With the increasing and certain demand for electric vehicles in the three regions of China, the US, and Europe, all car companies are revising their plans for 2022-2025. Even the conservative Japanese car companies have also made changes. According to a report by Nikkei, Nissan is working with AESC Faraday to invest $1.8 billion to expand factories in Japan and the UK. They will also continue to cooperate with CATL and LG Chemical to meet the requirements of producing one million electrified vehicles by 2023, including both HEV and BEV.

Note: Under Nissan NEXT, we said that we plan to sell 1 million units of electrified vehicles in FY2023. On the other hand, I think market acceptance and the speed of electrification will vary by region. We need strategies to meet the needs of each market. We have 2 pillars of electrification, battery EV and e-POWER. Our plan is to deliver the right products at the right time.

Revisions to Nissan’s plans

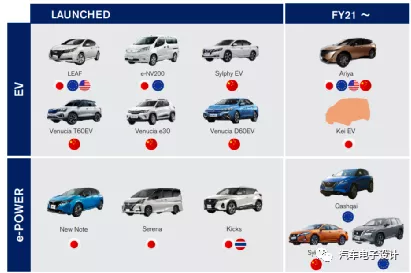

In Nissan’s performance report released on May 11th, the focus was still on promoting HEV plug-in hybrids, as shown in the following chart. The overall plan for BEVs includes only a few models such as the Nissan Kicks T60EV, e30, and D60EV in Japan, and the pure EV version of the Sylphy based on the Leaf. After 2021, the focus will shift to the development of the new Ariya platform, while the Kei EV developed in China will be even smaller.

Therefore, the report from Nikkei was quite surprising. Nissan’s partnership with AESC Faraday will invest over $1.8 billion to build new electric vehicle battery factories in Japan and the UK, with battery production starting at both new factories as early as 2024. Their goal is to provide a battery system for 700,000 new BEVs (200,000 existing and 500,000 new) with a total capacity increase of 700,000 units.Investments in the UK start at 6GWh and are expanded to 18-24GWh with the support of the UK government. Apart from AESC, two companies, AMTE Power and Britishvolt, have announced plans to build super battery factories in the UK, with the goal of building battery production capacity of 30GWh+.

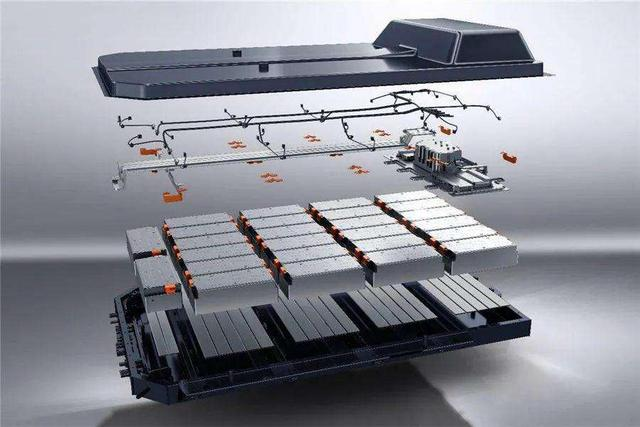

Currently, AESC’s design capacity can provide products for around 200,000 BEVs, and the next factory production of batteries will be supplied to the Renault-Nissan-Mitsubishi Alliance.

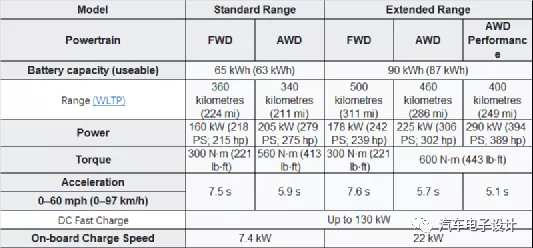

The main question here is still the long-term role of AESC in Nissan’s supply chain. Ariya has imported a new supplier, CATL, and if the current product plan is followed, the 65kWh and 90kWh batteries will completely replace the existing 62kWh LEAF, and subsequent updates for LEAF will focus on products with medium city range, around 40kWh. Therefore, we can make some speculations on this matter:

1) The first batch of Ariya for Nissan, from 2021 to 2023, will still revolve around the existing CATL supply.

2) Later on, as platforms expand and new increments are added from 2024, AESC will be given an opportunity to join the expansion.

Nissan Renault Mitsubishi Battery Supply

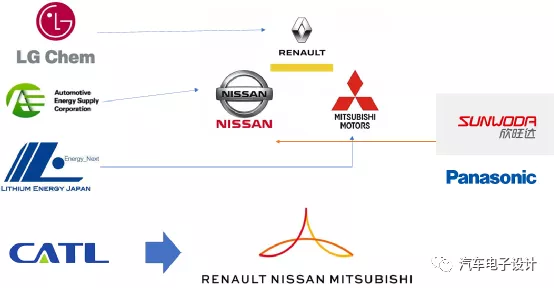

According to Korean media reports “LG Energy Solution Expected to Set up Battery Manufacturing Plant with Renault”, the Renault-Nissan-Mitsubishi Alliance is considering building four new battery factories in France, Spain, the United States, and China in addition to the decision to build two new factories in Japan and the UK. In Europe, the Renault-LG Chem cooperation scheme is more likely, while in China, the cooperation scheme between Nissan and Contemporary Amperex Technology (CATL) is more possible.

Note: In the US, it is probably still built with LG.

In this sense, apart from selecting CATL on a unified new platform, the existing two soft pack suppliers, LG and AESC, continue to supply, and Mitsubishi’s PHEV battery moves forward. In addition to the supply of HEV batteries, the supply relationship of the Nissan-Renault-Mitsubishi Alliance is shown in the diagram below, and there may be new potential suppliers joining in the low-cost lithium iron phosphate scheme.

Summary

In the current situation, there are indeed car companies that are planning to increase production capacity. As the scale of supply further increases, car companies need to first establish the production capacity and battery demand scale, regardless of whether the cars can be sold. This has formed a positive feedback with various regions encouraging and promoting electric vehicles, which has also intensified the upward trend of the lithium battery industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.