Recently, the bidding notice for the renovation of a production line by Jianghuai and NIO has brought NIO’s new model Gemini into the public view.

Currently, NIO has already launched four mass-produced vehicle models – ES8, ES6, EC6, and ET7. The addition of Gemini will undoubtedly further enrich NIO’s current vehicle model matrix. When it comes to the launch of NIO’s Gemini, people first think of the Model 3 from Tesla. However, in the eyes of Li Bin, NIO’s Gemini is not equal to Tesla’s Model 3. Perhaps in Li Bin’s mind, NIO’s brand positioning should also be higher than Tesla’s.

NIO aims to create a high-low combination of ET7+Gemini

The release of Gemini has brought NIO two vehicle models in the sedan market, which is essentially the same as the combination of Tesla’s Model S and Model 3, covering the current mainstream segmented market of electric sedans.

ET7 mainly takes on the responsibility of elevating brand positioning and showcasing the company’s technological strengths. However, it is still uncertain how many sales the flagship sedan priced at 500,000 RMB can obtain.

For Gemini, which has a relatively low positioning, leveraging the brand appeal created by the flagship sedan can lay a foundation to quickly increase sales through higher cost-effectiveness. Especially if NIO considers component commonalities in the early stages of planning and developing sedan models, it will save a lot of time and cost in the later stages and have greater pricing freedom.

From Tesla’s perspective, this is the strategy adopted by Model S and Model 3. Launching high-end vehicle models such as Model S helps establish Tesla’s brand image in consumers’ minds. Then harvesting users through Model 3 is effortless. If terminal sales are not good, as long as Tesla lowers the price of Model 3 a bit, consumers will flock to it. Because in the minds of many consumers, Tesla is a luxury brand that can compare to, and even surpass ABB in terms of intelligent interconnectivity.

Gemini will not become NIO’s low-end model.Using the NIO brand as a foundation, Gemini’s product positioning won’t be too low, and Li Bin confirms that Gemini will be priced above 300,000 RMB. For NIO, the value of the brand is more critical than short-term profit. With Li Bin’s shrewdness, NIO will not give up breaking the ceiling of domestic brand car prices that it has established for the sake of short-term sales growth.

However, NIO has another trump card – battery rental. NIO’s most significant technological advantage is the ability to implement a battery rental model through vehicle-electricity separation. This model has several benefits.

- Shortening electric vehicle charging time, basically achieving the same speed as fueling gasoline vehicles.

- Helping consumers dispel their concerns about the quality of the installed power battery, since the car owner is only renting the battery and doesn’t own the battery’s property rights. If there are any battery quality issues in the future, consumers will not have to bear responsibility.

- Of course, the most direct advantage of vehicle-electricity separation is that it can significantly reduce the cost of consumer purchases. This reduction in costs will not affect the used car retention rate or brand of the vehicle. By reducing the threshold to purchase a Gemini through this model, it will attract more consumers into the market.

Therefore, even if Gemini is priced over 300,000 RMB, a more popular battery rental Gemini will be priced below 300,000 RMB.

If we look at NIO’s goal of selling 60,000 units annually for Gemini, NIO aims to capture part of Model 3’s sales volume.

Currently, Tesla is facing its latest crisis after the release of its domestic models in China. Whether it is the repeated incidents of brake failure, or the various government organizations’ warnings against Tesla’s entry into certain areas, or the arrogance of Tesla’s public relations team in responding to relevant crises, this has led to continuous pressure on Tesla’s terminal sales. With Tesla in crisis, its direct competitors in China, which are new energy vehicle manufacturers, are experiencing a relatively favorable situation. Facing Tesla’s difficulties in the short term, NIO and other companies are entering the best period for increasing their market share.

PK Model 3, NIO needs to layout a new brand.To develop and expand the electric vehicle industry, the most critical issue is not the range, battery energy density, or charging infrastructure, but the cost of electric vehicles. Only when the battery cost is reduced to the point where the price of electric vehicles is equivalent to or even lower than that of gasoline vehicles, can the advantages of electric vehicles in terms of handling and operating costs become the decisive factor for consumers to purchase electric vehicles.

To reduce costs, it is necessary to increase sales volume. Only by expanding the scale can various costs of R&D and factories be spread to the maximum extent. However, the most direct way to increase sales is to follow in the footsteps of Tesla by introducing a low-cost electric vehicle with a price as low as $25,000 in the future. At that time, NIO can establish a new sub-brand outside the NIO brand to maximize sales using the existing brand value of NIO.

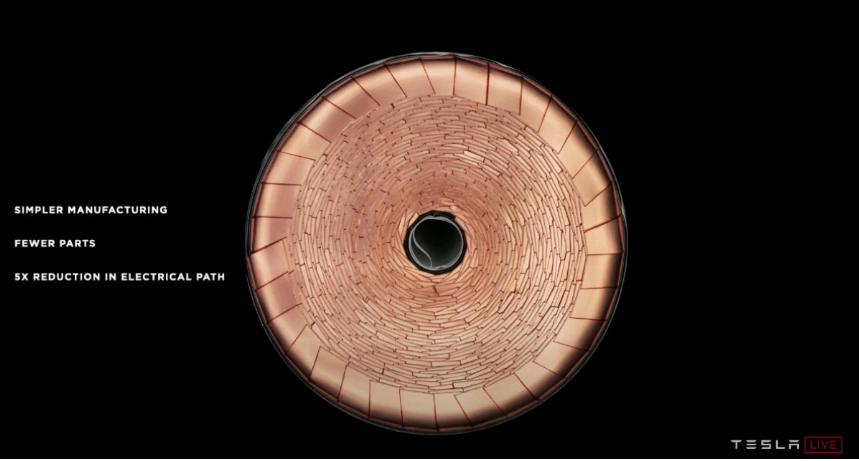

In addition to establishing a new brand, NIO also needs to make breakthroughs in the field of power batteries, which are the biggest cost of electric vehicles. Tesla’s confidence in introducing a $25,000 electric vehicle before lies in its self-developed infinite-ear battery and a series of processes that can reduce the cost of batteries.

For NIO, there is another issue to consider, which is the cost of customer operations and maintenance. Providing meticulous care to its customers is the biggest difference between NIO and other luxury brands. This service has been recognized by Chinese consumers, as evidenced by its high proportion of referrals from existing customers. However, a model in which a dozen employees serve one customer is doomed to be a risky gamble.

This model has helped NIO establish a foothold in the domestic luxury brand market and become one of NIO’s most eye-catching labels, but it has also brought relatively large maintenance costs to NIO. Maintaining the previous service standards means that NIO needs to continuously increase its investment in customer operations and maintenance as the number of users continues to increase.

Although the single-car gross margin of NIO has turned positive, the fact is that NIO as a whole is still losing money. To achieve an overall turnaround, NIO also needs to plan well for the customer operations and maintenance that are bleeding dry. After all, in the long run, Gemini will definitely not be NIO’s lowest positioning model, and the further sinking of the model is also an inevitable trend for NIO.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.