Mr.Yu

Finally, SenseTime has officially entered the automotive industry.

As one of the highest spec artificial intelligence (AI) industry events in China, SenseTime has become a mature autonomous driving supply chain vendor at the 4th World Artificial Intelligence Conference (WAIC).

In our opinion, it is not surprising that SenseTime entered the automotive industry as they have always emphasized “every technology is developed step by step.” We even believe that it is reasonable to do so.

As for those players who either entered or may enter the automotive industry, we have our own observations and thoughts. We will try to use facts as much as possible to avoid baseless speculations. Today, we will not discuss BAT, nor the three new carmakers, but only focus on the new players that have just entered or may join in the future. Those who have entered the industry are called “new players,” while those who meet certain criteria to join are referred to as “potential players.”

Before making any decisions, we actually suggest that everyone ask themselves a question: is making cars the ultimate goal, or just a means?

The First Group of AI Technology Unicorns

-

New player: SenseTime

-

Potential players: Megvii, Yunchuang, iFlytek, etc.

-

Advantages: strong development capability in underlying technology, scene understanding.

-

Disadvantages: weak funding ability, self-sustaining capability.

“The AI industry has experienced a period of overheated expectations for the masses, and is now in a period of returning to rationality. It will take time to truly enter a period of vigorous development. Disappointment with artificial intelligence to a certain extent is a normal phenomenon,” said Yao Zhiqiang, co-founder of Yunchuang Technology last month.

Indeed, these AI technology vendors that focus on B2B businesses are not as well-known to the general public as hardware brands such as smartphones and computers. However, these vendors play a major role as the second party in many industries:

For example, they work with local public security units to develop screening solutions for suspects based on visual algorithms, using vision algorithms to replace the human screening of surveillance videos, which greatly improves case handling efficiency in the field of intelligent security.

In the field of retail scenarios, they focus on people or places and provide decision-making support such as user profile formation and auxiliary operational decision analysis for offline retail stores such as cars based on overall activity data analysis and perception.

So, does this make it clearer? Let’s continue to use SenseTime as an example to discuss.In the SenseAuto Pilot-P driving navigation solution released by SenseTime, various L2 level autonomous driving functions have been implemented for the highway scenario, such as lane keeping, automatic overtaking, and adaptive cruise control. In the future, driving scenes will be expanded to urban roads.

On the other hand, SenseTime’s intelligent cabin solution has been installed in multiple models. As we mentioned in the article “Wrong Venue, Right Trend: Intelligent Cabin Features”, SenseTime not only has its own in-car intelligent assistant, but also has launched customized tools that support attribute customization based on interactive virtual characters, and even prepared relevant IP operation solutions.

SenseTime has its own solutions for intelligent driving, intelligent cabins, and even virtual human-computer interaction inside cabins.

In addition to conducting more than five years of exploration and practice in the field of automotive intelligence and establishing cooperative relationships with more than 30 car manufacturers worldwide, SenseTime is doing very well compared to other AI visual technology companies that have not yet had any announcements of deep cooperation with car companies.

According to reports, currently, SenseTime, CloudWalk, and Yitu are all in the key process related to going public and it’s natural to keep silence.

In our view, silence doesn’t mean they won’t enter the competition. These types of technology companies are not Internet companies and they tend to be more low-key in their publicity.

When we can see a certain technology company announcing its entry into the competition, it often means it has already accumulated a certain level of experience in that field. Speaking of SenseTime, the “Wherever You Are” company also established relevant cooperation with Toyota in the field of autonomous driving as early as 2016.

However, their situations are not exactly the same.

It is understood that, except for SenseTime, the other three members of the “AI Four Little Dragons” – CloudWalk, Yitu and Megvii are still not in a state of sustained profitability.

As we all know, doing AI basic research is a very expensive business. During a period when various enterprises are transforming and upgrading their business by entering the automobile market, it is difficult to say that these unicorn enterprises won’t regard entering the car industry as the key to their business breakthrough.

Category 2: Large-scale ICT Comprehensive Enterprises

-

New players: Huawei, ZTE

-

Advantages: Strong technological innovation, wide layout, large reserve of funds

-

Disadvantages: Long layout and broad front line, requiring high continuous investment in resources

“You have to keep your soul in your own hands.” Regardless of whether traditional car companies have souls, SAIC Group Chairman Chen Hong’s attitude towards third-party autonomous driving technology companies has contributed a considerable degree of hot topics to the automotive and technology industries.

Compared to Baidu, which has always emphasized helping car companies build good cars and then directly stepped down, Huawei at the “present stage” is much more frank. A little time spent researching it shows that its research and development layout has almost everything from the automotive field to comprehensive energy.

This is in line with Huawei’s style all along, and also the reason why many industry-leading companies are wary ——they show respect for fields that have not yet been entered, conduct secret research; refraining from action is the norm, but when they do act, the industry as a whole cannot ignore them.

Let me tell you a little bit of gossip. Someone once described Huawei people’s style to Mr. Yu like this: no arrogance of Internet giants, no coldness of foreign companies’ business style, and no scheming of some local companies; instead, “down-to-earth” and “amicability” are the two most commonly mentioned words.

Since the establishment of the Intelligent Automotive Decision-making Solution Business Unit (BU) in May 2019, Huawei has launched a complete solution in the automotive field in just over a year, including intelligent driving, intelligent cockpit, electric system, and intelligent car cloud services. Their appearance at the 2021 Shanghai Auto Show even attracted a lot of attention from new forces and traditional car companies that originally didn’t pay attention to it.

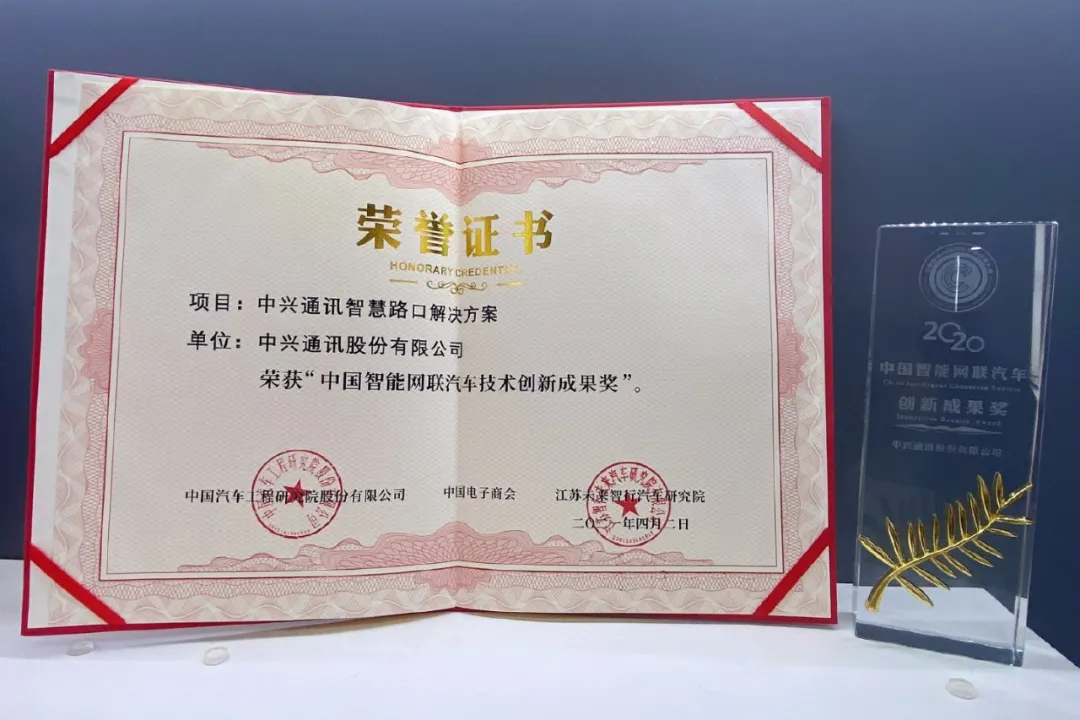

On the other hand, Huawei’s “old friend,” ZTE, has just released an autonomous driving patent called “Automatic Driving Control Method, Device, Electronic Equipment, and Computer-Readable Medium.” As the country’s second-largest ICT communication company, ZTE’s entry into the game seems much more low-key, but it’s not a sudden whim.

According to public information, ZTE has already laid out in the fields of vehicle manufacturing, autonomous driving development, connected vehicles, and power battery research and development. As early as 2012, ZTE began to enter the automotive industry, focusing on the research and development of wireless charging technology. It has established a complete business model, signed strategic cooperation agreements with more than 30 provinces and cities across the country, and deployed commercial wireless charging lines.

According to public information, ZTE has already laid out in the fields of vehicle manufacturing, autonomous driving development, connected vehicles, and power battery research and development. As early as 2012, ZTE began to enter the automotive industry, focusing on the research and development of wireless charging technology. It has established a complete business model, signed strategic cooperation agreements with more than 30 provinces and cities across the country, and deployed commercial wireless charging lines.

According to public reports, Feng Haizhou, Vice President of ZTE Corporation and General Manager of ZTE New Energy Vehicles, once said that wireless charging technology is not complicated. You only need to install a vehicle-mounted electromagnetic induction receiver under the car and add a ground pulse energy control module to the parking space. After the vehicle drives into the modified parking space and stops steadily, it can automatically connect to the communication network of the charging field for wireless charging.

Thinking back to the widespread discussion of the security issues of Xiaomi’s wireless charging technology a few months ago, it is unlikely that anyone would have thought that ZTE had already successfully implemented and commercially deployed it in the commercial vehicle field.

In July 2016, ZTE acquired Zhuhai Guangtong Bus Company.

After the acquisition was completed, ZTE’s subsidiary, ZTE Intelligent Vehicles Co., Ltd., was established. In the same year, ZTE established ZTE High Energy Technology Co., Ltd., focusing on the research and development, production, and sales of power batteries for passenger cars.

According to the latest internal news, ZTE Intelligent Vehicles Co., Ltd. has returned from a subsidiary to the system of ZTE Corporation Limited.

ICT companies represented by Huawei and ZTE have entered the track of the automotive industry during the technological transformation of the industry, not only to promote the transformation and upgrading of traditional automotive industry and help traditional automakers achieve ecological architecture diversification, but also to seek diversified extension of their own businesses. Through a complete set of ecosystems, they will completely connect ports such as mobile phones, automobiles, personal computers, smart wearables, and home scenarios, forming an invincible ecological advantage.

Sustained investment of a large amount of resources is essential to enter new business areas. This is a challenge that ICT manufacturers who have fully laid out in the automotive industry must face.

In the journey of bringing Microsoft back to the peak of trillion-dollar market value as the third CEO, Satya Nadella made decisive judgments when cutting those unprofitable or even loss-making business lines, which was not hesitant for this Indian who emphasizes inclusive and growth-minded thinking.

The third category: Internet hardware manufacturers

-

New players: Xiaomi

-

Potential players: OPPO and others

-

Advantages: understanding of user experience, IoT layout, channel capabilities, marketing capabilities, and cash flow situation.

We have heard and talked too much about Xiaomi’s entry into the automotive industry.

Apart from occasional complaints from friends about their colleagues being poached with high salaries, we have no idea when “the first car for young people” will be launched.

Like the mobile phone industry, which is also in a period of rapid change and transformation, the automotive industry has undergone dramatic changes. Companies like Xiaomi, which occupy one-third of the domestic smart TV market share, can no longer be simply classified as “mobile phone manufacturers.”

So let’s take a look at OPPO, which has a similar positioning in the industry.

At the 2019 OPPO Future Technology Conference, OPPO CEO Chen Mingyong talked about his views on the automotive industry, stating that: “If the automotive industry does not do well in the next decade, OPPO may build cars. Even if we build cars, we will focus on areas where OPPO can excel. Currently, we are not building cars. If car manufacturers cannot build good cars, and OPPO has the ability, we will try in the future.”

At the time, this statement was mostly for marketing purposes. However, in just two and a half years, both Baidu and Xiaomi have entered the industry, while Huawei has prominently displayed its Cyrus SF5 in its flagship store and announced its related layout in the automotive industry chain.

Looking back now, OPPO actually started earlier than we thought.

Two years ago, Guo Yandong, who was then the chief scientist at XPeng Motors, said in response to a question about how he viewed Internet companies joining the development of autonomous driving: “Many innovations come from organizational innovation. How to better integrate the autonomous driving center with the technical center of the entire vehicle requires great innovation and exploration. We used to rarely see automakers making artificial intelligence, the Internet, and autonomous driving as a primary center, but now there is such a trend.”

In March 2020, Eric Guo, the chief scientist at XPeng Motors, joined OPPO with the same position. It is understood that during his time at Microsoft, this technology expert led the technical team from 2016 to deeply research and explore vision-based in-car and outdoor perception functions.

In a certain sense, companies with both internet hardware and smartphone attributes possess unique advantages in brand building, pre-sales marketing, user operations, and after-sales service. They have always been the closest group of people to the users. By bringing in massive and segmented user data and the degree of understanding of the users through smartphones and IoT hardware, they possess what other manufacturers lack.

Of course, it is not clear what level of understanding these companies have of the automotive industry during this period of time.

At least on the level of technological research and development, OPPO has not been idle.

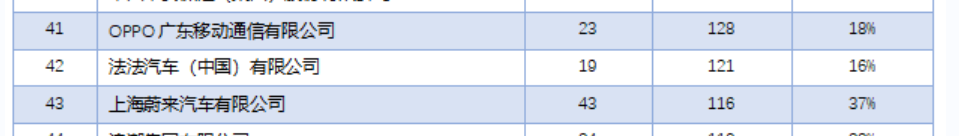

According to the “2021 China Autonomous Driving Patent Ranking TOP100” compiled by consulting firm “01intel”, OPPO’s patents in autonomous driving have reached 128, ranking 41st. The neighbor of OPPO on this list is NIO, ranked 43rd with 116 patents.

After years of development in the smartphone field, OPPO has already established a complete and thorough supply chain system. It is not difficult to imagine that with a familiar supply chain screening mechanism, OPPO will also establish a supply chain system in the automotive industry no less than its smartphone business after entering this particular market.

Moreover, there are probably not many car companies that have offline sales networks that cover the globe like OPPO does. With a well-known reputation for having numerous offline sales stores and a vast network of coverage, if OPPO were to replicate the model of selling cars in addition to selling phones like Huawei, it is believed to be an achievable task.

At this point, we all have our own answers as to whether OPPO’s entry into the automotive industry was impulsive or planned.

Having the personnel and necessary funds, in addition to ongoing research and development, and ongoing discussions for the required channels needed, what else is missing? It seems all OPPO needs is a gorgeous debut.

Final words

No one can deny that car making is very popular.

Thus, there have been companies that are tech-based, hardware-based, in real estate, and even in the alcoholic beverage industry entering this particular industry.

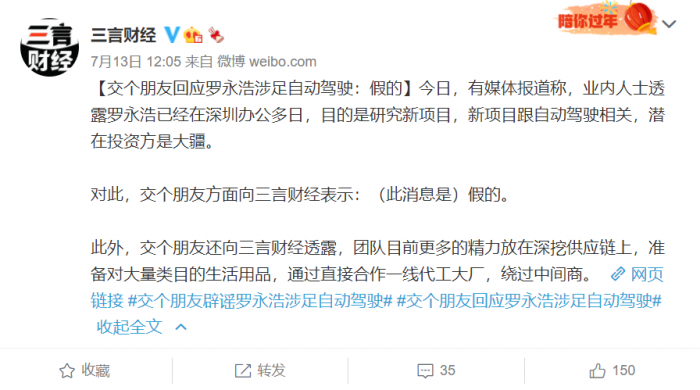

Yesterday, there were even rumors that Luo Yonghao will no longer participate in live streaming sales, but will join the ranks of car manufacturers.

Although he denied it very quickly, his attitude seems to be a little ambiguous.“`markdown

The ancients believed that heroes emerge in times of chaos. In the intelligent automobile industry, with just its first decade, so many cross-disciplinary “heroes” have emerged and joined the “chaos” of car-making.

Perhaps it’s because everyone sees an opportunity in the trend of industry reshuffle that is happening.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.