On July 15th, WM Motor held a mid-year media communication event. Freeman Shen, the founder, chairman, and CEO of WM Motor, showcased some of the high-tech products that WM Motor has launched in recent years, such as L4 level full-scenario autonomous driving and Qualcomm 8155’s intelligent chip.

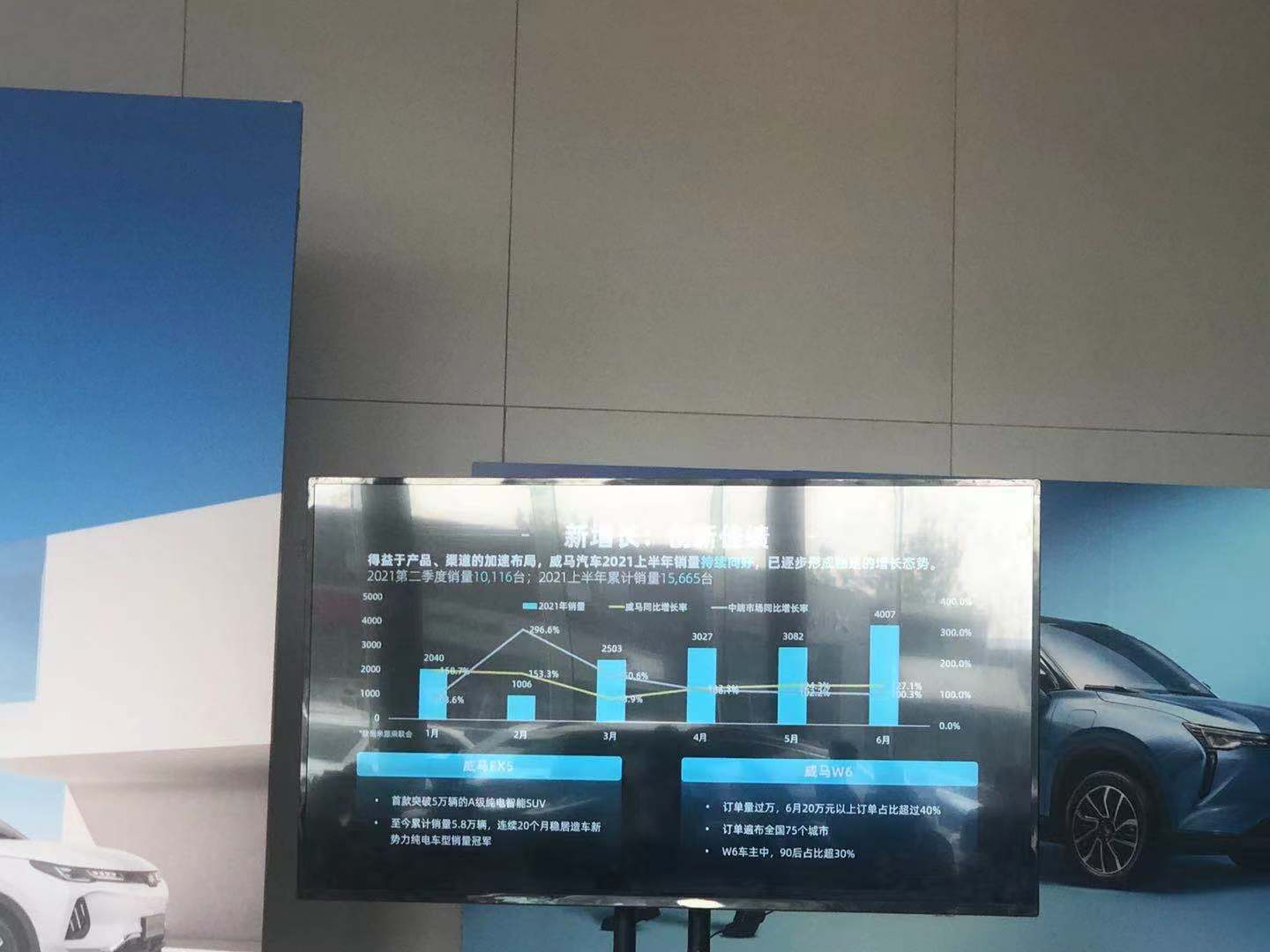

WM Motor currently has three models for sale, namely W6, EX5, and EX6. In terms of sales, a total of 15,665 vehicles were sold in the first half of 2021, a year-on-year increase of 103.8%. In June, a total of 4,007 vehicles were sold, a year-on-year increase of 97.6%.

In addition, WM Motor will launch two new electric sedans at the end of this year, one of which is the WM E5 for the ride-hailing market, and the other is a brand new pure electric sedan called the WM M7, which claims to exceed Tesla and benchmark against NIO ET7.

The following is an interview with WM Chairman Freeman Shen and Vice President Shihan Lin:

Q: You just introduced WM’s performance in the first half of the year and the plan for the second half. Recently, there has been a “voice” in the industry saying that WM Motor may be falling behind. I would like to ask Chairman Shen to evaluate WM Motor’s position in the new forces, and what are the plans for the medium and long term?

Freeman Shen: There are many such “voices,” but what we want to say is that we are currently in a quiet period, and there are many things that cannot be revealed actively. In fact, our sales growth rate is very high. From January to June this year, it doubled compared to last year, and we expect the same growth rate for the whole year. It is worth mentioning that compared with some companies with higher overall sales, our network layout is relatively small, and our new product launch speed is not so fast. It is not easy to achieve a “double year-on-year increase” in sales performance.As mentioned earlier, due to certain factors, we are unable to disclose some data publicly, which makes others feel that we provide less information and they cannot understand us. However, I think this is a good thing, as we can concentrate our efforts on users and products.

The new energy track is a long-term race. To draw an analogy, we are like playing football. We have not even finished the first 15 minutes of the first half, and we do not know who will win or lose. What I want to say is that our team has a very significant advantage over other new players. We have fought in the bloody battle of the combustion engine wave and have experience in 0-300,000 vehicles. We are strategic, focused on main-stream electric vehicles and technology for the public. Although the short-term noise might be less, we are confident that in the medium to long-term, we will become a leading enterprise.

Q: M7 uses several lidars with 500-1,000 TOPS. Which company’s autonomous driving chip will you choose?

Shen Hui: We have basically calibrated the hardware, and it is not convenient to talk about it publicly. Previously, people asked me every day which company’s lidars we used. Our logic is like this: the chip should be from a major company, and the lidars are mostly from companies that we think are relatively innovative.

Q: Will M7 and NIO’s ET7 form a direct benchmarking relationship?

Shen Hui: I don’t think it is the same subdivision market as the ET7. For example, when the ET7 is delivered in April next year, it is said that it will also be equipped with Qualcomm’s 8155. Our W6, which is half the price of the ET7, has been used since April this year. We focus on our user experience, and users’ requirements in each sub-segment market are different. Therefore, discussing the significance of autonomous driving in different sub-segments is not very important. We focus on what kind of autonomous driving our users like and what pain points we can solve for them.

So, what is the pain point for users in China? It’s parking. Many of our peers learn from Tesla and develop NOA highway entry and exit scenarios, which is meaningful from the perspective of showing off, but NPA is a driving habit of American users, not suitable for the Chinese market. So, solving the high-frequency parking scenario in the Chinese market is the real pain point. Therefore, we first develop L4-level autonomous driving in parking scenarios, which is what really matters to users.

No matter what, I think that as a product, we need to solve the high-frequency pain points for users in the Chinese market. That is the only meaningful perspective.Lin Shihan: Regarding the issues with M7 and ET7, Shenzhen CEO has just answered a question. The reason is that the user demands are different. Allow me to add that M7 aims to provide users with a more comprehensive and versatile autonomous driving experience. Unlike other competitors, we are not focused on competing with similar products, but rather on meeting the real needs of our users. This, I believe, is the biggest difference between WM Motor and its competitors.

Q: Is our new car M7 using a new or previous platform?

Shen Hui: First of all, when it comes to platform, it doesn’t matter much for new energy vehicles, especially pure electric ones. Since there is no engine, gearbox, fuel system, or emissions, there is no fundamental difference for pure electric products. However, I think there are still differences between different pure electric products, including details such as the layout of wires, the reducer, inverter, and the vehicle axle.

Q: Earlier, CEO Shen mentioned that vehicles costing less than 100,000 RMB can only be called electric cars, not intelligent electric vehicles. Why is that?

Shen Hui: I have a personal understanding of intelligent cars. Due to some hardware requirements and the need for continuous software iteration, we have done repeated calculations. Intelligent cars are currently in the stage of widespread deployment, and there will be some business models in the future that will require a few key concepts.

First, the requirements for the electronic and electrical architecture of intelligent electric vehicles, such as intelligent cabins or autonomous driving, are very high. The electronic and electrical architecture requires high communication and computing speed, connectivity, and sensors such as various cameras, millimeter-wave radar, and lidar for autonomous driving.

Second, autonomous driving requires significant investment in software. On one hand, software investment is necessary for the intelligent cabin and autonomous driving itself. On the other hand, it is necessary to cover the most basic costs as software needs to be constantly updated. For example, Tesla is also doing FSD, which costs 20,000 RMB, but the installation rate is said to be less than 10%. It is difficult to reduce this cost.

Third, if your target user group is more concerned about being cheap and just using the car, or if personalization and intelligent requirements are important, there will be different pricing strategies at delivery. This topic could be talked about for a long time, and different opinions are held. Each to one’s own. My philosophy is similar to that of He XPeng. Our philosophy for intelligent cars is that there must be a certain price to ensure user safety and reliability. Our philosophy at WM Motor is “safe, reliable, high-quality, enjoyable experience and reasonable cost”.

Q: Does WM Motor have any further OTA plans in the future? including our W6 equipped with the 8155 chip, which everyone looks forward to. What are our future plans, including AVP, and at what point in time?

(Please note that the English text does not include the final question mark as it only displays the heading of a question.)Lin Shihan: Just now, Mr. Shen mentioned our philosophy towards OTA, which is that for users, the longer they use it, the better it gets. Therefore, we have reversed this philosophy and in the future, in terms of OTA, we will pay more attention to user scenarios and methods of use. We will further explore how to provide users with a better experience throughout their use of our products.

To give a simple example, just like using a phone, sometimes a small button may be moved from left to right or from top to bottom, but this can greatly enhance the overall user experience.

Next, as Mr. Shen mentioned, in the era of smart electric vehicles, the biggest difference compared to traditional fuel-powered cars is that we will pay more attention to the difficulties and challenges that users encounter in real scenarios after purchasing the car. We will use OTA technology to solve these problems for our users. Our approach differs slightly from traditional car companies, who only focus on expanding the scenarios and feature set envisioned in the initial design. For example, in terms of expanding scenarios, as Mr. Shen just mentioned, our PAVP, as well as my RPA and APA, are functional expansions. Moving forward, in addition to expanding functionality, we hope to address the profound challenges users face when using our products.

Speaking of the W6 itself, because of its chip and SOA architecture, we now have a great ability for scenario programming. As we continue to deliver more cars, we will monitor how users actually use this scenario programming feature. Do they need more triggers or more functions in the SOA? Both options are available, but we want to focus on how users are actually using the product and then determine our next steps. This is where we believe we differ from our competitors in the smart electric vehicle market.

Q: How does WmAuto plan to implement PAVP in future landing scenarios?### Lin Shihan: PAVP has just been mentioned. In the early stages, we will have four cities: Beijing, Chengdu, Shanghai, and Shenzhen. In the future, we will focus on which shopping malls have the highest proportion of our users when we launch new PAVP sites. We do not want to develop a new PAVP parking lot but find that none of our users go there. As I mentioned earlier, we hope that our OTA and even our future new scenes can be closely bound to our users. Currently, W6’s orders are distributed to 75 cities nationwide. As we deliver more, we will focus on the top delivery cities and expand to more cities one by one. This is our current plan.

Shen Hui: PAVP is very interesting because it is co-created with users. HAVP is relatively simple, as each user always has a home or office, but PAVP is something that we hope to have data to tell us where such functions are needed more. Currently, we will start with four cities and five major shopping malls. We will work with Baidu to gradually open up PAVP based on high-precision maps. This is also a feature of smart cars. If users need it, we will do it faster. If they don’t need it, and say that it’s useless for a certain area, there’s no point in putting PAVP there. The interaction between users and operation results is different from what traditional car or other friendly competitors do in smart cars.

Q: How does Mr. Shen view tech giants such as Xiaomi, Baidu, and Huawei entering the automotive industry? Does this mean more intense competition or opportunities for WM Motor?

Shen Hui: I think this is a great opportunity. Objectively speaking, the average consumer’s attention to smart electric vehicles is still not enough because China delivers more than 20 million passenger vehicles every year, and the proportion of new energy models was around one million last year and possibly over two million this year, which is still relatively small. So the entry of friendly competitors, just like Tesla coming to China, attracts more young people or potential users to pay attention to our products and this sub-market. Making cross-sectoral vehicles is not a new concept. In fact, when China entered the WTO fifteen or twenty years ago, there were many cross-industry car companies in the country. For example, Bird mobile phones made the jet fighters in mobile phones, but they did not become the fighters in cars. AUX made air conditioners but failed to succeed in cars. However, some have done very well. Objectively speaking, BYD is also cross-sectoral, making electric cores that are not even vehicle power batteries but mobile phone batteries, which is very different from power batteries. And we won’t even mention that it is related to the car industry. They’ve made it a success, so I think it’s a very positive thing for the industry.### Q: You just mentioned that the responsibility for autonomous driving belongs to the host factory. Is there a boundary for this definition? For example, some roads may not be suitable for autonomous driving. If I have an accident while driving a WmAuto car, will it be attributed to the host factory?

Shen Hui: Regarding autonomous driving, objectively speaking, due to my previous job, I started paying attention to it in 2009. Along the way, besides technical issues, there are many legal and even ethical issues. Legal issues will definitely become the most important factor only when full-scenario L5 comes out. We currently have limited scenarios, which means that we have the technical confidence to take on this responsibility for the relevant scenarios. What we are currently delivering is L4 in limited scenarios, which is AVP. We take on all the issues.

Q: You just mentioned that WmAuto will further layout ride-hailing in the second half of this year, but I know that among the new forces of car-making, WmAuto’s layout in travel is relatively early, and there was a brand called Zeekr Xing before. However, I didn’t see Zeekr Xing in your PPT. Is the layout of ride-hailing on the basis of the previous strategic continuity in the travel field, or are there some changes?

Shen Hui: Travel, in fact, is not contradictory. Our Zeekr Xing is a platform. We didn’t talk about our Zeekr Xing platform today. What we talked about today are products. For this travel market, we have professional products. Traditional car companies basically do To B only when they cannot sell them, but we believe that even for To B cars, there are many different demands. Therefore, our products must support user needs, and we will do whatever users want. But we hope to have different segmented markets with To C individual users, and different car brands represent our different concepts, different services, and different ideas towards users.

Q: Our WmAuto label is user-defined cars, which means that our product development should be a bottom-up process, which is different from other new forces. I would like to ask Mr. Shen, do you think that the current market has reached the level where demand leads the product? Do consumers really know the true and correct answer?# Shen Hui:

There are two types of user-defined cars. One type is users who know clearly what they want and what products they need. For these users, our approach is to ask for their suggestions before the product definition is made. Many of these users are enthusiastic and willing to participate. The second type are users who have some understanding of their needs but are not familiar with specific requirements. In this case, we need the support of big data. For example, with nearly 60,000 car owners on the road, data may tell us that 3,000 users need the same thing every day. If we catch that, we will see if the next generation of products needs to undergo software OTA upgrades and whether the hardware can be done. If it can’t be done, it may have to wait until the next generation of cars to accomplish it, which many users don’t know.

I believe that with intelligent cars, we can analyze what users need through data and determine whether OTA upgrades can meet scenario requirements or whether hardware iteration is necessary, all while ensuring user privacy. As the degree of user personalization increases, we have landscape and portrait modes, screen rotation, dual-screen, and maybe more in the future. But are these really what users need? Only data can tell us.

Lin Shihan:

Following up on the previous question, if I ask you all today whether you prefer the navigation system on the car or on your phone, I’m sure most of you would say that you prefer the navigation on your phone. But if we were to define our needs according to this preference, we would give you nothing at all because you can use your phone for navigation. Why would we spend so much time putting a navigation system in the car?

In the PPT that Mr. Shen just shared, there was a number that represented our expectations, but in reality, when we developed a connected car that can understand voice navigation, with the data we have now, we have nearly 60,000 car owners, but the daily active usage of our in-car navigation is nearly 30,000. This means that about half of the car owners using our WmAuto EX5 and W6 use the navigation in the car, not on their phone.

However, from the perspective of demand, as I just mentioned, everyone says that phone navigation is definitely better, which is a paradox. Therefore, we believe that under the constantly changing demand of Chinese users, what the OEM can do is to plan the hardware well and reserve as much software and OTA capability as possible to respond to changes in scenario requirements of users in three to five years of usage.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.