*This article is reproduced from the autocarweekly WeChat subscription account.

Author: Luo Ji

When it comes to “SUV leader” in China, most people think of Haval, and when it comes to “new energy vehicle leader”, they can also reflexively say BYD. The slogans of the two brands seem to be quite obvious: in the SUV field, the leader in the Chinese market is Haval; and in the new energy vehicle field, if BYD admits to second place, no one should come and compete for first.

The two titles of “leader” and “leader” are both very subtle choices. At first glance, they are the strongest, the most front, and the most prestigious in their respective teams. Upon closer inspection, some problems can be found.

For the “SUV leader”, Haval, who has already launched H6, one of the first domestic SUV models, and has surpassed joint venture counterparts such as Honda CR-V and Volkswagen Tiguan, and has dominated the SUV sales chart for many years. Even if the H6 loses its championship in the future or the total SUV sales are surpassed by competitors, as long as the overall strength is still in the first echelon, it can always be worthy of the title of “SUV leader”.

As for the “new energy vehicle leader”, the word “leader” is even more implicit. Literally, “leader” emphasizes the order of time, rather than the position. In this respect, BYD has already launched the F3 DM dual-mode hybrid vehicle more than ten years ago, and then ranked at the forefront of the electric vehicle and hybrid vehicle markets for a long time, with the most comprehensive new energy product lineup in China. It is reasonable to call itself a “leader”.

However, if you look closely, the positions of Haval’s “leader” and BYD’s “leader” are not as solid as before. In the past two years, the sales of Haval’s SUV models have been overtaken by Geely and Changan, while the sales of pure electric and hybrid vehicles at all levels have been surpassed by different competitors for BYD. Against this background, some articles even began to discuss whether BYD has fallen behind in the field of new energy.

This also brings us to the topic we are discussing today: Has BYD really fallen behind in the field of new energy vehicles?

Regarding the argument that “BYD has fallen behind”, the evidence given by this article can be summed up in seven points, let’s first look at the first four:

1. Since the Spring Festival, BYD’s stock price has been falling, and its market value has fallen by 360 billion yuan as of May 10, with a total value of less than 420 billion yuan;

2. In 2020, the production and sales of new energy vehicles both fell, and the sales revenue of new energy vehicles and parts also declined by nearly 30%;

3. The sales volume of BYD’s new energy vehicle lineup that it has been focused on building is still lower than that of its own fuel vehicles;

4. BYD’s achievements in the field of new energy vehicles before are due to the government’s substantial subsidies, but now the country’s new energy subsidies have declined significantly, and BYD has lost a major helper.The four points above may not seem like a big deal when looked at individually, but when seen as a whole, they seem to be used as evidence to support negative claims instead of whether they are relevant. For example, with regards to the stock price, in the context of repeated waves of the COVID-19 pandemic and the overall chip shortage in the automobile industry, the decline is a normal reaction. Even though NIO, XPeng, and Li Auto, three newcomers in the auto industry that have been highly regarded by investors, have seen their stock prices decline this year.

As for the 2020 sales decline, BYD’s new energy vehicle sales only fell by 12.5%, not enough to be considered a “lagging behind” argument, even if the performance was not outstanding due to the outbreak of the pandemic.

As for the fact that new energy vehicle sales are not as high as traditional cars, I have checked BYD’s recent sales data, and the sales of its pure electric vehicles were only 17,405 in April, lower than the 18,396 sales of gasoline cars. However, if plug-in hybrid cars are included in the new energy vehicle category, BYD’s sales reached 26,487, far surpassing those of gasoline cars.

Of course, at the moment when new energy vehicle sales are higher than traditional car sales, it does not necessarily mean that it is a good thing. This means that there is room for improvement for BYD’s traditional cars in the context of a limited overall sales volume. Nevertheless, the argument of “new energy vehicle sales are not as high as traditional cars” is no longer valid.

As for the significant reduction of subsidies for new energy vehicles, it began in 2019, and it affected not only BYD but also every car manufacturer active in the new energy market. Although BYD received more subsidies before because it had more new energy vehicle models with higher sales, the competition at the core of the new energy vehicle market is still determined by product strength, and BYD’s subsidy is not directly related to its product strength.

While the above points may not be directly related to whether or not BYD is lagging behind, the other three points raised in the article, though not particularly insightful observations or analysis, do indeed address the real challenges that BYD currently faces:

-

Han, BYD’s flagship product, had a 20% decline in sales in April, failing to exceed 10,000, and exposed various quality issues;

-

Insufficient brand building that lacked momentum in the high-end market;

-

The power battery industry, where BYD was the frontrunner, was overtaken by CATL in 2017 due to its insistence on the internal supply mode, and its power battery supporting and receivable power fell significantly behind.After its launch in July 2020, the sales of Han EV kept climbing and broke through 10,000 units in November, then continued to reach new highs in December and January of the following year. Among them, Han EV alone maintained more than 9,000 units for two consecutive months.

This remarkable achievement is unprecedented for a domestically produced new energy vehicle with a starting price of over 200,000 RMB and a main version of over 250,000 RMB. Overnight, BYD, which had dominated the price range of under 150,000 RMB, became a player in the 200,000-300,000 RMB car category and also became the top-selling new energy vehicle above 200,000 RMB, excluding Tesla.

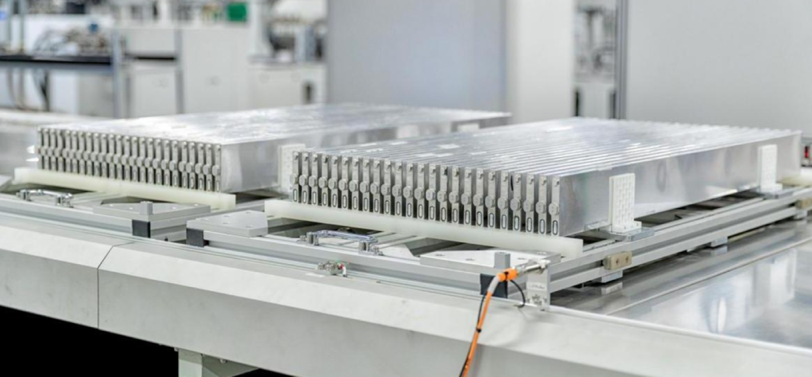

Therefore, both for BYD and the whole new energy market, the combination of Han EV and Han DM has a significant weight. From a marketing point of view, the “blade battery” that debuted with Han showed BYD’s accumulated strength in battery technology over the years. The success of a car enabled BYD to win in both the market and marketing domains.

Fans are naturally delighted, but onlookers have seen the weaknesses of BYD exposed in Han.

Although the styling design and quality have improved significantly compared to previous BYD models, the overall design of Han EV is somewhat mediocre compared to other new energy vehicles, especially in the high-end new energy field, because it still needs to accommodate the DM hybrid system. Except for the hidden door handles keeping up with the trend, there are no other obvious new energy vehicle design features on the side of Han EV.

In contrast, the same-priced Xpeng P7 has a significantly more noticeable rear-wheel-drive sports car proportion, a more streamlined roof line and side window design, and sleek finishing lines after the sloping back. In addition, due to the frameless doors, its B-pillar is stronger in overall integrity, even without opening the doors, revealing a strong coupe-style flavor.

When compared to the recently launched Jinkang 001, which is in the same price range as Han EV, although aesthetics aside, BYD needs to make further efforts in terms of technology, sportiness, and futuristic feeling.

As for the interior, to put it simply, it shows significant improvement compared to previous products; however, the overall layout and details still seem too traditional. The small details that strive to create a sense of luxury appear too forceful. Compared to other cars in the same period such as Xpeng P7 and NIO ET7, the design skills are evidently not in the same league.

Taking a closer look at the Han series, which has a price exceeding 200,000 RMB, it serves as BYD’s flagship model in the short term. However, the front suspension, which uses a MacPherson structure, is typically found in middle and low-end models. In contrast, models like Xpeng P7 and Jinkou 001 use a high-end double-wishbone structure. (A quick remark: without delving into the pros and cons between the two structures, in general, a non-independent rear suspension is generally inferior to an independent one. Additionally, the specifications for MacPherson front suspension are indeed inferior to the double-wishbone in the same price range).

Furthermore, while BYD has core technologies in battery, motor, and electronic control areas, apart from its lithium iron phosphate cell technology which provides some confidence, the Han EV is somewhat subdued in terms of range and power when compared to the Jinkou 001 at least.

As the peak of BYD’s technology and quality representation, Han exhibits an impressive sales performance. Nevertheless, it lacks the strength and aura of a true leader in the face of the continuous emergence of strong opponents.

In short, Han’s strength as BYD’s current new energy flagship is not high enough.

Regarding the limited information we have, BYD has not yet displayed the potential to compete with strong opponents. During the recent April period, Han’s sales have dropped significantly. Even though Han EV still performs outstandingly, showing signs of lethargy already. As competitors such as Jinkou 001 gradually enter the stage, how long Han’s hot sales will last remains a question mark.

The second issue lies in the persistent bottle-neck of the brand. However, it should be noted that BYD’s current situation is somewhat different from the past despite always facing brand issues.

In the past, BYD’s main problem was the homophonic brand name and the impression left by early large amounts of low-priced fuel vehicles. Stubborn engineer thinking in detail quality had prevented noticeable improvement, resulting in a low-end image in the eyes of ordinary consumers.Actually, this brand burden has been greatly diluted in the field of new energy. After chanting the slogan of new energy leader for many years, consumers of all levels cannot ignore the BYD brand when considering new energy models. The fact that the Han series can sell over ten thousand units per month in the market above 200,000 yuan also proves that consumers in the middle and high-end market will not refuse BYD solely based on its brand.

However, BYD still has a brand problem, but it is no longer prejudice from consumers, but rather BYD’s own marketing, sales, and service in a series of pre-sales and after-sales links that have not provided the level required for products over RMB 200,000.

The sales channels are not independent, and the Han series still has to be sold together with cars priced at tens or even thousands of yuan, and the sales and service personnel behind it are completely the same. Compared with the same-priced competitors, ignoring NIO’s high-end route, the marketing and service of brands such as XPeng, Polestar, Ideal, and WM have far surpassed BYD, which still stays at the level of the era of fuel vehicles.

In summary, in the past, BYD was indeed subject to market prejudices because of its brand burden, but now, if talking about brand issues in the new energy market, BYD must look for reasons from within itself.

The third issue is the power battery. BYD, which has accumulated a strong foundation in this regard, originally had unique advantages in both batteries and whole vehicles but was overtaken by CATL due to its lack of openness. In 2020, CATL’s global share of power batteries was nearly four times that of BYD. Less than 5 years later, CATL thoroughly surpassed BYD from a follower.

Nowadays, BYD has taken the initiative to sell its power batteries to other automakers, but the current effect is limited. In the latest power battery installation volume ranking for the first quarter of 2021, although BYD’s installation volume has increased significantly, it is mainly achieved under the background of the rapid growth of new energy vehicles. During the same period, CATL’s growth rate is even more significant and has expanded its advantage to 4.7 times that of BYD.

When BYD launched the blade battery last year, it strongly criticized the shortcoming of the ternary lithium battery that was prone to ignition and explosion in order to highlight the safety attributes of the lithium iron phosphate battery. This promotion had a remarkable effect, and the excellent sales of the Han series after its launch could not be separated from the safety attributes of the blade battery.In the following year, there were not many brands that switched from ternary lithium to iron phosphate. However, battery and automotive manufacturers such as CATL and GAC have brought safer lithium battery technology. Ternary lithium is still mainstream in the field of new energy batteries, but as other brands continuously make breakthroughs in range and charging speed, the disadvantages of BYD’s blade battery in terms of range and low temperature decay become more and more obvious.

These are indeed some issues that BYD needs to address. Objectively analyzing a car company, it is necessary to face its shortcomings and defects. However, it is too aggressive to draw the conclusion that “BYD’s new energy has fallen behind” based on this.

First of all, in terms of overall sales, putting aside SAIC-GM-Wuling, whose main selling price is less than 50,000 yuan, BYD’s new energy vehicle sales in April (in the domestic market) have surpassed Tesla, becoming the best-selling Chinese brand of new energy vehicles. The combined sales of SAIC and GAC, ranked behind BYD, are still less than BYD’s. That is to say, if we divide brands by sales scale, BYD is indisputably the first camp among Chinese brands, and can be said to be the only first camp brand outside of SAIC-GM-Wuling. For such a brand, to say that its new energy vehicles are falling behind, other automakers can only say that they are not even in the game.

Looking closely at the BYD brand sales ranking in April, we can see that Qin PLUS DM ranked fourth in sales among all products, selling 3,603 vehicles. This indicates that BYD’s brand-new DM-i plug-in hybrid product line has gained initial market recognition.

DM-i is a hybrid system with outstanding fuel-saving effect. It can directly compete with Toyota and Honda’s hybrid models in terms of power and fuel consumption. We have introduced it before. Models such as Song PLUS DM-i and Tang DM-i in the DM-i family have also been launched, opening up a brand-new market for new energy vehicles. At least for now, except for Great Wall, which has not yet undergone market testing, no other independent brand has launched a similar hybrid system.

The new energy market not only includes pure electric vehicles, but also needs to consider hybrid vehicles. BYD still has obvious advantages in this regard. Facing such a brand, it is difficult for me to come to the conclusion that BYD’s new energy vehicles are falling behind.

In the field of new energy, BYD is indeed not as dominant as it was a few years ago. After all, the competition in this arena has become more and more intense and diversified.BYD is indeed worthy of attention in the current market. If manufacturers do not give sufficient attention, it can also bring long-term negative effects. However, it should be pointed out that these problems are all revealed in comparison with outstanding players in various fields. That is to say, comparing the range with XPeng and Jekor, who use ternary lithium batteries, comparing intelligence with Tesla, comparing styling and quality with Jekor and NIO, comparing battery installation volume with CATL…

This unfair comparison does make BYD appear to have shortcomings everywhere. However, if we overcome bias and look at the whole BYD, it still has advantages that other new energy vehicle companies do not have, such as core technologies in lithium batteries, ferroelectric batteries, and electric control. The comprehensive layout of the DM-i hybrid system are all unbeatable weapons of BYD.

Returning to the initial question, is BYD really falling behind? I believe everyone will have their own answer. From my personal perspective, although I do not think BYD has fallen behind, I truly hope that BYD’s leadership can see this article, because there are indeed areas where everyone hopes to see improvement from BYD. After all, the fact that someone can raise the question of whether BYD is falling behind itself implies the emergence of a crisis.

And our expectations for BYD are definitely not just to avoid falling behind.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.