Author: Sun Xiaoshu

WM Motor, one of the earliest players in the new car manufacturing industry and a member of the first-tier new forces, now faces “falling behind” questioning from the outside world.

In response to the questioning, WM Motor CEO Shen Hui stated at the mid-year media communication meeting on July 15th that the current smart electric vehicle market is like a football game that has not yet completed the first half and has not reached the stage of victory or defeat, so there is no “falling behind” issue.

According to the data released by WM Motor at the communication meeting, WM Motor’s cumulative sales in the first half of 2021 were 15,665 vehicles, a year-on-year increase of 103.8%, and second-quarter sales were 10,116 vehicles, a year-on-year increase of 105.6%. Among them, June sales were 4,007 units, an increase of 97.6% year-on-year. In terms of sales performance in the first half of 2021, although WM Motor is not stunning, it is still on the smart electric vehicle table and has the opportunity to play its cards.

Two cars, two logos

WM Motor will launch the sedan product M7 in the second half of 2021 and then accept reservations. M7 is WM Motor’s fourth model and its first sedan product, which will be equipped with at least three laser radars and computing power of up to 500-1000 TOPS.

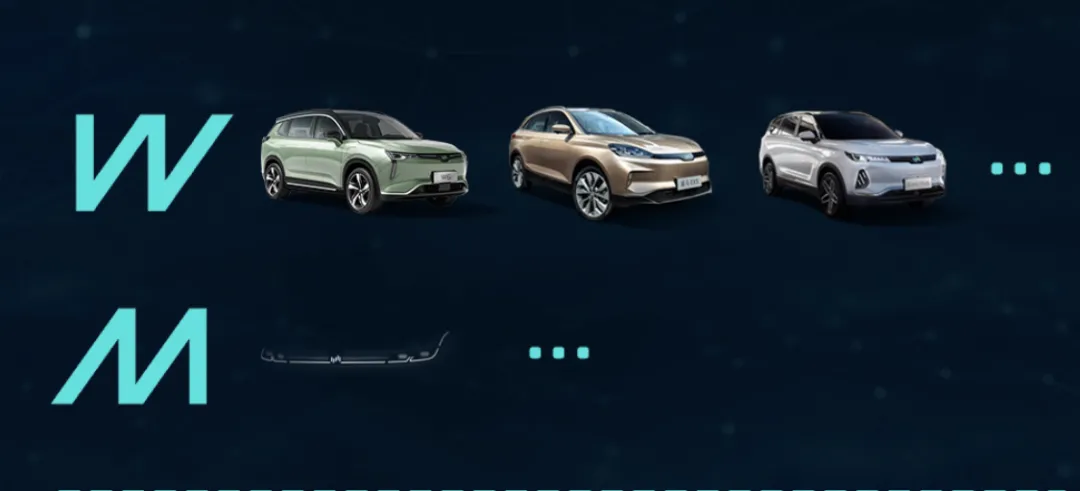

For WM Motor, one of the important meanings of the arrival of the first sedan product M7 is to enrich its product matrix. In the future, the W World series SUV product line represented by the W6 and the M Master series sedan product line represented by M7 will form WM Motor’s SUV/sedan “two cars” layout.

As for the automatic driving hardware supplier, WM Motor has not given a clear answer about whether M7’s chip will continue to use Qualcomm or switch to Nvidia. But at present, choosing chips from large factories and innovative enterprise products with laser radars has become the mainstream choice in the market, and it is believed that WM Motor M7 will not deviate from this range.

In addition to the first sedan product M7, WM Motor will also launch the sedan E5 for the travel market in 2021.

It is not uncommon for new energy products to be put into the B-end market. Models such as GAC New Energy Aion S, Geely Geometry A, and new forces such as XPeng G3 have also entered the online ride-hailing market. Investing in the B-end market has also made significant contributions to the sales of models. However, it is not common for WM Motor to introduce dedicated models for the travel market.Choosing to enter the mobility market, on one hand, is because WM Motor recognizes the potential growth in this industry. During a recent communication meeting, Shen Hui stated, “Many young people may have lost interest in owning a car. I think this is a significant blow to traditional car manufacturers, but it is very interesting for us new energy vehicle (NEV) start-ups. We are now in the transition from producing tens of thousands to hundreds of thousands of vehicles, and at this time, the mobility market will become our growth point.”

On the other hand, WM Motor has always had a clear “three-step” strategy since its founding: first, to be the popularizer of smart electric vehicles; second, to become a data-driven smart hardware company; and third, to grow into a new ecosystem service provider of smart mobility. By entering the mobility market, WM Motor not only hopes to bring in new business growth points, but also to implement its original strategic plans.

As for how to effectively distinguish between different product lines, WM Motor has chosen to launch a dual-brand logo strategy. The circular logo is specifically targeted at the mobility market, and the completely redesigned superellipse logo will be aimed at the personal market and will be used for the M Master series sedans and W World series SUVs.

During the recent communication meeting, Shen Hui kept emphasizing “driving fun” and “affordability”. “Driving fun” naturally refers to the improved user experience of smart electric vehicles compared to traditional fuel vehicles, while “affordability” represents WM Motor’s product positioning, advocating for the mainstream market price of CNY 150,000-250,000.

Regarding how to understand “driving fun”, Shen Hui does not agree with blindly following Tesla in the field of autonomous driving, for example, focusing on highway entry and exit ramps, as this is the primary driving demand of American users, but the Chinese market is different, and parking is the pain point of the market. Therefore, WM Motor chose to develop L4 autonomous parking in parking scenarios first.

In April of this year, WM Motor introduced one of the key features of the W6, the HAVP learning-based parking function. It is called a “learning-based parking” system because users need to drive the W6 through the parking route once. During this process, the W6 will use two front cameras, four surround cameras, five millimeter-wave radars, and twelve ultrasonic radars to memorize the driving trajectory and parking space location, both locally and on the cloud. After that, the vehicle can be summoned to park.In Q4 this year, the WM W6 will update its PAVP high-precision parking function via OTA. Initially, five parking lots supporting PAVP will be open in Shanghai Zhongsheng World Square, Shenzhen Xinghe COCO Park, Chengdu Joy City, Beijing Huarun Wucailan and Cuiwei Yingxiang City.

HAVP is designed to solve the automatic parking problem between fixed points, while PAVP can achieve unmanned driving parking in non-fixed parking scenarios. With the support of high-precision maps, the W6 with PAVP capability can autonomously bypass obstacles, cruise across floors, and park automatically in specific parking lot environments. To WM, the combination of HAVP and PAVP will be the answer to various parking pain points.

As for the market scope of “affordable” vehicles, Shen Hui believes that “electric vehicles priced below 100,000 yuan can only be called electric vehicles, not intelligent electric vehicles.” The main reason behind this is that the hardware cost and software investment of intelligent automobiles will not significantly decrease in the short term. Additionally, intelligent automobiles require high electronic and electrical architecture, which further increases R&D costs.

At the same time, Shen Hui largely agrees with He XPeng’s view that “to make intelligent electric vehicles well, the basic price should be 150,000 yuan.” Therefore, WM chooses to adhere to the original intention of “technological inclusion” and focuses on the mainstream market segment of 150,000 to 250,000 yuan.

To Be Listed Soon

There is a consensus in the automotive industry that the initial structure of the electric vehicle market will be “dumbbell-shaped,” and the mainstream market in the middle, which is the affordable market that WM has been targeting, will be the last segment to be conquered.

However, the Chinese new energy market is accelerating, with new energy vehicle sales accounting for over 10% of China’s total auto sales for the first time in April 2021, and a 10.2% MoM growth in May. WM predicts that the sales of new energy vehicles in 2021 will reach 2.6-2.8 million units. According to a relevant report by IHS Markit, the sales of China’s new energy market are expected to exceed 13 million units by 2030.

WM expects the penetration rate of new energy vehicles in the mainstream market segment of 150,000 to 250,000 yuan to increase from 3% to 40% in the next ten years, and by 2030, this market segment will account for about 60% of the domestic market share.

WM is looking forward to a round of “home game”; however, where the ammunition comes from may be an urgent issue facing WM, although it does not need to worry about production capacity, with the qualifications to build its own factories in Wenzhou and Huanggang.When asked if the first sedan of WM Motors came from a new platform, Shen Hui gave a response that “for new energy vehicles, especially pure electric ones, I think the significance of this platform is not significant. As there is no engine and transmission, oil circuit and emissions are no longer applicable, pure electric products have no fundamental difference.”

However, in fact, from the hardware aspects such as the wheelbase and suspension adjustment, to the software aspects of the coordination with the electronic and electrical architecture, the platform has a very important influence on the competitiveness of a model. NIO’s first sedan ET7 will be built based on the NIO second-generation platform. He XPeng, the chairman and CEO of XPeng Motors, also confirmed that XPeng Motors will launch a new product platform within two years, which can develop models of different markets and different sizes.

On the other hand, WM Motors proposed the “128 Strategy” in 2017: developing two vehicle platforms around one electronic and electrical architecture and launching eight electric vehicles.

However, WM Motors has not yet waited for its second platform. According to a report by LatePost, “WM Motors insiders said that the second platform encountered some resistance when promoted internally. One possible reason is that, apart from government investment for base projects, WM Motors does not have much R&D funds. Starting a new platform will compete with the original platform for already tight cash reserves.”

WM Motors needs ammunition and acceleration to go public. Shen Hui admitted that “the financiers understand WM Motors well, and one of their problems is that their actions in the capital market have been slow.”

In fact, as early as the beginning of this year, WM Motors submitted an application for listing on the Sci-Tech Innovation Board, but then there was no sound, and during this period, there were constant reports that WM Motors’ listing was blocked. Regarding the listing doubts, Shen Hui said at a communication meeting that “we can only wait for now. WM Motors only hopes to go public as soon as possible.”

Conclusion

New car opportunities and challenges coexist.

On one hand, new energy has a bright future, and the market structure has shown signs of changing from “dumbbell-shaped” to “spindle-shaped”. WM Motors, which adheres to “technological inclusiveness,” will have its long-awaited “home game” advantage.

On the other hand, the road ahead is rugged and rocky. New car-making requires enormous funds and there are many uncertainties. In this century-old transformation of the automotive industry, many players do not have many cards to play.

The second half of the new energy era is not far away. For WM Motors, the window of opportunity for this opportunity is very short, and the sense of rhythm is very important.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.