Overview of Europe’s New Energy Vehicle Sales Data in the Last Month of the Second Quarter

In the last month of the second quarter, the sales data for new energy vehicles in Europe was very good, with the main seven countries reaching 191,000 units, breaking 60,000 units in Germany, and over 30,000 units in both France and the UK. It is expected that Europe will have about 230,000 units based on the previous situation. In the first half of 2021, the cumulative sales of new energy vehicles in seven European countries reached 824,000 units, and it is estimated that the sales in Europe in the first half of the year will reach 1.01 million units.

Overview of Europe’s Main New Energy Vehicle Data

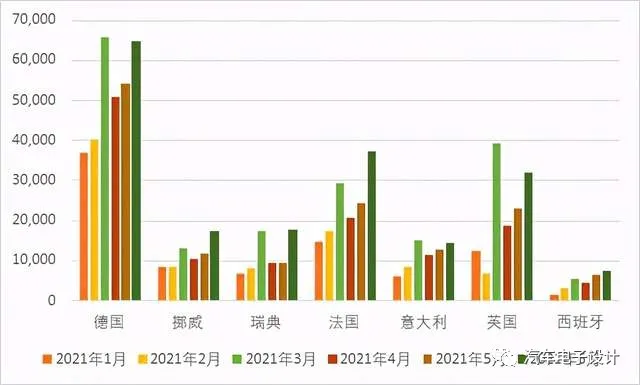

1) Comparison of Monthly Data

Now that all automakers are starting to release quarterly data, based on the data, March and June are both peaks. In June, the sales of new energy vehicles in Germany, Norway, Sweden, France, Italy, the UK, and Spain were 64,000, 17,300, 17,800, 37,300, 14,500, 32,000, and 7,400 units, respectively. From the monthly trend, the new energy upsurge is also fast in the three major European markets of Germany, France, and the UK, while the small markets of Norway, Sweden, and Italy still maintain good data. Currently, the market in Spain has not yet picked up.

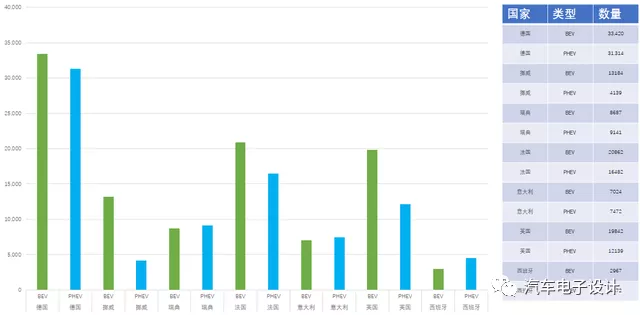

2) Comparison of BEVs and PHEVs

One characteristic of June is that pure electric vehicles surpassed plug-in vehicles. In fact, pure electric vehicles had been at a low point in Europe in the previous months, but with the increase in supply, in June, the pure electric vehicles in the seven main countries reached 106,000, while the plug-ins remained stable at 405,000 units. In this regard, the “ceiling effect” of pure electric vehicles in Germany still exists, with more than 30,000 units, and France and the UK also hit around 20,000 units. The number of plug-in vehicles is also very high, with more than 30,000 units in Germany, and around 15,000 units in France and the UK. This data is much better than before.

In 2021, the BEVs and PHEVs in the main seven countries were 405,000 and 418,400 units, respectively. In this sense, the rapid rise of BEVs still makes the overall data look better.

![Figure 4: Comparison of BEVs and PHEVs in Major Countries in 2021]

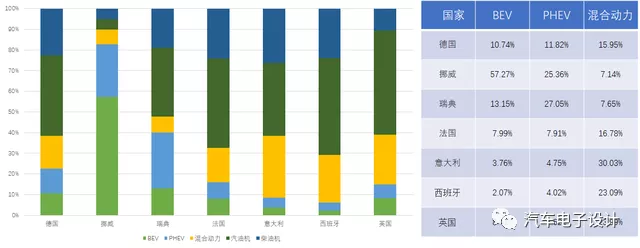

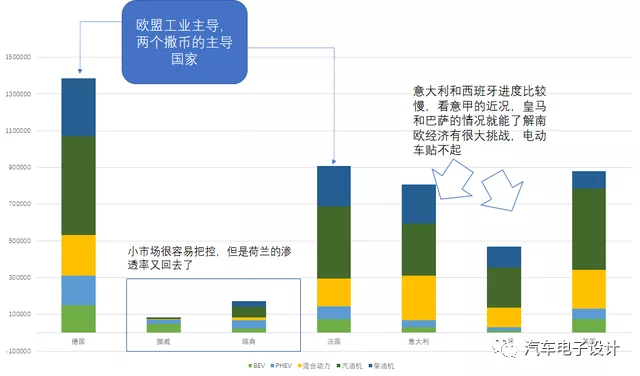

3)Overall penetration rate in H1 2021

Looking at the total market size and quarterly penetration rates together, we can see that the larger European car markets have already started to steadily increase their penetration rates. Germany currently maintains a 20+% penetration rate for BEV+PHEV, while France and the UK are both close to 20%. Italy and Spain are also starting to move upwards. Sweden has the potential to follow in the footsteps of Norway and rapidly advance towards electrification.

In fact, the progression of electrification is closely related to national subsidy policies, and the rapid increase in electrification rates in the three major countries of Germany, France, and the UK is mainly policy-driven, with large amounts of subsidies driving the growth. With the improvement of electrified vehicles in 2021, sales of fuel vehicles have actually grown quite slowly, and European automakers still need to seek external funding to pursue electric vehicles.

4)Data on hybrid vehicles

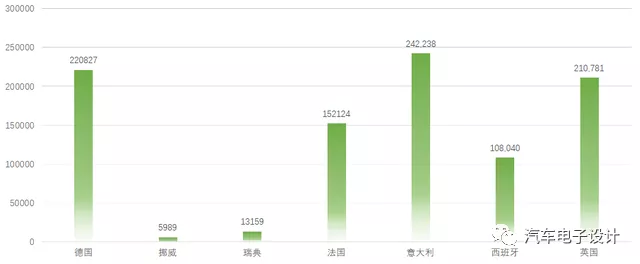

Although Europe has always emphasized the proportion of pure electric vehicles, the sales volume of HEV (including 48V) has actually increased rapidly in the first half of the year, especially in Southern European countries, where small and low-cost cars mainly reduce emissions through HEV. In the first half of the year, the number of hybrids reached a fast 953,000 units, with Germany and Italy both exceeding 200,000 units. However, in small markets, since BEVs can offer quick solutions, hybrids are often skipped.

Note: I estimate China is also like this. In mega-cities and large cities, hybrids have limited effects and may be directly skipped in favor of pure electric vehicles.

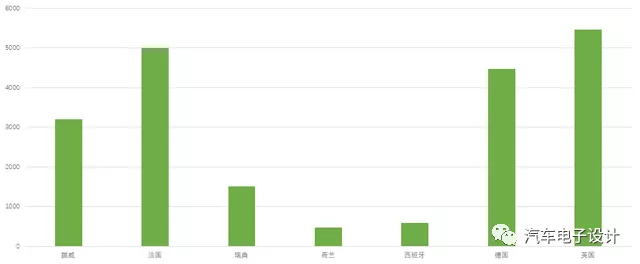

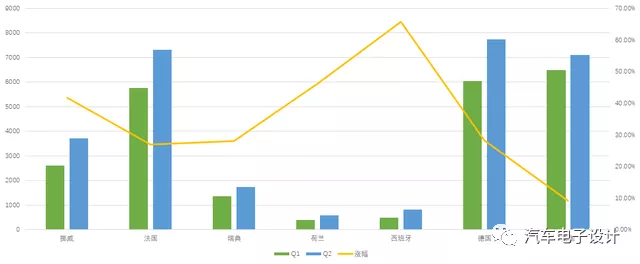

5)Tesla’s data in major countries in June and Q2

Tesla’s data in Europe during June was very impressive. The numbers for Germany and France were 4466 and 5001 respectively, while the UK reached 5468. Norway, Sweden, the Netherlands, and Spain were 3196, 1499, 475, and 583 respectively.

Given that the sales of Model 3 in the above-mentioned seven countries were 20,000 units, and these countries achieved 29,000 units in Q2, it is projected that the sales in Europe for Q2 might be 39,000 units according to the sample ratio of the previous quarter.

Conclusion: We will first present a macro analysis of the European situation. After the data for each country is available, we will do a summary of each country. It is estimated that sufficient data will be available by around the 15th to support this analysis work.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.