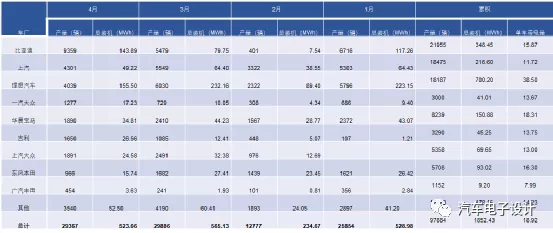

Yesterday, the new model of IDEAL One was released, and I would like to take this opportunity to talk about the situation of plug-in hybrid electric vehicles (including extended range). From January to April of 2021, the sales volume of plug-in hybrid electric vehicles fluctuated between 12,000 and 30,000 units, with a total production volume of 97,800 units and a corresponding battery installation capacity of 1.85 GWh. However, there are still some development bottlenecks.

1) From the perspective of the overall situation, companies with many credits like Volkswagen and BMW have reduced the production volume of PHEVs in 2021, and overall sales resources have started to shift towards pure electric vehicles. Therefore, we see system-wide adjustments among foreign companies in this field.

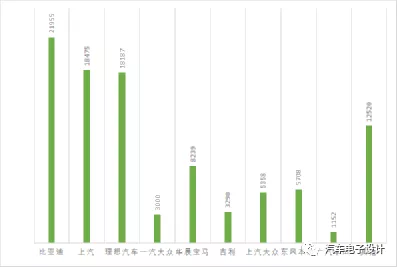

2) As for domestic companies, Geely has undergone the greatest changes, starting with PHEVs and vigorously promoting pure electric vehicles. We can see that the production volume of Geely in 2021 has systematically decreased. Currently, the three major PHEV manufacturers in China are BYD, SAIC and IDEAL, with production volumes of 21,900, 18,400 and 18,100 respectively in 2021.

In my opinion, the biggest problem still lies in the cost and scale effect of the entire system. In recent years, the increase in the scale of pure electric vehicles has rapidly reduced the cost of batteries, while the cost of PHEV batteries between 8 kwh and 38 kwh has also decreased, but not as steeply as the cost curve of BEV batteries. Although the overall cost has decreased, starting from 2020, it has led BMW and other automakers toward higher prices, making plug-ins highly concentrated in cities where purchase restrictions apply, greatly distorting the development direction of plug-ins.

Situation of Various Automakers in 2021

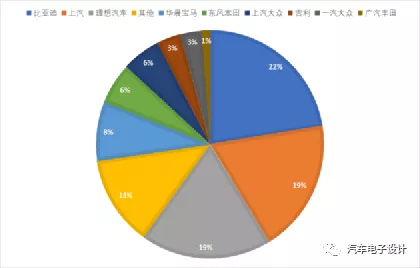

As mentioned earlier, the top three PHEV manufacturers BYD, SAIC, and IDEAL, have a sales volume of around 20,000 units, with a market share of about 20%. With the systematic reduction of Geely in PHEVs, these three domestic automakers are the only ones who can stand firm in the plug-in market in the short term. As previously mentioned, the center of work of joint venture automakers has shifted towards pure electric vehicles, and the only PHEV that has seen growth in 2021 is Dongfeng Honda. In terms of total sales volume, with less than 100,000 units in the first four months, a linear extrapolation would result in a scale of 300,000 units for 2021. One thing to consider is that less than 100,000 units, 30% of which were sold in Shanghai. For the plug-in hybrid market in 2021, the positive factors are that more supply will be added as supply increases for BYD’s DMI, and the new model of IDEAL One may maintain this volume. However, we haven’t seen any other automakers adding significantly to the supply in this area.

The domestic market share of Chinese auto companies has returned to over 60%, which is also the strategic choice made by Volkswagen and BMW to abandon the supply of plug-in hybrids and leave resources to BEVs. I think the biggest problem is that there are no obvious selling points in this sub-market.

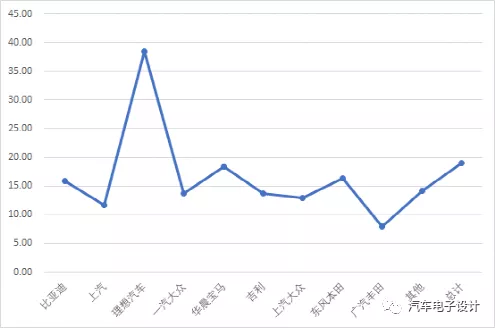

In the following chart, there is an interesting phenomenon, that is, the average electric range of plug-in hybrids. Most of the auto companies currently have a range of around 50-60 kilometers. The ideal strategy, like that of Ideal One, is to sell BEVs that have a longer range and avoid city restrictions, which is more in line with the complete definition of the entire vehicle.

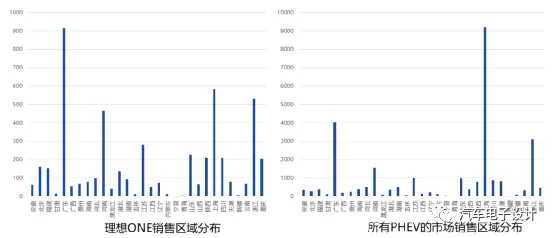

Regarding this point, I want to look at all the distribution data carefully. Due to differences in vehicle definition and dissemination, the sales regions of Ideal One and other PHEVs have significant differences in proportion. This car has taken a part of the market for large SUVs, so the distribution in the city has a long tail effect, which expands the market scope of application. This kind of selling point for extended range is very unique. With a larger battery, it requires fewer charges than other PHEVs, which makes it more worthwhile to charge once. With an engine, it can alleviate the anxiety of being purely electric. It is still a good solution until the battery capacity reaches 100 kWh.

Conclusion

Looking forward, I think the biggest challenge is whether the price of batteries can decrease rapidly. When I was discussing the cost reduction of batteries with Paul a few days ago, we explored the reasons for the cost reduction curve of Chinese batteries from 2018 to 2021 based on past data. The biggest problem with plug-in hybrids is still the hard constraint of cost, which is difficult to compare with the cost reduction curve of pure electric vehicles. In the short term, the project and attention for PHEVs are low, as overall resources are shifting and concentrating more toward pure electric platforms. At the Shanghai Auto Show, there were few people interested in plug-in hybrid vehicles, which is a forgotten corner.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.