Author: Lingfang Wang

“This year, the sales volume of new energy passenger vehicles will reach 2.2 million, and the entire new energy vehicle market may reach a scale of 2.5 million,” said Cui Dongshu, secretary-general of the National Passenger Car Market Information Joint Conference, giving the latest forecast.

Previously, Cui Dongshu’s prediction was that the total sales volume of new energy vehicles would be 2.2 million.

It is not only Cui Dongshu who predicted sales of over 2 million vehicles, but also Li Jinyong, executive chairman of the All-China Federation of Industry and Commerce Automobile Association and chairman of the New Energy Vehicle Committee.

“In Li Jinyong’s opinion, 2 million vehicles are just a minimum. The actual sales volume will definitely exceed this number.”

At the end of last year, Li Jinyong predicted that the overall production and sales of China’s new energy vehicle market will reach about 2 million vehicles in 2021, including 200,000 commercial vehicles, 400,000 rental and ride-hailing vehicles, and 1.4 million passenger vehicles. Among the passenger vehicles, he expects sales of A00 and A0 level models to reach 700,000. “Now Li Jinyong believes that sales of A00 and A0 level models will definitely exceed 700,000.”

It should be noted that at the end of last year, many industry experts predicted that the sales of new energy vehicles would be around 1.8 million, with passenger vehicles accounting for around 1.5 million.

The unexpected growth since the first quarter of this year may be the reason why industry experts have raised their expectations.

Growth Exceeds Expectations in the First Four Months

“From January to April this year, the production and sales of new energy vehicles exceeded 700,000, reaching 750,000 and 732,000, respectively, a year-on-year increase of 2.6 times and 2.5 times. Sales have hit new monthly records for 10 consecutive months.”

According to analysis by Dongwu Securities, in the first quarter of 2021, the off-season for new energy vehicles was not slow, capacity utilization improved, and all links were in full production and sales, with impressive profitability.

“Data from 91 companies in the new energy vehicle sector selected by Dongwu Securities show that in the first quarter of 2021, the listed companies in the new energy vehicle sector achieved revenue of RMB 212.971 billion, a year-on-year increase of 76.13%, and net profit attributable to shareholders of the parent company of RMB 10.697 billion, a year-on-year increase of 377.82% and a month-on-month increase of 200.22%.”

Among them, upstream enterprises such as battery raw materials saw higher year-on-year growth in net profit attributable to shareholders, indicating an improvement in the profitability of the industry chain.

In particular, raw materials such as lithium hexafluorophosphate and electrolytes, batteries, cathodes, and separators have all achieved high growth. The profitability growth of these enterprises is of course due to the soaring prices of raw materials caused by supply shortages.

In addition, the export volume of new energy vehicles has also seen explosive growth. In April, Tesla exported 14,174 vehicles from China, SAIC passenger vehicles exported 2,378 new energy vehicles, Aiways exported 335 vehicles, and other vehicle companies’ new energy vehicle exports are also ready to take off.In Cui Dongshu’s view, this kind of substantial increase is the characteristic of explosive growth in the market. Two consecutive years of sluggish growth also laid the foundation for high growth in new energy vehicles in 2021.

Subsidy policy intervention disappeared

Without negative effects from policies such as retreat and compensation, the market trend is very clear.

Li Jinyong believes that the first half of this year is beyond expectations, and the growth trend has basically maintained since the second half of last year.

Li Jinyong explained that from 2016 to 2018, there was an obvious trend of low in the first half year and high in the second half year. But he always believed that the low in the front was not really low and the high in the back was not really high, “the end-of-year effect caused by subsidy retreat influenced sales data in November and December which was actually false. At the same time, the sales of licensed vehicles in November and December last year impacted the number of new vehicles licensed in the first half of the following year.”

However, this situation underwent great changes in 2019. It was caused by policy changes that led to concentrated licensing in March and June, as well as a sluggish second half of 2019.

In 2020, the influence of subsidy retreat was already small and would not cause market fluctuations.

This is because although the subsidy is still declining, more and more car companies are beginning to use lithium iron phosphate batteries, which has greatly reduced costs, offsetting the impact.

In Li Jinyong’s view, in 2021, although the new energy vehicle subsidy is generally reduced by 20% compared with 2020, with the maximum subsidy of 18,000 yuan for pure electric vehicles with a range of over 400 kilometers, the speed of battery cost reduction is more significant.

Nowadays, the impact of subsidy retreat is already very small, and the licensed vehicles in the market reflects the real demand, and the momentum of high-speed growth is very obvious.

Rapid growth of micro-cars

Among these growth, the growth of micro-cars is particularly remarkable.

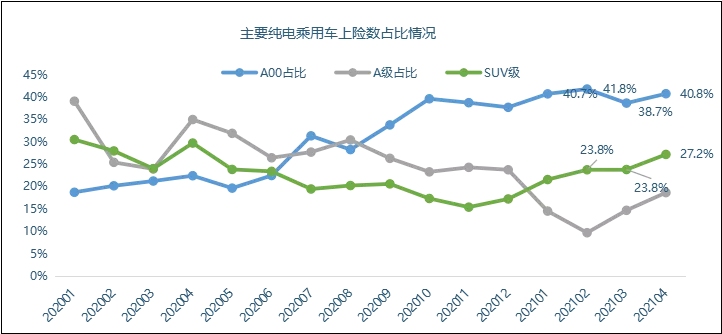

According to insurance data, in the first four months, A00-level car insurance coverage reached 199,000, accounting for 33% of the new energy vehicle market, the highest proportion of any car segment.

(1) Two factors boost micro-cars

In Li Jinyong’s view, the increase in sales of micro-cars is an inevitable trend.

This is mainly due to two reasons: the first is the rise in integral prices, and the second is the substantial increase in sales of new energy vehicles in cities without restrictions on purchase.

According to Li Jinyong, the current new energy score is more than 3,000 yuan per point, and he predicts that it will reach 5,000 yuan per point by the end of the year. This will have a greater impact on reducing the cost of new energy vehicles, especially for models priced below 100,000 yuan.

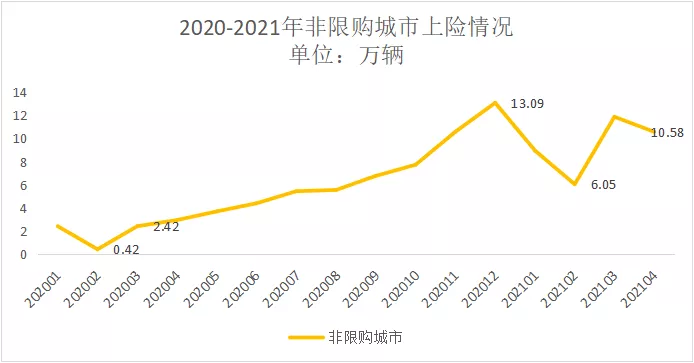

Taking the Euler Black Cat as an example, it can obtain approximately 2 points according to policies, and according to the current value of score, the Black Cat can obtain over 6,000 yuan of scores. Giving it to consumers or retaining it, will greatly improve the production and consumer purchase enthusiasm for enterprises.The acceptance of new energy vehicles in non-restricted cities is rapidly increasing, which has also boosted the demand for micro-cars. From the number of insurance registrations, it can be seen that due to the impact of the pandemic, the lowest point of new energy vehicle registrations was in February last year, with only 4,200 vehicles registered. With the easing of the pandemic, the number of insurance registrations climbed steadily to 130,900 vehicles in December. In April this year, the number of insurance registrations also reached 105,800 vehicles.

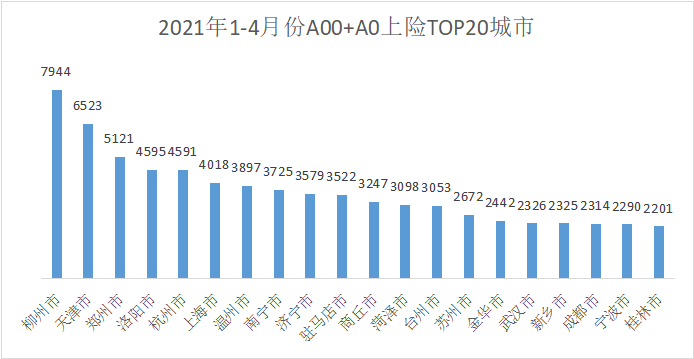

These non-restricted cities are the main market for A0 and A00 class vehicles. From the insurance registrations for A00 and A0 class micro-cars in January to April this year, it can be seen that their main consumer groups are concentrated in third- and fourth-tier cities, while the number of insurance registrations in first- and second-tier cities is also considerable. This combination further pushed up the sales of micro-cars.

Currently, in the pure electric vehicle market, for 3 months from January to April, A00 cars accounted for over 40% of the market. If Li Jinyong’s prediction of over 700,000 A0 and A00 vehicles this year is correct, then these two types of vehicles will account for about 50% of pure electric passenger cars.

(2) Focus on the Euler brand

Among these micro-cars, Li Jinyong is particularly optimistic about the Changan Euler brand, especially the Good Cat model, which he believes has great potential.

In Li Jinyong’s words, the Good Cat has filled the gap in the A0 class market, “Previously, the market for cars priced between 100,000 to 150,000 yuan, except for some models represented by ride-hailing cars, was basically blank for private consumption.”

In Li Jinyong’s opinion, the Good Cat is very competitive in terms of both appearance and autonomous driving in the same class of vehicles.

Li Jinyong revealed that Euler’s orders throughout the country could be as high as tens of thousands of vehicles. “I have almost 600 deposits for Euler cars, but the manufacturer cannot provide me with the cars.”

In Li Jinyong’s view, Euler’s sales in the first four months were lowered by battery supply issues. According to past experience, demand in the first half of the year is relatively low, and the number of planned vehicles is relatively small, but the current situation is completely different. “The early planning was insufficient, leading to a shortage of battery supply, which dragged down sales.”

That is to say, in Li Jinyong’s view, Euler will also become another support point for micro-cars, in addition to the Hongguang MINI EV.From the perspective of the supply chain, although there was a shortage of raw material supply in the early stage, it has now been alleviated. Due to the booming market demand, orders that used to be concentrated in first-tier battery companies have also begun to shift to second-tier battery companies.

The most troublesome chip supply problem doesn’t seem to be a serious issue in the field of new energy vehicles. Cui Dongshu said that as a key development area for every company, new energy will receive priority supply, and the impact of chip supply on new energy vehicles is not serious.

Currently, the China Association of Automobile Manufacturers has not updated its sales forecast for new energy vehicles, but in July, it is highly likely that it will increase its sales forecast.

Perhaps, as Li Jinyong said, except for the epidemic, there is nothing that can stop the outbreak of the new energy vehicle market this year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.