This article is reproduced from the autocarweekly WeChat public account

Author: Li, Financial Street

Many securities firms were constantly recommending Great Wall Motors last year, and this year they are still recommending Great Wall Motors, based on the situation.

Although Li used to work in the automotive industry doing strategic planning, honestly speaking, not even top-level executives of car companies can predict the overall trend of the automotive market, let alone predict enterprise sales. The secondary market is the same, the only constant is change, this is a speculative market, only by grasping the rules of speculation as much as possible can one remain unbeaten.

Li has listened to interviews with securities firms all year round. The summary opinions of many automotive analysts at domestic securities firms during roadshows were very consistent: “We firmly believe in Great Wall Motors.” A certain New Fortune analyst even gave this explanation: Great Wall Motors’s valuation is not that of a car company, but that of a technology company. He subsequently provided a bunch of methods for calculating the revenue of technology companies, with very very high valuations.

Many funds heavily invested in Great Wall Motors last year, and its stock price has also skyrocketed. Last Tuesday, Li chatted with everyone about CATL (Contemporary Amperex Technology Co Ltd.), and now, some friends want to chat about Great Wall Motors. Today, Li and everyone will explore why funds chose Great Wall Motors and what kind of market performance Great Wall Motors will have in the future.

Will pragmatic Wei Jianjun do marketing and market value management?

In the past, the media did not like Great Wall Motors because Great Wall did not do much advertising. Now everyone likes Great Wall Motors. This rule also applies in the secondary market. In the past, secondary market researchers paid little attention to Great Wall, but now many researchers and fund managers are like Great Wall fans.

A friend of Li works in the Great Wall Digital Center. Starting from last year, when reporting work to Chairman Wei, he always asked first: “What are the innovative points of your plan?” Small changes of the leader can often stimulate the internal driving force of the company. The changes and innovations of Great Wall Motors in the past two years have a lot to do with this.

An industrial friend thinks that Great Wall’s innovation is not novel. Whether it is Haval, Tank, or Lightening Cat, in the eyes of many industry insiders, they are just the original models repackaged with a young name. Some models at the Shanghai Auto Show also caused controversy among some industry insiders, but it is innovation in the eyes of funds. The difference in perspectives between industry and the secondary market has long existed. Li cited a few examples where the perspectives do differ:

In February, Great Wall Motors announced its strategic investment in Horizon Robotics, an automotive chip company.

The reaction of industrial friends: Great Wall and Horizon Robotics have begun cooperation, and Horizon Robotics has also cooperated with other automakers. Great Wall does not have anything special.

The reaction of capital friends: Great Wall has begun to heavily invest in the area of intelligence and automatic driving, core technologies have been realized and domestic suppliers have been substituted, and the supply chain security has been improved.

In March, Great Wall Motors released a new hydrogen energy strategy.

The reaction of industrial friends: A friend from Bosch said that Great Wall Motors does not have core technology, and some automaker friends do not care about hydrogen fuel cells. Many people don’t even know what a hydrogen fuel cell is.Capital friends’ reaction: Great Wall has established a complete hydrogen energy industry chain layout. Once the market of hydrogen fuel cell cars picks up, Great Wall Motors will be a good target.

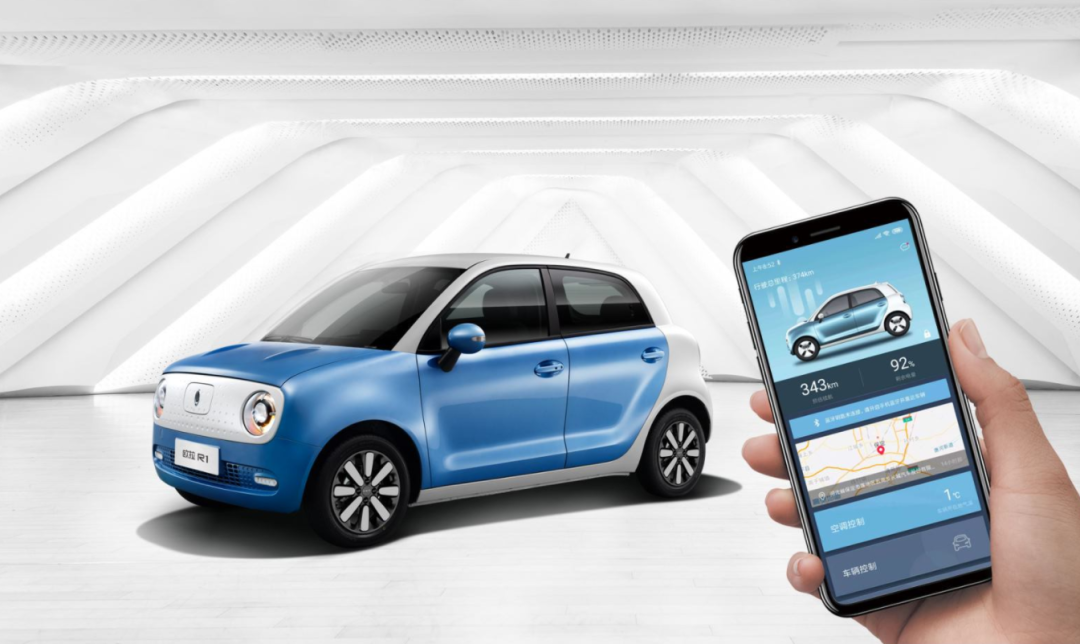

In April, Great Wall Motors released a series of brand-new models at the Shanghai Auto Show…among them, “Flash Cat” was especially noticeable.

Industry friends’ reaction: “Flash Cat” looks too much like the “Beetle.” Great Wall Motors didn’t establish their own style and thus, the industry had doubts.

Capital friends’ reaction: It is said that General Wei personally oversaw the project. Whether or not they are similar is not important. What’s important is that users like it. When the black cat was released, industry experts said it wouldn’t work. Nowadays, industry experts are increasingly unreliable…

In the industry market and the capital market, Great Wall Motors is like wearing two different coats.

In the past, Lao Li also thought that Great Wall Motors wasn’t anything special, in both product development and marketing. However, since last year, Lao Li thinks that Great Wall is alright and a good company. It wasn’t Great Wall that changed, it was me, as I started looking at Great Wall Motors through the lens of a fund.

When the industry was still deliberating and debating as to whether or not Great Wall Motors had technological competitiveness, the researchers in the capital market had long since gotten rid of these useless debates. Under the opportunity of the automotive industry’s transformation, making money is key. It is said, regardless of whether a cat is black or white, as long as it catches mice, it’s a good cat. Perhaps General Wei had this idea for naming the Euler car model; the capital market likes this statement.

In July 2020, Great Wall Motors Chairman Wei Jianjun announced that Great Wall Motors would transform from a traditional automobile manufacturer into a global technology company for travel. This is a decision in line with the industry’s development trends, and Great Wall Motors is not alone in this. However, it is true that it was from this point that Great Wall Motors gained recognition in the secondary market.

In Lao Li’s view, the valuation code for Great Wall Motors comes from General Wei, his execution, creativity, and openness.## Long-term Management Strategy of Wei Jianjun, CEO of Great Wall Motors

Wei Jianjun, CEO of Great Wall Motors, has always implemented a semi-militarized management style within the company, creating a strong and efficient management system that is favored by investors. In comparison, a competitor with a larger business scope has suffered from poor management, resulting in disarray within their development system and prolonged instability.

Since last year, Wei has been promoting innovation, which has led to the creation of new modules within Great Wall Motors, such as Hive Energy, Hoveron, and Digital Center.

Wei has also adopted a more open attitude towards capital markets. Whereas previously, Great Wall Motors primarily focused on internal growth and had little to no secondary market financing, Wei has since embraced capital markets through measures such as equity incentives and external investments. This has earned him approval from employees, local governments, and secondary markets.

It is important for company leaders to keep up with the times and the younger generation’s way of thinking.

Will Great Wall’s Long-term Success Be Based on Horizontal Not Vertical Growth?

In secondary markets, each company’s valuation is based on its own logic, which places them in either the category of top-tier or mid-cap stocks. However, Great Wall Motors is an exception. Looking purely at financial indicators, the company is not particularly outstanding. Similarly, while it is positioned in a growing automotive sector, its position is arguably neither particularly good nor particularly bad.

Examining Great Wall Motors over the past five years, it seems to have remained stable, with annual sales hovering around one million units and revenue around 100 billion RMB. The period from 2011 to 2016 represented a period of upward growth for the company. Of particular note is 2016, during which the company achieved a peak annual revenue of 98.62 billion RMB and net profits of 10.55 billion RMB.

However, following the downturn in the automotive sector and changes within the industry, Great Wall Motors’ performance has also struggled. Between 2017 and 2019, the company’s annual revenue did not fluctuate drastically at around 100 billion RMB; however, following its efforts to diversify into new sectors and brands, the company’s net profits have suffered over the past three years, with net profits in 2020 reaching 4.497 billion RMB after consecutive years of decline.

After three years of adjustments, Great Wall Motors’ financial situation improved in 2020, with its annual revenue reaching 103.3 billion RMB and its net profits experiencing a 18.36% YoY growth at 5.362 billion RMB.

Recently, Li and many friends have discussed and unanimously agreed that Great Wall Motor is not a financially excellent company. Compared with well-known leading stocks in A-shares, its performance is mediocre. So why did the secondary market choose it as a target? Everyone believes that there are two reasons:

First, there are no better subdivided tracks in the smart electric vehicle industry.

In the past two years, the smart electric vehicle track has become the third most popular track in A-shares, second only to medicine and consumption. Smart electric vehicles are the evolution from traditional cars to electrification and intelligence. The top three new powers enter the track from the whole vehicle. Correspondingly, a leading upstream of electrification Ningde Times has emerged. In the field of intelligence, the industry is still unclear, and the core targets Desai Xiwei and Zhongke Chuangda have not become potential leaders.

In the case of electrification being overhyped and intelligence cannot be hyped, traditional cars have become targets of the secondary market again. On the one hand, it is because traditional car companies are undergoing transformation. On the other hand, it is because traditional cars have not been speculated in three years, which is a rotation of the big cycle.

Second, compared with other targets of traditional cars, Great Wall has performed the best in the past two years.

There are not many whole vehicle companies in A-shares that can be speculated, and even fewer are of high quality. If funds want to buy cars, they will choose the best among the bad ones. Great Wall is the most stable among the overall strategies and performance of these companies, so buy Great Wall. The secondary market has not had much enthusiasm for state-owned automobile companies. The focus is still on the three major private companies. BYD has the best position, no need to say more; Geely has had a lot of highlights before 2018, but has been in turmoil since then. Li often investigates Geely, and a question that many analysts often ask is when the R&D team can stabilize.

After researching and discussing, everyone found that Great Wall is good and unanimously bought it. Last year, northbound funds and many institutions held a heavy position in Great Wall. Li shares a simple method with everyone, which is to open apps like Lixinger and see which stocks big funds have adjusted in each quarter to grasp the general direction of funds.

The logic of everything is interconnected. In the automotive market, the most stable-selling vehicles are always those models that have neither advantages nor disadvantages. This is also how major funds view Great Wall Motors: it is the leader among traditional auto companies, it is not falling behind in the new energy field even though it may not have as much imagination as the new players, it has not overlooked any aspects from electrification to intelligence in the new industry transformation, and it has a stable execution ability although there is no star aura in the company team building.

The logic of everything is interconnected. In the automotive market, the most stable-selling vehicles are always those models that have neither advantages nor disadvantages. This is also how major funds view Great Wall Motors: it is the leader among traditional auto companies, it is not falling behind in the new energy field even though it may not have as much imagination as the new players, it has not overlooked any aspects from electrification to intelligence in the new industry transformation, and it has a stable execution ability although there is no star aura in the company team building.

What is the Future of Great Wall Motors?

In recent years, some people have asked Lao Li what the differences are between the automotive industry and the capital industry. He believes that there are two major differences: the automotive industry emphasizes feelings, while the capital industry does not; the automotive industry emphasizes rules, while the capital industry does not. The different perspectives on Great Wall Motors among people mentioned by Lao Li stem from this.

There are no companies that can keep rising in the market, nor will capital keep buying Great Wall Motors all the time. After making a profit, the northbound funds and institutions sell one after another. The big drop in the first quarter of this year was caused by institutional funds dumping the stocks, and individual investors cutting losses. When the market sentiment and track conditions are good, funds will again catch the copper smell and buy in again, causing the stock price to rise.

The market has already priced Great Wall Motors at 300 billion yuan. After the market has priced it, performance support is required. If Great Wall Motors fail to meet expectations in the future, the market will be affected. If capital continues to hold onto it, its market value may oscillate or decline. If the funds dump the stocks, it could be labeled as a cyclical stock and return to the normal state of one year ago. If you enter now, you may be trapped for a long time.

In the eyes of many analysts, Great Wall Motors has the potential and strength to rise in electrification and intelligence, and its performance growth space has been opened up. In Lao Li’s view, the valuation of Great Wall Motors can refer to that of BYD. Both companies produce both gasoline and electric vehicles, and they also develop core components such as power batteries upstream. BYD has achieved excellent results in the field of electrification and received market valuation favor, and Great Wall Motors is highly likely to follow the same path.

To judge the market value trend of a company, there are usually several ways for reference only.To look at the long-term trend, you need to examine a company’s position and fundamentals. Good companies in good industries, such as leading healthcare and consumer companies in both the US and China, tend to see continuous growth. Similarly, if Capital were to view Great Wall Motors as a global technology company, then its industry track and fundamentals would also be positive. However, despite some brokerage firms promoting this concept, buyers have not expressed much interest. Overall, I agree with the view that Great Wall Motors can’t achieve long-term growth, as evidenced by its comparison with BYD.

To analyze short-term trends, one should focus on market sentiment, sector rotation, and company rotation. I have previously discussed market sentiment in my articles, indicating that the automotive industry has been relatively stable in terms of sector rotation. Therefore, the company rotation and, in particular, the situations of its two main competitors, Chang’an and Geely, are the most critical factors affecting Great Wall’s market value.

During the first half of this year, many funds favored Geely, and new incremental funds may flow into Geely. If Geely’s Q3 sales and performance do not shine, capital is likely to flow into Great Wall. If Chang’an does not release major brand announcements or capital cooperations in Q3, its valuation is not expected to exceed current predictions. Given these scenarios, Great Wall Motors could remain in a range of turbulence or stability; otherwise, it could be affected because capital never acknowledges financial rules and sentiment.

Old Li used to invest in the stock market, and his strategy can be summarized as follows: for good companies that he believes in for the long-term, if the short-term growth is significant, he will lower his expectations accordingly; if there is no short-term growth, he will patiently wait and be a friend of time. Buying and selling in increments is the most stable strategy for good companies. While I cannot guarantee that this approach can navigate every economic environment, it will not misjudge market sentiment or sector rotation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.