Translation using English Markdown

In the global market, Chinese car manufacturers are the most aggressive in the development of electric vehicles, followed by European and American car manufacturers, and even Korean car manufacturers are now aiming for a fully electric future. However, Japanese car manufacturers like Toyota and Honda represent a rather awkward situation. Based on recent statements from the CEOs of these two Japanese car manufacturers, let’s take a look at their goals and current situation.

Toyota’s Goals

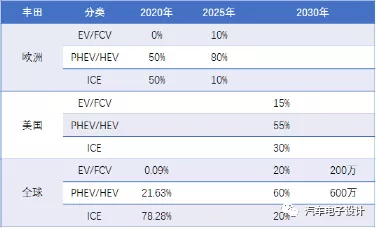

Compared to other car manufacturers, Toyota’s goals are relatively conservative. By 2025, its plan is to achieve 10% sales (150,000 units) of Battery Electric Vehicles and Fuel Cell Vehicles (BEV+FCV) in the toughest regulations in Europe. By 2030, the global estimated sales of BEV+FCV is only two million, which would account for approximately 20% of the total 10 million sold during that year, with the US having a relatively lower sales percentage of 15% for BEV+FCV. In that sense, Toyota is still focusing on its accumulated HEV (Hybrid Electric Vehicles) base and upgrading it to PHEV (Plug-in Hybrid Electric Vehicles) for further reduction of fuel consumption.

This issue is actually rooted in Toyota’s diversification strategy. Looking at the sales in 2020 or Toyota’s fiscal year, Toyota’s main pressure comes from China and Europe, with a total market size of 2.79 million units (29.3%). In Japan, North America, Southeast Asia, and other scattered markets, the market size is about 6.72 million units, accounting for over 70%. In these two markets, Toyota’s HEV strategy is more successful, and there is no short-term threat of fuel consumption.

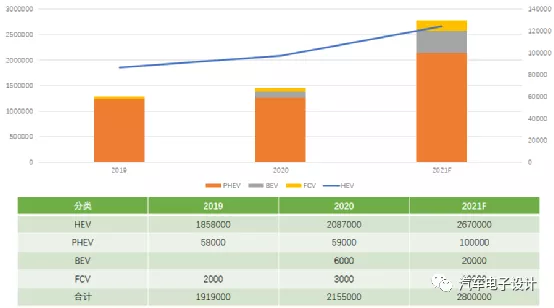

We can analyze the situation based on the actual sales figures from 2019 to 2021. In 2019, Toyota sold 1.858 million HEVs worldwide, increasing to 2.087 million in 2020, and targeting 2.67 million sales in 2021. This is Toyota’s basic lifeline for reducing fuel consumption. However, in the BEV category of new energy vehicles, Toyota sold none in 2019, 6,000 in 2020, and aims to sell 20,000 units globally in 2021.

If we break down these cars, 4 BEVs will be sold at 5,000 each, 2 fuel cell vehicle models will sell 10,000 each, and the PHEV4 models will sell 100,000 each. Toyota’s work centers have not fully transitioned from FCVs to BEVs yet; in 2021, the configuration is based on FCVs being 50% of BEVs. This is a very interesting idea. Based on estimating 150,000 units in Europe in 2025, Toyota’s plans in China will also fluctuate at this ratio, with an estimated total of 2 million units by then. 10% of that would be 200,000 BEVs, and globally in 2025, it will probably be around half a million.

If we break down these cars, 4 BEVs will be sold at 5,000 each, 2 fuel cell vehicle models will sell 10,000 each, and the PHEV4 models will sell 100,000 each. Toyota’s work centers have not fully transitioned from FCVs to BEVs yet; in 2021, the configuration is based on FCVs being 50% of BEVs. This is a very interesting idea. Based on estimating 150,000 units in Europe in 2025, Toyota’s plans in China will also fluctuate at this ratio, with an estimated total of 2 million units by then. 10% of that would be 200,000 BEVs, and globally in 2025, it will probably be around half a million.

All things considered, Toyota lacks the drive to quickly turn to pure EVs in the US and Japanese markets, which make up half of their foundation. In Japan, the issue of having more charging facilities is still a problem, and it is the only country where the number of charging facilities has decreased in recent years. Although Toyota has formed a large electric vehicle alliance consisting of Suzuki, Subaru, and Daihatsu of the Toyota Group, Hino Motors, and Mazda, the fundamental problem of these collaborations is the reluctance to invest in large-scale BEV production. If we review from 2018, there is no substantial support.

Honda’s Goals

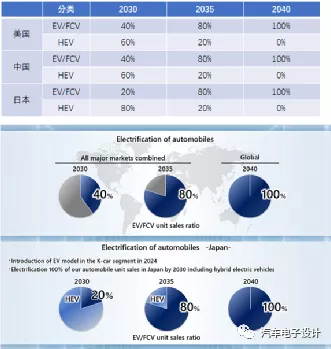

Honda is more aggressive than Toyota, with a goal to double by 2030. However, overall, 2035 and 2040 are still a long way off. First and foremost, the question is how Honda will proceed in 2025. They haven’t given an answer yet, just like Toyota. Similarly, by 2030, Honda does not see the possibility of selling more than 20% of BEVs and FCVs in Japan. Based on estimating the initial target of 2 million BEVs in 2030, the calculation is as follows.

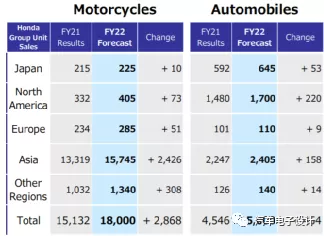

I think Honda has little presence in Europe with a scale of 100,000 vehicles, so it’s not essential. In North America, with a scale of 1.5 million vehicles, there is no significant pressure in the short term. However, this accounts for one-third of the 4.56 million vehicles, so Honda chooses to cooperate with GM on BEV strategies. In China, Honda can only go on its own, where the company sold 1.6269 million vehicles in 2020 (global sales of 4.79 million vehicles in the same year). So Honda needs to develop its own BEV.

I think Honda has little presence in Europe with a scale of 100,000 vehicles, so it’s not essential. In North America, with a scale of 1.5 million vehicles, there is no significant pressure in the short term. However, this accounts for one-third of the 4.56 million vehicles, so Honda chooses to cooperate with GM on BEV strategies. In China, Honda can only go on its own, where the company sold 1.6269 million vehicles in 2020 (global sales of 4.79 million vehicles in the same year). So Honda needs to develop its own BEV.

Conclusion:

Considering Nissan’s current situation, all Japanese automakers expect to achieve high volumes of electric vehicles after 2025. Therefore, a gap is apparent from 2021 to 2023. Without exception, all Japanese automakers have made HEV a strategic priority, which is perhaps a strategic choice.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.