On June 23rd, Bloomberg reported citing sources that XPeng has been approved for listing on the Hong Kong Stock Exchange, with the earliest possible financing of $2 billion this year. XPeng responded by stating that they have no comment on this matter.

In early March of this year, Reuters reported citing sources that Li Auto, NIO, and XPeng are planning to list in Hong Kong as soon as this year. At that time, insiders said that the three companies plan to sell at least 5% of their shares, and based on their market values in the US stock market, it is expected that the three companies can raise a total of $5 billion. In addition, XPeng and Li Auto may choose to have a dual primary listing in Hong Kong, and XPeng is considering a third listing on the Shanghai Science and Technology Innovation Board.

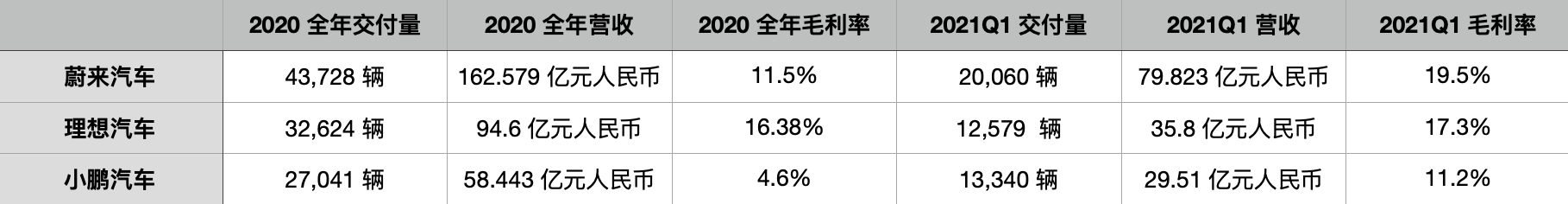

According to their comprehensive financial reports for 2020, all three companies achieved positive gross margins. Among them, NIO had the highest annual revenue, and Li Auto had the highest annual gross margin. As of the first quarter of 2021, NIO had the highest revenue and gross margin.

🔗Hong Kong and US stock account opening (receive 1 NIO share and 90 days of commission-free trading in the US)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.