Author: Qiu Kaijun

Despite having considerable hematopoietic capabilities, new players in the automotive industry continue to use capital market financing.

On June 23, the Hong Kong Stock Exchange published documents showing that XPeng Motors had passed the hearing and is expected to become the “first intelligent electric vehicle stock” listed on the Hong Kong Stock Exchange. The document did not disclose the expected financing amount, but Bloomberg predicts that the financing scale may be $2 billion.

According to an automotive investor familiar with the new car forces, NIO, XPeng, and Ideal have been preparing to go public in Hong Kong after listing in the US. Following XPeng Motors’ first crossing of the finish line, NIO and Ideal are expected to follow suit.

“These new car forces, NIO, XPeng, and Ideal, all have good sales volume and have realized gross profit. Why do they need continuous financing?”

From XPeng Motors’ use of Hong Kong stock financing this time and the development investment plans of each company, it can be seen that these three companies have lofty aspirations and do not aim for success or failure of their current products. Instead, they hope to occupy a dominant position in the future intelligent electric vehicle, especially in the competition of high-level autonomous driving cars.

Therefore, they need to master other capabilities outside of automotive development, production, and service, compete with stronger opponents, and require massive research and development investment. Relying solely on their own hematopoietic capabilities is still not enough.

The smart electric vehicle industry is currently clearly expanding and upgrading. Previously, the model we used to evaluate this “business” was probably not correct, and it may also be beyond the expectations of Li Bin, Li Xiang, and He XPeng.

“Electric Car Observer’s” thinking is that at the current stage of smart electric vehicles, it should not seek victory, but should seek to be present continuously. Otherwise, winning a battle may lead to the failure of the entire war.

How Much Money is Needed to Build a Car?

Li Bin once said that there is no need to build a car without 20 billion yuan. This number has already hit many new car force founders.

Even Li Xiang may not completely agree. He once said that profitability can be achieved with only $ 1 billion.

He XPeng may have been the earliest to make a judgment. He said that even 20 billion yuan is not enough.

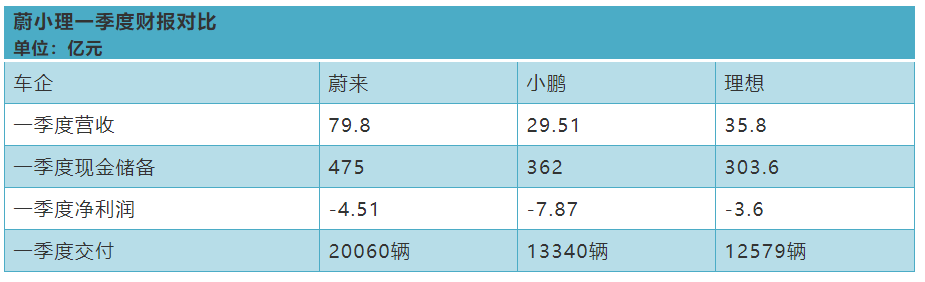

Now, regardless of the money they spent before, their cash reserves in just the first quarter have exceeded 30 billion yuan, and NIO’s even exceeded 40 billion yuan.

But! They still need to continue financing.

Why?

Don’t Pursue Profits, You May Lose

Perhaps, we can start looking for answers from Ideal Motors.In the fourth quarter of 2020, Li Auto achieved profitability with a net profit of 107.5 million yuan. Following this trend, Li Auto could potentially achieve annual profitability in 2021.

However, in the first quarter of 2021, Li Auto, which is stingy and focuses on efficiency, suffered a net loss of 360 million yuan, a significant increase from the net loss of 77.1 million yuan in the same period of 2020.

Sales are still growing, so why is profitability decreasing? According to the financial report, operating expenses increased by over 200 million yuan. Operating expenses mainly consist of two parts: research and development expenses and sales and general administrative expenses. Sales and general administrative expenses only increased by around 80 million yuan, while the majority of the growth was in research and development expenses, which increased by 140 million yuan.

Li Xiang also stated that research and development investment in 2021 will increase to 3 billion yuan, more than double the amount in 2020.

It is quite possible for Li Auto to be profitable in 2021 if it didn’t increase research and development investment significantly. But what about the future?

Compared with the research and development investment in 2020, among the three automakers, Li Auto invested the least with 1.1 billion yuan, while NIO invested the most with 2.488 billion yuan, and XPeng invested 1.726 billion yuan, but when it comes to the proportion of research and development expenses to income, XPeng is close to 30%, far surpassing NIO and Li Auto.

One not-so-coincidental trend is that in terms of autonomous driving, XPeng is already ahead of NIO and Li Auto in terms of talent, research and development progress, and current product functionality.

While Li Auto focuses on the development of extended range models and NIO faced a financial crisis, leading to the disbanding of its autonomous driving team, XPeng has never relaxed investment in autonomous driving.

The current battle of intelligent vehicles is still in the layout stage, rather than a decisive victory or defeat. At this time, it is necessary to deploy heavy troops on strategic high ground. Li Auto has doubled its research and development investment this year, focusing on high-voltage electric platforms and intelligent driving. This seems sudden and appears to be a significant advancement from the original plan. The logic behind it is not to compete over one city or one pool, but to gradually expand the company’s influence.

From Car Production to Expansion and Upgrades

If producing cars in the traditional sense, 20 billion or 1 billion US dollars may be enough.

However, for intelligent electric vehicle manufacturers, this may not be enough, because their boundaries and dimensions are completely different.

They need to expand outwards. Previously, powerful automakers controlled design, engine, transmission, and chassis technologies. Automakers without the same level of power handed over these core and non-core parts to suppliers, only doing final assembly before selling them.

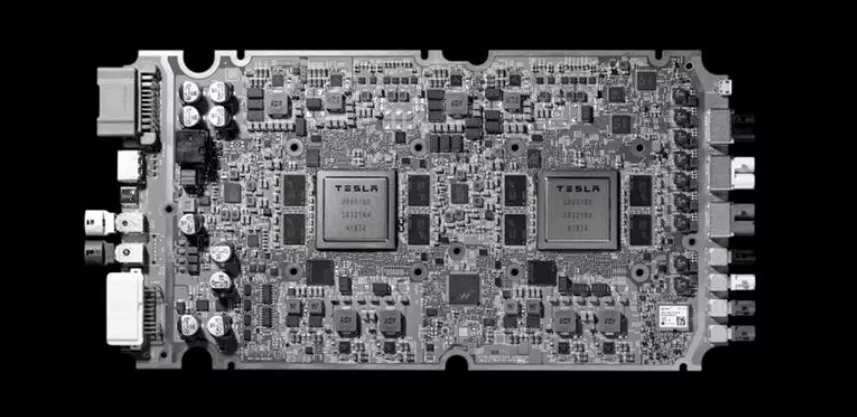

In the era of intelligent electric vehicles, to take the lead, they need to grasp more aspects.Taking Tesla as an example, in the beginning, it collaborated with companies like Toyota, Lotus, and Mercedes-Benz to learn about the design of car appearance, interior, chassis, and production. However, it began with independent research and development of battery packs, established a direct sales system, then developed electronic and electrical architectures, software, and even further, conducted independent research and development of intelligent driving and chips. During this process, Tesla also created a supercharging network and merged with Solarcity, expanding into the energy industry.

From traditional automakers to intelligent car manufacturers today, their capabilities have evolved from partial research and development and integrated production to research and development, production, sales, energy, and even more – especially research and development, expanding outward as a technology company combining hardware and software. From Wei Xiaoli’s research and development expenditure, it can be seen that they are not only developing car models, but also involve electronic and electrical architectures, operating systems, intelligent cabins, intelligent driving, charging and discharging technology, and even chips.

They need to upgrade. Thinking from the dimension of manufacturing problems is already outdated. They are no longer just manufacturers, but travel service providers or travel space operators, or difficult to define a role.

Shen Yan, CEO of Ideal Auto, once introduced at a forum at Shanghai Jiaotong University that to win the battle of intelligent cars, we need to think about upgrading. He believes that above intelligent electric cars, there is the integration of four worlds: the material world, the human cognitive world, the digital world, and the machine cognitive world. “The larger application scenario of these four worlds is smart electric vehicles.”

What capabilities are needed to integrate the four worlds? How much investment is needed to build these capabilities?

It is difficult to estimate because no one has done it before, but it is certainly not covered by the investment of car manufacturing.

Who Is the Competitor?

If a new automaker has two or three hot-selling cars and several billion yuan in hand, it can indeed challenge many traditional automakers. However, traditional automakers are no longer the main players in the era of intelligent automobiles.

The main players are bigger giants: Xiaomi, Huawei, and Apple…

In 2020, their financial data was as follows:

Xiaomi’s revenue was RMB 245.9 billion, with a net profit of RMB 13 billion;

Huawei’s revenue was RMB 891.4 billion, with a net profit of RMB 64.6 billion;

Apple’s revenue was USD 274.5 billion (over RMB 1.8 trillion), with a net profit of USD 57.4 billion…

Compared with them, WEY’s annual revenue of one or two hundred billion yuan and cash reserves of three to four hundred billion yuan are not at the same level.

Although Lei Jun invested in NIO and XPeng, he ultimately entered the field of car manufacturing, with an initial investment of RMB 10 billion and an expected future investment of USD 10 billion over the next ten years.

To compete with NIO and XPeng, their investment in the next decade also needs to be at the USD 10 billion level, right?

The participation of these technology giants from other industries will also change the competition situation of intelligent electric vehicles. As Ideal Cars summarized, it will change from the preliminary round to the final round due to greatly improved concentration.

Ideal Cars’ grand goal of occupying 20% of the market by 2025 is more about seeking survival than victory, because without scaling up, they will be eliminated.

Storing enough food and grass for a protracted war is a necessary choice for subsequent competition.

Currently, the capital market recognizes the field of intelligent electric vehicles and is willing to give high valuations. For Wei Xiaoli, it is better to finance as soon as possible, because it will be more difficult to obtain financing when the capital market turns against them. The first batch of new car companies also received favor, but failed to obtain enough financing. In the capital winter around 2018, the fund chain broke and they never recovered.

For spectators, financing through the capital market is a normal thing for companies, and there is no need to associate it with raising funds or cashing out. The original intention of the capital market is to exchange equity appreciation gains in exchange for giving entrepreneurial blood to business people.

In May, “Latepost” reported on the strategic adjustments of Ideal Cars and mentioned that Wang Huiwen, co-founder of Meituan, participated in a strategic meeting with Ideal Cars. Wang Huiwen reviewed his experience of playing in the final round during the group-buying battle: “You must do your best, because looking back, you always think that the previous strategies were too conservative, and the funding and resources invested were far from enough.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.