Author: Li Yuanyuan

It is said that the momentum of small pure electric vehicles is strong, but how strong is it?

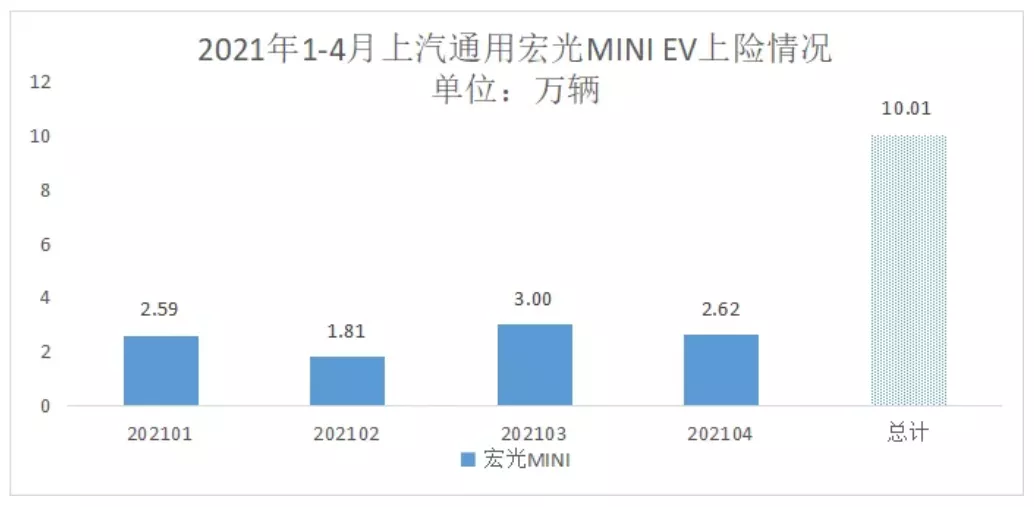

Taking the long-standing champion of the list, the Wuling Hongguang MINIEV, as an example: the car sold 110,000 units in the half year after its launch last year. From January to April this year, it has already sold 100,000 units. According to the “Electric Vehicle Observer” survey, the total sales volume of MINIEV is expected to reach 450,000 units for the whole year.

Not only MINIEV. The second place in the current small pure electric vehicle market, Ora Automotive, has a production and sales target of more than 100,000 units this year. Last year, Ora’s total sales volume was only 55,000 units.

In addition, Changan Automobile and JAC Motors have also launched new models and set ambitious sales targets, hoping to regain some of the lost market share through the good momentum of small pure electric vehicles.

From the frenzy of promoting new energy vehicles in the early stage, to the slump in sales during the peak subsidy period, to the current booming production and sales, small pure electric vehicles can make a comeback due to at least two factors.

Externally, the double integral policy has shown its effects. Small pure electric vehicles can not only meet the enterprise’s integral requirements but also bring considerable economic benefits to the manufacturer. Internally, with the rapid decline in the cost of three electric components, especially the power battery cost, the cost of small pure electric vehicles has reached parity with equivalent gasoline vehicles.

Small pure electric vehicles can make money and earn credits without subsidies, showing strong vitality.

Li Jinyong, executive chairman of the China Federation of Industry and Commerce Automobile Dealers Association and chairman of the New Energy Vehicle Commission, analyzed that sales of A00 and A0-grade new energy passenger vehicles will definitely exceed 700,000 units this year, and most of them will be A00 pure electric ones.

MINIEV 450,000 units, Ora 100,000 units, JAC 40,000 units…

In the early stage of promoting new energy vehicles in China, small pure electric vehicles were almost the must-push models of various car companies. With classic small EVs like the Benben EV, EC series, iEV series, Changan, BAIC New Energy, JAC, and other car companies became the top players in the domestic new energy vehicle industry for many consecutive years.

However, with the introduction of subsidy standards that tilt towards high energy density and long endurance, small pure electric vehicles were once abandoned by car makers, and sales also plummeted. Car companies that started with small pure electric vehicles began to lose their first-mover advantage, and high-endurance models also failed to be recognized by the market.

Since last year, starting with the hot sales of Hongguang MINIEV, the small pure electric vehicle market has rapidly recovered. A total of 290,000 A00 pure electric vehicles were sold throughout the year, with a market share of 26%.# The Sales of A00 Pure Electric Cars in the First Half of 2021

The Hongguang MINI EV, which went on sale in June, has become the biggest winner, selling 110,000 units in just six months and always being in short supply. The second-ranked Ora Black Cat also sold nearly 45,000 units.

This year, the A00 pure electric car market continued to expand.

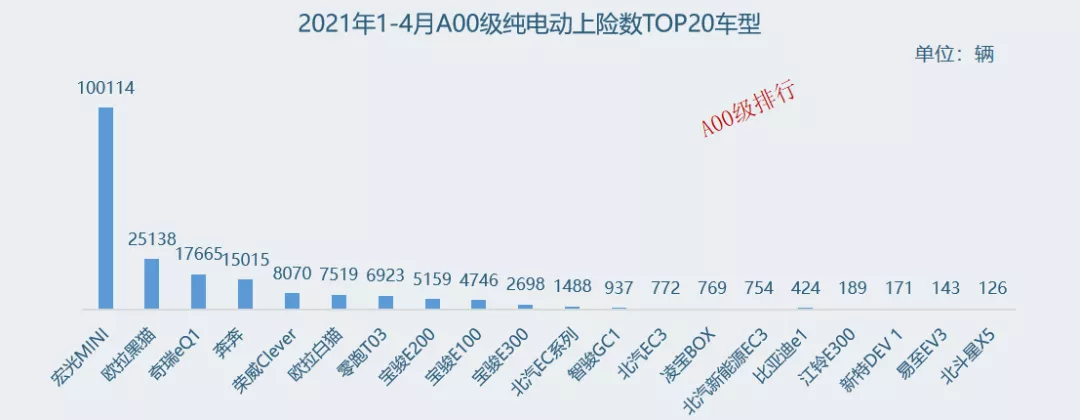

According to insurance data, from January to April of this year, nearly 200,000 A00 pure electric cars were sold, accounting for 33% of new energy passenger cars and 40.8% of pure electric cars. Among them, the Hongguang MINI EV sold 100,000 units and won the championship, and the second-ranked Ora Black Cat sold 25,000 units, exceeding half of the insured number for the whole year of last year.

In the second half of this year, the Hongguang MINI EV will launch a stronger offensive. According to the “Electric Vehicle Observer” survey, the production and sales plan for Hongguang MINI EV this year is 450,000 units, which means that its average monthly sales volume must exceed 30,000 units starting from May.

Not only Wuling has big goals.

In the second half of last year, Ora set a sales target of more than 100,000 units for this year. Last year, Ora’s total sales were only 55,000 units. Among the 100,000 units, it is foreseeable that micro pure electric vehicles will still be Ora’s main vehicle type.

In addition, JAC New Energy also hopes to break through in this market. According to JAC New Energy General Manager Xia Shunli, the minimum target sales volume for JAC New Energy this year is 50,000 units, including 40,000 micro-cars.

Changan, another veteran of micro pure electric vehicles, has also launched the E-Star National Edition with a minimum price of 29,800 yuan, vowing to carve out a piece of heaven and earth in the micro pure electric vehicle market on WeChat.

This price means a loss for Changan. Even for Wuling, which has an extremely strong supply chain, the hot sales of the Hongguang MINI EV will not bring much profit. It is still difficult to simply make money by selling cars.

According to the “Electric Vehicle Observer”, for many Wuling dealers, although the Hongguang MINI EV sold well in their stores, there is almost no profit in selling individual cars, and it is largely to complete the manufacturer’s sales tasks.

So, why do various car companies significantly increase the production of micro pure electric vehicles when they know that selling cars at low prices is difficult to make a profit?

Score Points, only profit without loss

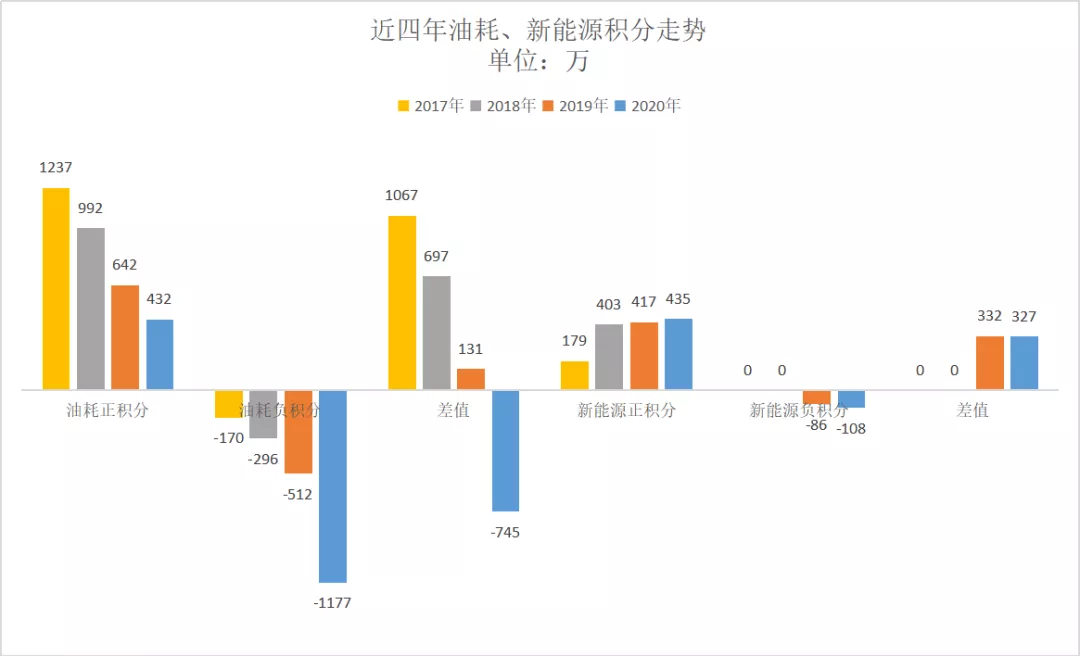

The soaring price of the double credit is an external reason for the increased enthusiasm of companies in producing micro pure electric vehicles.Before and including 2018, car companies did not require a new energy vehicle credit. Positive fuel consumption credit exceeded negative fuel consumption credit by a large margin, so there was basically no need to offset new energy vehicle credits. Therefore, on the new energy vehicle credit trading platform, the transaction price was extremely low.

This situation has changed significantly since the second half of 2020.

Several new energy vehicle companies told “Electric Vehicle Observer” that the price of positive points for new energy vehicles has started to rise significantly, with transactions of 3,000 yuan per point not uncommon. This has brought considerable income to new energy vehicle production companies.

According to the average fuel consumption of passenger car enterprises and the situation of new energy vehicle credits published by the Ministry of Industry and Information Technology in 2020, Tesla became the champion of new energy positive credit enterprises that year with 860,000 points.

Reuters cited insiders as saying that FAW-Volkswagen has purchased new energy vehicle positive credits from Tesla China at a price of approximately 3,000 yuan per point. That is to say, if all Tesla’s new energy positive credits in 2020 were sold, at least 2.5 billion yuan could be earned.

Different from independent new energy passenger car companies such as Tesla, NIO, and WM Motor, if traditional fuel passenger car companies do not meet the standard and generate negative fuel consumption credits, they need to offset with new energy passenger vehicle positive credits, or transfer them among their associated companies.

In the new energy and traditional energy passenger vehicle production companies, Wuling’s situation is good. In 2020, Wuling’s average fuel consumption credits were close to 500,000 points, and its new energy positive credits were close to 440,000 points. These 440,000 points could be transferred within SAIC Group or sold to other enterprises.

What about Great Wall, which is a high fuel consumer?

In 2020, its average fuel consumption credit was close to 370,000 negative points, and its new energy positive credit was less than 200,000 points. If old credits were not taken into account, Great Wall still needed to offset 170,000 points that year.

If purchased externally, calculated at 3,000 yuan per point, it would cost 510 million yuan. If producing new energy passenger vehicles, based on 2 points per Ora Black Cat, a production scale of 85,000 vehicles would be required to meet the standard.

In comparison, Changan is in a more difficult situation.

In 2020, Changan’s average fuel consumption negative credit was close to 620,000 credits and its new energy positive credit was less than 30,000 credits, leaving a deficit of 600,000 credits to be offset. Similarly, if purchasing credits at 3,000 yuan per credit, it would cost 1.8 billion yuan.

In 2020, Changan’s average fuel consumption negative credit was close to 620,000 credits and its new energy positive credit was less than 30,000 credits, leaving a deficit of 600,000 credits to be offset. Similarly, if purchasing credits at 3,000 yuan per credit, it would cost 1.8 billion yuan.

If producing Benben, each new energy positive credit for each car counts as 2 credits, therefore, 300,000 cars need to be produced. According to insiders, even if selling cars at a loss, the cost-effectiveness still exceeds that of purchasing credits. This is the main reason for Changan’s push for low-priced Benben E-Star.

Overall, in 2020, the positive fuel consumption credits in the industry cannot offset the negative credits, and even with the addition of new energy positive credits, there is still a supply gap of over 4 million credits.

Looking to the future, the deficit for negative fuel consumption credits will be greater, and although the supply of new energy positive credits will also increase rapidly, the demand-side growth rate may be even faster.

Li Jinyong predicts that with the increasing difficulty of obtaining new energy credits and the increasing pressure on fuel consumption reduction by major automakers, the supply-demand imbalance seen in 2020 will continue into 2021. The price of credits may reach 6,000-10,000 yuan per credit.

Speeding up the production of the most proficient and best-selling micro pure electric vehicles has become the top priority for Wuling, Euler, Changan and other enterprises.

Cost Reduction Accelerates the Elimination of Fuel-Powered Cars

If the sharp rise in dual credit prices is the external driving force behind the resurgence of micro pure electric vehicles, then the rapid decrease in the cost of the three-electrics, especially the power battery, is the internal driving force behind the production and sales of micro pure electric vehicles.

An electric vehicle supplier told “Electric Vehicle Observer” that mainly due to the sharp drop in the cost of power batteries, currently, electric vehicles with a price below 60,000 yuan and over 250,000 yuan have almost the same cost basis as their fuel-powered counterparts. Even without subsidies, these two types of electric vehicles can compete directly with fuel-powered vehicles of the same level.

In Li Jinyong’s opinion, the reduction in battery costs has the most significant positive effect on A00 electric vehicles.

Taking Eulercat as an example, in 2021, one Eulercat can receive 2.08 new energy positive credits, with each credit priced at 6,000 yuan, and the battery cost can be reduced by 100 yuan/kWh, with an even greater reduction for lithium iron phosphate. Although subsidies have been reduced by 3,300 yuan, the total cost can still be reduced by 12,400 yuan.The cost reduction of batteries is sufficient to offset the adverse impact of subsidy reduction on the production cost of car-making enterprises. Moreover, the advantages of electric vehicles are more prominent for A00-level and A0-level vehicle consumers who are more sensitive to vehicle usage costs.

More than just Wuling, ora, Changan and JAC, traditional players, are competing for this large cake in the micro pure electric vehicle market. In April this year, SAIC-GM-Wuling had a market share of 51.6% in the A00-level vehicle category, which dropped from 54.6% in March. This indicates that there are more competitive models in this field.

Under the dual effects of double integral score and cost reduction acceleration, SAIC Roewe launched its first micro pure electric vehicle, the Clever, last year and promoted it as one of its key models this year. New micro pure electric vehicle companies, represented by ZERORUN, have also performed well with their new models.

In addition, many traditional low-speed vehicle leaders are accelerating transformation and upgrading, introducing a variety of micro electric vehicles that can be licensed, featuring low prices, in an attempt to capture a share of the market. In the micro pure electric vehicle sales chart, compliant models launched by original low-speed vehicle enterprises such as Lingbao, Ledin, Xinri, and Punk are also present.

The sales of MINIEV, which totaled 450,000 units annually, is just the beginning of the booming sales of micro pure electric vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.