And unlike the three German car companies that are working on OS, the three North American car companies have made strategic choices around 2021. On the one hand, they are moving away from traditional automotive electronic chip solutions towards Qualcomm solutions that have evolved from mobile phones. On the other hand, they are embracing the Android Automotive OS for the cockpit OS.

I think there are several reasons for this:

Automobile manufacturers making their own OS cannot actually support an ecosystem regardless of how large their ownership is. Regardless of how many generations have been evolved, the QNX-based OS system that has been developed with a lot of manpower and resources is still a closed system. It is difficult to absorb developers to contribute, and the ecosystem is not established, so the input-output ratio is limited from a strategic perspective. Compared to investment in electric battery and factory transformation, investment in automation from software, algorithms to testing teams is still clearer and lighter.

From the current situation, Apple’s entry in the future, and Android Automotive OS provides a possibility in North America. The native system of these car machines will be used by users in the United States. With the trend of this upsurge, I believe that in terms of car OS, the closed Tesla, Apple car OS, and Android Automotive OS will be the three directions. However, Android Automotive OS could rise rapidly, as it has attracted GM, Ford, FCA, and Volvo’s fuel and new energy vehicles.

Ford’s Transformation

Looking back at the history of SYNC, Ford’s system can be traced back to SYNC1 developed based on Microsoft Windows CE before the 2007 financial crisis. At that time, the three North American car companies were in their heyday. These transitions also have historical backgrounds:

Ford’s two changes in the SYNC system, one was the switch from WinCE to QNX on the SYNC. Here, there is a background: Mark Fields took over as Ford CEO in 2014 and promoted Ford’s digital transformation during this cycle. In 2015, Ford launched the Smart Mobility strategy, which includes 25 parts, such as big data mining, car sharing, crowdsourcing parking, and unmanned driving. At that time, Ford’s approach was to transform from an automotive manufacturer to a mobility service provider and turn itself into a digital software company. Ford invested in Velodyne, a LiDAR company, computer vision company SAIPS, autonomous driving company Argo.AI, shuttle-sharing company Chariot, cloud software company Pivotal, etc.By 2017, Jim Hackett had taken over from Mark Fields, and Ford continued to heavily customize its systems on top of QNX. That same year, Ford hired 400 engineers from the BlackBerry Mobility Solutions division, continuing to iterate on the system. What we see with the SYNC 4 on Mustang BEV and F150 released in 2019 are the results of this.

Under James D. Farley Jr., beginning in October 2020, Ford announced a six-year strategic partnership with Google in February 2021. Beginning in 2023, both Ford and Lincoln models will feature a new vehicle entertainment and information system based on Android Automotive OS.

Looking at the hardware configurations, SYNC1 initially used Freescale’s I.MX31L chipset, evolving to I.MX51, then SYNC3 used TI’s OMAP 5 SoC, and SYNC switched to i.MX 8. What didn’t change was the layout of the system, placing it around the central control screen through a single-board configuration with gradually increasing screen sizes.

As for SYNC4’s hardware, I will discuss its specifics in a separate topic once information is clear.

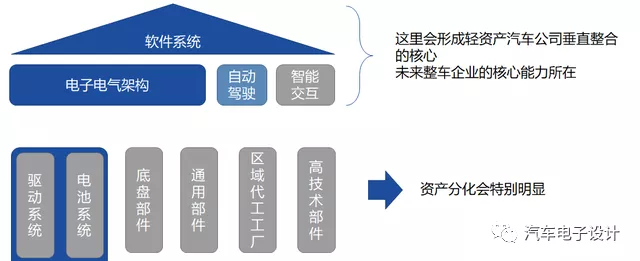

I think the rapid increase in electric vehicle penetration due to commitments to carbon reduction in various countries has put traditional automotive companies in a difficult position. With the elimination of the high barriers of the engine and transmission—parts with long iteration times and high requirements for breakthroughs—the automobile as a product has few major differences outside of the software systems, electronic and electrical architecture, and distinctive autonomous driving abilities that can still be controlled.We can assume that for the same 100kWh battery-powered SUVs from GM, Ford, and FCA, with all the basic features being the same, and with similar infotainment and instrument screens using the Google series of services provided by Android Automotive OS, there is no differentiation among these American car companies. The only difference could be the autonomous driving software capability and the overall OTA iteration capability, with no other differentiation. How could these car companies compete in terms of hardware costs? If they do not design and produce the battery and electric drive system in-house, can they really merge into one car company for operations, or spin off and reorganize all production into a model similar to that of telecom operators and tower companies?

In conclusion, I believe that in the future, in markets such as the United States, where cloud platform companies, chip companies, and software OS companies have strong capabilities, the only soul of American cars is autonomous driving functionality, and what car companies can seize is the current investment, iterative algorithm and data training through team cultivation. There is no other way. All other related investments, hardware, electronic and electrical architecture, and basic software platforms are only meant to serve this primary purpose. Good-looking exterior and differences in the price and performance of powertrain may only result in a slight premium.

Note: Of course, the situation is different for the Chinese cabin OS. Android’s system is modified by various brands, and then integrated with their own apps and the Chinese ecosystem. Investment is still necessary, but output is limited.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.