Author: Dayan

Tesla Model Y has once again become the center of attention in the circle of friends. The standard range version of Model Y, priced at RMB 276,000 after subsidies, has once again made various domestic car manufacturers feel the chill of Tesla’s price war.

Just when people were speculating whether Tesla’s sales would be affected by the continuous “brake gate” and a series of public relations crises at the Shanghai Auto Show, the China Passenger Car Association (CPCA) announced that Tesla’s sales volume in June had reached 33,155 units, telling Tesla’s competitors that Tesla is still the most popular new energy vehicle among Chinese consumers.

In terms of data, the domestic standard range version of Model Y adopts rear-wheel drive, with an acceleration of only 5.6 seconds per 100 kilometers and a range of up to 525 kilometers under NEDC test conditions, with a maximum speed of 217 kilometers per hour.

And this time, with a price of less than RMB 280,000, the Model Y is bound to push Tesla’s sales volume to a new level.

Tesla plays the price “trump card”

Leaving aside the post-epidemic stimulus policies released in the second half of last year, which led to the recovery of the car market, the slowdown of the car market since the second half of 2018 has already indicated that China’s car market has bid farewell to the days of high growth. But the luxury brand market has grown against the trend with the support of Chinese consumers’ upgrading of their car purchases. For major luxury brands, mid-size SUVs are undoubtedly the backbone of sales.

The low-priced entry of the Model Y once again declares to the outside world that Tesla has never targeted the new force of domestic car manufacturers, nor the expanding market share of gasoline-powered cars. Instead, the luxury segment market with rapid growth, especially mid-size SUVs of luxury brands, is the target market that Tesla covets.

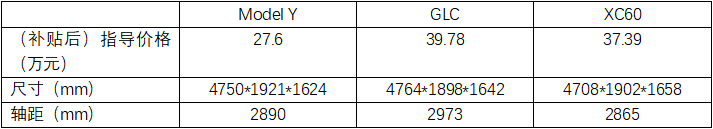

In terms of price, the price of Model Y, as a mid-size SUV, has already been much lower than that of the entry-level mid-size SUVs of major luxury brands. For comparison, we have selected the entry-level models of the first-tier luxury brand Mercedes-Benz GLC and the second-tier luxury brand Volvo XC60.

If we compare the official guidance prices of GLC and XC60 with Model Y’s after deducting national subsidies, Model Y has a significant price advantage. Even after deducting large terminal discounts of luxury brands, GLC and XC60 are still priced higher than Model Y. Not to mention, as a pure electric vehicle, Model Y can also enjoy license plate and road usage rights in first- and second-tier cities.

If we compare the official guidance prices of GLC and XC60 with Model Y’s after deducting national subsidies, Model Y has a significant price advantage. Even after deducting large terminal discounts of luxury brands, GLC and XC60 are still priced higher than Model Y. Not to mention, as a pure electric vehicle, Model Y can also enjoy license plate and road usage rights in first- and second-tier cities.

Using Shanghai as an example, the price of one Shanghai license plate is not only as high as 90,000 RMB, but also has a less than 10% monthly lottery success rate. Therefore, Tesla is determined to target the mid-size SUV market and shake the foundation of luxury brand sales in China.

Moreover, Tesla’s AutoPilot autonomous driving function is ahead of other luxury brands. Consumers can subscribe to related services and upgrade to higher levels of autonomous driving technology in the future.

Can it disrupt the rise of “Nio XPeng Li”?

As the first group of domestic new energy vehicle makers, Nio, XPeng, and Li Auto had impressive performances in June:

-

Nio delivered 8083 vehicles in June, a YoY increase of 116.1%;

-

Li Auto delivered a total of 7713 vehicles in June, a YoY increase of 320.6%;

-

XPeng delivered 6565 vehicles in the previous month, a YoY surge of 617%.

Behind such rapid growth is the increasing recognition of new energy vehicle makers among Chinese consumers. Whether the low price of Model Y will disrupt the upward trend of these three domestic new energy vehicle makers, deserves our attention as well.

However, upon analyzing the three automakers, we can discover that as the first group of domestic new energy vehicle makers, only Nio has the ES6 and Model Y in the same sub-market. Li One belongs to a medium-to-large SUV, while XPeng only has a compact SUV G3, with more sales coming from the P7 and P5, two sedan models aimed at Model 3.So, the price reduction of the Model Y will bring a significant impact on NIO ES6. However, NIO still has a trump card, which is the battery leasing with separate charging system. This not only significantly reduces the sales price of ES6 but also eliminates many concerns from the consumers regarding the battery. Tesla, who has abandoned the battery swap technology and pursued the supercharging technology, has no direct competition with NIO in this field.

As for Li Auto and XPeng, they are undoubtedly developing their own pure electric mid-size SUV in full swing. The Model Y, with no pricing bottom line, is a good reference for them.

Therefore, in the short term, there will be no direct conflict between Model Y and NIO ES6. However, over time, it will test whether NIO ES6 can find unique advantages to eliminate the impression that Tesla can provide consumers with a brand high-end, technologically advanced, and affordable price.

How to deal with Tesla’s continuous price drop?

With the deepening of localization, Tesla will introduce models with continuously decreasing prices, as the car price is the primary factor for most consumers in purchasing a car. Tesla is not engaging in a malicious price war. The price reductions are traceable, especially with the use of the LFP battery from CATL, which can directly reduce the battery cost by 40,000-50,000 RMB. Previously, Tesla also exhibited a series of methods that can reduce battery costs, including the “tabless cell” battery, with its goal to develop a low-cost entry-level model with a range of 1000 kilometers and a sales price of only 25,000 USD. This will create significant pressure for domestic brands, new car-making forces included.

Therefore, blindly competing with Tesla on price has no meaning for domestic automakers. Tesla reduces material costs through technological innovation. Tesla’s mastery of many core technologies is far ahead of domestic car brands.

Creating competition that has its unique and uncopyable competitive advantages is the biggest bargaining chip for domestic automakers to compete with Tesla. Previously, the pure electric vehicle Jive 001 of Geely and the ET7 of NIO, and P5 of XPeng, all attracted consumers through their respective technological highlights and were each red-hot. JVE 001 even discontinued 2021 deliveries, which made Geely proud of its achievements in the field of electric vehicles. Some even speculated that Geely will withdraw Geely Automobile’s listing on the A-share market, allowing JVE to obtain a more significant development opportunity.

Tesla is not invincible. The incident of external cameras taking many road photos and uploading them to foreign servers forced Tesla to spend a lot of money building servers in China, which will somehow curb Tesla’s development in China.

At the same time, the capacity of China’s electric vehicle market is large enough that Tesla cannot rely on its thin vehicle matrix to take all orders. As long as domestic automakers avoid weaknesses and seize opportunities, they can develop a foothold in China’s electric vehicle market, whether by deploying autonomous driving technology that can compete with Tesla, or by innovating in styling, or by having their own unique set of battery-swapping and customer operations like NIO.

Equalizing or even lowering the price of electric vehicles to be on par with gasoline vehicles has always been Elon Musk’s original intention. From the Model 3, which cost less than RMB 250,000, to the Model Y, which currently costs less than RMB 280,000, Tesla has been able to attract the market’s attention and hopes to emerge from the bottom with each price war it starts.

Chinese automakers’ fear of Tesla is useless because Tesla will continue to wage price wars whether or not challenged. After all, besides hardware, Tesla hopes to charge through software in the future.

NIO, XPeng, and Jidu Auto have actually shown us good examples of how to deal with Tesla’s impact.

With consumers becoming increasingly rational and the overall upgrading trend of the domestic auto market unstoppable, our new forces and independent brands should have higher confidence than Tesla.

In reality, Tesla is just a mass-market brand.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.