Roomy – Media under Outing Group, Focusing on the Evolution of the Automobile Industry Chain

“Start by running, and sprint from the beginning.”

Since the moment of announcing the updated logo, SAIC Group has not left any room for turning back. From Chairman Chen Hong to President Wang Xiaochiu, they have firmly believed in a transformation towards a “user-oriented high-tech company.”

Despite the fact that “user” and “tech” are already commonplace in this era of ubiquitous electrification, we cannot ignore the significance of SAIC’s decision to update their logo in the name of “group,” sharing the rhythm and goals of the change.

In fact, one can understand it as starting from scratch, including products, brands, channels, marketing, etc.

“We are making every effort to enter a new track and shift towards users in terms of concepts, ideas, business models, and organizational structure,” said Chairman Chen Hong at the 2021 capital market communication meeting, with “users” as a frequently mentioned term.

Times have changed, but the search for user demand remains the same.

Almost every huge technological advancement creates a great name. This has been the most powerful endorsement of Chinese cars in the 40-year process since the Santana. We hope that the future will continue to bear this name.

Changing the Logo – a Thorough Change

On June 15th, SAIC Group announced the use of a new brand logo.

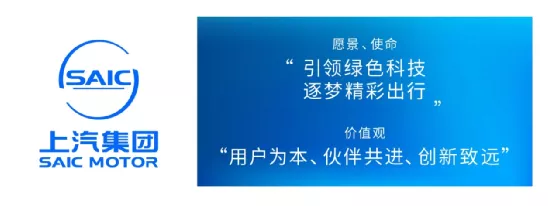

The new logo has a flatter font and badge design, with a color scheme using “SAIC Blue,” which is labeled “PANTONE 2387C,” implying “the blue planet, the rising sun.” It has been 9 years since the last logo change.

Replacing logos is not a new practice for automakers. Most companies aim to enhance brand value and reshape brand image through updating their logos. However, “using a logo change strategy to show youthfulness” is not SAIC’s main goal.

SAIC continues to contribute more power to the transformation of China’s automobile industry and the global trend of environmental protection through intelligence and technology, in this era where the new and the old forces stand at the same river.

These goals are not just grandiose ideas, but responsibilities that must be carried by leading companies.

Therefore, the meaning behind the new logo, “the blue planet, the rising sun,” represents SAIC’s vision, mission, and values: “Leading green technology, striving for a wonderful journey” and “Putting users first, progressing with partners, innovating for a better future.”

Changing the logo is like a necessary ritual in transformation, often implying the beginning of transformation and a firm determination.

Therefore, while changing the logo, SAIC also released plans for battery technology, software technology, and reform mechanisms. Chairman Chen Hong hopes to create a “new SAIC” through decisive internal and external changes.

Chairman Chen Hong has also offered a clear definition of what “new SAIC” means.# Full Efforts into the Next Generation Electric Intelligent Vehicles that “Data Determines Experience, Software Defines Vehicles”

The Saic Motor Corporation Ltd. (“Saic”) aims to accelerate its transformation into a high-technology enterprise that caters for users’ needs with technological advancement, globalized operations, upscale brand, and ultimate user experience. The new generation of electric intelligent vehicles embodies this development trend.

Moreover, Saic announced its goals regarding battery technology and autonomous driving: To begin mass production of solid-state batteries with global leading technologies and L4 level intelligent driving vehicles in 2025, respectively, and become a head enterprise in smart driving technology in China.

In fact, Saic’s transformation did not start with the rejuvenation of logo. It has been laying the groundwork for this turn for seven years, from the launch of its Connected Vehicle program in 2014 to the unveiling of its high-end electric vehicle brand—IM—in 2021, which achieved an accumulated sales volume of over 1.7 million units.

However, Chen Hong, the chairman of Saic, commented, “From a long-term perspective, it’s just the beginning of our company’s strategy.”

Expanding the Market Not by One’s Own Efforts

Saic’s aims to seize the market share amidst the trend of electrification and intelligent network connection.

Of course, the key elements to win the competition, like any other transformational story, are battery technology, software, and intelligent driving, which are the “strategic points.”

“Compared with other emerging automakers, we have an all-round layout that provides an integrated foundation,” said Chen Hong. Saic has made the most complete preparations for smart technology reserves.

By the end of 2021, Saic will begin production of the next-generation power battery system with a unified length and width design and three thickness series, compatible with four chemical systems including lithium iron phosphate, ternary, high nickel, and silicon-doped lithium, covering products ranging from economical to luxurious models.

The new power battery system is capable of “zero thermal runaway,” fast charging, easy replacement, and upgrading, enabling charging for only 5 minutes and driving from Shanghai to Suzhou. It aims to achieve a balance between high performance and low cost.

In 2025, Saic will also launch solid-state lithium batteries that have features of high safety, energy-density, and cater to business applications. Chen Hong revealed that “Saic has invested in QuantumScape, a head enterprise in solid-state batteries in the U.S.” Moreover, Saic also invested in Qingtao, a company that has been researching solid-state lithium batteries for over a decade in China.

In fact, Saic’s reserves of the three electric systems accumulated over the years and numerous vehicle types have already been abundant, and hence transformation is not the challenge.

What is the challenge?

It is “the software.”

Despite the fact that Baidu’s Platform has sounded the clarion for China’s connected cars, Saic still has a lot of homework to do for technologies such as autonomous driving.# “Do it yourself” is essential for automated driving, multilingualism, and global differentiation, as pointed out by He XPeng. It is also one of the pain points of transformation.

SAIC Motors has chosen to embrace the concept of “Do it yourself” by developing its own full-stack core software.

Currently, SAIC has made a comprehensive layout of five major centers for software development, big data, artificial intelligence, cloud computing, and network security. The SOA software platform under development is an open and service-oriented architecture that can be continuously improved through user experience.

In terms of intelligent driving technology, SAIC is developing key skills in projects such as Zhi-Ji Auto, R Auto, “5G+L4” Yangshan Intelligent Heavy Trucks, and Robotaxi, which aim to achieve 100,000 kilometers of L4-level automated driving takeover by 2025 and enable technology-level production.

“L4 must be achieved. Any company not pursuing L4 while claiming to be developing automated driving is basically deceiving people”, said Chen Hong.

Developing core software does not mean “building cars behind closed doors”. With the new industry chain boundaries being unclear, companies need not only internal power but also external support to expand their friends’ circle and realize complementary advantages. “Expanding into new markets is not something that can be achieved by working alone. We need to maintain an open mindset,” added Chen Hong.

SAIC is currently in talks with Momenta for cooperation and has invested in more than ten chip companies. By investing in start-ups such as Momenta and Horizon Robotics and collaborating in data collection, labeling, testing and other aspects of the entire vehicle, they can achieve continuous advancement of autonomous driving functions.

“Everyone is showing their capabilities in different fields,” observes Chen Hong.

Pursuing both new and old tracks with equal measure

Can “overwhelming strategic investment” lead to “overwhelming return”?

In the transformation of traditional car companies, collision often occurs due to the reconstruction of value chains and conservative development strategies, leading to weak decisions.

New carmakers unburdened by such problems are more agile, and as Chen Hong observes: “It’s still a matter of mindset. Some carmakers lack the determination and courage to start fresh.”

This time around, Chen Hong was asked if the outcome would be any different. He responded candidly that they face three core issues in total transformation.

First, how should they adapt their products to the evolving market? Secondly, how can they build a great technical advantage? Finally, how will market evolution and technological development drive changes in the industry?

How to match the huge resources and accumulated experiences of old patterns with new business models, and how to use mature product manufacturing and technological accumulation to create new intelligent products is the core issue facing this paradigm shift.

“We must renew the old track comprehensively when investing in the new track. Pursuing both the new and old tracks with equal measure is crucial,” concludes Chen Hong.# Independent R automobiles, the newly established IM brand, the parallel development of Roewe and MG, SAIC-GM-Wuling that created the Wuling phenomenon – all of them are advancing together in this revolution.

Even joint ventures are exploring non-traditional marketing approaches, with Volkswagen, Audi, and new energy operating as completely independent teams. SAIC Volkswagen recently released two pure electric models, the ID.4 and ID.6, while General Motors is also experimenting with separating new energy as a distinct unit and implementing a new model.

One of the factors that has made the transition to transformation difficult is the fixation of talent patterns, which SAIC has also noted. To inspire strong innovation, SAIC is committed to planting innovative seeds in the market from the very beginning.

In the future, 70% of SAIC Group’s executive income will come from “floating incentive compensation,” with 5% of executives being eliminated from the bottom each year, while building an open and cooperative new circle of friends and attracting more cross-industry talent.

Moreover, in order to obtain more dynamic mechanisms, SAIC has also split its 14 sci-tech companies and listed them separately. The company also plans to implement corporate and physical management for its five major centers: software development, big data, artificial intelligence, cloud computing, and network security, and actively# As an example, in the equity structure of IM Auto, 4.9% belongs to CSOP (user equity platform), where users have the final say in product manufacturing. By using blockchain technology and transferring equity rights, users are turned into “data collection officers” and actively participate in the construction of data.

IM L7 obtained 2,000 pre-orders in the first ten days of opening, and the Wuling Hong Guang MINI EV targeted the needs of short-distance travel in tier four and five cities, both reaching the resonance point between product and user.

Furthermore, SAIC Volkswagen and SAIC Audi have adopted new agency models, and MG raised funds by crowdsourcing to cater to the “customer-centric” trend.

As products go up, services go up even more to meet user needs, and brands must grasp and maintain interactions with users. For the entire SAIC team, it experiences changes every day in its operating thoughts.

Previously, someone asked Li Bin, the chairman of NIO, “Who can save NIO?” He always looked to users. The establishment of a user ecosystem and the reputation of car owners have embedded the label of “user enterprise” deeply into people’s hearts.

Compared with new players who do not have any burden, SAIC still has much more to do. Although new attempts have been made in user models, the “dealer model” introduced by SAIC-GM in 1997 still exists along with deep-rooted problems. “It’s difficult for us to continue with the old model between us and the dealers and between them and the end-users.”

How to accelerate the construction of ToC capabilities and carry out the allocation of business models and organizational structures is a problem for the industry and a weight on Chen Hong’s shoulders. Nevertheless, he is not worried.

“After all, heroes always manage to carve out their own paths.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.