When the automobile industry experienced severe homogenization, Tesla launched a new era of automotive revolution.

As a century-old store, General Motors (hereinafter referred to as GM) had to either reposition itself and emerge from its predicament or miss the opportunities of the new era and leave with regret.

Obviously, GM was not willing to do the latter.

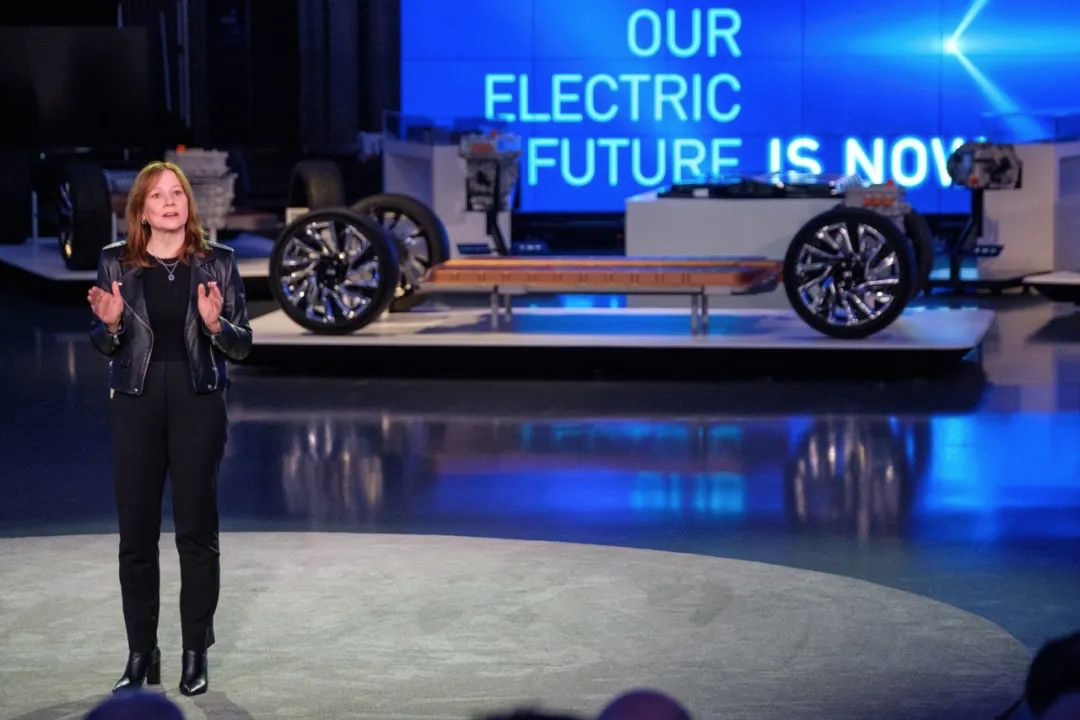

So GM shouted out: “Our electric future is now,” and released Ultium batteries, a modular driving platform, and the third-generation global electric vehicle platform (BEV3).

Today, let’s talk about the electrification platform through BEV3.

From the new platform to Ultium batteries

Firstly, we should understand why traditional car companies need to develop a new pure electric platform. Why not use the existing internal combustion engine platform?

As early as 2017, a teardown report by McKinsey pointed out that to build a high-performance electric vehicle, a native platform must be created. And the native platform is a completely new electric vehicle platform like GM’s BEV3.

If the electric vehicle is built on an internal combustion engine platform, it will have a significant gap in driving range and interior space compared with a vehicle built on a native platform.

The reason is that the former need to adapt the battery to the awkward space of the internal combustion engine platform, which limits the improvement of battery energy density. The latter can make the module design of the battery reach an optimal state.

In simpler terms, if traditional car companies build pure electric vehicles based on the original internal combustion engine platform, there will be inherent geometric design flaws in terms of space and battery energy density improvement.

Therefore, giants like GM and Volkswagen must develop a completely new electric vehicle platform if they want to make a difference in the pure electric vehicle field.

Against this background, GM’s third-generation global electric vehicle platform was born.

Source: GM Official Website

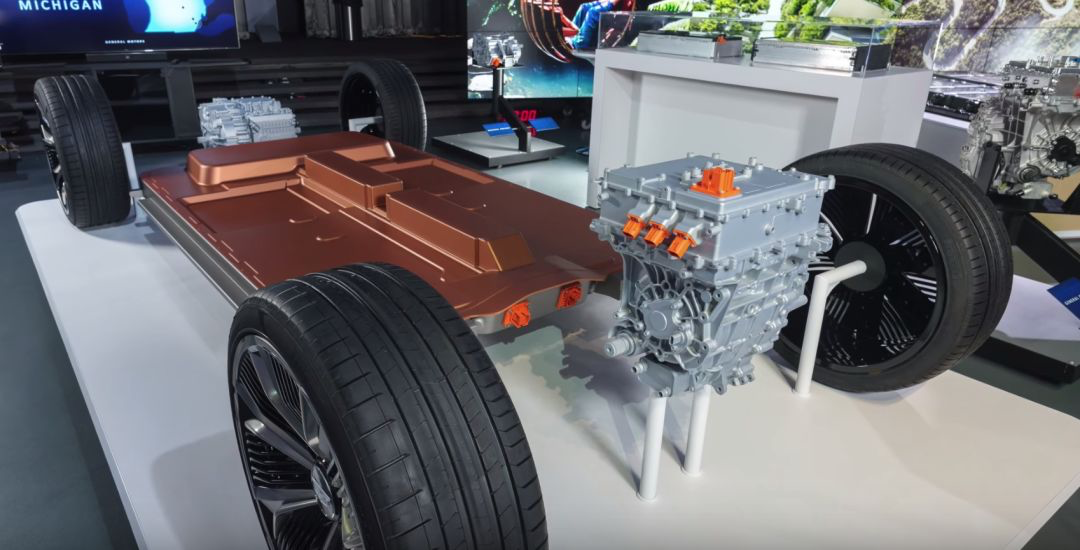

As GM put it, the third-generation global electric vehicle platform has a high degree of flexibility, can support different brands, different market segments, and cover products of various vehicle levels to meet diverse consumer needs. For example, crossovers, pickups, SUVs, sedans, commercial vehicles, etc.

Simply put, it reduces the development cost of new vehicle platforms and concentrates all vehicle models on one platform. However, things are far from being as simple as reducing costs.

Since all vehicle models are developed on the same platform, the platform must have the capability to meet the product requirements of different levels. Therefore, GM will develop different gradient products by matching battery packs of different capacities and different drive modules.General Motors officially announced that the Ultium battery system can be configured with battery capacities ranging from 50 kWh to 200 kWh, and with different drive systems such as front-wheel drive, rear-wheel drive, all-wheel drive, and performance all-wheel drive, GM will offer a total of 19 combinations of batteries and drive systems to meet the needs of different products.

Among them, the Ultium battery system mounted on the new platform is one of the biggest highlights, with its battery cell adopting a soft pack design.

Image source: GM official video

You may wonder why GM did not adopt more mainstream cylindrical or square battery cells but chose a soft pack. This is what I am going to talk about next.

In terms of advantages, GM had already used the soft pack battery cell design on the Chevrolet Bolt EV, which performed well in the North American market, indicating that GM clearly understands the advantages of soft pack batteries.

Its advantage lies in that, compared to cylindrical and square battery cells, soft pack battery cells have a larger deformation space in the aluminum-plastic film. In case of thermal runaway, it is less likely to explode compared to steel shell or aluminum shell battery cells. At most, it will only swell and crack, hence its safety is relatively high.

Bolt EV battery cell

In addition, the shell of a soft pack battery cell is a layer of aluminum-plastic film, which is lighter in weight. Its weight is about 40% lighter than that of steel shell lithium batteries of the same capacity and about 20% lighter than that of aluminum shell batteries. Therefore, it can reduce the weight of the whole vehicle and improve the range to a certain extent.

Furthermore, the capacity of a soft pack battery cell is larger. Under the same size specifications, the capacity of a soft pack battery cell is higher by 10%-15% compared to a steel shell battery cell, and 5%-10% higher than an aluminum shell battery cell.

However, soft pack battery cells also have disadvantages, such as fewer existing model types, which cannot meet market demand, and high development costs for new models. In addition, the shell strength is low, which is highly dependent on grouping technology. Compared with the winding production method, the production efficiency of lamination is relatively low.

These were important reasons why soft pack batteries achieved only 5.50 GWh in installed capacity and accounted for 8.85% of the market for power batteries in China last year. It is also one of the reasons why GM plans to jointly invest $2.3 billion with LG Chem to build a battery plant.

From the perspective of the new platform, soft pack battery cells have another important advantage, which is easier to control the thickness accuracy of the battery pack.<!–

Since the new platform aims to include various types of vehicles, such as sedans, SUVs, pickups, and commercial vehicles, controlling the thickness of the battery is particularly important, especially for lower sedans, which can provide more usable space for vehicles. Soft-pack batteries have this advantage because their thinner thickness makes them easier to control and therefore control the height of the vehicle floor, which makes the new platform more flexible.

Picture from General Motors’ official video

Based on this, General Motors has played differently on Ultium Battery. It divides the battery cells into two different types of arrangements, which are vertically and horizontally arranged, to obtain a soft-pack module that is suitable for the volume.

Why is it volume instead of height? First, let’s take a look at the layout of these three modules through the picture.

Picture from General Motors’ official video

From the picture, we can see that the height of the module can be increased or reduced by horizontal stacking. By placing the soft-pack battery cells vertically, the height and width of the module will change. In this way, the precision of the module volume is increased, making it more convenient for the new platform.

In addition, General Motors has adopted a “T-shaped” stacking method, which continues the design of Bolt EV and is mainly used to be compatible with the chassis structure of plug-in hybrid vehicles.

If a vehicle with higher battery capacity is needed, battery cells can be added to the “T-shaped” module. The vertical and horizontal arrangement of battery cells can also be used to achieve higher precision control of battery capacity.

Picture from GM’s official website

For larger vehicles, General Motors will adopt a double-layer layout to obtain higher battery capacity. At this time, soft-pack battery cells can better control the thickness of the battery pack in double-layer layout.

From the perspective of partners

The battery carried by Bolt EV in the early stage was produced by LG Chemical, and LG Chemical mainly produces soft-pack battery cells. On December 5, 2019, General Motors announced that it has established a battery joint venture with South Korea’s LG Chemical, and the annual production capacity of the factory will exceed 30 GWh. Therefore, it is reasonable to use soft-pack battery cells.

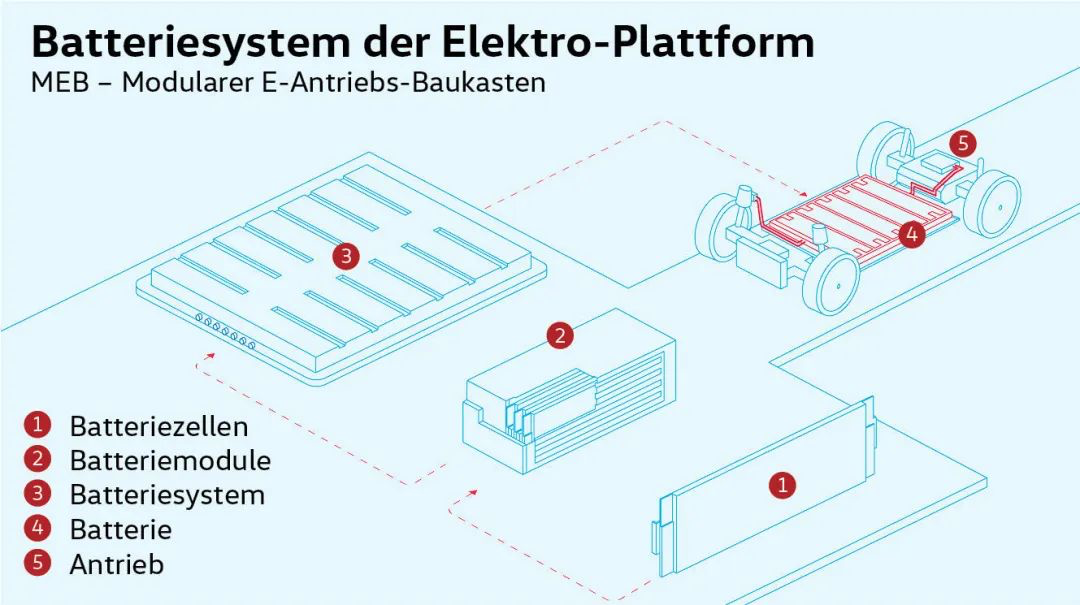

–>And when we look at peers, not everyone uses pouch cells. Volkswagen’s MEB platform also uses pouch cells. So here comes the question, what is the difference between General Motors’ Ultium battery and the battery configuration of Volkswagen’s MEB platform?

From Ultium Battery to MEB and PPE

To understand their differences, let us first look at these two more intuitive diagrams.

MEB battery pack

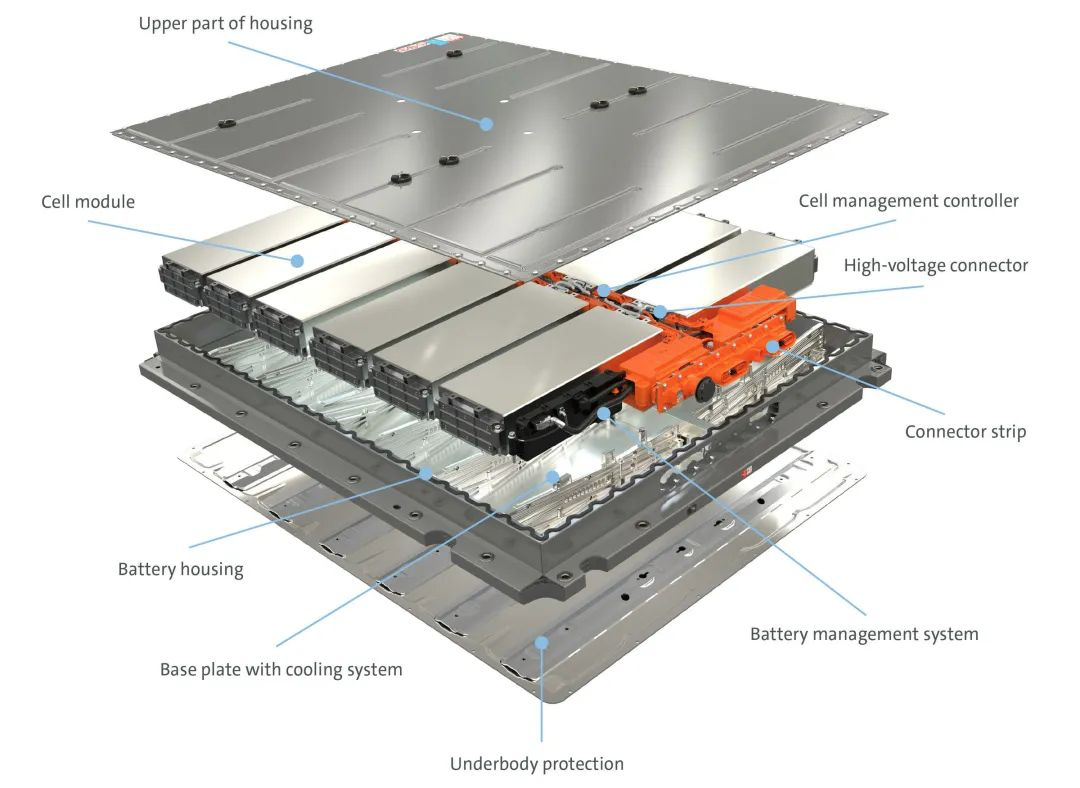

Ultium battery pack

From the structural design, we can clearly see from the pictures that Volkswagen’s MEB battery has integrated the battery control system into the middle of the module, forming a structure similar to a “crossbar”.

This layout mainly causes a problem of taking up a certain amount of space, so under the same volume, its battery capacity will be reduced. This is exactly what we mentioned at the beginning, that if electric vehicles are based on traditional internal combustion engine platforms, similar space constraints will arise.

However, General Motors has avoided this issue by integrating the battery control system around the outer shell of the battery system. We cannot say which design is better, mainly depending on the product layout. But in terms of expandability, General Motors’ design seems to be easier to configure.

Because if General Motors uses a similar layout as the MEB battery, it will bring some problems in stacking double-layer modules. For example, if this “crossbar” structure is added in the middle of the second-layer module, the design may become more complicated.

As for the number of battery cells in a single module, Volkswagen’s MEB currently only has one layout, which is 24 cells per module. General Motors has multiple types of layouts, divided into vertical direction with 24 cells and horizontal direction with 12 cells. In theory, General Motors’ design will have better space utilization than Volkswagen.

Image source: Volkswagen official website

As for battery voltage and fast charging capabilities, most General Motors vehicles will be equipped with a 400V battery pack and a 200 kW fast charging capability, while electric pickup trucks will be equipped with an 800V battery pack and a 350 kW fast charging capability. The first-generation MEB platform fixed the battery voltage at 408V, and under AC charging, the maximum charging power is 11 kW, and under DC charging, the maximum charging power is 125 kW.In terms of battery capacity, as mentioned earlier, the capacity of General Motors’ Ultium battery ranges from 50 kWh to 200 kWh. Volkswagen’s MEB platform has battery capacities of 48 kWh, 62 kWh, and 82 kWh.

Numerically, under the same voltage, General Motors is superior to Volkswagen in fast charging capability, and the battery capacity range is also wider. However, Volkswagen must have considered this issue, and higher battery capacity is certainly better (based on conditions such as safety and service life). The only explanation is that for products on the MEB platform, this range of battery capacity is basically sufficient.

For luxury and performance brands, Volkswagen has chosen the PPE (Premium Platform Electric) new platform to meet the demand for high-dimensional product battery capacity, among other things.

According to official Audi sources, PPE was developed in collaboration with Porsche from the very beginning. Products under development based on PPE will cover various vehicle types such as SUVs, Sportbacks, Avant, and Crossover.

Image Source: Audi official website

The technology of PPE is mostly similar to MEB. However, PPE will achieve different levels of performance and battery capacity. Audi officials said, “Just like in the Audi e-tron GT concept car, the battery voltage can reach 800 V. Combined with efficient thermal management, it can achieve a maximum charging power of 350 kW.”

It is worth noting that, according to Bloomberg, Volkswagen is discussing with other manufacturers on how to share key technologies of PPE. This will help Volkswagen enlarge its scale, share costs, and most importantly, generate new revenue streams.

So by now, you should understand what I said earlier, that pure electric platforms are not just about reducing production costs, but can also explore new revenue models, such as sharing the platform with other small and medium-sized car companies to generate corresponding revenue.

Michael Dean, an analyst at Bloomberg, said that this may attract the attention of many smaller luxury brands, including Aston Martin, McLaren, and Maserati.

On this point, General Motors also expressed that they will seek new business opportunities.

In my opinion, General Motors is very likely to adopt a similar approach to Volkswagen. This is because the General Motors official has indicated that they will participate in battery cell production, and through further upstream integration of the industrial chain, they can authorize batteries to be applied to third-party products, thus developing new revenue sources.So, if this model from Volkswagen is feasible, the all-new electrification platform will become a new “pay-for-open-source” revenue model. This is why the automotive industry is facing a new electric platform battle.

This is also why the two giants have chosen to adopt different gradients of battery capacity. The reason for this is that small and medium-sized car companies do not have the capability or the necessity to develop a completely new electrification platform. They still need to produce products with different gradients. The greater the span of the electric vehicle platform, the stronger its compatibility.

From Ternary to Quaternary

However, simply having such a model is not enough. The key indicator for the platform’s success is how to increase battery energy density in a short amount of time.

Therefore, in terms of choosing the material system for the battery cell, Volkswagen’s Frank Blome indicated that cobalt content will be reduced in the next generation of batteries, and it may even be possible to produce cobalt-free batteries.

This is similar to General Motors, which also chose to increase nickel content and reduce cobalt content in their batteries. This led to General Motors choosing the NCMA (Lithium Nickel Cobalt Aluminum Oxide) quaternary battery (which I will continue to discuss below). Increasing nickel content can increase energy density, and reducing cobalt content can reduce costs (cobalt is the most expensive element in ternary lithium batteries).

Image source: General Motors official website

At the beginning we also mentioned that the development of a new soft-pack battery cell model is costlier. In order to further control costs, General Motors has partnered with LG Chem to establish a joint venture to jointly research and develop and produce battery cells, with a cost target of reducing the battery cells to $100 per kWh or even less.

As a result, in addition to reducing the cost of their own products, the platform will also be able to lower the thresholds for small and medium-sized car companies, attracting more players to join the shared platform.

According to official information from General Motors, the cobalt content in NCMA quaternary batteries has been reduced to around 5%, while the nickel content has been increased to 90%. This news has once again attracted industry attention to NCMA quaternary batteries.

Among them, LG Chem’s battery material system path is from NCM622 and NCM712, and then to NCMA quaternary batteries. But isn’t ternary lithium batteries the mainstream in the market? Why switch to quaternary batteries?

In fact, NCMA quaternary batteries are not a new product. As early as 2016, researchers from Hanyang University in South Korea and Korean battery companies proposed this concept.

In China, in 2019, SVOLT Energy (formerly known as the Power Battery Division of Great Wall Motors) released NCMA batteries.

Image source: SVOLT Energy official website## What is NCMA Quaternary Battery?

The so-called NCMA quaternary battery refers to the addition of aluminum element in the traditional NCM nickel-manganese-cobalt ternary lithium battery, which ensures that the energy density, safety, cycle performance, charge/discharge, and other characteristics of the battery cell will not decline while achieving low cobalt content.

Simply put, while reducing costs, the performance of the power battery will not decline, and may even become better.

However, since the performance of NCMA is so good, why hasn’t it been used until now?

The reason is simple. The technical difficulty of conquering NCMA is very high because the addition of a new element means an increase in the uncertainty of electrochemical reactions, which greatly increases the difficulty of control.

In addition, it will bring huge challenges to the consistency and production process of battery cells. Therefore, the mass-produced NCMA has not appeared yet.

Under the joint efforts of LG Chem and General Motors, NCMA seems to be emerging. If the progress is fast enough, it will inevitably cause a price war in the battery industry. As I mentioned earlier, General Motors will participate in the manufacturing of battery cells, further integrating the upstream industrial chain, and future authorizing the use of batteries in third-party products.

That is to say, once the time is ripe, General Motors and LG Chem jointly produced NCMA will be sold to third parties, opening up a completely new source of revenue. After all, if 30 GWh is achieved, General Motors will not be able to digest it with its current status.

Therefore, in addition to being used on General Motors’ third-generation global electric vehicle platform, NCMA can also be directly realized, so why not do it.

So, what about the progress of NCMA at present?

Here we need to look at the honeycomb energy that released the world’s first quaternary material battery cell last year. According to the latest report from Moneyball, Honeycomb Energy will deliver more than 7 GWh of electric batteries to a European car manufacturer, but the manufacturer has not been disclosed. Before that, relevant reports showed that PSA, BMW, Audi, and Mercedes-Benz were evaluating the battery cell.

Turning to LG Chem, at the Q1 earnings conference last year, Kang Chang-bum, general manager of LG Chem’s battery business, said that LG Chem’s NCMA quaternary battery will achieve large-scale production in 2022.

Looking back at General Motors’ product plan, the electric pickup truck GMC Hummer equipped with Ultium battery will debut in May and is scheduled to be put into production at the Hamtramck plant in Detroit in the fall of 2021.

From the timeline, if General Motors wants to achieve the production of GMC Hummer in the fall of 2021, it must accelerate the research and testing of NCMA with LG Chem.

At this moment, NCMA has become a key element in driving General Motors’ plan.

Image source: The official website of the automaker

In conclusion, it should be noted that Ford agreed last year to use Volkswagen’s major electric vehicle platform for the mass production of cars in Europe. The agreement is worth $10-20 billion and will last for six years. The two companies are currently negotiating the production of a second model based on Volkswagen technology. This has become a new revenue model for Volkswagen.

The significance of the native platform can be seen in Volkswagen and General Motors’ strategic plans.

Volkswagen first launched its electrification strategy in 2016, with the “TOGETHER-Strategy 2025”. At that time, the MEB platform was not mentioned in the public strategic plan. Volkswagen has explicitly stated that they plan to launch more than 30 electric vehicles by 2025 and sell 2-3 million electric vehicles by then.

After launching the MEB and PPE platforms, Volkswagen announced in its latest plan that they plan to launch 75 pure electric vehicles by 2029. By then, the cumulative production of electric vehicles will increase to around 26 million. Among them, 20 million electric cars will be built on the MEB platform, with the majority of the remaining 6 million cars built on the PPE platform.

At the same time, Volkswagen plans to invest nearly €60 billion in hybrid power, electric transportation, and digitalization over the next five years. Of which, approximately €33 billion will be invested in electric transportation.

General Motors, on the other hand, was slower than Volkswagen to introduce its new platform. When it released its new electric vehicle platform, General Motors showcased 10 electric concept cars, which it plans to launch by 2025, and plans to sell 1 million electric vehicles in the North American and Chinese markets. In addition, between 2020 and 2025, General Motors plans to invest $20 billion in funds and resources in electric vehicles and autonomous driving.

In 2020, Tesla produced 1 million vehicles, General Motors released a new electric vehicle platform, and MEB continued to mature. It seems that traditional car companies are catching up.

As people begin to realize that pure electric vehicles are gradually entering their lives, a smokeless war is brewing.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.