“An enterprise cannot withstand the time gap between a business decline and another business rise, as it is like a living organism. They must create new businesses without delay before the core industry declines,” said Wang Chuanfu, the Chairman and CEO of BYD, an automotive industry translator responsible for English translation, spelling proofreading, and wording modifications for this statement, ensuring that the meaning is unchanged but only correcting and improving where necessary.

As the soul of BYD, Wang Chuanfu has led the company through many crucial moments. One of them is the recent cooperation between BYD and Toyota, establishing the BYD Toyota Electric Vehicle Technology Joint Venture Company during a critical moment in the automotive industry.

This “technology parity” cooperation is a crucial moment for BYD in the era of new energy. A company needs to make adjustments during critical periods in order to sustain long-term development. This article will elaborate on BYD’s various key moments in development, explaining how it has come to where it is today.

BYD’s Transformation

When an enterprise successfully repositions itself, the gap in productivity will be astonishing. BYD’s first critical moment was 17 years ago when it transformed from a battery manufacturer to an automobile manufacturer.

Early BYD LOGO

Many believed that it was impossible for a layman to enter the automotive industry and survive, and this is still true today. However, BYD had enough strength and opportunity at the time.

As the “king of batteries,” BYD had encountered sales bottlenecks in battery manufacturing. This was due to the fact that after witnessing BYD’s success in batteries, hundreds of new companies emerged in the battery field, competing with each other and driving profits down. It became difficult for BYD to make significant breakthroughs in battery sales.

Additionally, BYD had 1.24 billion yuan in idle cash at the time and needed to expand its business. Therefore, transformation became a necessary path for BYD.

There was a choice to make: to transform into the smartphone industry, as BYD already manufactured phone batteries. However, because BYD’s clients were Motorola, Nokia, and other phone manufacturers, if BYD transformed into the smartphone industry, its battery sales would undoubtedly be severely impacted.

At this point, Wang Chuanfu thought of another path. If vertical expansion didn’t work, then horizontal expansion was needed. He prepared to expand towards parts such as phone cases. It was this idea that enabled Wang Chuanfu to encounter the automotive industry.

In 2002, while inspecting a Japanese phone case mold factory, Wang Chuanfu discovered that the factory also manufactured car molds. He also discovered that all aspects of car mold production, except processing, could be accomplished by hand.Wang Chuanfu believed that “China definitely has an advantage in everything related to artificial processes,” expressing that the large population in China ensures a better control of costs in the industry.

Wang Chuanfu Photo Source: BYD official website

Compared to the mobile phone industry, there were fewer players with higher barriers to entry in the automotive industry. This is why Wang resolved to seize this opportunity, as the phrase goes, “fortune favors the bold.”

He later said, “When I saw that BYD could also have an opportunity in the automotive market, I moved so fast that others were left behind.”

Looking back at the social environment of that time, the Chinese automobile industry experienced explosive growth in 2002. This opportunity aligned with Wang’s intention to enter this industry.

One statistic shows that in 2002, the production of sedans in China increased 53% from 700,000 units in 2001 to 1.1 million units. Another statistic indicates a national production of 3.2512 million units, a 38.49% increase from the previous year, with sales of 3.2481 million units, increasing by 36.65%.

Therefore, at that time, a trend of amateurs entering the automobile industry emerged, similar to the rising new forces of recent years.

Midea air conditioning is one of them. In 2003, Midea and the Kunming High-tech Zone signed an agreement to invest 2 billion yuan over five years to build the “Yunnan Midea Automobile Industry City.” At the time, Midea was the most prominent company in the home appliance industry to enter the automotive industry.

We can also see that when a new opportunity arises in an industry, many investors will be lured in, and the bigger the market, the more investors will surge in, as we commonly refer to it as the “trend.”

Wang Chuanfu, who had already had the idea, was no exception. In January 2003, BYD officially entered the automotive manufacturing industry by acquiring a 77% stake in Shaanxi Qin Chuan Automobile Co., Ltd. for 296 million yuan.

However, things did not go so smoothly, and this move was questioned by many.

After the news of BYD’s acquisition of Qin Chuan Automobile was released, its stock price fell more than 21%, with a drop of over HKD 2.7 billion in market value over two days.

This is simply because most investors did not believe that a battery manufacturer without any experience in automobile production could succeed in the automotive industry.

In fact, the investors’ concerns were not unfounded. In 2002, Qin Chuan’s “Fulai Er” sold more than 17,000 units, earning revenues of CNY 700 million and profits amounting to only CNY 780,000, all of which demonstrated the investors’ worries about BYD.But Wang Chuanfu did not give up due to investors’ doubts and the sharp decline in stock prices. On the contrary, he continued to pursue the commercialization of cars, especially electric cars.

Therefore, the key moment for BYD was when “Wang Chuanfu saw the potential of the car market and stood on the growth trend of the car industry, coupled with the unshakable belief that was not affected by external factors, which led BYD back to the right development path.”

In April 16, 2005, BYD announced the official launch of its first new car F3 in Xi’an, and at the same time, a new production base with a capacity of 200,000 vehicles was officially completed.

” A good start is half the battle won.” Once BYD F3 was launched, it quickly gained popularity in the market. In September 2005, after the launch of BYD F3 in Jinan, the number of orders reached 9,000 within a month. It approached the sales level of the popular Shanghai GM Sail, and this was still BYD’s first car model.

Afterwards, the BYD F3 was successively launched in Hangzhou, Shenzhen, Shanghai, Beijing and other cities. Among them, in the Shenzhen market, the F3 was the only independent brand car model that entered the top 10 sales ranking for three consecutive months, and in the sales of about 80,000 car models in Shanghai, the F3 quickly occupied the first place.

In 2006, the F3 accumulated sales of 63,153 vehicles, a year-on-year increase of 472%. The F3 became the fastest-selling independent brand model to exceed 100,000 units sold in less than 20 months after its listing. In the first half of 2009, the F3’s monthly sales of 10,000 vehicles exceeded that of the Elantra and Focus, two major mainstream models of the same level.

From April 2005 to February 2006, the BYD F3 won 68 awards in 10 months.

There is also an interesting thing. After the F3 was hot-selling, Toyota bought back a BYD F3 research to try to figure out why this F3, which looks very similar to the best-selling Toyota Corolla worldwide, could be produced so cheaply.

Returning to the beginning of our article, when a company has successfully repositioned itself, the difference in productivity will be astonishing. From the sales of the F3, BYD took the first step successfully in repositioning itself. In addition, from the history of BYD, the success of the F3 has largely contributed to BYD today. It was precisely because of the hot sales of the F3 that brought BYD the first wave of “big traffic”. This created room for later development of the F3DM and drove BYD’s development.After the success of the F3, BYD did not bask in the joy of victory. When acquiring Qinchi Automobile, Wang Chuanfu said, “The automobile power battery project will determine our future.” Therefore, BYD’s future strategy is mainly focused on electric vehicles.

The first electric vehicle produced by BYD was equipped with a lithium battery, which was installed on the Folaier model during the acquisition of Qinchi in the automobile industry, with a single endurance of about 280 km.

However, Wang Chuanfu said that the ability to travel 280 km was far from enough to commercialize electric vehicles. Additionally, since the cost of the battery accounts for nearly half of the entire vehicle cost, it is difficult for the retail price to drop; it is unacceptable for ordinary consumers.

From here, we can also see that the battery cost has still been hard to reduce significantly in more than 10 years; it is mainly difficult to achieve popularization in pure electric vehicles.

Furthermore, we can see the forward-looking of BYD in the electric vehicle industry, but as it was limited by many factors, it was still difficult for pure electric vehicles to survive at that time. Thus, owing to the limitations on battery technology and other factors at the time, BYD decided to launch the DM hybrid model. On December 15, 2008, BYD released the oil-electric hybrid F3 DM model.

F3 DM takes 9 hours to fully charge using a household charger, while it approximately takes 10 minutes to obtain 50% charge under quick charging conditions. It provides 100 km of pure electric driving and 430 km of driving with an internal combustion engine. Thereby, BYD’s electric vehicle concept gradually became well-known by the public. When F3 DM was included in the 179th product catalog of the National Development and Reform Commission, Wang Chuanfu said: “Automobiles have been around for more than 100 years, and they need to change. The emergence of automobile batteries has made the change in automobile power a reality.”

In summary, besides making the correct decision during this crucial period, BYD’s first vehicle model, the F3, achieved a good start with solid sales, which helped BYD to continue advancing in the automobile manufacturing industry. Before the decline of battery business, BYD found a new business opportunity.

Imagine if F3’s sales had been flat, BYD could have stopped at any time. After all, manufacturing automobiles requires huge financial resources, and BYD was not favored by the outside world at that time.The emergence of F3 DM marks the first time a Chinese automobile brand has played a leading role. It is true that F3 DM also brought another critical moment for BYD: Warren Buffett’s investment.

Warren Buffett’s Investment

Buffett’s investment in BYD mainly provided sufficient expansion funds and brand influence for BYD after the global financial crisis.

In fact, BYD is a key enterprise in China’s breakthrough in the field of electric vehicles. Whether BYD can hold a place in this field will determine to some extent whether China’s auto industry can compete with European and American manufacturers on an equal footing.

After all, at that time, F3 was the best-selling model on the Chinese domestic market, and there was no equivalent.

Buffett (left) and Wang Chuanfu (right), image from Forbes

So Buffett’s investment had a direct impact on whether BYD could successfully enter the field of electric vehicles and demonstrate its strength at a critical moment in the industry.

On September 29, 2008, Berkshire Hathaway’s subsidiary, MidAmerican Energy Holdings Company, announced that it would invest $230 million in a 10% stake in BYD, earlier than the launch of F3 DM.

Before investing in BYD, Buffett accepted an interview with CNBC, saying: “You will see a lot of my investments in China in suitable environments.”

Two months later, Buffett’s words were fulfilled, and he chose BYD, which was also the first privately owned enterprise that Buffett chose to invest in, demonstrating the significance of this investment for BYD.

As for why he chose to invest in BYD, Sokol, the former president of MidAmerican Energy, said: “Our purpose in investing in BYD is to help the company break through and find new technologies. This is not just a financial investment, but a business combination.”

In simpler terms, they saw the development prospects of BYD’s new energy vehicle models. However, in the world of finance, everything is not that simple.

At that time, the most mainstream electric vehicle powertrain was the DM dual-mode technology, which is what we call plug-in hybrid technology today.

At that time, only three companies in the world, General Motors, Toyota, and BYD, had mastered dual-mode technology. BYD’s F3DM had the longest pure electric range, which was the most advanced.

Before making a decision, Sokol visited BYD in China after being introduced by Charlie Munger, and he said: “BYD has an outstanding management team, and its research and development capabilities have left us with a deep impression. We also particularly admire BYD’s ability to turn research and development results into high-tech products.”In addition to BYD’s own technology and the future potential of new energy vehicles, Buffett also has a strong regard for the Chinese economy. Economists say that China has a latecomer advantage, which means that by introducing technology from developed countries, domestic technology can evolve faster.

BYD is even more impressive because it “obtains technology by dissecting advanced foreign cars, avoiding patents and innovating”. In other words, innovation is achieved through imitation, thereby leading a new automotive industry model: new energy vehicles.

Buffett’s investment in BYD has had several major effects: “Firstly, Buffett has tremendous international influence, and his investment in BYD has greatly increased the brand’s influence”; “Secondly, BYD will use new energy vehicle models as a door opener to enter the North American and European markets, and Buffett’s investment can accelerate the promotion of BYD’s new energy vehicle models in markets such as North America”; “Thirdly, it has solved the financial pressure BYD was facing due to declining profits at the time.”

In simpler terms, “Buffett is equivalent to giving BYD a vote of confidence.”

Sure enough, Buffett’s arrival brought the “Buffett effect” to BYD. After Buffett subscribed to BYD’s shares, the stock price experienced an extraordinary surge and quickly exceeded HKD 60.

Wang Chuanfu’s personal assets also reached HKD 35 billion, becoming the richest person on the Chinese mainland. Of course, Buffett’s investment also received generous returns.

In 2009, Berkshire Hathaway, owned by Buffett, held a shareholders’ meeting. After the meeting, Buffett and Wang Chuanfu exchanged gifts. Wang Chuanfu gave Buffett an F3DM model, and Buffett gave Wang Chuanfu a wallet.

It can be seen that “this model had significant meaning at the time. It represented a new technology and also represented a new investment direction.”

In addition to Buffett’s investment, BYD’s rise is also due to seizing the opportunity during the 2008 global financial crisis. At that time, the government enacted the Ten Major Industry Revitalization Plan, which greatly stimulated the explosive growth of the automotive industry.

At that time, BYD launched multiple models including F3, F3R, and F0. According to Q1 2009 data, sales of some BYD models increased by 130% to 140% on a year-on-year basis.

Furthermore, according to BYD’s 2008 annual report, automotive sales were nearly CNY 8.65 billion, a year-on-year increase of 77%, of which gross profit was approximately CNY 504 million. Compared with 2007, gross profit nearly doubled.

In a sense, Buffett directly helped BYD seize this opportunity.Translate the Chinese Markdown text below into English Markdown text, in a professional manner, keeping HTML tags inside Markdown and only outputting results.

In addition, through Buffett’s influence, BYD’s pure electric car model E6, which was exhibited in January 2009, attracted the attention of global investors, and BYD thus stepped into the field of pure electric car models.

BYD E6 from the official website of BYD USA

During this key period, Buffett’s investment allowed BYD’s new energy vehicle technologies to gain more and higher quality exposure, positioning itself as the leader in new energy vehicles.

Looking back now, Buffett’s investment has solidified the foundation for BYD to become a leading domestic automotive brand. This foundation has also laid the groundwork for BYD’s recent cooperation with Toyota.

Technology and innovation are the foundation for standing firm

However, hitting iron requires one’s own hard work. While Buffett provided resources and funding, BYD also needs to continue to grow in terms of technology.

In terms of technology, since Wang Chuanfu himself is an engineer, BYD, under his management, has always adhered to the business philosophy of “technology-based” and “innovation-driven”.

On the matter of focusing on technology, Wang Chuanfu believes that if you don’t focus on research and development and technological upgrades in car making, even if you can gain some market share in a short period of time with one or two models, it will be difficult to stay at the forefront of the automobile replacement wave.

This is the same as Musk’s belief that “engineering is the real magic”. Only with core technological competition can we stand invincible. By the way, according to the data of the China Association of Automobile Manufacturers, Tesla’s automobile sales in China were 10,160 units in March 2020.

In the early days, before BYD, many domestic manufacturers used a single approach to making cars: purchasing design drawings from Italian design companies, opening molds in Japanese mold factories, and purchasing chassis from Alvin Michel. As a result, the produced cars were mainly assembled from parts and sold out, making it difficult to make progress in terms of technology and innovation.

The main reason why BYD can come to today is that BYD has led the upstream expansion from automobile products from the beginning. Wang Jianjun once said, “Except for glass, tires, and steel plates that cannot be self-manufactured, all other parts will be Made In BYD.”

Therefore, BYD’s strategic approach has been different from others from the beginning, designing and manufacturing on its own, making the product prices lower, and requiring solid technology to do it. Thus, it progresses, only with its own strong technology can it go further.BYD’s strategy has always been clear, that is, to utilize its profound accumulation in the electric vehicle industry to become the world’s leading automobile brand. Whether it can become the world’s number one is still uncertain, but what BYD is doing is definitely worth discussing.

Fast forward to now, from BYD’s E-platform and Blade Battery technology, we can also see that BYD has always adhered to the concept of technology-oriented and innovation-driven.

In China’s new energy vehicle market, there are hardly any companies that can achieve what BYD has done. The E-platform and Blade Battery are also one of the important reasons that attracted Toyota’s joint venture.

BYD Blade Battery

First is BYD’s E-platform. I mentioned in “The Signal for the Real War Starts in Electrification Platforms” that in order to make a real difference in the pure electric field, it is necessary to create a native platform, which means creating an exclusive platform for pure electric vehicles.

The reason is that if a pure electric vehicle is based on an internal combustion engine platform, there will be natural design flaws in space and battery energy density improvement.

So BYD also realized this point and decided to create a new platform. Based on this, the E-platform was born.

Here is a brief introduction to what the E-platform is.

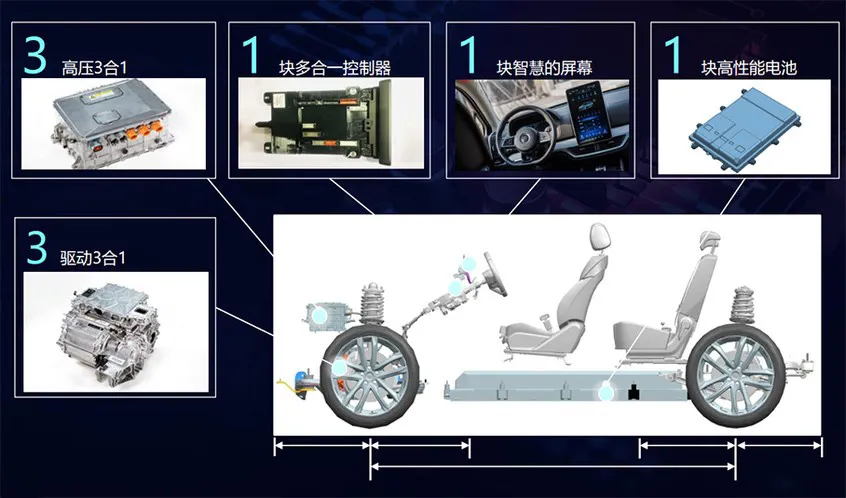

The so-called E-platform is simply a highly integrated hardware platform. The core of the platform is “33111”. What is “33111”?

Among them, the first “3” refers to the three-in-one drive motor. The second “3” is a three-in-one high-voltage controller. The remaining three “1”s respectively refer to a low-voltage controller multi-in-one (including instruments, air conditioning, audio, intelligent keys, etc.); 1 intelligent networked large screen (equipped with DiLink system); and 1 power battery.

In simple terms, it is through highly integrated and compressed space as much as possible to facilitate the development of standardized modules, and ultimately obtain a highly standardized pure electric vehicle platform. Imagine our laptops, and you probably understand it.

The picture is from the official website of BYD.

In addition, the blade battery was detailed in our article “BYD’s ‘Blade Battery’: marketing gimmick or technical innovation?” (http://mp.weixin.qq.com/s?_biz=MjM5NTIyMjA2MQ==&mid=2656756915&idx=1&sn=d1bfdc9701e9d78de42118acc1de4113&chksm=bd5583f18a220ae79b95ea3d21256796e75e79107040f9f2ff77182d39f5ecb22a2ea3337dfe&scene=21#wechatredirect). If you want to further understand it, you can read this article. Here, I will briefly summarize the blade battery. The most important significance of it is that BYD leads a new technological trend and is the first to achieve mass production of cell to pack.

The macro significance of this is that the lithium iron phosphate in range can be equivalent to the ternary lithium battery, and it can have higher safety, thereby occupying the leading position in the second round of competition in power batteries.

In practical terms, in addition to being used by BYD itself, this battery can also be supplied to other manufacturers to quickly realize the commercialization of blade batteries.

Therefore, the achievements on the pure electric platform and battery not only led BYD into the new field of pure electric vehicles, but also differentiated it from the previous strategy of relying on traditional fuel-powered platforms to develop purely electric models. This key moment is that BYD timely adjusted its direction from a fuel platform to a pure electric platform.

At the same time, BYD’s achievements on the pure electric platform and battery directly promoted the cooperation between BYD and Toyota. This cooperation has become a new key moment for BYD in the new energy vehicle industry.

Toyota & BYD

In the key moment of the new energy vehicle era, BYD’s direct performance is the cooperation with Toyota.

This key moment is mainly to find new business before the decline of the traditional fuel-powered car business, and the pure electric platform and battery can not only be used by themselves but also can be shared commercially among B-end users.

In other words, B-end pure electric platform and battery cooperation business. Toyota’s joining is like Buffett’s investment, giving BYD a world-class vote of confidence.

In November 2019, Toyota Motor Corporation and BYD Co., Ltd. signed a joint venture agreement to establish a company for the research and development of pure electric vehicles. On March 25th of this year, BYD Toyota EV Technology Co., Ltd. was officially registered and established in Pingshan District, Shenzhen.

Toyota announced that according to Qichacha, the company’s registered capital is RMB 3.45 billion. Toyota Motor Corporation and BYD Co., Ltd. hold a 50% stake, and each has a subscribed capital contribution of RMB 1.725 billion.

The company’s business scope is the design and development of pure electric vehicles and their derivative vehicles, including pure electric vehicles and parts for derivative vehicles. The import and export of parts, components, and assemblies for pure electric vehicles and their derivative vehicles, as well as providing sales, after-sales service, and related consultation.

The establishment of BYD Toyota EV Technology Co., Ltd. has macro significance in leading domestic car brands into the “new joint venture era.”

Why is it a “new joint venture era”? We know that before, companies like FAW, GAC, and Toyota cooperated through market exchange. But this time, the cooperation with BYD is the first time Toyota has jointly developed a vehicle with a Chinese car brand on an “equal technology” basis.

Looking at it from a higher perspective, this also means that the domestic automobile industry is gradually moving away from relying on market exchange to win technology, and instead is winning cooperation through technology and auto industry giants. From this perspective, BYD has become the “national brand” of the automobile industry.

Image from Automotive News

But there is also a question: why did Toyota choose to cooperate instead of developing on their own?

Very simple, they don’t have time.

In the era of internal combustion engines, Toyota was undoubtedly the world leader. However, in the upcoming new energy vehicle era, Toyota is clearly falling behind. So they need to quickly enter the pure electric vehicle market, catch up and even surpass the leaders. But at Toyota’s current speed, it is already too late to build a pure electric vehicle platform from scratch.

Even if Toyota develops a new platform with their best efforts, will it be competitive after the long development cycle? Will it still be advanced? These are issues that Toyota needs to consider. So these problems have forced Toyota to cooperate with other manufacturers.

But why didn’t Toyota choose other manufacturers? Why BYD?

First of all, we need to know what Toyota needs. And it’s very simple: Toyota will never allow other giants to take the whole pie of China’s new energy vehicles. In the current environment, Tesla is gaining momentum, and Tesla’s Shanghai factory officially started production at the end of 2019. The weekly output of domestic Tesla Model 3 has exceeded 3,000 units.

Tesla Shanghai Super Factory

In addition, Volkswagen and General Motors have begun to layout the new energy vehicle market and invested heavily in it.

Therefore, Toyota urgently needs to seek for a partner in the Chinese market to build pure electric vehicles quickly. In the face of uncertain future technology, cooperative research and development has become the mainstream way for major automakers to avoid risks.

As a battery supplier for Toyota’s hybrid models, BYD has always been in Toyota’s vision. Coupled with the mature E-platform that BYD has developed for many years, using the E-platform can greatly shorten Toyota’s R&D cycle and product launch cycle, not to mention that BYD also has advanced blade batteries.

In this way, BYD, with the advantages of battery and platform, becomes Toyota’s preferred partner.

This kind of cooperation is two-way, for Toyota, they can use BYD’s mature technology; for BYD, it needs to break through the middle and high-end products because BYD understands that manufacturing long-term low-end products will lead to a dead-end, and upward breakthrough is inevitable.

The core of this breakthrough is to build a strong brand, improve the premium of its own products, and Toyota has such advantages.

Therefore, BYD quickly entered the pure electric vehicle market with the core technology of pure electric vehicles, and BYD also gained the trust of the auto giant Toyota.

Just like Buffett’s investment in BYD, Buffett brought the “Buffett effect” to BYD. With Toyota’s joining, BYD may also usher in the “Toyota effect” by leveraging Toyota’s influence in the world.

In addition, the most critical key is that, as I said before, BYD can directly promote the commercialization of the shared pure electric platform and battery by obtaining Toyota’s trust.

For example, Ford signed an agreement with Volkswagen last year, using Volkswagen’s main electric vehicle platform for a large number of cars in Europe, with a value of 10 billion to 20 billion US dollars and a term of 6 years.

Therefore, BYD’s new profit model may change from B-end accounting for most of the revenue to a new model that will be promoted through Toyota’s participation.

Conclusion

Opportunities are always reserved for prepared companies. From the perspective of BYD itself, insisting on a technology-oriented and innovation-driven path is the fundamental reason for its success.

Whether it is transformation into the automotive industry, Buffett’s investment, or Toyota’s joint venture, we can see that these key moments are inseparable from BYD’s persistence in technology.Back to the first sentence of the article, “Companies must create new businesses without delay before the decline of their core industries.” In this respect, BYD has done well. Through constantly creating new businesses, it has been able to seize new opportunities during critical moments in the industry.

During the critical moment of the new era of the automotive industry, with the help of Toyota, BYD’s chances of success will be greatly increased.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.