Author: Wang Lingfang

In recent years, the demand in the energy storage market has been expanding rapidly. Power battery companies are rapidly increasing their share in the energy storage field.

In 2020, the sales volume of Ningde Times energy storage systems was 2.39 GWh, a year-on-year increase of nearly 237%. Ruijie Energy also shipped more than half of its shipments in energy storage batteries in the first half of this year. Guoxuan High-Tech has also publicly stated that its energy storage business will account for more than 30% of its total revenue…

Why are power battery companies strengthening their layout in the energy storage business? What is the development potential of energy storage batteries? What are the differences and connections between energy storage batteries and power batteries, and why are they frequently mentioned at the same time?

To answer these questions, “Electric Car Observer” conducted in-depth communication with industry insiders and obtained three main conclusions.

Firstly, producing new batteries for energy storage is more profitable than power batteries, but the stability of energy storage projects is not good. Therefore, companies that take both into consideration will not mainly invest their energy in the energy storage field. Secondly, with the growth of the energy storage battery market, there is a trend of separate production lines between the two, and energy storage batteries will not squeeze out the production capacity of power batteries. Thirdly, there is a lot of controversy in the industry about using ladder batteries in large-scale energy storage projects, and their future development is uncertain.

Increase in energy storage share of power battery companies

More and more power battery companies are entering the energy storage business, and their share is increasing year by year.

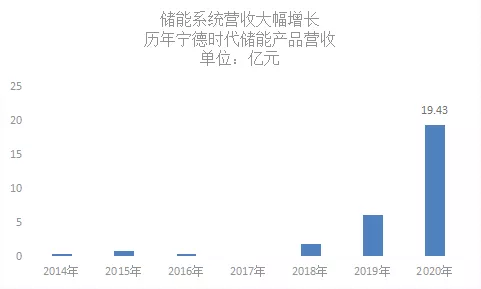

Last year, Ningde Times achieved sales revenue of 1.943 billion yuan from energy storage systems throughout the year, a year-on-year increase of 218.56%; energy storage system sales volume was 2.39 GWh, a year-on-year increase of nearly 237%.

Fengchao Energy has also started to make efforts in the energy storage business for a long time. Fengchao Energy has built a photovoltaic storage charging project in Dalian, which has functions such as peak shaving and filling, emergency backup power supply, fast charging for electric vehicles, and orderly charging management. Fengchao Energy has also released a series of large-unit energy storage, medium-sized energy storage, and integrated liquid-cooled energy storage systems for system applications.

Zhang Xiaocong, Marketing Director of Ruijie Energy Co., Ltd., told “Electric Car Observer” that energy storage is indeed very popular, and they are unable keep up with the orders. “In the first half of the year, more than half of Ruijie’s production capacity was given to energy storage, and the output of power batteries was relatively lower.”

“Electric Car Observer” found that many well-known power battery companies have a huge output volume in the energy storage industry.

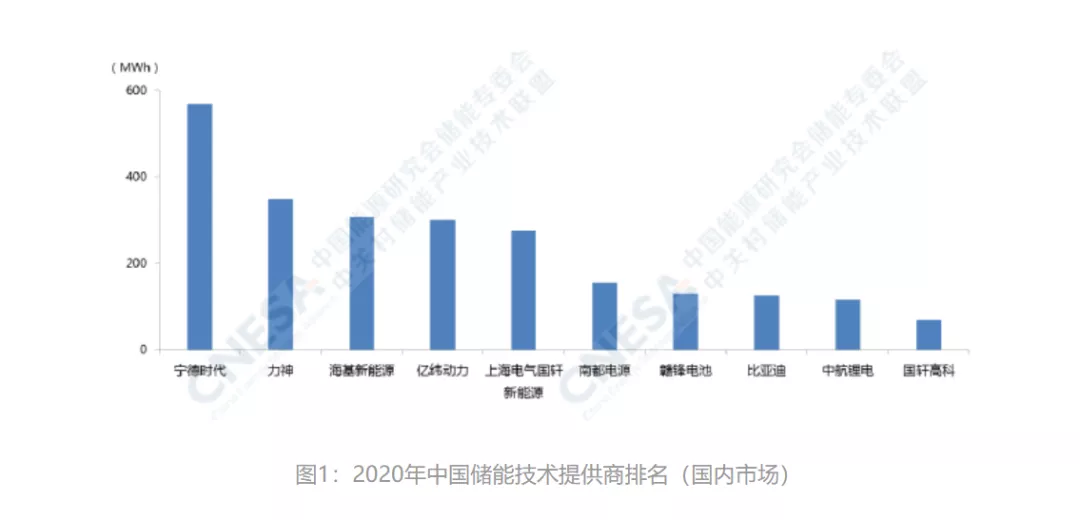

According to the “2021 Energy Storage Industry Research White Paper,” among the newly added electrochemical energy storage projects put into operation in China in 2020, the top 10 energy storage technology providers in terms of installed capacity are: Ningde Times, Lishen, Haike New Energy, YWE, Shanghai Electric Guoxuan New Energy, Nandu Power, Ganfeng Lithium Battery, BYD, CEAIE and Guoxuan High-Tech.

Ningde Times has the largest shipment volume, which is close to 600 MWh, and Lishen ranked second with nearly 400MWh.

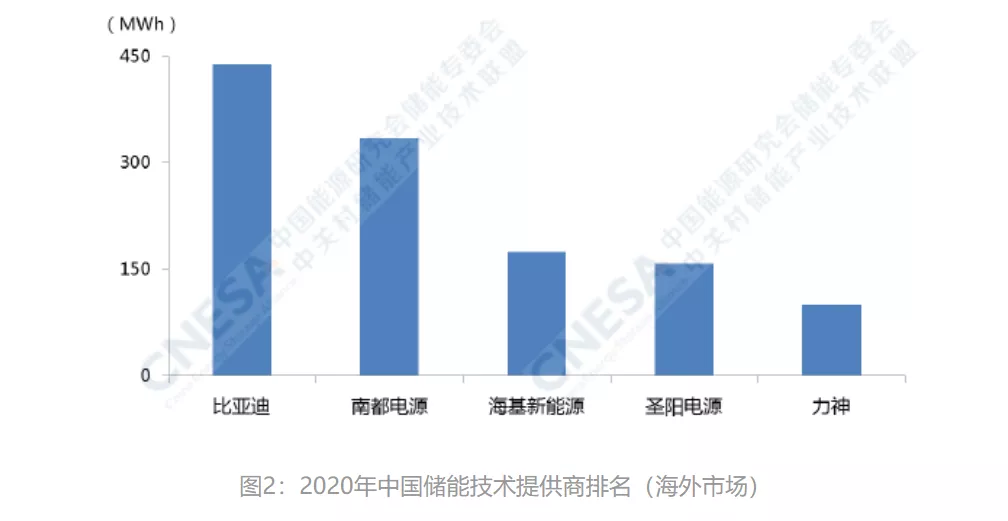

In the overseas electrochemical energy storage market (excluding household energy storage) in 2020, the top 5 Chinese energy storage technology providers by shipment volume are BYD, Nandu Power, HAE, Shengyang Power, and Lishen, respectively.

Guoxuan High-tech, a provider with relatively lower shipment volume, is also making efforts in the energy storage battery sector. Huang Zhangxi, vice president of Hefei Guoxuan High-tech Power Energy Co., revealed during the 2020 China Automotive Supply Chain Conference that the company hopes to achieve revenue exceeding ¥40 billion in 2023, with energy storage business revenue exceeding 30%.

High demand for energy storage batteries

Why are power battery companies committed to increasing the shipment volume in the field of energy storage?

This is related to internal technological progress and external market demand.

Internally, after years of development, the cost of power batteries has continued to decrease, while their performance has improved, laying a foundation for the development of energy storage batteries. In addition, targeted design of energy storage systems promotes their popularity.

Externally, countries around the world have formulated development strategies to accelerate energy structure adjustment and vigorously develop clean energy. For example, in 2009, Australia passed a Renewable Energy Target Act, establishing a goal that renewable energy would account for 20% of its electricity demand by 2020. In 2018, the EU Commission signed an agreement to raise the proportion of renewable energy in overall energy consumption to 32% by 2030. The UK government has also set a target of achieving net zero greenhouse gas emissions by 2050, among others.

Implementation of these strategies has led to a rapid increase in installed capacity of renewable energy. Renewable energy generation is dependent on natural conditions and is characterized by intermittency and volatility. When the proportion of power generated by renewable energy sources is high, it can cause a significant impact on the safety and stability of the power grid. Therefore, introduction of energy storage systems is essential.

Extreme weather phenomena have also accelerated the growth in demand for energy storage. Zhang Xiaocong said at the “2021 China Next Generation High-Quality Development Forum” that battery demand began to surge at the end of last year, with the energy storage market growing very rapidly. The serious snow disasters in North America at the end of last year caused some serious accidents, driving market demand. Currently, the energy storage market is exploding worldwide. Ruipu’s energy storage market has more than tripled since last year.China also has a great demand for energy storage. Under the target of “peak carbon emissions and carbon neutrality”, the rapid increase in new energy installed capacity has further enhanced the necessity of energy storage.

According to CNESA data, as of 2020, the global cumulative installed capacity of electrochemical energy storage was 14.2 GW, a year-on-year increase of 49.2%, accounting for 7.4% of the installed capacity of energy storage systems; China’s cumulative installed capacity of electrochemical energy storage was 3.27 GW, a year-on-year increase of 91.2%, accounting for 9.2% of the overall energy storage. It is worth noting that in 2020, China’s newly added electrochemical energy storage installed capacity reached 1.56 GW, a year-on-year increase of 145%, and China’s newly installed energy storage capacity exceeded the GW threshold for the first time.

In the field of electrochemical energy storage, lithium-ion batteries dominate, accounting for 92%, especially in China, where lithium iron phosphate batteries are the main type.

It should be noted that last year’s high growth in China’s electrochemical energy storage occurred without mandatory storage requirements.

In 2020, many regions issued policies to encourage and support the configuration of energy storage for new energy, but almost no province made mandatory configuration requirements. Since this year, more than 20 provinces and cities have proposed renewable energy storage requirements, including mandatory and encouraged storage requirements. For example, Hunan, Shandong, and Hubei provinces require mandatory configuration, and Shanxi and Gansu provinces suggest configuration, with a configuration ratio between 10% and 20%.

Therefore, the installed capacity of energy storage batteries this year will definitely be larger.

According to the CNESA’s “White Paper on Energy Storage Industry Research 2021”, under conservative/ideal circumstances, the new installed capacity of electrochemical energy storage in 2021 will be 2.52/3.35 GW, and the cumulative installed capacity is expected to reach 35.52/55.88 GW by 2025, with a CAGR (compound annual growth rate) of 57.38%/70.48% from 2021 to 2025.

Another advantage of energy storage batteries is the high profit margin. Zhang Xiaocong admitted that currently there is greater demand for energy storage batteries abroad, especially for home energy storage projects. Their products are exported to developed regions such as Europe, America, and Japan, and the product profit margin is larger than that of power batteries.

For example, in 2019 and 2020, the gross profit margins of power battery systems of Contemporary Amperex Technology Co., Limited were 28.46% and 26.56%, respectively, while the gross profit margins of energy storage systems were 37.87% and 36.03%, respectively, 10 percentage points higher than that of power batteries.

Major Differences Between Power and Energy Storage Performance

Although both are energy storage devices, there are many differences between energy storage batteries and power batteries, so they cannot be simply used interchangeably.

Huang Shilin, Vice Chairman of Contemporary Amperex Technology Co., Limited, publicly stated that energy storage batteries have much higher requirements than power batteries. Currently, 1500-2000 cycles are sufficient to meet the requirements of power batteries for passenger cars, while energy storage batteries require at least 8000 cycles, making them much stronger than power batteries.Currently, batteries are divided into three categories based on their usage: consumer batteries, power batteries, and energy storage batteries. Consumer batteries are used in products such as mobile phones, laptops, and digital cameras, while power batteries are used in electric vehicles, and energy storage batteries are used in energy storage facilities.

Power batteries, as a mobile power source, demand high energy density in terms of volume and mass on the premise of safety to achieve long-lasting endurance capabilities. Electric vehicles also hope to achieve safe and fast charging, and high and low temperature performance requirements are also high. However, their lifespan is generally around 1000-2000 cycles.

Energy storage batteries are suitable for capacity-type batteries with a charge-discharge ratio of ≤0.5C, as they are generally charged or discharged continuously for more than two hours. For energy storage scenarios that require power frequency modulation or smoothing of renewable energy fluctuations, energy storage batteries need to quickly charge and discharge in seconds to minutes, making them suitable for applications with ≥2C power-type batteries. Additionally, long lifespan and low cost are also important indicators for energy storage batteries.

However, both types of batteries can use lithium iron phosphate batteries and ternary lithium batteries. According to Zhou Xiaoliang, a senior professional in battery cascaded utilization, there are slight differences in their formulas depending on their different performance requirements. Furthermore, energy storage battery cores are often larger. Therefore, with the same amount of electricity, energy storage batteries require fewer accessories, resulting in relatively lower costs.

Relationship between energy storage and power batteries

What impact will the rise of energy storage batteries have on lithium iron phosphate power batteries?

(1) Capacity: Separate production of energy storage and power batteries is becoming a trend

Zhang Xiaocong told “Electric Vehicle Observer” that Ray Power’s future plan is for 60% of vehicle-use power batteries and 40% for energy storage.

Zhang Xiaocong admitted that although energy storage batteries have relatively higher profits, their stability in demand and promotion of corporate brand power are far less than that of power batteries. “Energy storage batteries are project-based, and uncertainty is relatively high. It brings difficulties to battery companies in production scheduling. Therefore, making power batteries is still more common.” Zhang Xiaocong said.

In terms of production scheduling, the two batteries can be produced on the same production line. “However, changing production lines is very detrimental to cost and quality control. Since the second phase of the project, both have been produced separately.” Zhang Xiaocong said.

It can be seen that power batteries and energy storage batteries are completely independent with no impact on each other in the production process.

(2) Raw materials: With sufficient supply of lithium iron phosphate raw materials, energy storage demand still accounts for a small proportion.

The main raw materials for both are lithium, iron, and phosphate sources. Except for the relatively few lithium source suppliers, the iron and phosphate sources are abundant, and the supply is sufficient. With the increase in the number of lithium production companies and the release of domestic lithium source supplier production capacity, the supply of lithium sources is gradually becoming sufficient.From the perspective of raw material supply, the positive electrode material supply of lithium iron phosphate batteries is sufficient to meet large-scale demand. In other words, as long as the production capacity can keep up, there will be basically no situation where battery prices fluctuate due to insufficient raw material supply.

One of the major disposal directions of retired power batteries is the cascading utilization. Generally, the batteries retired from electric vehicles are used in low-speed vehicles and then gradually used in fields such as energy storage, base station backup power, and emergency lighting.

(4) Feasibility of Energy Storage Is Doubtful

From the official attitude, the application of retired power batteries also has contradictions and swings.

In 2020, the Ministry of Industry and Information Technology specifically solicited opinions on the management of cascaded utilization of new energy vehicle power batteries: “Encourage cascaded utilization enterprises to research and develop cascaded products suitable for base station backup power, energy storage, charging and swapping, etc….”

Energy storage application was prominently mentioned.

However, the management direction has changed this year.

The “Management Specifications for New Energy Storage Projects (Trial) (Draft for Soliciting Opinions)” issued in June this year clearly stated that, before the key breakthrough is achieved in battery consistency management technology and the monitoring and evaluation system of power battery performance is sound, large-scale power battery cascaded utilization energy storage projects should not be newly established in principle.

The direct reason for the National Energy Administration to stop large-scale power battery cascaded utilization energy storage projects is that on April 16, Beijing GuoXuan High-Tech Co., Ltd.’s “Light-Storage-Charge” integrated power station exploded and caused two firefighters to sacrifice and one firefighter to be injured.

Safety is the main reason for this suspension.

As a supporter of module cascade utilization, Zhou Xiaoliang is not optimistic about the application of cascaded batteries in large-scale energy storage stations.

Zhou Xiaoliang’s concerns are mainly safety and economy.

First, retired batteries become larger, and safety hazards increase. Generally speaking, retired batteries are dismantled from large to small, and the consistency problem of the battery is reduced, so safety will be improved. However, in the case of energy storage station application, the voltage and capacity of the battery on the car are relatively small, and it is necessary to connect several car batteries in series and parallel for use, and the consistency problem of the battery will be magnified.

Second, the cost recovery cycle of retired batteries used in energy storage stations is generally longer. However, the calendar life of retired batteries is far inferior to that of new batteries. After battery faults or damages, it is relatively difficult to find the same type of product accessories, and the maintenance cost is high. Energy storage stations are relatively dispersed, and the cost of after-sales maintenance personnel is also high.

Therefore, Zhou Xiaoliang believes that using retired batteries for tricycles and small-scale energy storage projects is the best direction.

Of course, whether the cascaded utilization of retired batteries is a false proposition still depends on the cost reduction of new batteries. Judging from the current situation, the price reduction of batteries has slowed down significantly. Zhang Xiaocong frankly stated that there is little room for further reduction in battery costs. In the future, it is still necessary to extend battery life and reduce costs through cascaded utilization.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.