Translation

Recently, lithium mines and various bulk materials have begun to rise, and the cycles of various links related to batteries have begun to adjust. There are some explanations and discussions on the cost reduction path of batteries from China in 2018 to 2021, as well as more questions.

1) The core issue here is what caused the difference in battery costs between Chinese leading power battery companies and Korean battery companies. With the upward trend in the upstream resource chain, can this most direct price difference continue?

2) Taking Tesla and Volkswagen as representatives, can so-called auto companies entering the battery industry really reduce costs through battery design, material control, factory efficiency improvement, and pack optimization under the current environment?

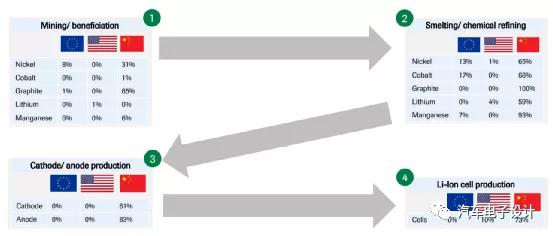

3) Assuming that China, the United States, and Europe will all form their own battery industry chains from resources, refining to materials and cell processing in the future (in order to have long-term value and keep relevant employment local, and for local companies to survive), will this resource competition give the resource end a favorable position?

Battery Cost Price

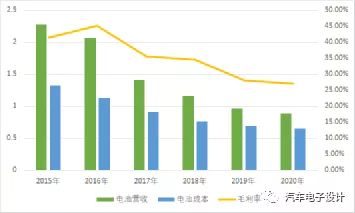

Let’s first look at a benchmark, which is the battery system price (including LFP and ternary) given by CATL in its annual report. From this price to the correction of our actual purchase price, we can roughly see that the unit price of battery system Wh ranges from 2 yuan to 0.9 cents.

We calculate that the annual reduction rate of this decrease is -30% under the condition of a significant decline in subsidies, and then it gradually decreases to a normal -10% as the subsidy declines. According to CATL, in the cost of power battery systems, material costs account for about 80%, and labor costs account for about 20%. In this process, reducing material costs includes business cost reduction (investment and bargaining power along the industry chain) and R&D cost reduction (developing fewer materials per Wh, which is the development from 42Ah to 180Ah cells that we experienced before). Labor cost mainly includes promoting intelligent manufacturing, improving production processes, and improving product yield, which are two major paths.

There are some special features in the cost reduction of power batteries in China, as shown in the following figure:

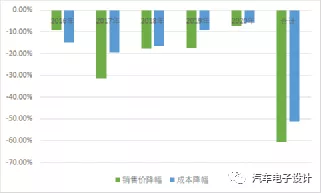

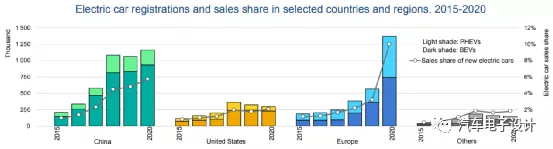

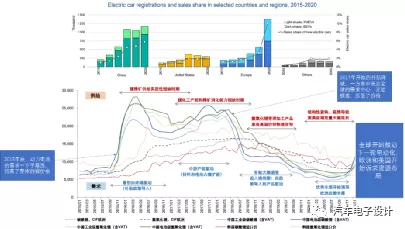

1) From 2015 to 2017, China rapidly expanded, and from 2018 the demand for batteries and the number of cars remained stagnant for three years. Compared with the world, except for a rapid rise in Europe in 2020, China’s battery industry chain and upstream resources have a production expansion period with high prices and a price decline period under demand contraction.2) In this process, the Chinese battery industry experienced a round of cruel concentration of market share, as the leading companies continued to bind car manufacturers and expand production against the trend of declining battery prices, constantly widening the gap in competitiveness. Therefore, there really exists strong commercial cost reduction promotion in the context of supply-demand mismatch.

So in a sense, I personally think that the two effects of battery price reduction of -60% and visible cost reduction of -50% are driven by the above mentioned two trends.

As shown in the figure below, driven by the demand for subsidies of 300km+ vehicle models since 2017, the price of ternary materials rose to a peak, while the price of lithium iron phosphate continued to drop. The price of lithium iron phosphate reached a very low level in mid-2020, and began to rise again in October with the demand growth.

In the analysis of upstream lithium carbonate prices by Minmetals Securities, the supply-demand mismatch of this resource price is also worthy of comparison. When I went to Yiliping Salt Lake for investigation in November 2017, the price of lithium carbonate was high. With three years of stagnant market, except for China, demand outside of China was weak. During the three years from 2018 to 2020, Chinese companies maintained their operation and continuously improved efficiency. Only a few companies were able to achieve profitability.

In the three regions of China, the United States and Europe, China has great bargaining power in the layout of battery cells, positive and negative electrode materials, refining and resources, especially the ability of the battery cell companies to regulate upstream and downstream commerce is very strong, which results in a rapidly decreasing cost curve while maintaining considerable profits.

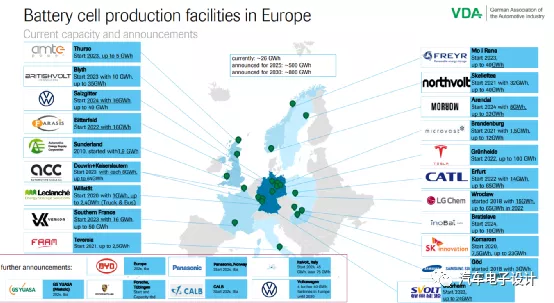

When discussing the development of battery factories in Europe and the United States, there are two approaches. Europe’s first stage is to encourage battery companies to build factories in Europe and then encourage European battery companies to invest and guarantee supply, while the government provides loans and financial resources and encourages collaboration in the industry chain. On the other hand, the US directly allows car companies and controllable battery companies to form joint ventures. Both regions can learn from China to limit battery production sites. The question is whether to reuse China’s existing cathode and anode materials and production capacity, and whether to reuse battery raw materials and refining capabilities.

When discussing the development of battery factories in Europe and the United States, there are two approaches. Europe’s first stage is to encourage battery companies to build factories in Europe and then encourage European battery companies to invest and guarantee supply, while the government provides loans and financial resources and encourages collaboration in the industry chain. On the other hand, the US directly allows car companies and controllable battery companies to form joint ventures. Both regions can learn from China to limit battery production sites. The question is whether to reuse China’s existing cathode and anode materials and production capacity, and whether to reuse battery raw materials and refining capabilities.

There are two investment groups: the East Asian Battery Investment Group and the European-supported Innovative Enterprise Group. The former still aims to transport materials to Europe (and ideally just fill the battery with electrolytes once there), while the latter focuses on developing an independent and controllable chain with government support in Europe. Therefore, we can understand that Europe and America will definitely construct an industry chain to prepare for the popularity of EVs, from 25% (4 million in Europe and the US) to 50% (8 million in Europe and the US).

From a scale of 10-50GWh to TWh in the future, there will be three independent regions that will inquire about resource pricing, and capital and production capacity expansion on the resource side will undergo a new round of demand and price spikes, with huge pressure on battery costs. Moreover, this round of Europe and America is still in the high subsidies stage, which is out of step with China’s gradual marketization.

Therefore, I personally believe that if the US and Europe are determined to play in the electric vehicle and battery industry chain, they will need to form the ability to compete in three regions. Strategically, Europe and the US can tolerate the relatively high cost of the industry chain construction process, making it difficult to negotiate prices for our market-oriented expansion. In other words, China previously had 70-80% of battery production capacity and supporting materials. Once Europe and the US establish so many battery factories and build material factories, their bargaining power in the following regions will be strong, and you cannot negotiate prices with commercial capability. The comparison is simply based on battery design (which ultimately becomes standardized), production line efficiency, and yield.

Conclusion

Therefore, I believe that if the US and Europe are determined to play in the electric vehicle and battery industry chain, the ability to compete in three regions will be necessary. From a strategic perspective, Europe and the US can tolerate the relatively higher costs of the industry chain construction process. This will make it difficult for us to negotiate prices for our market-oriented expansion. China previously had 70-80% of battery production capacity and supporting materials. However, once Europe and the US establish so many battery factories and build material factories, their bargaining power in the following regions will be strong, and this will make commercial negotiations almost impossible. In the end, only the battery design (which will eventually become standardized), production line efficiency, and yield will determine the outcome of the competition.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.