I find it interesting that Volkswagen’s continuous expansion in the MEB series has achieved a good result in Europe. The previously noteworthy Ioniq 5 with 800V charging capabilities has a remarkably fast charging speed and has completely overtaken the Kona EV. These globally popular EV models help us understand the acceptance of EVs worldwide.

MEB Series Models

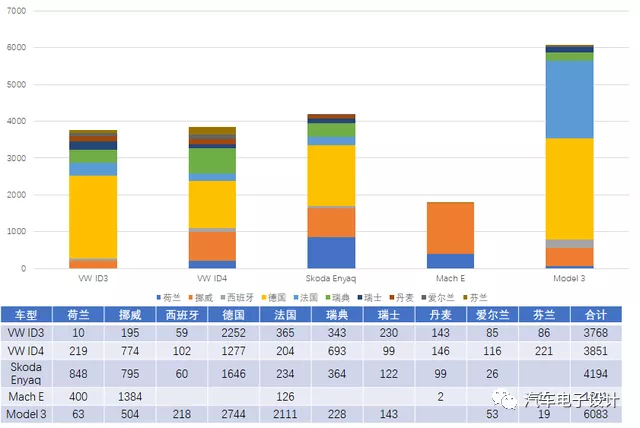

As shown in the figure below, the situation in major European countries in May is illustrated. In 10 countries, the total number of ID3 is 3768, ID4 is 3851, while Skoda’s Enyaq has reached 4194. In contrast, the Mach E, which has started to be sold in Europe, has sold 1800 units, mainly concentrated in the Netherlands and Norway. However, the Model 3 has shipped 6083 units in these countries in May (although Tesla’s main market has shifted from Norway and the Netherlands to France and Germany, and the UK, including Germany, remains focused on centralized demand delivery).

Note: According to Chinese monthly exports of over 10,000 units plus exports from the US, the data for Europe in June should increase significantly. Currently, the largest pure electric vehicle market in Europe is Germany, followed by the UK, France, and Norway, which is quite representative.

1) May’s Electric Vehicle Market in Germany

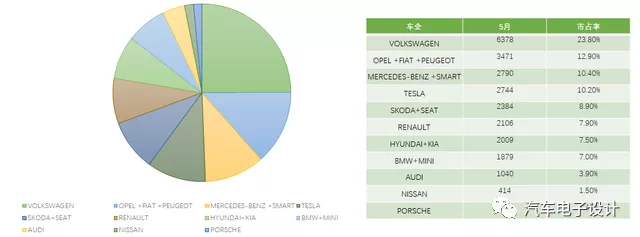

From an overview perspective, we have already analyzed it at the beginning of the month. We then look at the quality of the electric vehicle market in Germany based on graded data. In the market of 26,700 vehicles, Tesla accounted for 10% while Volkswagen Group (Volkswagen, Skoda, SEAT, Audi, and Porsche) accounted for a total of 38%, still occupying a very strong local advantage.

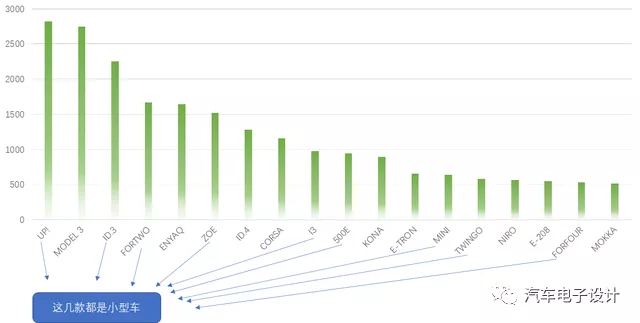

There are problems in the details because small cars rank higher, leading to situations where the E-up sells better than the ID4 and the i3 and mini models sell better than the iX3. Mercedes’ main force is still the Smart For2 and For4. There are significant subsidy effects in the current market.

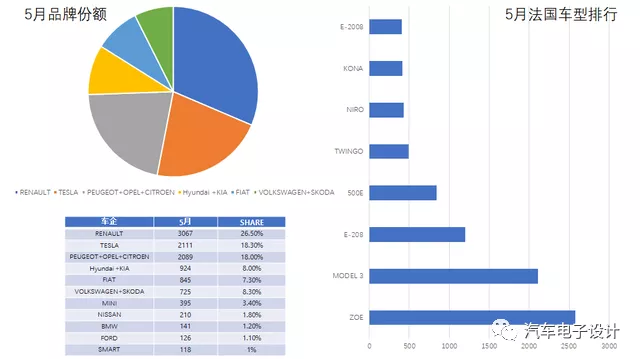

2) Pure Electric Vehicle Market in FranceThe scale of the pure electric vehicle market in France is 11,500 units, with Renault accounting for 26.5% of the market share, followed by Tesla with 18.3%, and PSA+FCA with 18%. However, the situation in France is more extreme than in Germany, with only small cars except Tesla dominating the market.

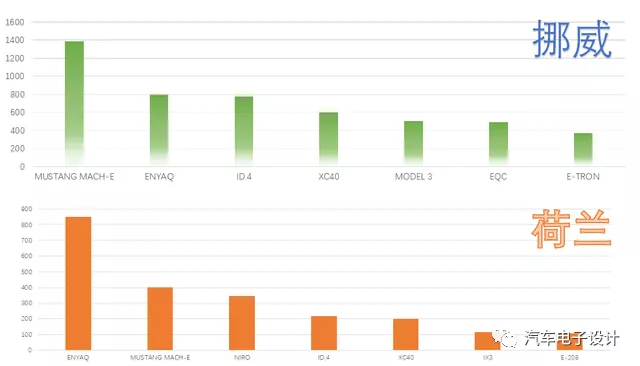

3) Norway and the Netherlands

Norway and the Netherlands are typical examples of subsidies for electric vehicles, and the demand for models is different from that of Germany and France, where subsidies are high. On these two markets, there are some representative demands. Overall, models such as Mach-E, ID4, and XC40 still perform well. Skoda’s Enyaq is expected to become a batch of dark horses.

Hyundai and Ioniq 5

Hyundai’s sales in May were very interesting, with a total of 8,977 electric vehicles sold worldwide, including 7,760 pure electric, 1,217 PHEV, and 898 fuel cell vehicles. From the overall structure, Hyundai has completely switched to BEV as the mainstay, and FCV has accumulated locally for development.

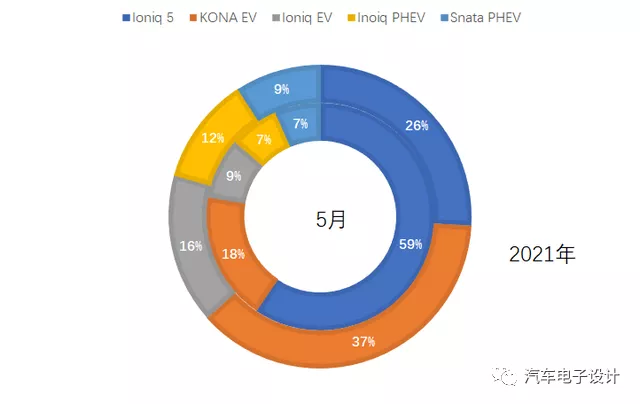

In terms of models, the growth rate of Ioniq is very fast:

Hyundai Ioniq 5 – 5,335 (8,554 YTD)

Hyundai Kona Electric – 1,637 (12,305 YTD)

Hyundai IONIQ Electric – 788 (5,271 YTD)

Hyundai IONIQ Plug-In – 633 (3,771 YTD)

Hyundai Santa Fe PHEV – 582 (3,011 YTD)

As shown in the following figure, Ioniq 5 accounted for 59% of the month’s sales, and Kona EV was squeezed to 18%. Given the reputation and order status of these two cars, the trend is expected to continue.

Note: Hyundai’s reported figures have not yet matched the current sales in Europe, possibly due to wholesale sales. The increase in Ioniq sales in Europe is expected to be reflected in the market end in June and July.

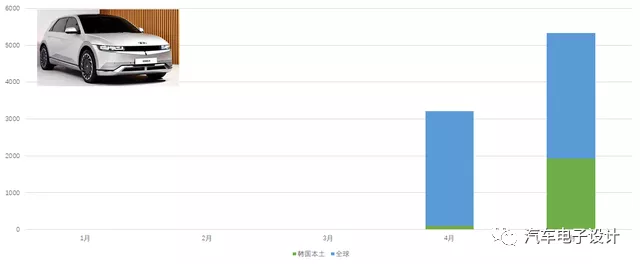

The delivery of Ioniq 5 has begun in South Korea, and it is expected that the number may reach around 8000 next month. This is a very competitive model and significant sales are expected this year.

The delivery of Ioniq 5 has begun in South Korea, and it is expected that the number may reach around 8000 next month. This is a very competitive model and significant sales are expected this year.

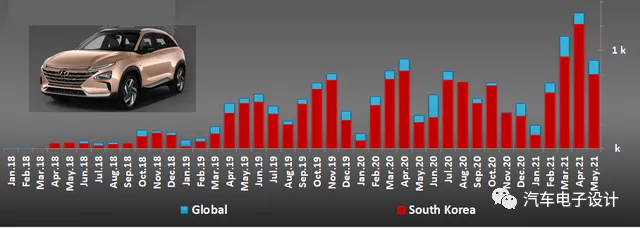

With Honda’s withdrawal from the sales of FCV passenger cars, Hyundai and Toyota remain the two companies in the market for fuel cell electric passenger cars. Currently, Hyundai maintains sales of about 1,000 units. Therefore, Hyundai and Kia have made a very remarkable strategic transformation, leaping directly from PHEV to pure electric platforms.

In summary, the global automotive industry faces only one issue, how to make a popular car model and sell it to the world market. This is the most critical test.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.