Since 2016, most car manufacturers and investors have been paying attention to the development of second-tier power battery companies, except for CATL and BYD. By 2021, the overall pattern is still relatively clear.

This growth path still depends on whether there is a strategic binding of car manufacturers. In the short term, it is based on domestic car manufacturers (it can be expected to reach volume in one year from cooperation to landing), and in the long term, it depends on the order cultivation of global car manufacturers (a cycle of more than 3 years, which means it should be evident by at least 2022).

Due to the differences in the current industry’s transition, there have been two tracks: the low-cost route of lithium iron phosphate and the high-performance track of ternary lithium batteries.

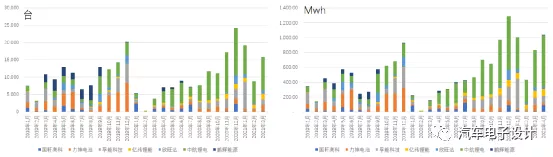

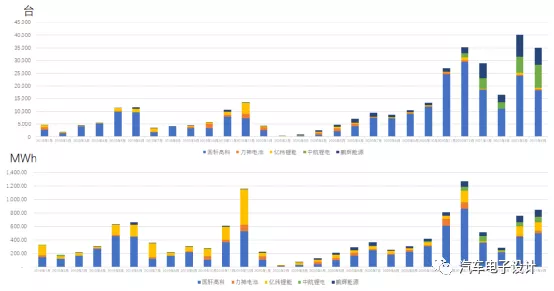

The two tracks for second-tier battery companies

Even BYD has begun to gradually turn its strategic focus toward the ternary track. Among the second-tier companies, the largest proportion in the ternary track is currently held by CALB, which has a monthly production volume of more than 10,000 units, corresponding to an installed capacity of 693 MWh.

Following behind are EVE Energy and Funeng Technology. Currently, it seems that these three companies can continue to operate under the ternary track. In this regard, Lishen had a good shipment situation in the ternary field in 2019, but its market share was heavily compressed by 2020.

In the lithium iron phosphate track, Guoxuan High-Tech has a very high proportion of lithium iron phosphate batteries and was the first to employ cylindrical low-cost routes in the microcar field. Due to the continuity of lithium iron phosphate in buses, EVE Energy previously did a considerable portion of this.

Starting in 2021, CALB also introduced lithium iron phosphate batteries in low-speed vehicles, so the following chart shows the pattern of second-tier batteries in the iron field.

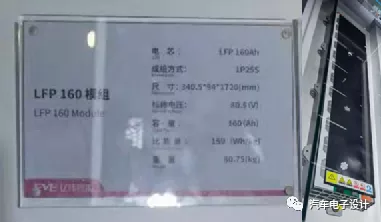

Seeing EVE’s 160 Ah iron shell and long module at the auto show, if it is indeed designed and developed for Tesla (there is no business confirmation yet, this is a kind of rehearsal), then the usage of a single car company might increase.

From the difficulty of the iron battery production line, the pace of transition from ternary to iron batteries of car manufacturers that expanded the ternary production line will be relatively fast. Therefore, once most car manufacturers replace low-cost batteries below 60 kWh in this field, the threshold in this track will be lowered.

Currently, the difficult part in this field is locking the high energy density lithium iron phosphate materials and cell design (there is no particularly significant advantage in using soft-pack for iron in addition to PHEV and microcars).

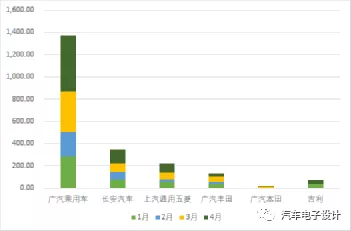

CATL, EVE, and Funeng

Let’s take a careful look at the differences between the three companies. CATL is currently selling the most batteries. Its main clients are domestic automakers. Collaborating with GAC Passenger Car led to the delivery of nearly 1.4 GWh within four months (GAC Toyota and GAC Honda followed the same path). Changan Automobile comes second, aiming for 400 MWh. Although the number of vehicles produced by SAIC-GM-Wuling is increasing, the overall amount of battery delivered is still around 200 MWh.

This case shows that a carmaker producing around 80,000-100,000 vehicles can produce 4.8-6 GWh with an average battery capacity of 60kWh, which is enough to generate higher demand. Covering two to three core domestic clients could sustain subsequent foreign carmakers’ demand in China.

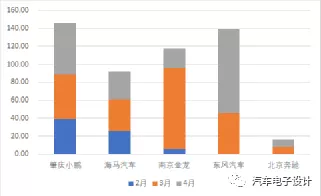

I have also made a similar graph for EVE Energy. Its primary clients are XPeng Motors, Nanjing Golden Dragon, and Dongfeng Motor, and it is now directly supplying to Beijing Benz for PHEVs. In the long run, as the foreign automakers’ demand in China rises, its delivery volume might take off from the second half of the year.

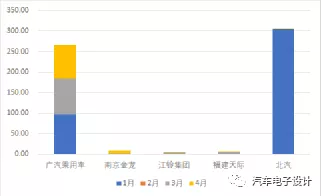

Finally, Funeng mainly delivered batteries to BAIC in January and around 250 MWh to GAC (there is still a significant difference between Funeng and CATL).

Conclusion

It is possible to estimate the installed capacity by using conservative models, numbers, and released data. However, the results may be biased as there is more than one month’s difference between production and delivery data. All data provided above is for reference only, and any potential deviations may be disclosed in later insurance data.

Currently, the survival status of second-tier battery companies can better reflect the importance of auto companies, which objectively verifies a path. That is, under the condition of basic product stability, if the scale of auto companies is increased, the investment and control of second and third-tier battery companies are necessary and sufficient conditions for stable supply for both parties.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.