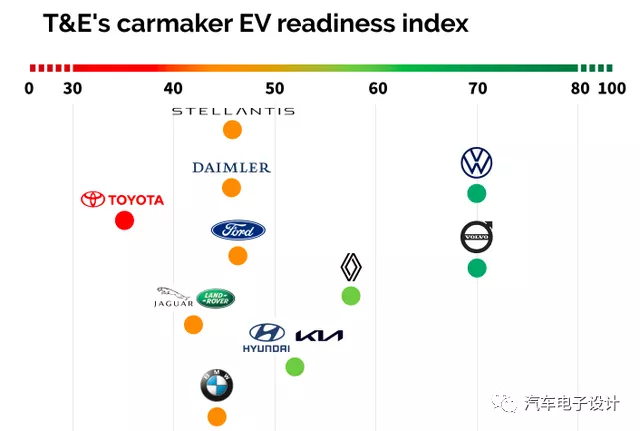

Recently, there have been continuous news regarding battery companies in Europe. I think it is necessary to look at the overall background here. The most important issue is that the European Parliament voted on the EU Climate Law on Thursday, approving the goal of reducing emissions by at least 55% from 1990 levels by 2030. The latest EU legislation proposed by EU commissioners on July 14th, which prioritizes actual emission reductions, will help achieve this 55% reduction target. The draft law also includes the goal of achieving net-zero emissions by 2050 and plans to establish carbon dioxide reduction targets for 2040. In this sense, this directly restrains the compensation of European car makers for turning to pure electric vehicles.

Battery layout of European car makers

During this period, the biggest star in Europe is Northvolt.

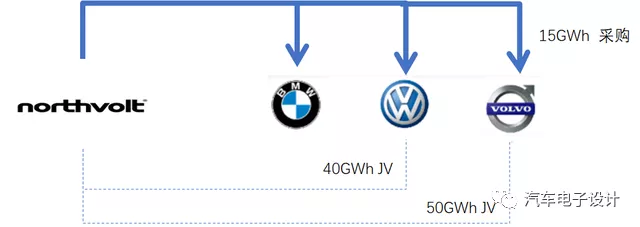

On June 9th, Swedish battery company Northvolt received a new round of financing of $2.75 billion (the annual production capacity of the Swedish factory will increase from 40GWh to 60GWh). Production will begin at the factory in 2021, and deliveries to Volkswagen will begin in 2023.

On June 21st, Swedish automaker Volvo also established a joint venture with Northvolt, which is aimed at an annual production capacity of 50GWh for the future. Before that, Volvo and Northvolt established a research and development base in Sweden in 2022 to develop a new generation of batteries for Volvo and Polestar. More importantly, Volvo has covered 15GWh of Northvolt’s previous factory capacity.

In addition to the €2 billion battery supply contract signed with BMW, Northvolt has taken a considerable part of Europe’s electric vehicles.

2) According to Business Insider’s report, Daimler has leaked news.# European Union’s self-sufficient battery plan is supported by the following efforts

This media’s disclosure (possibly the second round) has revealed that Daimler also hopes to manufacture batteries in Europe. Previously, Daimler agreed with Farasis Energy in 2019 to purchase lithium-ion batteries from Farasis’ German factory. According to this media, Farasis’ battery cell samples did not match Daimler’s expectations, which directly led to Daimler CEO Ola Kallenius changing his mind. Daimler’s plan is to either enter this field completely on its own (which is not practical) or to find a battery company to cooperate with.

Note: Among the numerous European battery startups, Northvolt, Freyr, Verkor, Automotive Cells, Britishvolt, and InoBatAuto, Northvolt is considered the most reliable.

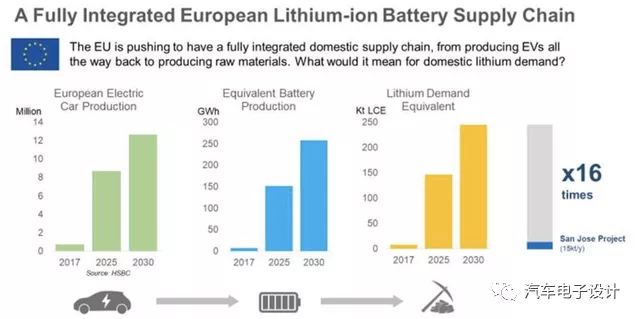

I believe we shouldn’t be mistaken. The continuous increase in carbon emissions reduction requirements is supported by the European Union’s efforts to produce batteries. From the plan, by 2025, the EU will be able to produce enough batteries to power its rapidly developing electric vehicle industry, essentially getting rid of its dependence on imported batteries as a means of significantly reducing carbon emissions. Currently, even if the EU can obtain raw materials such as lithium, it still needs to transport them to China for refining. This “carbon footprint” reduces the attractiveness of batteries to European consumers. At the same time, if there is a shortage of key raw materials such as lithium and rare earths, the EU will not be able to achieve its climate neutrality goals. Therefore, the relationship between the EU and key raw material supplier countries will be “more strategic”. The EU will ensure the security of critical raw material supply to achieve EU “strategic autonomy”.

The main measure taken by the European Union to promote electric vehicles is the new battery regulation proposed by the EU Commission Members in December 2020, Regulation (EU) 2020/353 on batteries and waste batteries, which will take effect on January 1, 2022. The EU has upgraded the existing battery management approach from a “directive” to a “regulation,” implementing more comprehensive regulation of the EU battery industry chain, including specific environmental protection regulations such as carbon emissions, raw materials supply and demand, and the utilization rate of reusable raw materials. Starting from July 1, 2024, only rechargeable industrial and electric vehicle batteries with established carbon footprint declarations may be placed on the market. New requirements for carbon footprint, recycled raw materials, electrochemical performance and durability, disassembly and replaceability, two-dimensional barcode and CE label, battery management system, battery passport, safety, etc. are added, and new requirements are made for operator due diligence investigations and the recycling and treatment of waste batteries. In the future, only products that comply with the EU’s relevant standards will be allowed to circulate in the European Union. The ultimate goal is to establish the EU battery standard as an international standard in the battery industry. In addition, the EU plans to include the minimum recycling quotas for batteries entering the EU market in legal provisions. From 2027, electric vehicle batteries will need to declare their cobalt, lead, lithium, and nickel content at the time of recycling, and the minimum recycling quotas will be implemented in 2030. The recommended quotas for cobalt, lead, lithium, and nickel are 12%, 85%, and 4%, respectively, with gradual increases. In 2032, the quotas for cobalt, lithium, and nickel will increase to 20%, 10%, and 12%, respectively. In my personal opinion, the European Union is indeed pushing for electric vehicles in various aspects, and their attitude is truly serious.

The main measure taken by the European Union to promote electric vehicles is the new battery regulation proposed by the EU Commission Members in December 2020, Regulation (EU) 2020/353 on batteries and waste batteries, which will take effect on January 1, 2022. The EU has upgraded the existing battery management approach from a “directive” to a “regulation,” implementing more comprehensive regulation of the EU battery industry chain, including specific environmental protection regulations such as carbon emissions, raw materials supply and demand, and the utilization rate of reusable raw materials. Starting from July 1, 2024, only rechargeable industrial and electric vehicle batteries with established carbon footprint declarations may be placed on the market. New requirements for carbon footprint, recycled raw materials, electrochemical performance and durability, disassembly and replaceability, two-dimensional barcode and CE label, battery management system, battery passport, safety, etc. are added, and new requirements are made for operator due diligence investigations and the recycling and treatment of waste batteries. In the future, only products that comply with the EU’s relevant standards will be allowed to circulate in the European Union. The ultimate goal is to establish the EU battery standard as an international standard in the battery industry. In addition, the EU plans to include the minimum recycling quotas for batteries entering the EU market in legal provisions. From 2027, electric vehicle batteries will need to declare their cobalt, lead, lithium, and nickel content at the time of recycling, and the minimum recycling quotas will be implemented in 2030. The recommended quotas for cobalt, lead, lithium, and nickel are 12%, 85%, and 4%, respectively, with gradual increases. In 2032, the quotas for cobalt, lithium, and nickel will increase to 20%, 10%, and 12%, respectively. In my personal opinion, the European Union is indeed pushing for electric vehicles in various aspects, and their attitude is truly serious.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.