To become an industry giant, having top-notch technology and broad market prospects is crucial. From Nokia in the era of feature phones, through Apple in the era of smartphones, to Waymo in the era of autonomous driving, these are products of the times empowered by technology.

From 2009 to 2020, Waymo has been widely recognized as the leader in developing and commercializing autonomous driving systems, competing with rivals from all around the world. Born with a silver spoon in its mouth, Waymo embarked on a solitary journey to achieve the highest level of autonomous driving.

In contrast, the strategy adopted by mainstream car manufacturers, particularly Tesla, starting from L2 and progressing step by step, is now becoming the main direction in the industry.

The dispute over the autonomous driving roadmap between Tesla and Waymo has seemingly become a topic of conversation in the industry over coffee. Because, so far, nobody knows what autonomous driving will eventually look like, and each company is demonstrating its technological superiority to the market.

Recently, there have been continuous financings in the field of autonomous driving. Is the $2.25 billion financing behind Waymo the final battle for the autonomous driving roadmap?

Continuous financing, capital isn’t cold

First of all, let’s take a look at the situation of several companies in this market.

- On March 2, Waymo announced its first external financing of $2.25 billion;

- On February 26, Pony.ai announced it had raised $462 million in B round financing;

- On February 25, WeRide announced its B round strategic financing, but the amount was not disclosed.

Google’s autonomous driving subsidiary, Waymo, announced on Monday that it had raised a $2.25 billion financing round, with investors including Silver Lake, the Canada Pension Plan Investment Board, Mubadala Investment, as well as auto parts giant Magna, venture capital firm Andreessen Horowitz, and Google.

This is Waymo’s first external financing since it spun off from Google.

On February 26, Pony.ai announced a $400 million investment from Toyota to deepen and expand the collaboration between the two companies in the field of travel, and to further accelerate the research and development and commercial application of autonomous driving. It is reported that Pony.ai’s latest round of financing totaled $462 million, with a valuation slightly higher than $3 billion, making it one of the highest valued autonomous driving companies globally.

Although WeRide did not disclose the specific financing amount, its lineup of investors is eye-catching, with Bosch’s strategic investment. WeRide provides autonomous driving technology for both logistics and travel, and its cooperation with Bosch will help the company upgrade its products and services, thus better serving its global customers.

There has always been a debate on the technical route in the field of autonomous driving. But looking at the recent financing, the technical camp based on LiDAR has gained upper hand, because most of the funded companies are focused on achieving Level 4 and Level 5 autonomous driving.

From AI algorithm-based autonomous driving controller, data management platform, to unmanned vehicle operation platform and other technologies, whether it is an autonomous driving vehicle operator or a full-stack autonomous driving solution provider, the underlying technology determines how far the company can go.

The integrated development of technology is an inevitable trend. Regardless of the route, the ultimate goal is to achieve an industrial revolution brought by artificial intelligence. Therefore, whether building bridges or making ships, there will be capital willing to participate in “crossing the river”.

Technology burned with Waymo’s money

Image source: Waymo official website

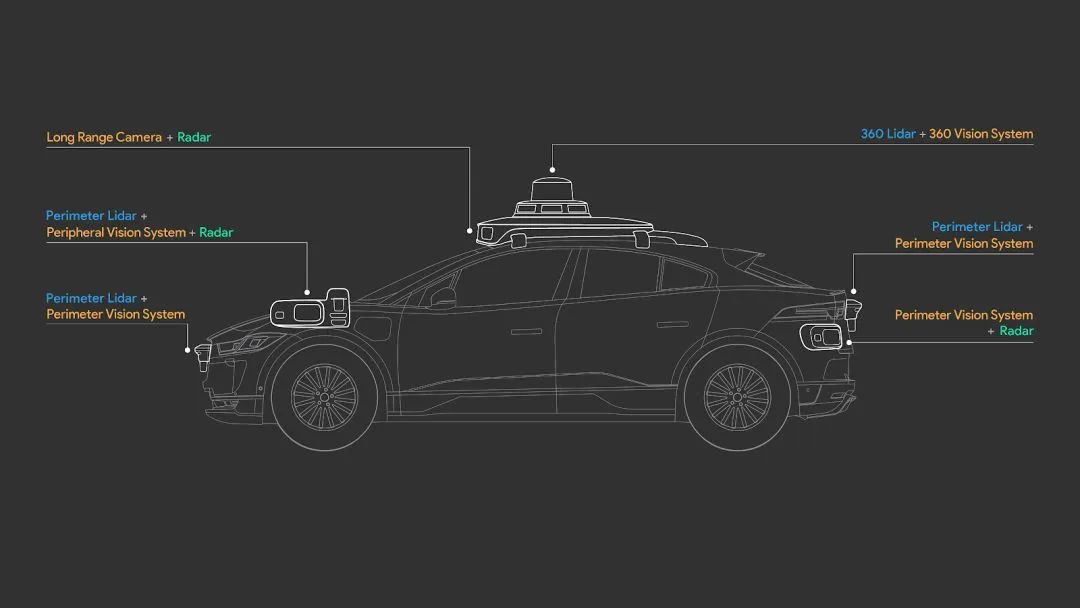

As new technologies emerge, Waymo, after announcing its first financing, started to flex its muscles. In order to operate self-driving taxis, Waymo needs to deploy autonomous vehicles on a large scale, which requires more powerful technical support.

On March 5th, Waymo launched a new generation of autonomous driving system, which not only leads the technology but also further reduces the cost of sensors. The system is installed on the pure electric car I-PACE purchased from Jaguar by Waymo. According to the released news, Waymo will continue to deploy 20,000 cars over the next two years.

Image source: Waymo official website

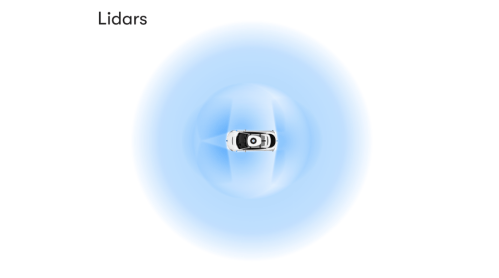

LiDAR is still the key focus of the new system. Waymo claims that the performance of the new system has improved 10 times compared to the previous generation. In order to better mass-produce and reduce costs, Waymo integrates two LiDARs into the new system, and two on the roof are integrated into one. It can fully perform distant and medium-range detection tasks. The new radar provides a 360-degree view, bird’s-eye view of objects around the vehicle, their sizes and distances, and generates 3D images. The maximum detection distance can reach 300 meters.

Image Source: Waymo Official Website

Waymo announced that the new generation Lidar can recognize objects accurately at night, during bright daylight or extreme weather conditions, and can even detect objects hundreds of meters away on highways.

Apart from the long-range Lidar, short-range Lidar is also distributed around the vehicle to provide better short-range spatial resolution and avoid potential blind spots on complex roads. The use of Lidar sensors by Waymo does not mean that they have given up visual sensors. The future mainstream direction is also a fusion solution. Therefore, Waymo independently developed visual sensors as well.

Image Source: Waymo Official Website

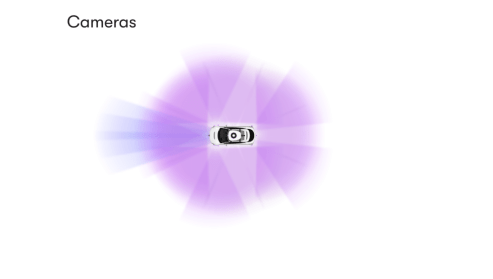

According to the official website, 29 cameras were mounted on an I-PACE to assist the Lidar. From the published images, environmental detection cameras were added to the front wheel arches of the vehicle to let the car recognize surrounding objects more comprehensively, and to react earlier and faster. The new camera sensor can collect data at a distance of over 500 meters.

Image Source: Waymo Official Website

In simple terms, apart from self-developing Lidars, Waymo also spent time developing cameras because Lidars can recognize the speed and distance of objects, but cannot tell what they are. Therefore, cameras are used to identify what the moving objects are.

Image Source: Waymo Official Website

On the fifth-generation hardware platform, Waymo independently developed a millimeter-wave radar, which is the mainstream next-generation imaging radar in the industry in recent years. The company has independently developed the antenna cover, antenna, circuit board, mechanical shell, firmware, software, and other components.

First of all, what is Waymo? What else has it done besides new technologies?## World’s top companies share a common trait ─ “what we thought we knew was right” is not always the case. Apple never considered itself a hardware company, but rather, a software company; Tesla does not position itself as a traditional automaker, but rather, as a tech company; and Waymo does not deem itself as an automaker or an autonomous driving company, but rather, a tech company.

For Waymo, autonomous driving is merely a technology they are currently working on. Their vision lies in the new definition of the world under artificial intelligence, starting with the automobile. From this perspective, it is easier to understand why Waymo is dedicated to researching and developing Level 4 and above autonomous driving technology.

Over the past decade, Waymo has walked on industry’s cold streets alone. In the past year, Waymo has recorded more than 20 million miles of driverless mileage and more than 10 billion miles of simulated testing on public roads across 25 cities in the United States. According to the 2019 DMV (Department of Motor Vehicles) Road Test Report, Waymo had a total of 148 road test vehicles in California, with a total of 1.45 million miles road tested and an MPD (miles per disengagement) value of 13,219 miles.

Since launching the Waymo One project in 2018, Waymo has serviced nearly 100,000 passengers with over 1,500 riders each month. This is an achievement they take pride in, even compared to China’s autonomous driving leader, Baidu.

In addition to strengthening their technical research and development, Waymo has been expanding their businesses, including autonomous driving taxi service, self-driving operation service, autonomous driving system service, and LIDAR sensor technology.

In 2018, Waymo announced it would no longer require a safety driver in the car for some rides. Later that year, they formally launched Waymo One, a paid self-driving taxi service in the United States. Although safety drivers remain in the vehicles, this is the biggest certification for autonomous driving technology from both consumer and government perspectives.

After years of accumulation, it seems that Waymo is now preparing to commercialize at a large scale in 2019.In 2019, Waymo opened its self-driving car factory in Michigan, USA. It is a factory that only produces L4 and higher level autonomous vehicles. To compensate for its weaknesses in vehicle manufacturing, Waymo chose to cooperate with Magna, which has mature experience in automotive manufacturing outsourcing and can control costs once again.

The same year, Waymo also established its own maintenance center to ensure the efficiency of vehicle maintenance. They also built a factory for producing self-driving cars in Detroit. This series of actions can be seen as important commercial operations.

For Waymo, 2019 was a milestone year. Their test vehicles were deployed across 25 cities in 9 states across the United States. The monthly active users of their self-driving taxi service app, Waymo One, reached 1500 people in Phoenix. In addition, the cumulative test mileage of Waymo’s autonomous vehicles has reached 20 million miles, and the simulated tests are countless.

In terms of takeover rates, Waymo improved from 0.09 times per 1000 miles last year to 0.076 times per 1000 miles.

On March 2, 2020, Waymo announced its first external financing.

According to the announcement, this funding will deepen investment in personnel, technology, and operations, all of which are for the deployment of Waymo Driver worldwide. The announcement shows that Waymo’s employee count has almost doubled from 800 people last year to 1500 people now, and they will continue to invest in technical personnel in the future, with an expected annual expenditure of $1 billion.

Waymo will also continue to expand its taxi fleet. Waymo has launched its self-driving taxi business, Waymo One, where passengers can call a taxi from almost anywhere in the Phoenix area at any time. It will prompt passengers with estimated arrival time and cost. This is actually no different from Didi, except that it does not require people to drive, but it still needs safety operators for now.

Waymo is preparing to significantly expand its business scale in the coming months. The company’s fleet will add about 62,000 Chrysler Pacificas, and it has signed an agreement with Jaguar Land Rover to produce 20,000 I-PACEs for Waymo in 2020.To promote the commercialization of autonomous driving, Waymo has officially announced the Waymo Via project, which focuses on autonomous driving logistics in short and long-term scenarios. Waymo will also ramp up efforts to commercialize autonomous driving in logistics scenarios in the coming months.

In order to prepare for internationalization, Waymo will launch a global testing project and provide unmanned driving freight services for countries or regions that meet the conditions. Targeted testing and operations will be carried out to obtain greater priority as soon as possible.

A technical and scenario dispute, leading to interim results?

When it comes to autonomous driving, Waymo and Tesla cannot be ignored. These two companies have always been considered as the leaders of two different technological camps. We all know that for autonomous driving, computing power, algorithms, data, and perception are essential skills. From the perspective of achieving autonomous driving, Tesla and Waymo have chosen two different technological routes.

Tesla chose to gradually transition from Level 2 autonomous driving to Level 4/5. Waymo, on the other hand, is ready to take a step forward and start developing Level 4 autonomous driving directly.

However, due to the fact that fully automatic commercial use of autonomous driving is not feasible in the short term, there are also rumors that Waymo has biased the development path of the entire industry, and Tesla is the trend.

The ultimate form of autonomous driving is like a lighthouse in the dark, visible but difficult to reach. Since Tesla updated Autopilot in 2018, it has been widely praised. After several iterations, Autopilot has become more user-friendly, and the market voice has started to change.

First of all, ultrasonic radar and millimeter wave radar, due to their technical irreplaceability and cost controllability respectively in parking and smokeless scenes, have become indispensable technical supports for both paths. As for cameras and lidars, they each have their own advantages and disadvantages from a technical standpoint.

The camera technology is relatively mature, with the advantage of a low cost and support for type recognition based on deep learning. However, it is susceptible to factors such as weather, ambient light, etc., and cannot effectively obtain three-dimensional information.

Lidar works in the infrared and visible light bands, and uses emitted laser beams to detect target position, speed, and other features for precise modeling, with a long detection distance. Currently available ones include 8-line, 16-line and 32-line lidars. The more laser beams a lidar has, the higher the measurement accuracy and safety.

In 2018, the unit price of cameras was about $100, while the unit price of LiDAR was as high as $20,000. According to public data, Waymo has reduced the cost of developing LiDAR by more than 90%, to about $7,000, which is essentially the same cost as using cameras, which is less than $1,000. Therefore, the cost of cameras is much lower than that of LiDAR.

Waymo insists on the LiDAR route because of the accuracy of driving data. The cameras can only obtain 2D plane data, and their work is limited by external conditions, which limits the amount of data they can collect, while LiDAR can obtain more accurate driving data.

However, as LiDAR development continues, its cost is expected to decrease significantly, and it will be widely used. Therefore, at the current stage, for automakers like Tesla, cameras are still mainstream, but with the cost of LiDAR decreasing, it is expected that by 2025, when L4 is reached, LiDAR will gain the opportunity for development.

Conclusion:

The two companies differ from a strategic perspective when compared to Tesla. Tesla is certainly aware that using visual sensors alone for autonomous driving will have shortcomings. However, as a functional system for the entire vehicle, Tesla not only needs to reduce costs but also achieve profitability in the initial stages. As a vehicle manufacturer, Tesla’s level of spending can be compared to the plight of domestic new forces, so Tesla must seek the most optimal solution in the short term.

Moreover, backed by Google, Waymo has a wealth of funds and a single research purpose, focusing solely on autonomous driving systems without the need to manufacture vehicles like Tesla. Waymo uses a dimensionality reduction method and is well aware of the dominant market position of the absolute leader. With the support of Google’s research and data capabilities, researching L4 and above levels can quickly occupy the industry’s top position, and commercialization will be natural. In fact, as early as 2013, Google tested L3 autonomous driving, not because it could not do it, but because it was pursuing higher goals.

For Waymo, perhaps it does not consider itself to have competitors. From Waymo’s current technology research and development to the construction of commercialized scenarios, the direct development of L4/L5 may be viable. I don’t believe that autonomous driving has camps because technology is just a way to reach your destination, and the “most appropriate” method for the current stage is equally important.I think Waymo has led its competitors off track. Waymo itself probably has a clear idea of the goals it wants to achieve and has been gradually implementing them. In the early stage, it invested heavily in research and development to form a technological barrier, while seeking commercially viable opportunities. It must continue to maintain its lead, as the market will not sympathize with the weak. Nowadays, Waymo has established a technological barrier and a closed loop scenario in terms of business.

In the short term, I still think Tesla has the advantage, as it needs to be viewed from both the enterprise and consumer ends.

For enterprises, the best solution at this stage is most important because infrastructure like policy and regulations are not yet synchronized. Addressing safety issues related to vehicle regulations is crucial, and it is most important to provide the best technology solution under the policy.

For consumers, experiencing the kind of automatic driving (assisted driving) levels of Tesla is already very exciting, which is a driving experience that has not been seen in decades.

Although Waymo is about to deploy its autonomous vehicle and other businesses globally, I believe its underlying logic is still based on accumulating technology. It is difficult to judge the market space for unmanned freight transportation, and at least it cannot make money currently. Waymo has run 20 million miles of data, but this is limited to the United States. It is very important to achieve data synchronization among multiple countries. At least, it is currently impossible for China to come in.

Now, commercial exploration may not necessarily be for making money, but as the saying goes, “each industry can only have one leader.” Waymo certainly hopes to be the leader and be the first to deploy its business, which can establish a first-mover advantage. Otherwise, if consumers equate automatic driving with Tesla, Waymo will be at a disadvantage. The scale and reputation advantages established by Microsoft, Google, and Apple have proven to be valuable even to this day.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.