Author: Qiu Kaijun

“On May 24th, Huawei reiterated that we do not make cars. We have not invested in any car companies, and we will not invest in any car companies in the future, let alone have controlling or participating interests.”

In this statement, Huawei also specifically explained two modes of operation in the automotive industry. The first is “Huawei Inside”: providing automatic driving solutions to three Chinese carmakers, BAIC, Changan, and GAC, to support their own sub-brands.

The second is “Huawei HiCar”: cooperating with Seres to provide electric components and HiCar cabin components, and selling them through some Huawei terminals.

A few days before Huawei’s reaffirmation that they do not make cars, the company announced changes in its management. Yu Chengdong was appointed CEO of the Huawei Intelligent Automotive Solutions Business Unit, in addition to his role as the CEO of the Consumer Business Group. Wang Jun continues to serve as the President of Huawei’s Automotive Business Unit.

So how should we interpret Huawei’s commitment to not making cars in terms of its automotive business?

According to Electric Vehicle Observer, CEO is generally higher than President. If we assume that Yu Chengdong represents the “Huawei HiCar” line, and Wang Jun represents the “Huawei Inside” line, we can say that both lines run parallel to each other, but the strategic level of the “Huawei HiCar” line is slightly higher.

What exactly is the “Huawei HiCar” line? Is it as simple as what Huawei said?

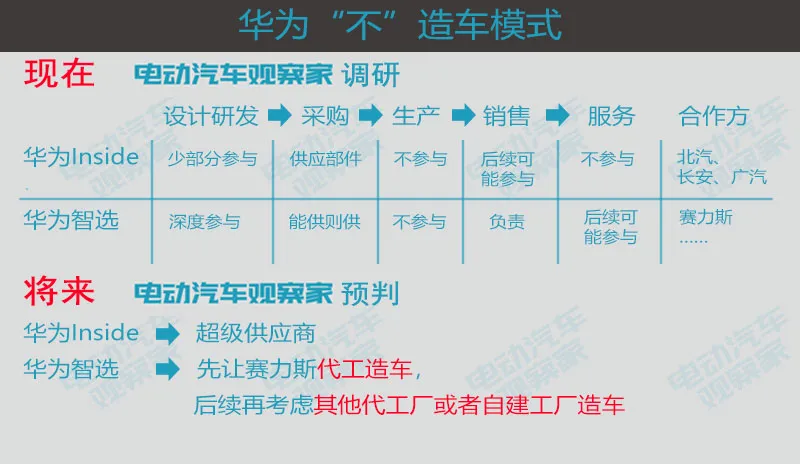

Of course not. Here is a chart explaining the “Huawei HiCar” strategy:

On the “Huawei HiCar” line, Huawei not only serves as a “supplier + distributor” but also continuously participates in research and development and design. They are gradually replacing Seres’ role, which can be said to be a curve-of-learning approach to car making.

According to the Electric Vehicle Observer, this could be seen as Huawei’s “hidden strategy” within the “don’t make cars” strategy. The “Huawei HiCar” mode, in cooperation with Seres, will continue to deepen, and Huawei will gradually control the entire process of automotive research and development, production, sales, and service, but they will not manufacture cars themselves. In this sense, they “don’t make cars,” just like how XPeng Motors found Haima to act as a contractor in the early days of the company.

Many people are saying the same thing about Huawei’s strategy. The key is, what are the reasons and evidence?

Why Is It Seres?

“At that time, Huawei wanted to enter the main factory, and they asked around a lot, but only Changan was willing to play with them… But at the same time, they were also contacting BAIC, GAC, and Jin Kang.” an engineer from a main factory who worked with Huawei recalled the collaboration at that time.

Later, four automakers had deep cooperation with Huawei, and only SAIC MAXUS was in the “Huawei intelligent selection” mode in the circle of cooperation. Why is it?

The answer is obvious: SAIC MAXUS has the least bargaining chips.

Compared with the three major state-owned auto companies, SAIC MAXUS, even including its parent company, Xin Kang Stock, is a private player and is currently in poor shape. In 2020, Xin Kang Stock sold a total of 273,590 vehicles, a year-on-year decrease of 15.92%. As for the new energy and new brand SAIC MAXUS, it is even more difficult. The investment has been significant, but it is challenging to continue investing, especially since SAIC MAXUS is positioned as a high-end brand and Xin Kang Stock’s background is not strong enough to support it.

“Xin Kang is used to following larger companies,” said an insider familiar with SAIC MAXUS’s cooperation with Huawei. Xin Kang Stock previously relied on Dongfeng and now sees Huawei as a big tree.

According to him, in the cooperation with Huawei, SAIC MAXUS demonstrated a level of openness that none of the other automakers possessed. All data related to R & D, procurement, and production was fully open. Regarding Huawei’s requirements, SAIC MAXUS did not discuss right or wrong, but made changes.

Most importantly, SAIC MAXUS has opened up product research and development to Huawei. The first SAIC MAXUS-Huawei collaborative product, SF5, still does not have many of Huawei’s design elements.

However, Huawei has been fully involved in the planning of the second and third vehicles that SAIC MAXUS has planned, which are scheduled to be launched around October of this year and February of next year, respectively.

For subsequent SAIC MAXUS models, Huawei will not only provide all automotive components that can be mass-produced and supplied but will also lead the design of the models, dictating functionality, performance, and customer experience. Only in this way can Huawei be sure the product will sell well.

It is not yet time for the “pressure principle”

Huawei started as a company founded by Ren Zhengfei with a capital of several tens of thousands of yuan, but is now the world’s leading telecommunications equipment enterprise with a “magic weapon,” which is the “pressure principle.”

The so-called “pressure principle” is a strategy for those who come late to the game. Ren Zhengfei once used tanks and nails to explain: tanks weigh dozens of tons but can drive through the desert because the broad tracks disperse the weight per unit area; nails are small but can penetrate hard objects because they concentrate kinetic energy on a small tip. The difference between the two lies in the fact that the latter’s pressure is greater.

Huawei’s “pressure principle” is to concentrate limited resources on one point, greatly exceeding the competitors in terms of configuration strength, in order to achieve a breakthrough in key areas, rapidly expand gains, and ultimately achieve system leadership.For the automaker, Huawei currently has no grasp. Although Huawei has been involved in the automotive industry very early on, it has focused on communication modules, T-BOX and other fields, and later expanded to vehicle power supply, electric drive, intelligent sensing hardware, and autonomous driving solutions. However, in terms of automotive development and design, Huawei is basically an outsider.

In terms of supply chain management and production management, although Huawei has experience in smart devices such as mobile phones and PAD, it cannot be compared with the automotive industry. Moreover, Huawei has always been strong in research and development and marketing. The company also uses a large number of OEMs in mobile phones. There is still a long way to go if they want to make their own cars.

For example, Huawei’s electric drive products have been supplied to two or three automakers. However, according to insiders who cooperate with Cooper Chengshan Huawei, the stability of Huawei’s electric drive products is not good.

The “Huawei Smart Choice” mode of cooperation with Cooper Chengshan – Huawei constantly cuts into research and development, design, sales, and service, and Cooper Chengshan serves as an OEM and brand, which is the best training ground for Huawei.

Why reiterate that Huawei is not making cars?

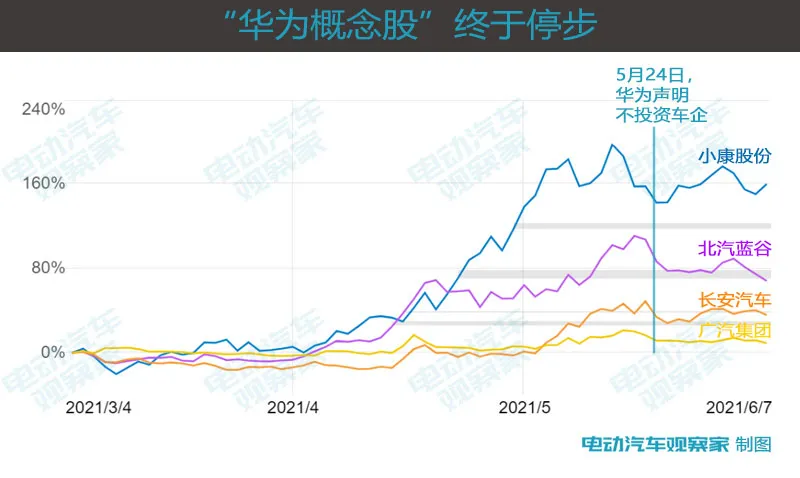

Due to Huawei’s brand effect, once any automaker is involved with Huawei, the stock price soars.

Although publicly, no automaker has confirmed Huawei’s cooperation at the capital level, the market is full of conjecture. Relevant stakeholders are also intentionally or unintentionally affecting market expectations.

This is not groundless. At least earlier this year, the above-mentioned insiders revealed that Huawei had planned to invest in Xiaokang, but it was finally called off by Huawei’s top management.

However, such an operation may make Huawei unbearable, so on May 24th, a statement was issued stating that “in the future, any discussion about Huawei making cars or participating in the car manufacturing industry is a rumor, and should not be taken lightly.”

After Huawei’s statement, “Huawei concept stocks” finally fell from a high trend.

In this statement, Huawei once again mentioned its 2018 strategy. In the “Resolution on the Management of the Intelligent Automotive Parts Business” found on Huawei’s “Xinsheng Community” on November 25, 2020, this strategy was also mentioned.

This resolution is accompanied by the text: “This article will be effective from the date it is issued and will be valid for three years.”

Many people believe that based on this speculation, 2023 will be the time when Huawei starts making its own cars.

Why?

The strategy of this resolution, and the logic that the senior management of Huawei’s automotive business has repeatedly emphasized: give full play to its ICT advantages, become an incremental supplier, help automakers make good cars, and make a profit of 10,000 yuan per car… is probably not feasible.Huawei’s core product – the Huawei Autonomous Driving Solution – has a significant impact on the core competitiveness of intelligent automotive products, and most car manufacturers are unwilling to cooperate. BYD has a deep relationship with Huawei, but cannot entrust the entire solution to them.

After the smartphone business was forcibly cut off, Huawei’s terminal sales really needed new business, but the ideal of “earning 10,000 yuan per car” may not be realized due to limited scale. Huawei will have to seek to earn more money on each car, even if the scale is not large, the total volume can also grow. This also means that Huawei needs to go deep into every aspect of the automobile: research and development, design, production, sales, and service.

Production is just the last step to personally take.

Regarding the promise of “not building cars,” someone commented on Huawei’s Heart Voice community’s resolution post in 2020:

Twenty years ago, Huawei failed in fixed-line telephones. The boss made a tough statement that Huawei would never enter the field of communication terminals, as if it were written into the basic law?

Twelve years later, the communication terminal business gradually emerged, and by 19, it occupied more than half of the business…

Around 01, the boss criticized the PHS, resolutely not doing it, even the entire system data was ready, waiting for the boss to sign…still didn’t do it

After 04, it seemed that the boss finally agreed to PHS, Huawei’s PHS OEM began to dominate the market…then UT quickly collapsed…

In October 20, the boss criticized angrily and firmly stated that they will not build cars…

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.