Renault currently has two big news. First, in terms of electric vehicle planning, Renault has the ElectriCity plan to establish a wholly-owned entity to produce electric vehicles using its Douai, Maubeuge, and Ruitz factories, with an annual production of 400,000 vehicles by 2025. At the same time, China’s AESC FarEast Group will invest 2 billion euros to build a battery factory near “ElectriCity”, which will achieve 9 GWh by 2024 and expand to 24 GWh by 2030.

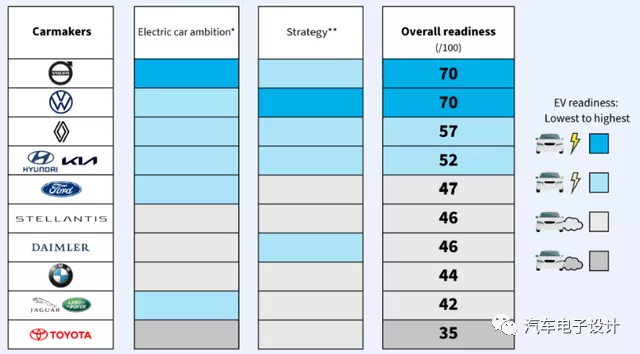

Note: I think the global automotive industry is facing a very special and unfamiliar situation with the epidemic and changes in capital attitudes towards industrial change. For example, all European car companies are currently competing for the most pure electric planning, and each car manufacturer wants to publicize when to abandon the internal combustion engine through the media, while Toyota, whose pure electric pace is slow, has become the tail of the pure electric industry. In China, every car company hopes to lay the foundation for changes in the middle. For example, Great Wall’s ambitious plan for 4 million vehicles and 80% new energy in 2025 has different opinions on domestic companies. I hope to start from the facts and discuss where there are strange places. Now it seems that many plans heard are unrealistic.

Renault’s plan

For Renault, it is necessary to consider last year’s situation. In 2020, Renault’s net loss was 8 billion euros, the largest annual loss ever, with nearly 5 billion euros in losses coming from Nissan. To address this loss, Renault needs to significantly reduce costs, reduce research and development investment (from 10% to 8%), and may close factories (global production capacity will be reduced from 4 million to 3.1 million). While other European peers have significantly increased investment in electric vehicles, Renault needs to achieve a 3% operating profit margin in 2023 and increase it to 5% by 2025.

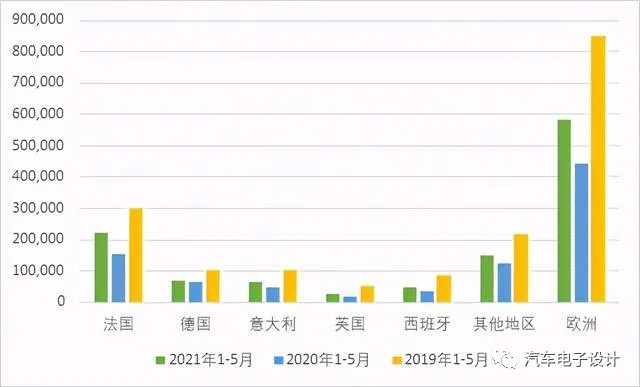

I carefully looked at it, and Renault’s situation in Europe is average. In January-May 2021, European sales were 580,000 units, which was much better than the most difficult 440,000 units in January-May 2020, but compared with the 852,000 units in 2019, it is expected that this year will not be particularly good.

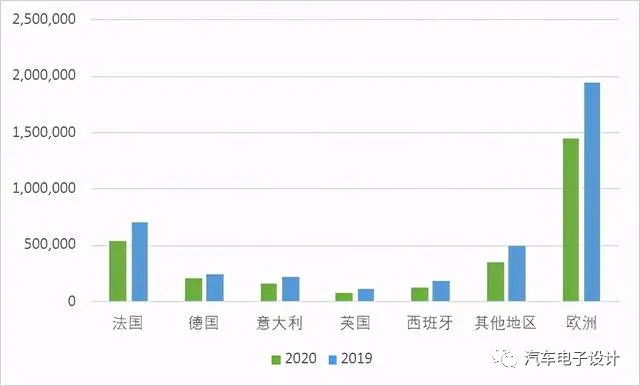

From the overall perspective, Renault sold 1.945 million cars in Europe in 2020, and the number dropped to 1.4439 million in 2020. Considering the current chip constraints and the fluctuating situation of the epidemic, it is expected that the sales will reach about 1.5-1.6 million this year. With the reduction of factories, the product mix in Europe needs to be oriented towards HEV, PHEV and EV, and the sales target of 400,000 BEVs is difficult to achieve without additional large-scale investment.

From the overall perspective, Renault sold 1.945 million cars in Europe in 2020, and the number dropped to 1.4439 million in 2020. Considering the current chip constraints and the fluctuating situation of the epidemic, it is expected that the sales will reach about 1.5-1.6 million this year. With the reduction of factories, the product mix in Europe needs to be oriented towards HEV, PHEV and EV, and the sales target of 400,000 BEVs is difficult to achieve without additional large-scale investment.

Note: Renault sold 115,888 electric cars in 2020.

Renault’s main models currently sold are the ZOE in the B-segment analyzed in Europe. Renault’s main way to increase its profit margin in Europe is to focus on the C-segment. In fact, we can understand that it may be necessary to establish an entity by stripping out the electric vehicle product matrix and factories, which may require the French government to invest or seek external funding support. Otherwise, it is difficult to rely on the current product force to increase the sales of BEVs to 400,000 units.

Can Mégane E-Vision under CMF-EV make it?

Mégane E-Vision is currently in the preparatory stage. The 60kWh version (130kW charging may be different from the battery of the LEAF) under CMF-EV is actually very similar to Volkswagen’s ID3 in all aspects. This car is expected to be unveiled in the second half of this year and delivered in 2022. Judging from Renault’s unsatisfactory sales of electric vehicles, ZOE sold 5,826 units in May and a total of 22,491 units in 2021; Twingo 3 ZE sold 1,751 units in May and a total of 8,338 units in 2021. Dacia’s small car Spring sold 202 units in May and a total of 928 units, plus Kangoo ZE’s 4,673 units, Renault sold about 34,000 units in the first five months of 2021, which is far from doubling in 2021.According to the data of China Association of Automobile Manufacturers, Spring EV has exported 6,000 units, and it is estimated that this will be the production volume for this year. Looking from this perspective, Renault has more than two battery suppliers: LG supplies batteries for ZOE in Europe, Dacia is supplied by a Chinese battery supplier, and Mégane E-Vision is another procurement. AESC will provide 9GWh in 2024, which is approximately 150,000 units, accounting for just over one-third of the 400,000 BEVs.

In Europe, we can actually divide companies into those that are making money and those that are losing money. Renault is a typical car company that currently faces significant challenges. On the one hand, it needs to save costs, and on the other hand, it needs to catch up with other car companies’ rapidly increasing penetration rate of pure electric vehicles. The only way to achieve this goal is to separate the electric vehicle component and seek funding from the government. Developing electric vehicles requires a lot of investment and cannot be profitable in the short term. This report, written by TE, is about how car companies are constantly making promises, but in the current environment of automobile business and pandemic, how can they overcome the challenges? Stubborn Toyota is definitely a “laggard” in BEV in Europe.

In summary, looking at the funds of three Chinese start-ups in electric vehicles, and then looking at the relatively miserable European car companies (Renault, Jaguar Land Rover, Ford), it is obvious that a lot of money is needed to transition to high penetration rates of BEVs. Moreover, the scale and profit of their traditional fuel car businesses are shrinking, and this state of affairs cannot be self-consistent. Currently, Renault cannot acquire more money to invest in battery companies on its own. This approach can only rely on battery companies that are willing to invest. On June 30th, Volvo will have a technology day where we can see how Volvo solves this problem. Recently, Volvo has also given a lot of battery orders to Northvolt. Currently, European car companies are focusing on increasing electric vehicle production capacity (which may be a vision) and maintaining local battery suppliers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.