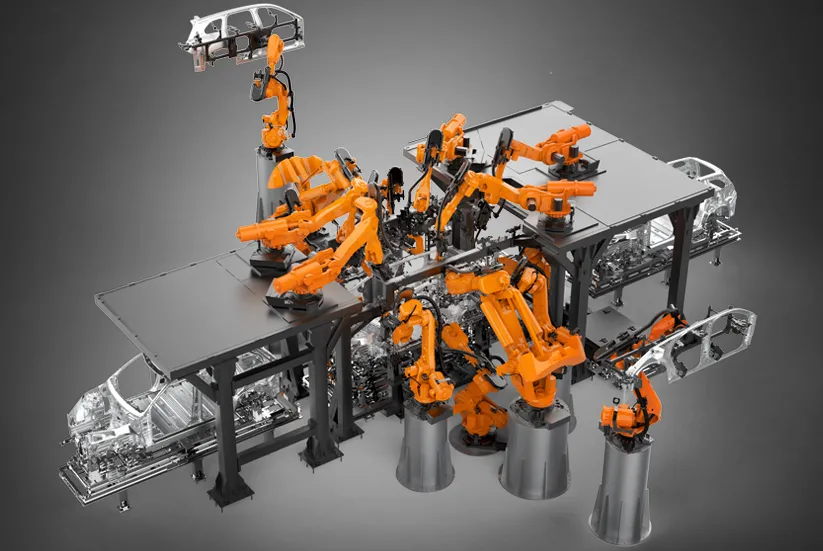

Juyi Technology differs from Jingjin Electric in that its business is primarily composed of two parts: intelligent equipment and comprehensive solutions for electric drive products. The former can be subdivided into intelligent connected production lines for vehicle body parts, intelligent testing production lines for automotive powertrains, intelligent testing production lines for power batteries, digital operation and management systems, and more. During the first round of inquiry, Juyi Technology added core technology, risk warnings and use of funds, and administrative penalty content.

During the reporting period of the first half of 2017 to 2020, Juyi Technology did not experience any losses, and its net profit remained positive. Therefore, in the second round of inquiry, the company was asked about issues such as negative cash flow from operating activities in its 2020 annual report, a significant decline in its electric drive business in 2020, a high proportion of tax incentives, consecutive increases in government subsidies, and the scientific and technological attributes of its intelligent equipment lines. In the audit center’s opinion review letter, the company was asked to provide comprehensive risk warnings and information disclosure, as well as a plan to address issues such as the decline in its electric drive business and production capacity utilization rates.Industry insiders told “Electric Vehicle Observer” that since the launch of the Science and Technology Innovation Board (STIB) two years ago, “from last year’s cases, it seems that STIB only focuses on formal examination and as long as the requirements are met, it will be approved, allowing shareholders to determine and judge by themselves. But now, with the low threshold of STIB and high valuations of listed companies attracting more companies to apply, and the irrationality of investors becoming more apparent, STIB has returned to the idea of substantive examination at the end of last year.”

Unlike formal inspection, “the key to substantive inspection lies in the sustainability and stability of the business. At present, the risk of the main automakers, especially the new forces of car manufacturing, is still very high due to their lack of business sustainability and stability. By contrast, although the imagination of parts companies is not as good as that of main automakers, their sustainability and stability are much better.”

Overall, the STIB’s strict review is reflected in two aspects: strict review of STIB attributes and sustainability and stability of the business. Geely, with good financial conditions, may be deficient in technology content, while the new forces of car manufacturing, such as WM Motor, have a more urgent need for listing financing and have not been able to enter the process. The problem of their insufficient self-generating capacity still needs to be solved, and whether the proportion of investment in research and development meets the requirements of STIB also needs to be verified.

Although the STIB was created to support scientific and technological innovation enterprises, it is also to select eligible and potential companies. A strict review and policy tightening are good news for companies that truly have research and development capabilities and competitiveness.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.