From January 11th to 13th, 2020, the China Electric Vehicle Hundred People Forum (2020) was held at the Diaoyutai State Guesthouse in Beijing. The theme of this year’s forum was “Grasping the Situation, Focusing on Transformation, and Leading Innovation”.

As usual, let’s talk about the overall trend reflected in the entire conference first, and then give the key points of the speeches by the participating leaders and guests.

The word “sales decline” appeared frequently at the Hundred People Forum this year. With the macroeconomic downturn and the subsidy reduction for new energy vehicles, the development of the entire automotive industry has slowed down, and the development of electric vehicles has entered an adjustment period. However, from various signs, the long-term positive trend of the development of new energy vehicles has not changed.

This year, the safety of new energy vehicles is still a focus of everyone’s attention. Several leaders mentioned in the speeches at the main venue that dispelling consumers’ concerns about safety is an essential step in the development of new energy vehicles.

As the energy density and safety of individual battery cells reach a balance point, Academician Ouyang Minggao proposed that the specific energy of a single cell is not what our cars need, but the true system-specific energy that is finally installed on the car. He also praised the technological innovations of CTP batteries from CATL and blade batteries from BYD.

To stabilize market expectations and ensure the healthy and sustainable development of the industry, Minister Miao Wei stated that this year’s new energy vehicle subsidy policy will remain relatively stable and will not be significantly reduced.

Secondly, based on China’s energy structure, with the increase in the number of pure electric vehicles, charging piles will not only meet the charging needs of electric vehicles, but also need to meet V2G technology. After vehicles and the grid are connected, double-sided charging and discharging can be flexibly carried out through scientific regulation to effectively achieve peak-shaving and filling the valley for the national grid.

The following are the key points of the speeches by the participating leaders, corporate executives, and technical experts, divided into three parts.

Part 1: Key Points of Speeches by Participating Leaders

- Market Situation:

“This year, the entire automobile industry ended its rapid growth that lasted for several years and entered a new stage of deep adjustment in the market. From January to November of this year, automobile production and sales completed 23.038 million and 23.11 million respectively, a year-on-year decrease of 9% and 9.1%, but the sales in December seemed to be narrowing the decline.”## Three Aspects Contributing to the Decline in Car Sales

In terms of analysis, there are roughly three aspects: first, macroeconomic downturn pressure and external effects such as trade friction. Second, during the upgrade of emission regulations from National 5 to National 6, there were cases where policies, market, and enterprises were not coordinated, causing a backlog of National 5 vehicle inventory and insufficient preparation for National 6 vehicles. Third, the impact of the phase-out policy of new energy vehicle subsidies has caused a certain degree of digestion, causing a significant decline in sales since July. — Vice Chairman of the National Committee of the Chinese People’s Political Consultative Conference and Chairman of the China Association for Science and Technology, Mr. Wan Gang

“In 2019, there was a relatively significant increase in industrial integration. In the passenger vehicle sector, the top ten companies accounted for 75.6% of sales; in the commercial vehicle sector, the top ten companies accounted for 74.8%. Overall, the top ten companies’ share in the vehicle industry is at around 75%, while the proportion of the top five battery companies reached 79.4%, indicating a more obvious concentration in the power battery market.” — Vice Chairman of the National Committee of the Chinese People’s Political Consultative Conference and Chairman of the China Association for Science and Technology, Mr. Wan Gang

“This year’s production and sales may see negative or zero growth, similar to the significant decline of around 10% and 8% in 2018 and 2019, respectively. This trend has started to narrow, and from the current months’ performance, it indeed matches everyone’s analysis. This year, or at the latest, next year will be the period when auto production and sales bottom out and stabilize. We estimate that our production and sales will remain at around 25 million vehicles, which will be the bottom line. The automobile industry has also entered a key period of transforming development methods, optimizing industrial structure, and shifting to high-quality development from high-speed growth.” — Minister of Industry and Information Technology, Mr. Miao Wei

“In recent years, the development of clean energy both domestically and abroad has been very rapid. Nearly two thirds of the world’s newly installed power capacity is from clean energy. As of the end of 2019, China’s non-fossil energy installed capacity had reached 800 million kilowatts, accounting for about 41.5% of the total installed capacity, including wind, solar, hydro and nuclear power at 200 million, 190 million, 360 million, and 45 million kilowatts, respectively. The installed capacity of wind, solar, and hydro ranks first in the world, and nuclear power ranks the third. The consumption of non-fossil energy continues to improve.” — Regulatory Director of the National Energy Administration, Mr. Li YeAt the end of 2019, China’s charging infrastructure reached 1.2 million, an increase of 500,000 from the previous year. The structure of the facilities was further optimized, with 500,000 public charging piles growing at a slower rate and 700,000 dedicated charging piles maintaining a high-speed growth trend. This is in line with the transformation of new energy vehicles from policy-driven to market-driven. – Li Ye, Director of Supervision of the National Energy Administration

Currently, the stock of new energy vehicles is about 3.63 million (as of October 2029), with a platform access volume of 2.96 million. The accuracy of the national platform early warning rate in the first 10 days before the accident can reach 70%. The number of fuel-burning accidents for cars is 20,000 to 40,000 per year on average nationwide, while the number of new energy vehicle burning accidents is approximately 0.9-1.2 per year with a total of 10,000 vehicles burned. – Sun Fengchun, Academician of Chinese Academy of Engineering and Professor of Beijing Institute of Technology

- Policy orientation:

(1) It is recommended to optimize the purchasing and usage environment of new energy vehicles in the public service sector.

(2) It is recommended to open up road rights for new energy logistics vehicles nationwide.

(3) It is recommended to cancel the restrictions on the purchase and use of new energy vehicles.

(4) It is recommended that by the end of 2020, new energy vehicle financial subsidies will not be further reduced, and no new subsidy policies or adjustments will be made to the product and technology indicators. This will allow companies to invest more time and effort into product planning and research and development after the subsidy cuts, better meeting market demand.

(5) It is recommended to continue to waive the purchase tax on new energy vehicles before 2025. At the same time, we should optimize the management system for the implementation of the double credits system, which ultimately needs to be incorporated into the carbon trading process. This is because the greatest contribution of new energy vehicles is to reduce carbon emissions.

(6) It is recommended that charging service companies for civilian vehicles enjoy civilian electricity prices. – Wan Gang, Vice Chairman of the National Committee of the Chinese People’s Political Consultative Conference and Chairman of the China Association for Science and Technology

“Everyone is very concerned that the subsidy reduction in July 2019 will be further reduced on July 1 of this year. Rest assured that there will be no further subsidy reduction on July 1 of this year.” – Miao Wei, Minister of Industry and Information Technology

It is recommended to promote the development of the hydrogen and fuel cell industry from six aspects:

(1) Strategic leadership must be maintained. It is recommended that the country incorporate hydrogen energy into the national energy strategy system, clarify the status of hydrogen energy in the energy system, and develop a system that supplements hydrogen energy with hydropower, wind power, and photovoltaic power generation.

(2) Innovation-driven development should be pursued. Based on the analysis of the current deficiencies and competitive advantages of the industry’s technology, we should overcome the shortcomings of basic materials, core technologies, and key components, and achieve independent innovation and high-level open cooperation through collaborative promotion, with a focus on breakthroughs in key technologies.### 3. Accelerate Industrial Layout

To strengthen the coordination of the industrial chain and form a full industrial chain system layout for the production, storage, transportation and utilization of performance. R&D should be relied on to support industry assistance, demonstration projects and other initiatives to improve the level of industrialization.

4. Adhere to Market Orientation

5. Stick to Leading with Standards

6. Expand International Cooperation

“Electric power drives the transformation of energy and power, intelligent networking and autonomous driving promote changes in the operating mode, intelligent manufacturing promotes changes in industrial production and processes, and the construction of smart cities is promoting the use of automobiles and energy. For the automotive industry, this transformation is the confluence of energy and power, R&D and manufacturing, and marketing models. It is the biggest transformation the automotive industry has encountered in a hundred years, making it an unprecedented shift.” – Vice Chairman of the National Committee of the Chinese People’s Political Consultative Conference and Chairman of the China Association for Science and Technology, Wan Gang

“Hydrogen fuel cell power is more suitable for long-distance, large-scale, high-speed, heavy-load substitution of diesel engines, while lithium-ion batteries are more suitable for replacing gasoline engines. Although the proportion of diesel vehicles compared to gasoline vehicles is small, their energy consumption and emissions are still significant.” – Academician of the Chinese Academy of Sciences and Executive Vice Chairman of the China EV100, Ouyang Minggao

Although the total amount of charging operation is large, the technical level is still low. Various charging facilities can only realize one-way charging and cannot interact with the grid. Private charging facilities cannot provide intelligent sharing services.

It is necessary to carry out experiments and demonstrations of charging facilities interacting with the grid in key areas, encourage the application of new technologies such as V2G, strengthen equipment R&D, and rely on the Internet + smart energy to improve the intelligence level of charging. – Li Ye, Director of Regulatory Control of the National Energy Administration

3. Technological Directions:

“In terms of electric motors, we need to develop new types of electric power drive systems, including efficient drive motors, new power electronics and integrated drive transmissions. Power batteries and management systems should be developed towards efficient, safe, low-cost and intelligent management systems, as well as new types of power batteries. Improving basic research, especially in electrochemistry, power electronics, fuel cells, and lightweight structures, is essential to drive original innovation during the period of transformation.” – Vice Chairman of the National Committee of the Chinese People’s Political Consultative Conference and Chairman of the China Association for Science and Technology, Wan Gang

“In the future, high-performance, high-safety, long-life, and low-cost new lithium-ion batteries and new battery systems will become the main direction of the development of power batteries. New lithium-ion batteries are mainly developed by replacing the existing lithium-ion system with high-voltage, high-capacity positive and negative electrode materials and high-voltage electrolytes, and include lithium-sulfur batteries, lithium-air batteries, and all-solid-state batteries. These are still in the basic research and development stage and need our attention.” – Vice Chairman of the National Committee of the Chinese People’s Political Consultative Conference and Chairman of the China Association for Science and Technology, Wan Gang.The change in this year is that the specific energy of single battery cell is not what our vehicles need. What automotive industry really needs is the system’s specific energy that is ultimately placed on the car. We hope that the ratio of the specific energy to that of the single battery cell is roughly half greater. For example, in terms of volume, half of it is not occupied by single battery cells but by non-single ones. Therefore, the potential in this area is enormous. Two technology-leading companies in battery packs have made innovations in the field of battery packs, such as CATL’s CTP and BYD’s blade battery technology. — Ouyang Minggao, Academician of the Chinese Academy of Sciences and Executive Deputy Director of the China Electric Vehicle 100 Forum.

Our battery system costs have reached 0.6-1 yuan/Wh. 1 yuan/Wh is for ternary batteries, and the lower cost is for lithium iron phosphate batteries. In the future 5 years, there is still room for battery cost reductions, for example, the cost for ternary batteries could be reduced to 0.7 yuan/Wh by 2025. The cost advantages of lithium iron phosphate batteries are particularly noticeable for battery recycling and utilization, and blade batteries and other technologies can effectively alleviate the short board in volume-specific energy for lithium iron phosphate batteries. For an A0-class model, the volume can be loaded up to nearly 60 kWh, which can basically solve the problem of range anxiety.” — Ouyang Minggao, Academician of the Chinese Academy of Sciences and Executive Deputy Director of the China Electric Vehicle 100 Forum.

“Next, there are two aspects to improve performance further: the first is the new generation of power electronics, which will make the electric drive system integrated and flattened with the vehicle’s chassis. If it is a hybrid, the battery is full, and the next step is to continue removing the empty space. This is the common terminology. The second aspect is the further improvement of performance, of course, the progress of electrolyte technology.” — Ouyang Minggao, Academician of the Chinese Academy of Sciences and Executive Deputy Director of the China Electric Vehicle 100 Forum.

“Diversification of functions, three Vs in one, V2G, V2H, V2X, V2H has now begun, which is the integration of buildings and vehicles with the electric drive system. The integration of the three systems, namely, electrification, low carbon energy, and intelligent systems, is the blue ocean. Therefore, new energy vehicles have multiple attributes of intelligent terminal transportation tools and energy equipment. If customers need more batteries, the total cost may decrease because they can use the battery as energy storage to discharge to the grid for profit.” — Ouyang Minggao, Academician of the Chinese Academy of Sciences and Executive Deputy Director of the China Electric Vehicle 100 Forum.”By 2030, the total ownership cost of pure electric vehicles will become equivalent or better than the cost of plug-in hybrid vehicles with an electric range of 100km compared to pure electric vehicles with a range of 500 km. We believe that plug-in hybrid vehicles will rise first and then gradually decline, with a peak around 2025. Why has this happened? Because by 2030, functional diversification will emerge, and customers will need to add more batteries to their cars. This is because at that time, our vehicle inventory will be large and V2G technology will come into play.” – Ouyang Minggao, academician of the Chinese Academy of Sciences and executive vice chairman of the China Electric Vehicle Hundred Member Association

“In the future, we need to accelerate the upgrade of the next generation of electric drive technology, especially in high-performance electric motors, ultra-high-power density integrated motor controllers, and in high-density IGBT and silicon carbide semiconductor devices. These are the directions for future upgrading and development.” – Wan Gang, vice chairman of the National Committee of the Chinese People’s Political Consultative Conference and chairman of the China Association for Science and Technology

“The next step is to accelerate the development of plug-in and extended-range hybrid electric vehicle specific drive systems. In the future, the development of the extended-range and plug-in hybrid electric vehicles may be an important direction. Therefore, in terms of control strategy, we should primarily use internal combustion engines and power generation systems to meet energy needs, use electric drive systems to meet dynamic needs, and pay special attention to energy recovery, which can improve comprehensive energy conservation and emissions reduction.” – Wan Gang, vice chairman of the National Committee of the Chinese People’s Political Consultative Conference and chairman of the China Association for Science and Technology

“Do not hand over all the challenges of autonomous driving to intelligent connected cars. We need to leverage our institutional advantages and market advantages to promote digitization and intelligence transformation of our country’s highway system and traffic control systems such as traffic lights. There are two types of technologies used internationally. One is based on LTE V2X under 4G and 5G scenarios, and the other is based on DSRC on the basis of 802.11P. There have been diverging views within the Ministry of Transport for a long time. Finally, we reached a consensus. In China, we will strongly promote 5G and LTE V2X in the transformation of roads. Road network digitization, road network and in-vehicle digitization will follow the same standard with shared and mutually recognized data format interfaces.” – Miao Wei, Minister of Industry and Information Technology

“BYD has developed a blade battery – iron battery product, which will be mass-produced for the first time in its Chongqing factory in March. The Chongqing factory is a modern power battery factory. This new blade battery has a 50% higher volume energy density than traditional iron batteries, with high safety, long life, and a vehicle life of more than one million kilometers. The first model equipped with a blade battery will be the BYD Han, which will be launched in June this year and will have a range of 600 km.” – Wang Chuanfu, Chairman of BYD Co., Ltd.”Facing the upcoming era of post-subsidy, there are four major challenges for the automotive industry: first, how to further discover and redefine user value; second, how to handle the increased supply competition brought by the double integral policy; third, how to seize the opportunities brought by non-restricted cities and private users; fourth, how to digest the cross-border technology risks and operating cost pressures.” — Wang Xiaoqiu, President and Deputy Secretary of the Party Committee of SAIC Motor Corporation Limited

“Although the operating costs of new energy vehicles are low, high initial investment costs and low residual values of second-hand vehicles discourage most private consumers. The charging infrastructure is still inadequate, with public charging poles and fast-charging systems lagging behind market demands, further diminishing consumers’ purchasing desires. In particular, in 2019, the subsidy exceeded expectations, and after the transition period, the market continued to decline, seriously impacting the market’s confidence.” — Zhang Baolin, Chairman of Changan Automobile Co., Ltd.

“Tesla has lowered its price again for locally produced cars. Can you still withstand it? Overall, we are still alive.” — Li Bin, Founder, Chairman and CEO of NIO

“Our average vehicle sales price at NIO, before subsidies, is over RMB 400,000. That is, adding up the ES8 and ES6 will cost over RMB 400,000. We don’t have much room for a price cut when Tesla is cutting prices, and we are all negative gross margin. Therefore, the only thing we can do is to provide good service and products, and consumers will reward us.” — Li Bin, Founder, Chairman and CEO of NIO

“We believe that a battery swap-based solution for separating cars and electricity can bring many benefits to users, including rechargeability, interchangeability, upgradeability, and tiered utilization, enabling users to lease battery assets like other assets.” — Li Bin, Founder, Chairman and CEO of NIO

“I especially want to call attention to the fact that new energy vehicles are very important. We can start with a new way and a new track. But to become a strong player, we must have intelligent electric vehicles. I think intelligence represents software, intelligence represents data, and this is the future.” — He XPeng, Chairman and CEO of XPeng Motors

“Digitalization and electrification will be the two key words that define the future of the automotive industry. For both of them, the global standards and driving force will come from China. As the long-term leader of this industry, Volkswagen adheres to the promise of making in China for China, and even for the whole world.

Our shift towards zero-emission vehicles embodies our commitment to achieving carbon neutrality by 2050, not only for the vehicles we produce, but also our goal to achieve zero emissions in China and the global value chain.” — Stephan Wöllenstein, CEO of Volkswagen Group (China)

“In terms of overall energy efficiency, FCVs cannot compete with BEVs, especially over the entire lifecycle. The fuel efficiency of an FCV can only reach 25% to 30%, while a BEV can achieve 70% to 80%. In addition, a significant amount of energy is lost during the hydrogen production process, not to mention the serious lack of hydrogen infrastructure currently. There are also significant challenges in the transportation safety of hydrogen. “- Volkswagen Group (China) CEO Stephan Woellenstein

“According to estimates, the cost of mainstream power batteries can be reduced by 30% by 2030. At the same time, as China’s global fuel consumption standards continue to rise, the cost of conventional fuel vehicles will gradually increase. Therefore, by 2023, new energy vehicles are expected to be cost-competitive with traditional fuel vehicles. By 2029, the investment return cycle for vehicles will gradually shorten from 10 years to 3 years, further highlighting the competitive advantage of new energy vehicles.”- Beijing Automotive Group General Manager Zhang Xiyong

“Currently, what we are doing is not the most satisfactory. We still need 1-2 years to further integrate the driving system to a price point similar to an 8AT. This is our goal and will be achieved in two years. After two to three years, when our electrical and driving systems are stable, we are confident that we can achieve comprehensive cost advantages over traditional fuel vehicles in PHEVs.”- Shanghai Automotive Industry Corporation Deputy Chief Engineer Zhu Jun

“I don’t know how other vehicle manufacturers are doing, but our sales last year were not ideal. At the same time, price competition in the market has driven us to only theoretical gross profits. If we continue to decrease or withdraw subsidies, it will be impossible to not significantly reduce costs or find new paths.” – Shanghai Automotive Industry Corporation Deputy Chief Engineer Zhu Jun

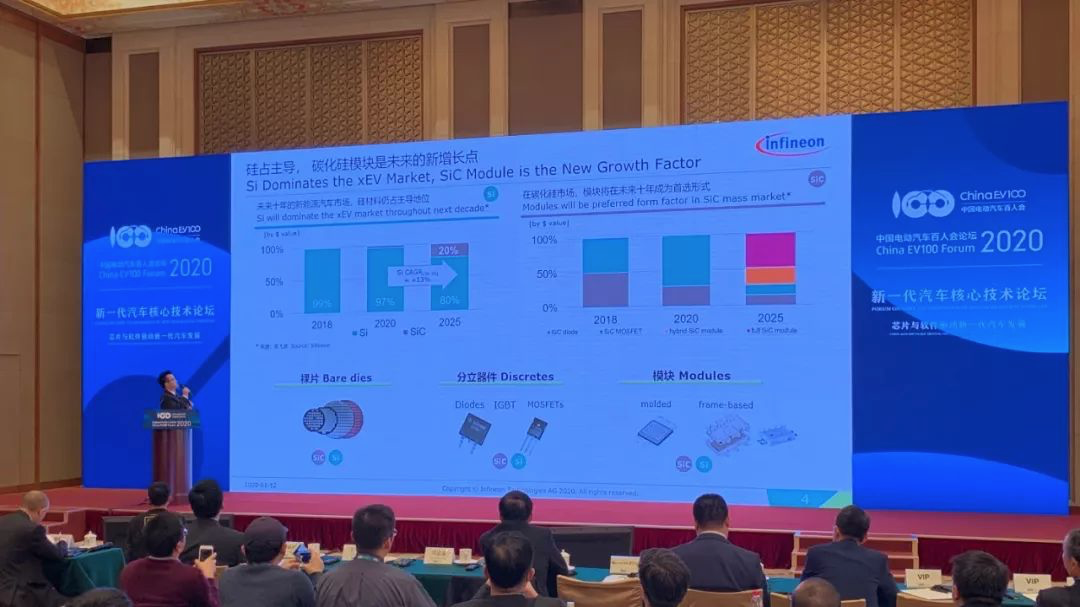

“We believe that in the range extender field, the two main development technologies in the future are integration and optimization. I encountered many difficulties during the matching process, and only with highly integrated engine systems, including the layout of the entire front-end system, overall efficiency, safety, and more, can we achieve the best results. In the future, it may be possible to achieve ‘six-in-one’, which integrates the engine, transmission, generator, drive motor, engine EMS, and generator GCU/MCU together, achieving more efficient range extension. In addition, there will be optimization for the engine itself.” – Liu Liguo, Vice President of the Ideal Automotive Technology Research Center.”For traditional powertrain vehicles, the average value of semiconductor is about $350, and power semiconductors account for about 20\%, which is $70. With the development of electrification, the value of semiconductors in pure electric vehicles has doubled, reaching $700, and about half of them are power semiconductors. In the electrification process of automobiles, the vast majority of incremental semiconductor markets are in power semiconductors.” – Qin Jifeng, Market Director of Automotive Electronics Business Unit, Greater China Area, Infineon Technologies (China) Co., Ltd.

“Until 2025, silicon will still dominate. And the current market share of silicon carbide is about 1\% to 3\%, with the development of silicon carbide technology, about one fifth of the market will use silicon carbide solutions by 2025.” – Qin Jifeng, Market Director of Automotive Electronics Business Unit, Greater China Area, Infineon Technologies (China) Co., Ltd.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.