Author: Dàyǎn

As the head of SAIC Group, Chen Hong probably did not expect that his truthful remarks would cause a huge uproar online. What he didn’t anticipate was that although Chinese people have a Huawei complex, they do not have an SAIC complex. Chen Hong’s exact words were: “This is like a company providing us with a complete solution. In this way, it becomes the soul while SAIC is the body. SAIC cannot accept such a result and must grasp the soul in its own hands.”

Let’s interpret this. SAIC does not actually reject cooperation with Huawei, but its bottom line is not allowing Huawei’s autonomous driving technology to be fully introduced into SAIC’s models. Doing so would mean that SAIC abandons its own autonomous driving technology and helps Huawei establish a reputation in the intelligent connected vehicle field.

The battle between SAIC and Huawei ultimately boils down to a power struggle between automakers and high-tech companies for dominance in the future automobile industry. Although traditional car companies are far behind other internet high-tech companies in software algorithms, chips, and even customer operations and maintenance, their accumulated experience in the field of vehicle engineering is also difficult for other enterprises to match in the short term.

Both NIO, Xpeng, and Tesla faced great difficulties at the beginning of their model production, with delayed deliveries becoming the norm while repeatedly hovering on the brink of bankruptcy. Therefore, the candid remarks of the head of SAIC Group are more of a power struggle between traditional car companies and high-tech enterprises in the competition for dominance in the intelligent connected vehicle industry.

Huawei’s ambition is far greater than that of Bosch

For an automaker, in a certain sense, the dominance of the industrial chain is even more important than the success or failure of a single model. Mastering the dominant voice of the industrial chain means that it has a huge system to support its operation and can bring a continuous stream of profits.

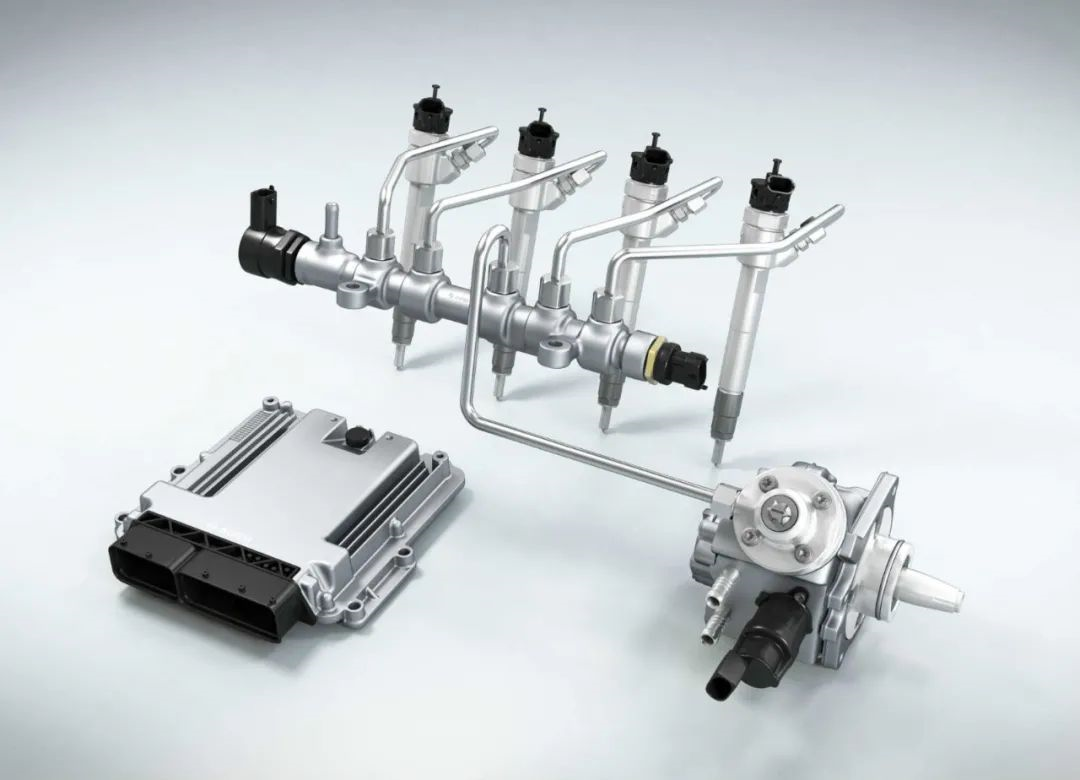

Therefore, in the era of traditional fuel vehicles, suppliers like Bosch who have absolute control over high-pressure common rail and control modules for diesel engines, ABS, ESP and other active safety systems can only earn considerable profits but cannot shake the status of automakers as they cannot overturn the dominant position of automakers.

However, what Huawei wants to do is to completely break this existing pattern.

Huawei has brought in partners such as BAIC BluePark and SAT to deploy their autonomous driving technology, and attached the HI brand to the two models that carry Huawei’s autonomous driving technology.

For consumers, the brand power and product power of BAIC EU-Series and Sylphy were not worth mentioning. However, after being endorsed by the HI brand, they have achieved significant improvement in sales and attention. Therefore, consumers began to pay attention to those marginalized car brand because of Huawei’s endorsement. This is something that Bosch or other component companies have never been able to achieve.

The painful lesson from Zebra

For SAIC, which Huawei holds a grudge against, there was a relatively failed car networking experience in the past.

As the pioneer of domestic internet-connected cars, the first generation of Roewe RX5 once flourished in China with the Zebra system, becoming SAIC’s sales pillar at one point. However, after establishing the reputation of an Internet-connected car, there were serious differences between SAIC and Alibaba, the two shareholders of Zebra, regarding the future development path of the Zebra system.

SAIC hoped that Zebra could become a dedicated system for its models and help Roewe and MG brands occupy a favorable position in the market competition. Alibaba, on the other hand, hoped to promote Zebra throughout the entire domestic car market as soon as possible, helping itself expand and strengthen in the domestic car networking market.

It’s understandable that both companies acted in their own interests. However, due to irreconcilable conflicts, Zebra was unable to continue its high-speed development momentum and missed the best strategic development opportunities in China.

Currently, the domestic car networking market is basically occupied by Baidu and Tencent, and Alibaba’s first-mover advantage is gone. For SAIC and Alibaba, this is almost a lose-lose result, and the beneficiaries are Baidu and Tencent.

If SAIC fully introduces Huawei’s autonomous driving system, it will face similar problems:1. Once there is a safety accident, it will not only make it difficult to define the responsibility between SAIC and Huawei, but also affect the resolution of related technical issues during product development. Even if Huawei provides a complete solution, traditional OEMs still need to provide support in areas such as online control of chassis. The deep integration of self-driving and vehicle engineering itself is a very complex and difficult technical problem to solve.

-

SAIC may not be able to sign an exclusive agreement with Huawei, as Huawei has already deployed its self-driving system on the Bestune and Seres vehicles. With the precedent of the Baidu case, SAIC will never allow this situation to happen again.

-

SAIC’s autonomous driving technology may face a setback. Since Huawei’s autonomous driving technology has been deployed, it inevitably means that SAIC’s own set of autonomous driving technology has been put on hold. Currently, autonomous driving technology is still in a rapid development phase, and all companies involved in self-driving are accumulating a large amount of actual mileage to comprehensively improve algorithms. If SAIC slows down the pace of its self-developed autonomous driving technology at this time, the gap with cutting-edge technology in this field will only grow larger, which is unacceptable for SAIC.

The competition between traditional carmakers and high-tech companies is just beginning

Although Huawei had repeatedly stated that it would not enter the field of whole vehicle manufacturing, the statement from the leader of SAIC is likely to reverse the situation. The increasing vigilance of OEMs and the consensus on independently developed core technologies all make it more difficult for Huawei to implement its own technical deployment.

Another company, DiDi, had once created an alliance, hoping to reduce its own vehicle procurement costs to a maximum extent by leveraging its large volume of whole vehicle demand.

But today, apart from establishing a joint venture with BYD to produce DiDi D1, there has been no progress on any other developments. Even this company is also in a big shareholding position of BYD.

Although the OEMs in the alliance envy DiDi’s huge volume of ride-hailing, they do not want to fall into the role of mere contract manufacturers. So recently, there have been repeated rumors that DiDi is building its own team and plans to personally enter the vehicle manufacturing industry.

In addition, in the field of autonomous driving in China, Baidu, which leads in technology, has established a joint venture with Geely to enter the field of whole vehicle manufacturing with a brand called “Jidu” while collaborating with other OEMs.

Even in the US, the competition between high-tech companies and traditional OEMs in autonomous driving technology has never ceased.

The universal Cruise and Ford’s Argo AI are the darlings of these two traditional automotive giants. Meanwhile, Tesla, Google’s Waymo, Amazon, and even Apple have not slowed down their investment in the field of autonomous driving. So far, we have not seen any overlap between the two camps.

With Tesla’s soaring market value in sight, traditional car companies are balancing their current vehicle business while actively transforming into high-tech companies. From hardware platforms to software code, automakers are expanding their underlying technology into software-defined cars and intelligent connected cars. As for high-tech companies, they are occasionally mentioned to have plans for building cars, and perfecting their own vehicle design and integration capabilities is also a must for them. A comprehensive competition between the two camps has already begun.

There is no right or wrong in the conflict between SAIC and Huawei. Everyone has different starting points, and they need to consider different corporate interests. However, compared with SAIC, Huawei, which is under extreme pressure from the United States, is easier to get support from the Chinese people.

Entering the intelligent connected car market and finding new support industries for the company, as well as reducing dependence on mobile phones and communication services, is a shortcut for Huawei to achieve sustainable development. For SAIC, as a large number of new automotive forces have emerged, its leading position in China has already faced great challenges. Ensuring mastery of leading core technology is also a guarantee for future sustainable development.

The outcome of the competition between the two camps is currently uncertain, but one thing is certain: anyone who chooses comfort when they should be fighting will inevitably lose their dominance and even their right to survive in the future.

SAIC and Huawei are both very clear on this point.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.