Introduction

In recent years, the structure of China’s automotive industry has undergone significant changes. NIO, XPeng, and Li Auto have successively gone public and achieved considerable achievements, while more and more consumer electronics and internet companies have begun to enter the automotive field and embark on the road to car manufacturing. In these few short years, China’s automotive industry has made significant progress in electrification and intelligence fields, which makes us proud.

From my perspective, I will talk about the proud development of China’s automotive industry in the field of autonomous driving.

The rise of full-stack self-developed autonomous driving technology

In the traditional automotive parts field, Tier 1 companies such as Bosch and Continental have always had a great say in the industry. Even in cases where sales cannot be guaranteed, some Tier 1 companies will refuse to cooperate with these automakers.

In the field of autonomous driving, there are also corresponding technology providers for many automakers to choose from, such as Mobileye’s vision solutions, Bosch, Continental’s (millimeter-wave) radar solutions, etc. However, these solutions generally only achieve level L1 to L2 autonomous driving functions through chassis tuning packages sold to whole vehicle manufacturers. These solutions do not consider software upgrades from the design stage and are outdated when they leave the factory.

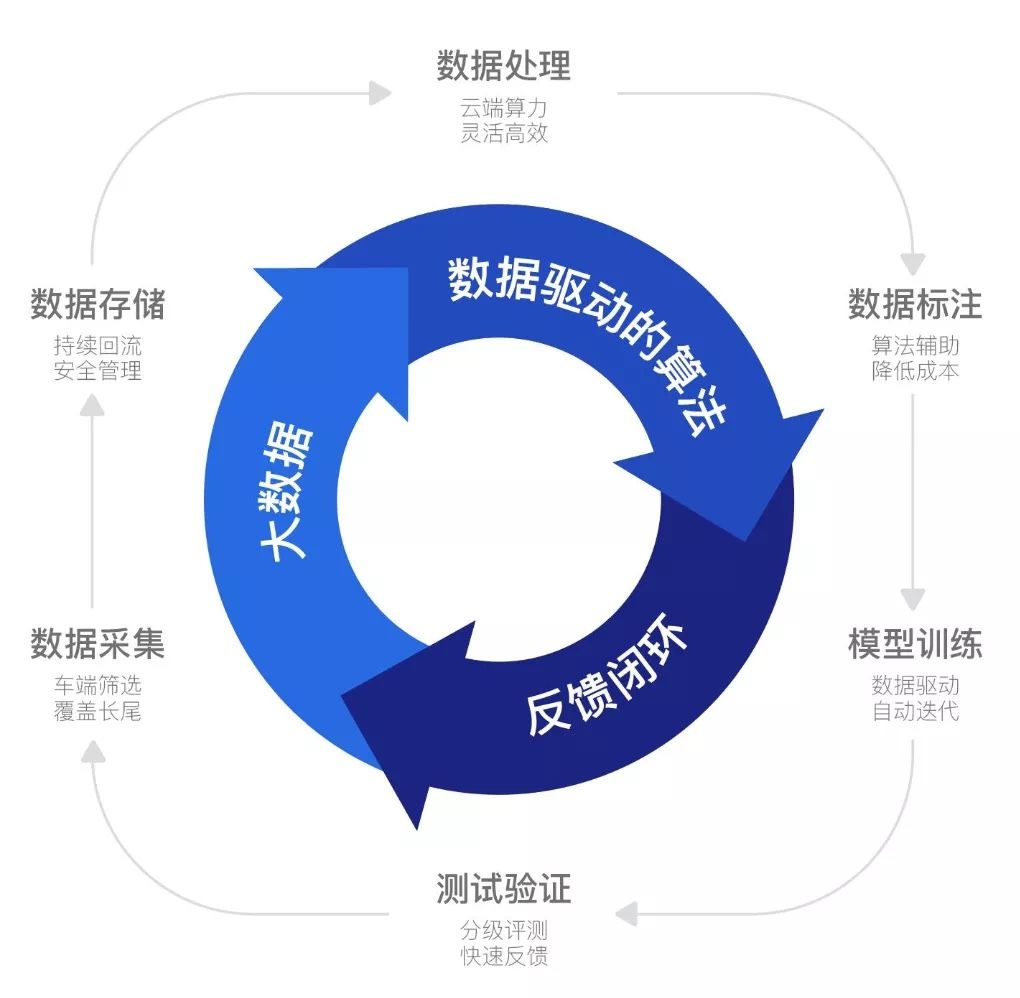

Data-driven software iteration

More and more Chinese manufacturers, such as XPeng, NIO, and Li Auto have realized this problem and have begun to deploy full-stack self-developed autonomous driving solutions on the next generation of models. The purpose is to solve the long tail problem of autonomous driving through continuous updates and iterations.

Taking XPeng P series vehicles as an example, the XPilot system carried on the models has selected the higher upper limit of the full-stack self-developed route since the first generation. As one of the few full-stack self-developed systems in the world, XPeng has invested heavily in this system. Although significant results may be difficult to see in the short term, XPeng insisted on this path, and ultimately proved the feasibility of full-stack self-developed system through good performance in comparison to its competitors.

Autonomous driving is a system that needs continuous iteration and improvement. Full-stack self-developed system can ensure the closed loop of autonomous driving data, and drive algorithm iteration with data. The longer the time, the more data accumulated, the stronger the algorithm ability and the better the iterative development.

Further breakthrough in software iteration – hardware upgrade

Both the autonomous driving and intelligent cockpit experience are gradually improved through OTA software upgrades. Enhancing user experience through data loop and software upgrades is a widely recognized consensus in the industry.From the recent releases of self-driving models, it can be seen that the models equipped with LiDAR are either high-end or mid-range, and there is no hardware upgrade path available for the low-end models after purchase. This limits the upper limit of the self-driving function of these models, and may make it technically impossible to achieve higher-level self-driving functions. After all, unlike electronic products like smartphones, cars cannot be replaced with a new one every one or two years, which makes it difficult for car owners with limited budgets but hope to upgrade their cars’ self-driving functions in the future.

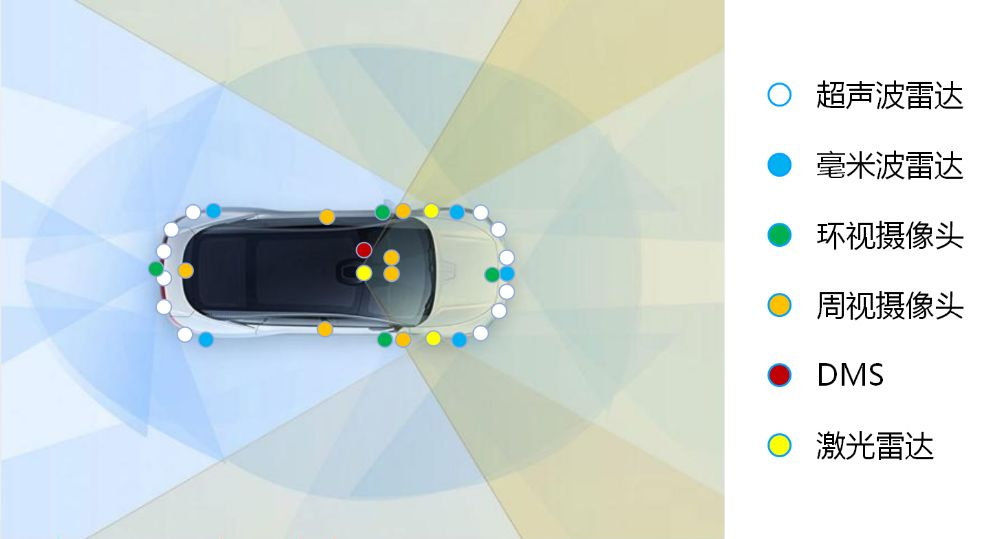

In addition to considering software iteration, some domestic manufacturers have already paid attention to the gradual upgrading of self-driving systems. While foreign countries have not yet noticed this issue, new domestic brands have already considered the hardware upgrade. For example, IM Auto has designed a compatible hardware and software architecture redundancy plan for LiDAR. Among these sensors, three LiDARs can be installed by hardware upgrade, providing the possibility of hardware upgrade for those mid and low-end models.

Rise of autonomous technology providers

With more and more consumer electronics and internet companies such as Huawei and Xiaomi entering the automotive field, old players in the automotive industry have also begun to feel the crisis. These “disruptors” like Huawei and Xiaomi are not good at the powertrain and chassis areas where industry veterans have been working, but rather the cutting-edge fields that require continuous iteration of intelligent driving and intelligent cabin systems based on a large amount of data.

The entry of consumer electronics and internet companies has also created a group of top autonomous technology providers such as Huawei, Horizon Robotics, and DJI. The rise of these autonomous technology providers has also enabled car companies to no longer be dominated by high-speech companies like Mobileye and Bosch, and domestic car companies have more localized choices. The technology provided by these local technology providers is more suitable for domestic road conditions.

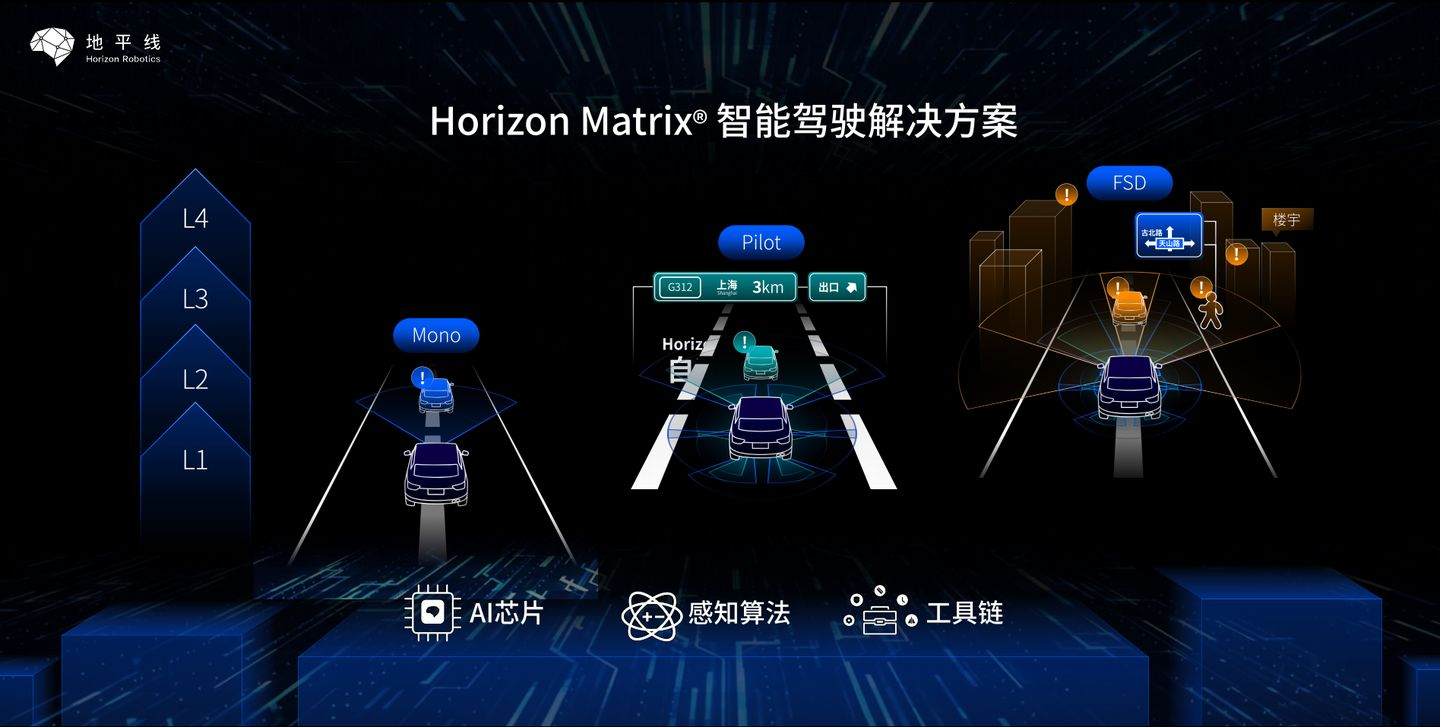

Taking the technology provided by Horizon Robotics as an example. Their released Horizon Matrix intelligent driving solution can provide product solutions covering L1~L4 level autonomous driving. Car companies can choose to purchase technology products according to their needs to fill their own shortcomings in a single scene or overall closed-loop.

The product provided by Horizon Robotics for L1 is the Horizon Matrix Mono series, which is the first mass-produced solution of monocular front view in China. It has been widely used in mass-produced models such as Changan and GAC.The Horizon Matrix Pilot series is designed for L2+ level autonomous driving. With specialized training data selection and algorithm optimization for Chinese road conditions, the Horizon Matrix Pilot can easily handle typical Chinese road conditions such as tunnels, sharp turns, and ramp merging.

The Horizon Matrix FSD series is designed for L3~L4 level autonomous driving. With the support of the Horizon Journey 5th generation AI chip, the Horizon Matrix FSD has more powerful algorithms, which can support multi-camera end-to-end fusion and achieve autonomous driving perception capabilities in urban areas. The layout of the FSD technology is designed to achieve autonomous driving in urban areas, and to accomplish closed-loop autonomous driving in all scenarios.

In the field of autonomous driving, some companies have chosen the full-stack self-research technology route. This route has stronger capabilities to overcome long-tail problems, and the data and algorithms are more controllable. However, this route involves significant investment and may not show significant effects in the short term. The best approach is to prepare for both routes and promote them simultaneously.

Most domestic automakers follow this path, purchasing mature technologies directly from autonomous driving technology providers according to their own shortcomings (such as detection of traffic participants and recognition of traffic lights), in order to improve their autonomous driving systems.

Conclusion

The technological progress in the field of autonomous driving is just a microcosm of the development of China’s automotive industry. In addition, China’s automotive industry has also made rapid progress in areas such as three-electric systems, vehicle networks, and intelligent cabins. These advances have enabled more and more domestic carmakers to break free from the technology monopoly of international giants, and the globalization of domestic carmakers is becoming unstoppable.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.