Author: Ling Yun

Finally, Haima Automobile has escaped the risk of delisting.

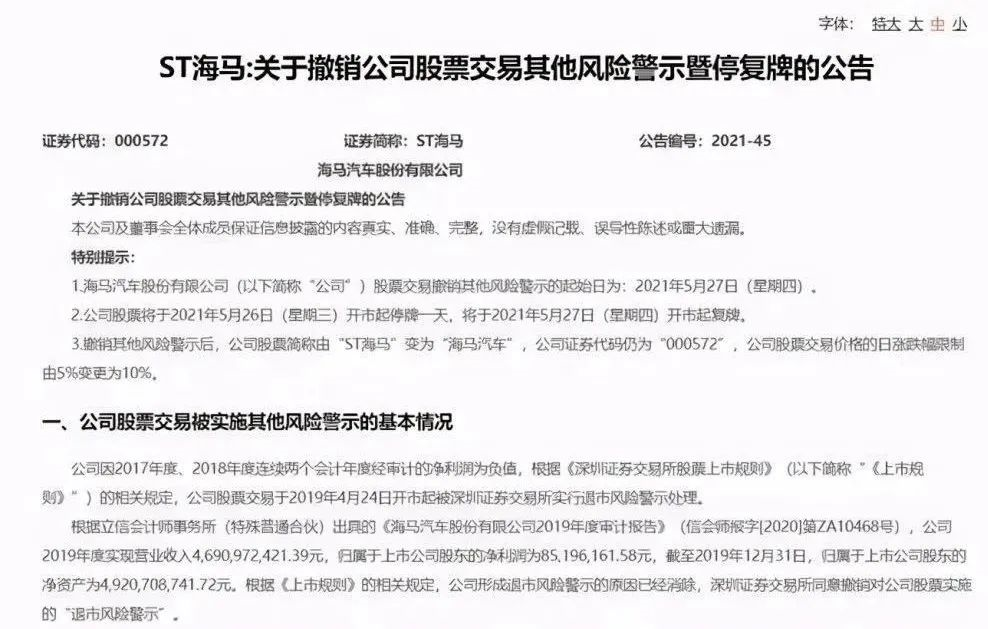

Recently, ST Haima announced that starting from May 27th, the stock abbreviation of Haima Automobile will be officially changed from “ST Haima” to “Haima Automobile”, and the daily limit of stock price rise and fall will be changed from 5% to 10%. In other words, Haima Automobile has successfully removed the “ST” hat after nearly 2 years, and has got rid of the risk of delisting.

Regarding this “removal of the hat”, Haima Automobile stated in the announcement that the company has undergone a series of strategic adjustments, and the innovative changes in technology, products, and marketing in multiple areas have achieved remarkable results. The asset quality has continued to improve, and the continuous operating capacity has been significantly enhanced, laying a solid foundation for the company’s resurgence.

Affected by this, the stock price of Haima Automobile rose by the daily limit on May 27th and 28th. Among them, it closed at 5.66 yuan per share on the 28th. After experiencing two consecutive days of soaring, the total market value of Haima Automobile is currently 9.309 billion yuan, which is a high light that Haima Automobile has not had in nearly four years. According to statistics, since 2021, Haima Automobile’s stock price has risen by 82.39%.

Previously, due to negative net profit audited for two consecutive fiscal years in 2017 and 2018, Haima Automobile’s stock trading was warned of delisting risk by the Shenzhen Stock Exchange (referred to as “SZSE”) on April 24, 2019, and the stock name was changed from “Haima Automobile” to “*ST Haima”. However, after self-rescue efforts in 2019 and 2020, Haima Automobile finally “removed the hat”.

“Haima Automobile’s ability to remove the hat only meets the relevant regulations of the exchange, which does not mean that Haima Automobile’s automotive business and profitability will be further improved in the future.” said Zhang Xiang, an analyst in the automotive industry.

In other words, although the hat has been removed, Haima Automobile’s main business is still worrying, and whether it can truly get rid of the predicament is still an unknown factor.

“Sell Houses and Sell Equity” to recover the funds

From the edge of delisting “*ST Haima” to “ST Haima”, and then to the successful “removal of the hat”, Haima Automobile’s “counterattack” road can be described as quite tortuous.

Let’s go back five years. In 2016, Haima Automobile sold nearly 220,000 vehicles. Although this achievement was not very eye-catching in the Chinese auto market at that time, it was not bad for Haima Automobile.In 2017, the situation began to change. Data showed that Haima Motors’ cumulative sales that year were 140,000 vehicles, a 35% year-on-year decline. In the following years of 2018, 2019, and 2020, Haima Motors’ sales plummeted even more dramatically, with only 17,800 vehicles remaining by 2020.

With the cliff-like decline in sales, losses were inevitable. In 2017, Haima Motors’ revenue was CNY 10.079 billion, a year-on-year decrease of 29.22%, and the loss amount was CNY 994 million. The net loss continued to expand to CNY 1.637 billion in 2018. Due to two consecutive audited accounting years of negative net profit, on April 24, 2019, the Shenzhen Stock Exchange issued a warning of delisting risk for Haima Motors’ stock trading. The stock abbreviation was changed from “Haima Motors” to “* ST Haima”, and the daily limit for rise and fall was 5%.

For a listed company, the biggest risk is delisting. Therefore, in order to remove the hat, Haima Motors also began to save itself.

On May 15, 2019, at the ninth meeting of the tenth board of directors of Haima Motors, the 53-year-old founder of Haima Motors, Jianjun Jin, was recalled and resumed the position of chairman of Haima Motors.

Although Jin’s return conveyed a signal to the outside world that Haima Motors would enter the “start-up” state again, given the faint hope of turning around through its main business in a short period of time, Haima Motors, which needed to maintain its operations, could only choose to “sell its house to stay alive”.

In 2019, Haima Motors sold 401 sets of real estate and also sold some real estate properties and divested its R&D business. Thanks to this, Haima Motors successfully “kept the shell” with a net profit of CNY 85 million that year, and smoothly “removed the star” in June 2020, changing from “* ST Haima” to “ST Haima”.

After experiencing a slight profit in 2019, Haima Motors’ operating income fell again to CNY 1.375 billion in 2020. The net profit attributable to the owner of the parent company was -CNY 1.335 billion, a year-on-year decrease of 1667.09%. However, thanks to the profit turnaround in 2019, Haima Motors avoided the situation of two consecutive years of negative net profit and met the requirements to “remove the hat.”

It is worth mentioning that Haima Motors’ successful “removal of the hat” was not just due to the sale of assets. In 2018, XPeng Motors, which did not yet have a production license, chose to cooperate with Haima Motors and had the latter produce its first model, the G3, on its behalf. It is understood that the production of the outsourced model is accounted for under the net amount method, which also has an impact on Haima Motors’ operating income.## The future is still uncertain

Although successfully “removing the hat”, it is not an easy task for Haima Automobile to truly revive.

Public information shows that in February 2021, Haima Automobile sold 7% equity of Hainan Bank held by it to China Railway Investment for 329 million yuan.

Like the profit situation, the performance of Haima Automobile’s main business is also not good. According to Haima Automobile, their main products are the Haima 7X, a positioned MPV, the Haima 8S, a positioned SUV, and the Haima 6P, their first plug-in hybrid model. The Haima 7X was a newly launched MPV in August 2020, and initially had high hopes, but its sales of 1,153 units in 2020 and 2,159 units in the first four months of 2021 obviously failed to meet expectations.

Compared with the Haima 7X, the Haima 8S and the plug-in hybrid Haima 6P are not doing well either. According to data, the cumulative sales of Haima 8S in the first four months of this year were only 941 units, and Haima 6P was 28 units.

In the case of overall weak performance of self-owned car models, Haima Automobile may also lose its OEM business. On March 19, 2020, XPeng Motors announced the acquisition of Guangdong Fudi Automobile Co., Ltd., and the latter’s shareholders changed to Zhaoqing XPeng New Energy Investment Co., Ltd. Through this acquisition, XPeng Motors began to have production qualifications, and its models no longer rely on Haima Automobile for OEM manufacturing.

To make matters worse, it was rumored that the mid-term updated model of XPeng G3 will be officially launched in the second half of this year, and the new car will be produced by XPeng Motors like XPeng P7 after it is launched. If this rumor is true, then after losing its OEM business, the sales data of Haima Automobile may become even worse.

Facing these difficulties, Haima Automobile did not sit still. In 2020, Haima Automobile began to lay out the hydrogen energy and intelligentization fields. In terms of hydrogen energy, Haima Automobile has completed the development of the hydrogen fuel cell vehicle test car and cooperated with scientific research institutions to build an integrated station for water-based hydrogen production and high-pressure hydrogen refueling.In terms of intelligence, Haima Automobile stated that in addition to autonomous driving, it will also introduce 5G technology into sales experience, product development, production and manufacturing, and other aspects, further promoting the full-scene application of the automotive market.

For Haima Automobile, which has no way out, hydrogen energy and the “new four modernizations” are excellent opportunities for a comeback. However, it is worth noting that at present, Haima Automobile has no advantage in the field of intelligence, and hydrogen energy vehicles are still in the development stage worldwide. When they can mature is still unknown.

In other words, Haima Automobile’s layout in the field of hydrogen energy is unlikely to become the support of its main business in the short term.

In addition, the profit situation of Haima Automobile, which is worrying, is also an unknown factor in how to cope with the huge investment required for intelligence and hydrogen energy.

Therefore, some industry insiders believe that it remains to be seen whether Haima Automobile can succeed in making a comeback.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.